As earnings and interest rates continued to drive the narrative, markets remained volatile ahead of a shortened holiday week. Let’s recap what you missed. 👀

Today’s issue covers investors betting the farm on Deere, AMC Networks putting on an earnings show, and AutoNation’s earnings driving prices to new highs. 📰

Check out today’s heat map:

6 of 11 sectors closed green. Consumer staples (+1.29%) led, and energy (-3.56%) lagged. 💚

The bond market has priced in higher rate expectations over the last two weeks following that record-hot January jobs data. Two big banks, Goldman and Bank of America, are now calling for three more U.S. rate hikes this year. And a second Fed Governor, Michelle Bowman, suggested she supported a 50 bp hike last meeting, saying that inflation remains “much too high.” 🥵

U.S. import prices fell 0.2% MoM and rose 0.8% YoY in January, marking the smallest annual gain since December 2020. Core import prices, which exclude fuel and food, rose 0.2%. 🔻

Air travel remains a mess, with power trouble impacting the international terminal of New York’s JFK airport. For example, an Air New Zealand flight had to turn back after 8 hours of flying because of the issue. Overseas, workers striking at German airports have grounded 300k passengers. ✈️

Tech company employees’ angst remains high, as Meta reportedly gave 7,000 workers poor performance reviews to set up new layoffs. Meanwhile, Amazon is the latest company to bring folks back into the office for at least three days a week. 😬

In crypto news, Canada is reportedly close to tightening its rules for crypto exchanges. Paul Pierce, previously of the Boston Celtics, is settling with the U.S. Securities & Exchange Commission (SEC) for unlawfully touting and making misleading statements about a crypto asset. And despite the regulatory noise this week, crypto prices had one of their best weeks of the last year. ₿

Other symbols active on the streams included: $AMC (-0.19%), $TSLA (+3.10%), $PIXY (-24.69%), $LMFA (+13.79%), $GNS (-8.31%), $SRNE (+20.20%), and $GMBL (-6.93%). 🔥

Here are the closing prices:

| S&P 500 | 4,079 | -0.28% |

| Nasdaq | 11,787 | -0.58% |

| Russell 2000 | 1,946 | +0.21% |

| Dow Jones | 33,827 | +0.39% |

Earnings

AMC Networks Puts On A Show…

AMC Networks is back making headlines for a better reason than usual. That’s because it reported better-than-expected earnings for the first time in a while. 👍

Its adjusted earnings per share of $2.52 topped the $1.02 per share expected by analysts. Meanwhile, revenues of $964.5 million were up 20% YoY and beat the $934 million consensus estimate.

On the earnings side, cost-cutting efforts taken by the company are producing their desired results. On the sales side, U.S. operations revenue jumped 26% as distribution and streaming gains offset a slowdown in advertising and weakness in cable television.

$AMCX shares rose 32% on the day following the positive results. 🤩

Earnings

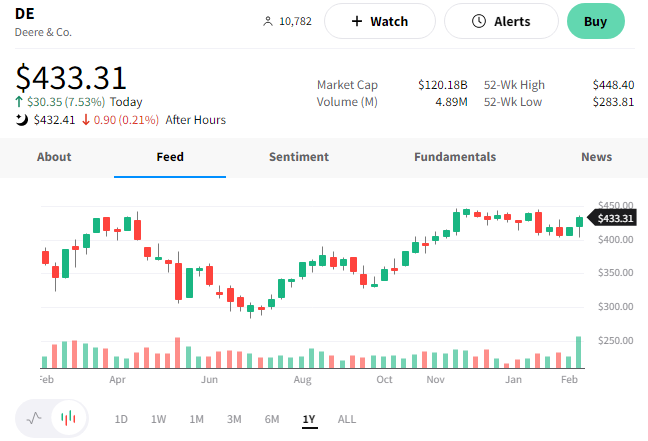

Investors Bet The Farm On Deere

The world’s largest farming equipment maker is back with another strong quarter, as robust demand continues to outweigh supply. 🚜

Deere’s earnings per share of $6.55 rose 124% YoY, and revenues of $12.652 billion were up 32.2% YoY. Both exceeded analyst estimates of $5.57 and $12.325 billion, respectively.

Executives noted that demand for farm and construction equipment remains healthy. Meanwhile, an improved operating environment has allowed for higher levels of production. Overall, the company remains well-positioned for the current environment of strong underlying fundamentals and low machine inventories as long as they continue their solid execution. 👍

As a result, executives raised their fiscal 2023 guidance to $8.75-$9.25 billion in net income, well above the $8.31 billion consensus estimate.

$DE shares rose 7% and continue to trade just below all-time highs. 😮

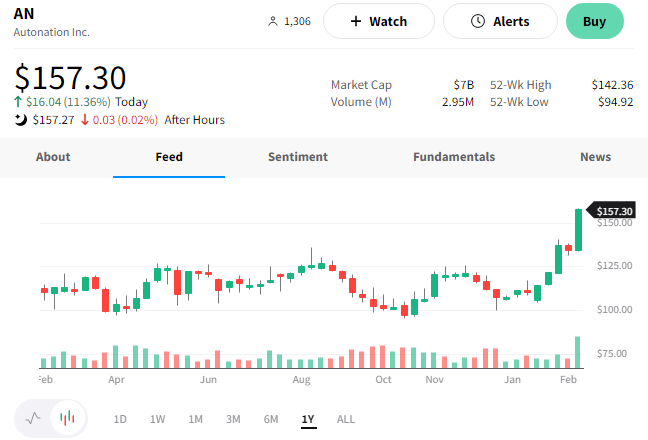

One of the top U.S. auto retailers, AutoNation, rose to new all-time highs after reporting better-than-expected earnings.

Its earnings per share of $6.37 beat the $5.83 consensus estimate. And revenues of $6.7 billion (+2% YoY) topped the $6.52 billion expected. 💪

The company experienced poor performance in its used-vehicle segment, where prices have fallen, and demand has stalled. However, demand for new vehicles, spare parts, and services offset that weakness. Revenue from new vehicles and after-sales were up 8% and 7%, respectively, while used-vehicle sales were down 8% YoY.

Executives say improving supply chains have caused new vehicle prices to come down and transactions to pick up, as dealers are able to fulfill customer orders. They expect new vehicle demand to remain strong but transactions and prices to settle below their post-pandemic peak, which was unsustainable. ⛰️

While some analysts are concerned about the macro environment impacting consumer spending, others say new auto sales will stay strong given the last few years of depressed activity.

$AN shares rose 11% on the day to fresh all-time highs. 📈

Bullets

Bullets From The Day:

🏌️ Judge rules PGA Tour can depose LIV Golf’s Saudi backers. A federal judge ruled that the head of Saudi Arabia’s sovereign wealth fund, the backer of LIV Golf, must sit for depositions and produce documents in LIV Golf’s antitrust lawsuit against the PGA Tour. Lawyers for the Public Investment Fund had sought to nix subpoenas using the argument of sovereign immunity; however, if this ruling is upheld, it will pull back the curtain on the fund’s business dealings. Yahoo Finance has more.

🪫 France’s state-controlled power company EDF posted record losses in 2022. The company reported a 17.9 billion euro loss despite record-high energy prices in 2022. Driving the third biggest loss in French corporate history was the price cap on energy for French consumers and the forced closure of many of its nuclear power stations for repairs. The outages caused the company to become a net importer of electricity for the first time in decades to service the 80% of France’s electricity market that it controls. It was a perfect storm for the company, which saw its debts balloon to over 64.5 billion euros. More from BBC News.

⏲️ Drivers pay the price for late customers, but Lyft’s wait time fees cut them out of the fold. In December, the ride-sharing company finally began charging riders for wait times, with fees kicking in two minutes after on-time arrival for standard fares and five minutes after Black and Black XL. Despite consumers paying this new fee, drivers claim they haven’t seen any changes to their pay. They argue they’re impacted by late arrival because every minute counts when they’re competing for rides and completing trips, so the fee should go to them. It’s another point in a contentious battle between gig economy workers and their “employers.” TechCrunch has more.

💾 TikTok is looking to open two more data centers in Europe. The Chinese social media giant is looking to further quell the security concerns of users and governments around the globe by expanding its data centers and using more third-party service providers. The company is stepping up efforts in Europe because its 125 million monthly active users mean its subjected to stricter EU online content rules known as the Digital Services Act (DSA. They’ll have four months from the February 17th deadline to comply with the regulations or risk fines. More from Reuters.

💰 Abu Dhabi’s Adnoc looks to cash in on the energy boom. The United Arab Emirates’ national oil company plans to raise $2 billion or more by listing its natural gas business, marking the largest initial public offering of the year. It will offer a 4% stake in Adnoc Gas, which was formed through a merger of liquefied natural gas and gas processing. The IPO process will take place over the next three weeks, with trading beginning on March 13th. If it proceeds as expected, it should give Adnoc Gas a valuation of at least $50 billion, making it one of the world’s biggest listed gas firms. BNN Bloomberg has more.

Links

Links That Don’t Suck:

🫧 The climate change real estate bubble risks billions

🚀 First launch of Japan’s H3 rocket aborted moments before liftoff

🏨 Hyatt is doubling down on luxury while its competitors focus on budget hotels

⚖️ FAA wants to fine SpaceX $175,000 for failing to submit data before a launch

🤔 China Renaissance shares plunge more than 20% after it says founder Bao Fan is missing