Stocks continue to gyrate in a sideways range as investors digest earnings and rising interest rates. Let’s recap what you missed today. 👀

Today’s issue covers Paramount’s earnings premiere, after-hours $DASHers, and an update on producer prices. 📰

Check out today’s heat map:

Every sector closed red. Consumer staples (-0.72%) led & consumer discretionary (-2.15%) lagged. 🔻

DocuSign joined the layoff trend by cutting 10% of its workforce (~700 jobs). ✂️

In crypto news, reports indicate that Binance moved $400 million from a U.S. partner to a firm managed by Binance CEO Changpeng Zhao. The U.S. Securities & Exchange Commission (SEC) has charged Do Kwon and Terraform with fraud related to the Terra collapse. And Bitcoin poked back above 25,000, closing at its highest level since June 2022. ₿

Other symbols active on the streams included: $TWLO (+14.23%), $ROKU (+11.15%), $SHOP (-15.88%), $BOXD (+61.76%), $MARA (-9.31%), $SI (-22.27%), and $RDW (+2.38%). 🔥

Here are the closing prices:

| S&P 500 | 4,090 | -1.38% |

| Nasdaq | 11,856 | -1.78% |

| Russell 2000 | 1,942 | -0.96% |

| Dow Jones | 33,697 | -1.26% |

Earnings

Pre-Market Earnings Premieres

Paramount Global kicked off today’s pre-market movers, posting earnings that significantly missed expectations. 🎬

Its adjusted earnings per share of $0.08 and its revenue of $8.13 billion missed the $0.08 and $8.17 billion expected.

The company pointed to several headwinds impacting results. Secular trends like a competitive market streaming market and cable cord-cutting remain persistent. Meanwhile, cyclical headwinds include the global slowdown in advertising activity and inflation pressures impacting consumers’ discretionary spending. Total ad revenue was down 5% YoY, and cord-cutting drove a 4% decline in its affiliate and subscription revenue. 🌬️

Regarding its streaming business, Paramount+ subscriber net additions of 9.9 million were in-line with estimates. It now has 56 million users, as Top Gun: Maverick, 1923, Criminal Minds: Evolution, NFL Sunday games, and other hit content drove engagement. Global Pluto monthly active users (MAUs) rose by 6.5 million to 79 million and beat the 77 million estimate. 📺

Despite its direct-to-consumer (streaming) business meeting engagement expectations, its 2022 loss of $1.82 billion missed its $1.8 billion guidance. However, ad revenue in this business segment rose 4% YoY, and the company looks to narrow its losses further by increasing the prices of its streaming service by one to two dollars, depending on the tier selected.

Executives expect the company to return to earnings growth in 2024. They also plan to merge the Paramount+ and Showtime streaming services into one as they further integrate their cable television and streaming offerings. This could reduce costs and consumer friction further. However, they did also disclose a potential $1.5 billion write-down from its Showtime integration. ✂️

On a related note, a new regulatory filing indicated Buffett’s Berkshire Hathaway boosted its stake in the company by $40 million in the fourth quarter. It now owns more than 93 million shares.

$PARA shares fell 9% on the news but recovered to close down 4%. 🔻

Datadog reported better-than-expected fourth-quarter earnings but issued soft guidance. Its adjusted earnings per share of $0.26 and revenue of $469 million beat the $0.19 and $450.2 million expected. Slowing growth among its cloud computing partners remains a headwind for the monitoring and analytics platform company. Its current-quarter and full-year revenue forecasts of $468 million and $2.08 million fell short of expectations. $DDOG shares fell 7% on the news. 🐶

Shake Shack reported an adjusted loss per share of $0.06, beating the $0.11 consensus estimate. Revenue of $238.5 million and its same-store sales increase of 5.1% were in line with estimates. Last October, the company raised menu prices by mid to high single digits to offset high food and paper inflation. The company told analysts it would protect its margins but does not expect further menu price increases anytime soon. It expects to open 40 U.S. locations and license 25 to 30 locations in 2023. $SHAK shares initially fell close to 7% but recovered to close -3.44%. 🍔

WeWork posted a wider-than-expected fourth-quarter loss and issued weaker-than-expected first-quarter revenue guidance. Its adjusted loss per share was $0.59 (vs. $0.43 expected), and revenue was $848 million (vs. $847 million expected). For the first quarter, it expects $830 to $855 million in revenue, well below the $880 analyst forecast. $WE shares initially dropped more than 10% but managed to close down 3%. 🏢

Nestle, the world’s largest food group, posted a rare earnings miss as rising costs pressured profits. The company says rising input prices drove its gross margin down by 2.60%, even after accounting for the price increases it made in 2022. It expects pricing pressures to continue this year, saying it needs to repair its gross margin while balancing the costs it pushes to consumers. As such, further price increases will be very targeted and only implemented where input cost inflation justifies the increase. The company’s $2.1 billion writedown of the peanut allergy therapy it invested in two years ago also impacted results. Additionally, it forecasted organic sales growth of 6% to 8% in 2023. $NSRGY shares were down 3% today. 🍫

Economy

Producer Prices’ Positive Path

It was another busy day of economic data, with producer prices taking center stage. Let’s recap.

January’s headline producer price index jumped 0.7% MoM and 6% YoY. It marks the largest increase since June and topped the 0.4% expected. Excluding food and energy, core prices rose 0.5% vs. the 0.3% estimate. In addition, the core number excluding trade services increased by 0.6% vs. the 0.2% expected. ♨️

It doesn’t get as much attention as other inflation metrics but can serve as a leading indicator because its measures the prices producers pay on the open market. Disinflation continues as this is the seventh straight month of declines. But today, the market appears to be reacting to the higher MoM increase than expected rather than the longer-term trend in the data.

The U.S. housing market continued to cool in January. Housing starts fell 4.5% MoM and 21.4% YoY to a seasonally adjusted annual rate of 1.31 million. Single-family housing starts, which account for the bulk of homebuilding activity, were down 4.3% MoM. Building permits rose just 0.1% MoM in January and are still down 27.3% YoY to a seasonally adjusted annual rate of 1.339 million. 🏘️

Falling mortgage rates have buoyed homebuilder confidence over the last few months, but the market looks like it will remain soft with rates back on the upswing.

U.S. manufacturing’s outlook remains bleak. The Philadelphia Fed manufacturing index unexpectedly fell to -24.3 in February, widely missing the consensus estimate of -7.4. 🏭

Digging into the numbers, the indexes tracking new orders, shipments, delivery times, and employee headcount all weakened. In addition, inflationary pressures remained as the prices paid index rose for the first time since April 2022, and prices received fell to their lowest level since February 2021. This indicates a slowdown in manufacturing activity and slimmer margins for producers.

Labor market conditions remain historically tight, with initial jobless claims spending their fifth straight week below 200,000. Continuing claims rose 16,000 to 1.696 million. 👨💼

Meanwhile, several Fed members spoke today. Cleveland Fed President Loretta Mester made headlines. In her speech, she noted there was a compelling case for a 50 bp hike at the last meeting and that the Fed still has more work to do on the inflation front. 📝

The hotter-than-expected producer prices mattered most to the market, given much of the other data is in line with current trends.

Earnings

After-Hours Earnings $DASHers

Three tech stocks are dashing higher after hours following positive results. 🤩

First up is DoorDash, which reported an adjusted loss per share that was wider than expected ($1.65 vs. $0.68). Driving the weakness was its acquisition of Finnish food delivery company Wolt and stock-based compensation expenses related to layoffs made during the quarter.

Revenues of $1.82 billion beat estimates by $0.05 billion. The total number of orders it delivered in the fourth quarter rose 27% YOY to 467 million, exceeding the 458 million estimate. 🥡

The company gave upbeat guidance for marketplace gross order volume between $15.1 to $15.5 billion in the current quarter. Analysts had expected $15 billion. Additionally, the company approved a buyback of up to $750 million.

$DASH shares were up nearly 8% on the news. 🔺

Next up is HubSpot, which easily beat fourth-quarter estimates. 📰

Its adjusted earnings per share of $1.11 and revenues of $469.7 million. That topped estimates of $0.83 per share on $446 million in revenue. The company believes it’s ready to take on challenging macroeconomic conditions. As a result, both its current-quarter and full-year guidance exceeded Wall Street’s estimates.

$HUBS shares are up 13% on the news. 📈

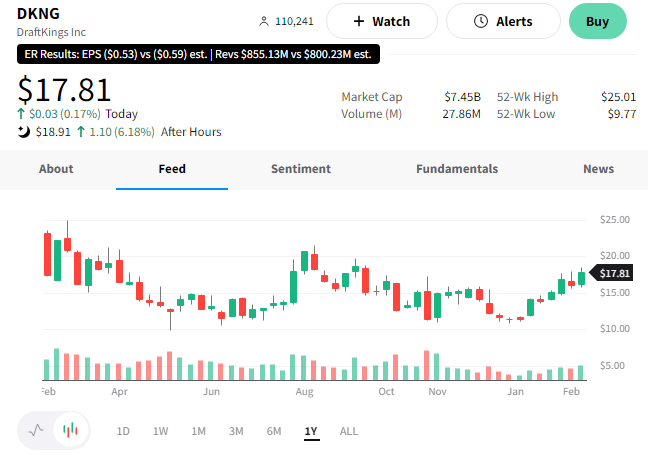

Finally, DraftKings reported better-than-expected fourth-quarter results. 🏈

The company’s $855.1 million revenue set a new record for the online-gambling company. Meanwhile, its adjusted loss per share of $0.53 improved from $0.80 a year ago.

Executives have high hopes for 2023, increasing their annual revenue guidance to $2.85 to $3.05 billion. They also reduced their adjusted EBITDA loss forecast to $350 to $450 million. 👍

$DKNG shares were up 6% on the news.

Bullets

Bullets From The Day:

⚖️ The founder of WallStreetBets is suing Reddit. Jamie Rogozinski is accusing Reddit of wrongly banning him from moderating the community and undermining his trademarks. He claims he was de-platformed for violating the Reddit policy against “attempting to monetize a community.” And that this action was taken by Reddit to ultimately keep him from controlling the brand that helped push the platform’s valuation to $10 billion by the end of 2021. Reddit rejected his claims and said, “this is a completely frivolous lawsuit with no basis in reality.” Reuters has more.

🪄 Magic The Gathering sales topped $1 billion in 2022. However, the maker of Magic The Gathering, Dungeons & Dragons, and Transformers reported disappointing holiday sales given the weak macroeconomic backdrop and a slowdown in consumer demand. Last year was difficult for the toy industry, and Hasbro is maintaining a conservative outlook into 2023. Executives are projecting full-year revenue to decline, but they expect things to pick up in the second half. As part of its three-year turnaround plan announced in October, it will continue to prioritize its direct-to-consumer segment, licensing, and entertainment as it drives towards a 20% operating profit margin by 2027. More from CNBC.

💛 Holy “Snap,” that’s a lot of users. At an investor day, the social media company shared that it’s now grown to more than 750 million monthly active users. That puts it in the middle of behemoths like Meta and TikTok, which boast billions of users, and Pinterest and Twitter, which have hundreds of millions. Of those users, 150 million are in North America, and roughly 2.5 million subscribers pay $3.99/month for Snapchat+. Given the competitive landscape and drop in global advertising spend, it remains a challenging environment for the company. Still, the company focused on several other stats to impress investors at the event. TechCrunch has more.

💻 YouTube CEO Susan Wojcicki is stepping down. Google’s sixteenth employee has been with the company for twenty-five years, leading YouTube for the last nine years after convincing Google to purchase the video site. She’s stepping down to “start a new chapter focused on my family, health, and personal projects I’m passionate about.” She will work closely with her successor Neal Mohan during the transition and stay on in an advisory role across Google and Alphabet. The change comes at a time when YouTube and other platforms integrate short-form video content to maintain their edge in the competitive environment. More from Vox.

🏭 Texas Instruments plans an $11 billion investment in Utah. It plans to build another 300 mm wafer fab in Lehi, Utah, next to an existing fab to combine the two eventually. The investment is the largest in Utah history and is expected to bring 800 Texas Instrument jobs and thousands of indirect jobs. Like its peers, the company anticipates strong growth in industrial and automotive semiconductor needs and is investing in internal manufacturing capacity to meet that longer-term demand. In addition, the company is actively seeking funding from government programs like the CHIPS and Science Act, which incentivizes this type of domestic investment. Fierce Electronics has more.

Links

Links That Don’t Suck:

💳 Consumer debt hits record $16.9 trillion as delinquencies also rise

💬 Instagram launches a new broadcast chat feature called ‘Channels’

🤑 TavelCenter stock pops 70% after BP announces $1.3 billion deal to buy company

🥚 English police say they foiled an ‘eggs-travagent’ plot to steal Cadbury chocolates

🧬 CRISPR pioneer Feng Zhang just raised $193 million for a new genetic delivery startup

👍 FDA advisers vote in favor of making opioid overdose antidote available over the counter

❌ Tesla recalls 362,758 vehicles, says Full Self-Driving Beta software may cause crashes