Much like Home Depot, big-box retailer Walmart posted a weaker-than-expected outlook for the year ahead. And for a lot of similar reasons… 🤔

Before we get into its outlook, it’s worth mentioning the company’s holiday-quarter earnings and revenue beat expectations. Adjusted earnings per share of $1.71 and revenues of $164.05 billion beat the expected $1.51 and $159.72 billion. 👍

Driving the positive results were cost-conscious shoppers looking for food, gifts, and household items at a lower price. In other words, inflation and economic anxiety have people bargain-hunting.

And it’s not just low and middle-income shoppers. Executives confirmed that some of the growth is coming from higher-income consumers “trading down” after feeling the pinch over the last year. Walmart CFO John David Rainey said, “The consumer is still very pressured. And if you look at economic indicators, balance sheets are running thinner, and savings rates are declining to previous periods.” 🛍️

As such, the company is taking a more cautious approach to its outlook. It now expects U.S. same-store sales growth of 2%-2.5% (excluding fuel), below the 3% analysts expected. That’s also well below the 8.3% YoY growth this past quarter. 🔻

Overall, the message from Walmart executives is that consumer behavior is continuing to adjust to a weaker economic environment. As a result, the retailer is ratcheting down its expectations now to avoid the mistakes made throughout 2022 when issuing guidance.

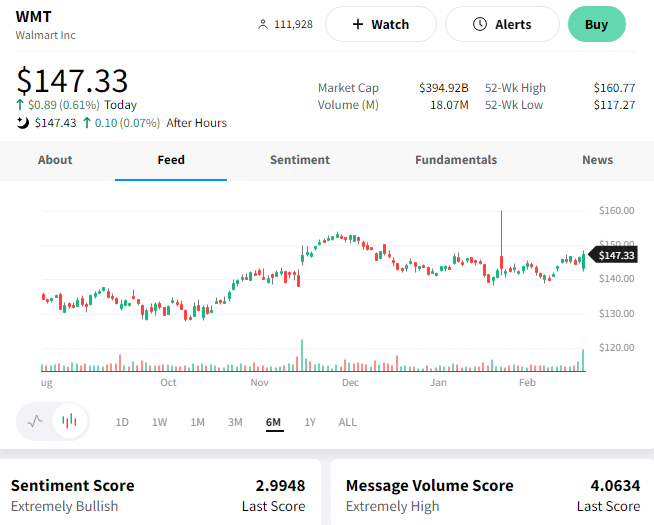

$WMT shares fell as much as 5% in the pre-market but recovered to close green. 📈