The bulls must’ve taken an extra day off because the bears were in control, pushing stocks and bonds lower as the safe-haven U.S. Dollar held its bid. Let’s recap what else you missed. 👀

Today’s issue covers what’s weighing on Walmart and Home Depot’s forecast, an update on Coinbase’s comeback, and more from the day. 📰

Check out today’s heat map:

Every sector closed red. Consumer staples (-0.38%) led & consumer discretionary (-3.34%) lagged. 🔻

In economic news, existing home sales fell for the twelfth straight month to their lowest level since 2010. After seven months of decline, U.S. business activity showed signs of improvement as the S&P composite flash PMI rose to 50.2 from 47.5 (readings over 50 indicate expansion). 🏭

Canada’s annual inflation rate cooled to +5.9% in January, but the price of groceries and interest rates on mortgages continue to pressure consumers. Meanwhile, overseas, Japan saw its factory activity shrink at the quickest pace in about 2.5 years. Weak global demand caused export orders to fall the most since July 2020, while service-sector activity grew for a sixth straight month. 📉

Shares of the Australian mining giant BHP rose marginally despite a sharp decline in profits. Executives remain optimistic that growth in China and India will increase commodity demand and buoy prices. ⚒️

In crypto news, trading platform eToro secured a BitLicense and money transmitter license from the New York Department of Financial Services, allowing it to provide crypto services in the state. And Sam Bankman-Fried was spotted on a flight to New York, sparking speculation about why he’s traveling while on house arrest. ₿

Here are the closing prices:

| S&P 500 | 3,997 | -2.00% |

| Nasdaq | 11,492 | -2.50% |

| Russell 2000 | 1,888 | -2.99% |

| Dow Jones | 33,130 | -2.06% |

Earnings

$HD Slides On Spending Slowdown

Inflation’s got homeowners saying “hands off” their wallets. At least, that’s what Home Depot said, as it forecasted full-year revenue below the consensus estimate.

The company’s fourth-quarter earnings per share of $3.30 beat the $3.28 expected. However, revenues of $35.83 billion fell short of the $35.97 billion consensus estimate. This marks the first time it’s missed revenue expectations since November 2019. 😬

Executives say a primary driver of this weakness was the drop in lumber prices, which are nearly 80% below their pandemic highs. While prices have settled above pre-pandemic levels, they note that there’s a lot of volatility, and it’s hard to predict lumber prices. 🪵

Overall, the theme remains that pricing pressures are catching up to Home Depot customers, who had been resilient throughout 2022. Executives are now working with a fundamental assumption that consumer spending will be flat as changes in the broader economy start to reflect in consumer behavior.

The post-covid shift in spending is a cyclical headwind. “Do-it-yourself-ers” are spending less on goods and more on travel and experiences. And the housing market slowdown has started to hit professionals like builders, contractors, etc. As a result, total transaction volumes were down 6% YoY, offset by the average ticket size rising 5.8% YoY. 🛒

There’s still a solid backlog of projects in the pipeline, but it’s below last year’s peak and is dwindling as new demand slows.

Looking ahead, Home Depot expects sales and comparable sales to be approximately flat for the new fiscal year. It’s also looking for an operating margin of 14.5%, which includes the company’s $1 billion investment in raising wages for its workers. As such, it expects a mid-single-digit percent decline in diluted earnings per share. 🔻

The softening outlook led to $HD shares falling 7% on the day.

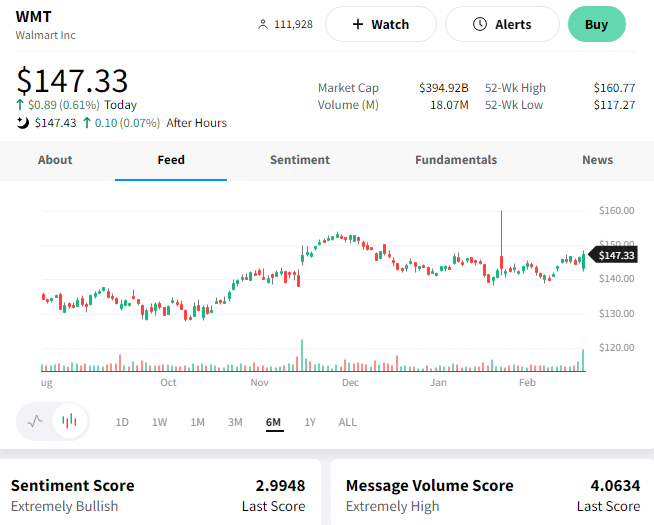

Much like Home Depot, big-box retailer Walmart posted a weaker-than-expected outlook for the year ahead. And for a lot of similar reasons… 🤔

Before we get into its outlook, it’s worth mentioning the company’s holiday-quarter earnings and revenue beat expectations. Adjusted earnings per share of $1.71 and revenues of $164.05 billion beat the expected $1.51 and $159.72 billion. 👍

Driving the positive results were cost-conscious shoppers looking for food, gifts, and household items at a lower price. In other words, inflation and economic anxiety have people bargain-hunting.

And it’s not just low and middle-income shoppers. Executives confirmed that some of the growth is coming from higher-income consumers “trading down” after feeling the pinch over the last year. Walmart CFO John David Rainey said, “The consumer is still very pressured. And if you look at economic indicators, balance sheets are running thinner, and savings rates are declining to previous periods.” 🛍️

As such, the company is taking a more cautious approach to its outlook. It now expects U.S. same-store sales growth of 2%-2.5% (excluding fuel), below the 3% analysts expected. That’s also well below the 8.3% YoY growth this past quarter. 🔻

Overall, the message from Walmart executives is that consumer behavior is continuing to adjust to a weaker economic environment. As a result, the retailer is ratcheting down its expectations now to avoid the mistakes made throughout 2022 when issuing guidance.

$WMT shares fell as much as 5% in the pre-market but recovered to close green. 📈

Earnings

Coinbase’s Comeback Continues?

Coinbase shares nearly tripled off their December lows as the crypto market, and other rate-sensitive assets caught a strong bid. 💪

Today investors got another look at the company’s earnings as they try to determine whether the stock price’s turnaround will continue…Or if the company’s struggling fundamentals will keep a lid on the share price.

Let’s take a look. 👀

First off, the company reported a loss per share of $2.46 on revenues of $629 million. The loss was wider than the $2.55 expected, but revenues topped the $590 expected. With that said, revenue is down roughly 75% YoY as the crypto winter continues to impact engagement metrics.

Speaking of engagement, monthly transacting users (MTUs) fell from 8.5 million to 8.3 million QoQ. However, that was still higher than the 8.22 million analysts expected. Retail transaction revenue of $322 million did miss the $327 million expected. 🔻

Since trading volumes remain low and pricing power is compressing in the space, the company is continuing efforts to cut expenses and survive the market rout. It expects restructuring expenses of $150 million in the first quarter.

Regulatory risk remains a big concern for executives and investors alike. The U.S. Securities & Exchange Commission (SEC) and other agencies have recently taken a more aggressive approach toward the industry. That’s unlikely to go away anytime soon, though some point out it could be a positive for Coinbase, which is already an established U.S. exchange. 🕵️

Despite the lackluster results, $COIN shares are only down about 1% after hours as investors assess the future of crypto. 🤷

Bullets

Bullets From The Day:

👍 U.K. employers seemingly like the four-day workweek. Roughly 90% of the 61 firms across Britain that were trialing the four-day-a-week schedule are deciding to stick with it, with about a third making it permanent. Employees worked an average of 34 hours across four days between June and December last year while keeping their existing salary. We’ll have to wait and see whether this trend is just a symptom of a tight labor market or if there’s real staying power to this work-life balance shift. Reuters has more.

🏀 The NBA is teaming up with China’s Ant Group. The two organizations have entered a strategic partnership around video content, program broadcasting, and membership. The agreement will allow Alipay users to access NBA video content on the platform. A new channel launched last week, hosting user-generated content from NBA China’s network of influencers and Alipay’s authorized content creators. Despite some social and political tensions in 2019 hurting viewership, basketball fans in China are watching the NBA at similar levels as before that rift began. More from CNBC.

🏭 Polluting is getting expensive in Europe as carbon credits hit a record high. The price of permits on the European Union’s carbon market hit 100 euros per tonne for the first time ever this week. EU Allowance (EUA) contracts are the main currency in the European Union’s Emissions Trading System (ETS) that forces manufacturers, power companies, and airlines to pay for each tonne of carbon dioxide they emit. The recent use of coal and other “dirty energy” sources as alternatives to Russian oil is pushing these carbon prices higher…and theoretically working to incentivize companies to invest in more renewable options. Reuters has more.

⚡ United Airlines launches a $100 million sustainable fuel investment fund. The airline has launched the United Airlines Venture Sustainable Flight Fund, partnering with Air Canada, Boeing, General Electric, JPMorgan Chase, and Honeywell to invest in start-ups focused on researching and producing sustainable aviation fuel (SAF). While the airline industry contributes just 2% of global carbon dioxide emissions, it remains under pressure to reduce emissions and meet the 2050 net-zero emissions target set by the International Air Transport Association (IATA) in 2021. More from Reuters.

📝 Public company hires EY to help it fight back against a short seller. The cybersecurity firm Darktrace has hired auditing firm EY to review its “key financial processes and controls” after the short seller Quintessential Capital Management said it was “deeply skeptical about the validity of Darktrace’s financial statements.” It also believes that Darktrace’s sales and growth rates may have been overstated. Darktrace’s board believes the review will provide a sign of confidence, and so far, it has. Shares are up roughly 3% but remain well off last year’s highs. CNBC has more.

Links

Links That Don’t Suck:

⚒️ Tesla is considering buying a lithium miner, report says

🛴 Lime reports first profitable year, tests the waters for IPO

♻️ The first fully integrated electric recycling and waste truck unveiled

✈️ United Airlines will no longer charge families extra to sit together on flights

✅ Facebook and Instagram start hawking blue badges just like Twitter