It was a quieter end to a wild week in the markets, as risk assets gave back some gains and the U.S. Dollar shined. Let’s recap everything you missed during today’s session. 👀

Today’s issue covers the red-hot labor market report, Ryan Cohen’s next ‘meme stock’ target, and what’s got a mid-cap biotech’s shareholders twisting and shouting. 📰

Check out today’s heat map:

Every sector closed red. Financials (-0.19%) led, and consumer discretionary (-3.08%) lagged. 🔻

Oil prices suffered a second straight losing week, and natural gas prices dripped to a two-year low. 🛢️

In electric vehicle news, China’s Xpeng has launched its flagship EVs in Europe as it continues an international push. Additionally, Tesla and Ford got a boost after the Treasury Department adjusted the EV tax credit to include additional vehicles. ⚡

In crypto news, the Overstock-funded tZERO Crypto exchange will shut down on March 6th due to regulatory challenges. Binance is returning to South Korea’s crypto market through its majority stake in the GOPAX Exchange. And India has revealed the International Monetary Fund (IMF) is working with the G-20 countries to streamline crypto regulations. ₿

Other symbols active on the streams included: $VINO (-46.11%), $KAL (+11.57%), $AI (+18.07%), $MULN (+7.06%), $GENE (+80.20%), $GNS (-4.65%), and $RSLS (+170.48%). 🔥

Here are the closing prices:

| S&P 500 | 4,136 | -1.04% |

| Nasdaq | 12,007 | -1.59% |

| Russell 2000 | 1,986 | -0.78% |

| Dow Jones | 33,926 | -0.38% |

Economy

A SLAYbor Market Update

January’s nonfarm payroll report was released this morning and was great news. Or bad news. Honestly, we’re not so sure anymore. 🤷

The economy added 517,000 jobs in January, blowing away the 187,000 consensus estimate. The blockbuster gain pushed the unemployment rate to a 53-year low of 3.4%. The labor force participation rate also ticked up marginally to 62.4% as higher wages lure people back into the workforce.

Meanwhile, wage growth continues to decelerate. While average hourly earnings rose 0.3% MoM as expected, their 4.4% YoY increase was down from 4.6% in December. 🔻

Ultimately, the labor market continues to spell trouble for the Federal Reserve. Despite Jerome Powell’s efforts to weaken growth and bring the labor market “back into balance,” it’s defied all odds and stayed historically strong.

Julia Pollak, ZipRecruiter’s chief economist, said today’s jobs report was almost too good to be true, “…Like $20 bills on the sidewalk and free lunches, falling inflation paired with falling unemployment is the stuff of economics fiction.”

In other words, the goldilocks situation that the stock and bond markets are currently pricing in is not often seen in reality. If the labor market remains this strong, it will keep wage growth strong and buoy demand. And that could lead to a re-acceleration in inflation sometime in 2023. 😨

As a result, the primary risk to the market remains higher-than-expected inflation. That’s why risk assets gave back some of their gains today. For now, we’ll have to wait and see if January’s report was an anomaly or if labor market strength ultimately begets more strength. 👀

Want a winter escape without the hassle of plotting the details, planning your travel, and paying for it all? You’re in luck!

Here’s your chance to win an all-inclusive trip to Montego Bay, Jamaica, from February 21st to February 25th, in just a few clicks!

Open a brokerage account with at least $250 by Feb 10, 2023, to be automatically entered to win a 5-day / 4-night stay for yourself and a guest at the all-inclusive Hyatt Ziva Rose Hall resort.

You’ll also receive roundtrip airfare to Montego Bay and roundtrip transportation between the resort and Montego Bay airport.

The contest is open to US residents only and ends on Feb 10, 2023, so don’t delay! Here are the official rules.

P.S. Want to increase your odds? Receive an additional entry for every $250 deposited into your account during the contest period (maximum 20 additional entries).

Company News

Ryan Cohen’s Next Meme Stock Target

Two weeks ago, we covered the news that activist investor Ryan Cohen had taken a stake in Alibaba, pushing for more share buybacks. But, we noted at the time, it might’ve been more difficult for him to enact meaningful change at a firm that size. And apparently, it seems he might be coming around to that thesis as well. 🤷

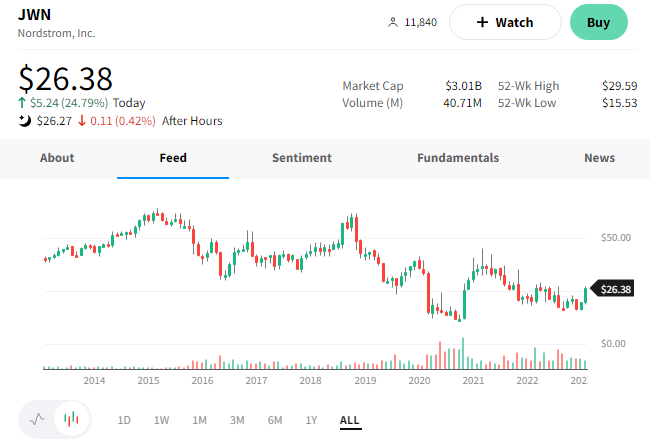

That’s because today, it came to light that the GameStop Chairman had bought a significant stake in department store retailer Nordstrom. His purchase makes him one of the company’s top five nonfamily shareholders, and he’s looking to use his influence to shake up the retailer’s board of directions. 👨💼

The retailer reported a lackluster holiday quarter and cut its full-year guidance a few weeks ago. In response to today’s move, the company has said, “While Mr. Cohen hasn’t sought any discussions with us in several years, we are open to hearing his views, as we do with all Nordstrom shareholders…” and “We will continue to take actions that we believe are int he best interests of the company and our shareholders.”

Typically his positions trigger major moves in his target stocks, though the long-term results remain mixed. A recent example is Bed Bath & Beyond, which he sold last year after failing to push his agenda and stage a turnaround at the company. 📉

What this ultimately means for Nordstrom remains to be seen. But, as usual, the news pumped the stock and put it back on traders’ radars. As a result, $JWN shares were up 25% on the day and are likely to remain in focus in the weeks ahead. 👀

Earnings

Twist & Shout & Sell It All Out

After a crazy week of earnings, we had a light day today. With that said, one company’s results had investors “twisting and shouting” their way out the door.

The mid-cap biotech company posted $54.2 million in revenue, beating the $54.1 million estimates. Driving those results were 134,000 gene shipments to 2,060 customers, up from 1,800 customers in the prior year. Its loss per share of $0.74 was also better than the $1.13 expected. 👍

However, where the company fell short was in its fiscal second-quarter guidance. It expects revenues of $56.5 million, well below the $61.9 million consensus estimates. That revenue forecast consists of $24 million synbio, $25 million next-generation sequencing, and $7.5 biopharma sales.

It still expects full-year fiscal 2023 revenue between $261 and $269 million. But the soft second-quarter numbers really threw investors for a loop. 🥴

As a result, $TWST shares were down 18% on the day, nearing their year-to-date low. 📉

Bullets

Bullets From The Day:

🤝 Activision Blizzard settles SEC probe for $35 million. The company faced claims that it violated federal whistleblower protections and failed to maintain adequate disclosure standards. The SEC filing alleged that Activision Blizzard required “a significant number” of departing employees who signed separation agreements to tell the company if regulators tried to contact them or if they wanted to make a complaint of their own. That is one example of the company’s alleged illegal practices. It’ll pay $35 million without admitting wrongdoing. CNBC has more.

🚴 Japanese startup selling a $550,000 Star Wars-inspired hoverbike is coming to the Nasdaq. Aerwins Technologies has received approval to list on the Nasdaq through a merger with blank-check firm Pono Capital Corp. Current estimates are for a $600 million valuation. However, many mobility startups have faced difficulties raising funding. The company is currently taking pre-orders for the hoverbike, which it says can fly up to 40 minutes and up to 62 miles per hour. It also sells drones and related technologies. Its only reported sale of the hoverbike has been to Japanese entrepreneur Yoshiyuki Aikawa. More from Reuters.

✅ A piece of code revealed that Instagram could roll out a paid verification system. The new references in the app’s code have some suggesting that it’s developing a paid verification feature, following the likes of Elon Musk’s “Twitter Blue” idea. The same reference appears in the Facebook app, indicating that Meta could introduce paid verification across all of its major platforms. Typically the company confirms smaller tests or prototypes when discovered, but it has yet to comment on the paid verification specification. TechCrunch has more.

🕵️ How exposed is Wall Street to Adani’s $100 billion collapse? The fallout from Hindenburg Research’s critical report of the Indian conglomerate Adani Enterprises continues this week, as its losses extend to more than $100 billion. As the shares fall, many are worried about contagion or what other firms could be impacted by the decline. For example, the Life Insurance Corporation of India is the 3rd largest holder, with 4% of the shares outstanding. Vanguard, Blackrock, and other asset managers are also on the list, though with minimal stakes in the company, primarily through the ETF and mutual fund products. More from CNBC.

😮 Don’t look now, but the U.K.’s FTSE 100 just hit an all-time high. Despite all the economic problems facing the United Kingdom and the surrounding regions, the country’s primary equity index just hit a fresh all-time high. This marks the first period of outperformance for the index in over a decade, as its heavy weighting toward commodity and financial stocks helped it fare well in the current environment. However, it’s important to note for international investors that a decline in the British Pound has driven part of the advance. As a result, the index has returned about zero percent in U.S. dollar terms since the June 2016 Brexit vote. Yahoo Finance has more.

Links

Links That Don’t Suck:

😡 Angry Google workers stage protests over layoffs in NYC, California

⏪ Netflix deletes new password sharing rules, claims they were posted in error

📝 Mastercard’s NFT lead exits, selling resignation letter as NFT

✈️ Hong Kong is set to give away 500,000 free airline tickets to lure back tourists

🤑 Companies save billions of dollars by giving employees fake “manager” titles, study shows

🐦 Elon Musk will share Twitter ad revenue – but only with creators who pay for Twitter Blue

🍣 ‘Sushi terrorists’ tamper with other diners’ conveyor belt sushi in viral video trend