Three tech stocks are dashing higher after hours following positive results. 🤩

First up is DoorDash, which reported an adjusted loss per share that was wider than expected ($1.65 vs. $0.68). Driving the weakness was its acquisition of Finnish food delivery company Wolt and stock-based compensation expenses related to layoffs made during the quarter.

Revenues of $1.82 billion beat estimates by $0.05 billion. The total number of orders it delivered in the fourth quarter rose 27% YOY to 467 million, exceeding the 458 million estimate. 🥡

The company gave upbeat guidance for marketplace gross order volume between $15.1 to $15.5 billion in the current quarter. Analysts had expected $15 billion. Additionally, the company approved a buyback of up to $750 million.

$DASH shares were up nearly 8% on the news. 🔺

Next up is HubSpot, which easily beat fourth-quarter estimates. 📰

Its adjusted earnings per share of $1.11 and revenues of $469.7 million. That topped estimates of $0.83 per share on $446 million in revenue. The company believes it’s ready to take on challenging macroeconomic conditions. As a result, both its current-quarter and full-year guidance exceeded Wall Street’s estimates.

$HUBS shares are up 13% on the news. 📈

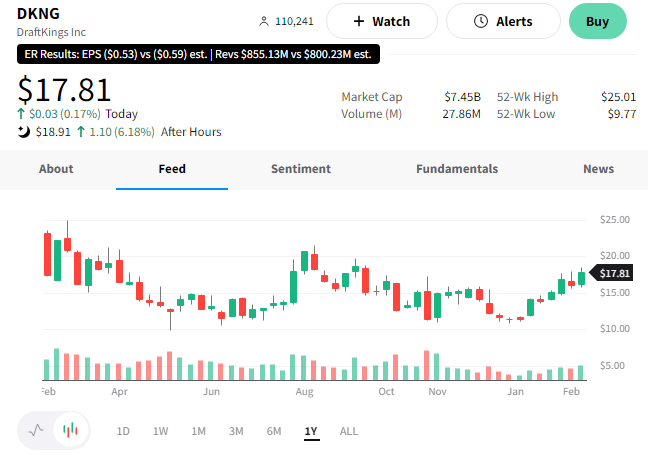

Finally, DraftKings reported better-than-expected fourth-quarter results. 🏈

The company’s $855.1 million revenue set a new record for the online-gambling company. Meanwhile, its adjusted loss per share of $0.53 improved from $0.80 a year ago.

Executives have high hopes for 2023, increasing their annual revenue guidance to $2.85 to $3.05 billion. They also reduced their adjusted EBITDA loss forecast to $350 to $450 million. 👍

$DKNG shares were up 6% on the news.