The world’s largest farming equipment maker is back with another strong quarter, as robust demand continues to outweigh supply. 🚜

Deere’s earnings per share of $6.55 rose 124% YoY, and revenues of $12.652 billion were up 32.2% YoY. Both exceeded analyst estimates of $5.57 and $12.325 billion, respectively.

Executives noted that demand for farm and construction equipment remains healthy. Meanwhile, an improved operating environment has allowed for higher levels of production. Overall, the company remains well-positioned for the current environment of strong underlying fundamentals and low machine inventories as long as they continue their solid execution. 👍

As a result, executives raised their fiscal 2023 guidance to $8.75-$9.25 billion in net income, well above the $8.31 billion consensus estimate.

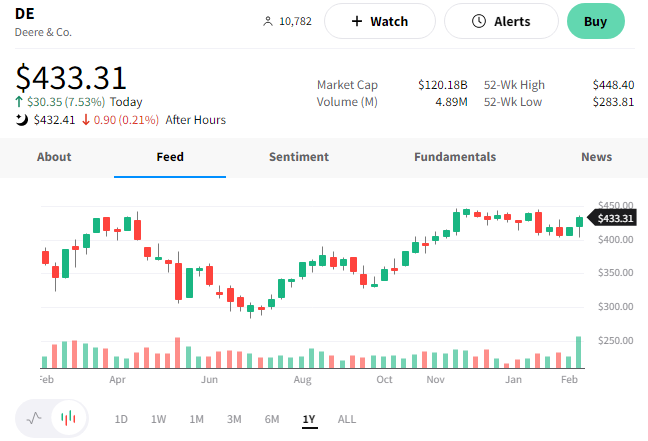

$DE shares rose 7% and continue to trade just below all-time highs. 😮