Declines in Silvergate Capital and SVB Financial sparked contagion fears in the financial services sector, which dragged the entire market down. Let’s recap what else you missed today. 👀

Today’s issue covers a brief overview of the bank stock meltdown, the continued slowdown in tech revenue, and more from the day. 📰

Check out today’s heat map:

Every sector closed red. Utilities (-0.79%) led, and financials (-4.09%) lagged. 🔻

In economic news, initial jobless claims rose by 21,000 to a 5-month high of 211,000. Meanwhile, General Motors sent a letter to its U.S. white-collar employees offering voluntary buyouts as it looks to cut costs further. And Salesforce is cutting hundreds of sales and marketing jobs this week. ✂️

Internationally, Russia’s biggest lender Sberbank saw an 80% decline in its 2022 net profit as sanctions impacted its operations. 🏦

Shares of General Electric rose the most in two years after it issued upbeat guidance for its Aerospace business’ margins and energy business profitability goal. 👍

Other symbols active on the streams included: $TRKA (+3.77%), $XELA (-14.51%), $OCEA (+125.16%), $ASAN (+18.93%), $MYO (+5.40%), $SINT (-7.21%), $SMMT (-6.58%), and $LUNR (+57.80%). 🔥

Here are the closing prices:

| S&P 500 | 3,918 | -1.85% |

| Nasdaq | 11,338 | -2.05% |

| Russell 2000 | 1,827 | -2.81% |

| Dow Jones | 32,255 | -1.66% |

Company News

Headed For A Bankless Future?

When crypto and fintech enthusiasts talked about a bankless future, we don’t think this is what they meant… 🤔

Yesterday Silvergate Capital plunged after hours because it told investors it would shut down its operations and liquidate the bank. This comes just a week after the company filed a notice that it would delay its annual report filing due to business and regulatory challenges. 📰

The crypto-focused bank experienced a meteoric rise during the bull market but saw billions of deposits leave amid falling confidence in the industry’s prospects. $SI shares had already fallen more than 95% from their 2021 highs but continued their decline today to fresh all-time lows. 📉

As if that wasn’t enough to spook the market, Silicon Valley Bank added to the market’s hysteria. As its name suggests, its institution services early-stage businesses, serving as the banking partner for nearly half of U.S. venture-backed tech and healthcare companies that went public in 2022. 🤖

With that said, the sharp reversal in private and public market valuations over the last two years has put tremendous pressure on its clients. That reduced the number of deposits the bank had on hand and left it struggling to keep up as other institutions raised interest rates to attract and retain capital. It also left the bank on the hook with debt and other investments that have plummeted in value.

Apparently, its troubles were worse than investors initially realized. Today, the company announced that it’s selling $1.75 billion in shares and liquidated a $21 billion portion of its “available for sale” investments at a $1.8 billion after-tax loss to shore up its balance sheet. 💰

The news sent $SIVB shares down 60% in the regular session and another 20% lower after hours. 🔻

Overall, confidence is the name of the game in the banking industry. If depositors, investors, and other stakeholders lose confidence in a bank’s ability to stay solvent/liquid, a bank run could ensue. And given how interconnected today’s financial institutions are, fears over the entire industry’s health are spreading. 😱

Whether those fears are warranted or not is up for debate. But when it comes to people’s money, they tend to act first and ask questions later. “Better safe than sorry” becomes a form of due diligence…and understandably so. 💸

Financial stocks and ETFs tracking the sector experienced sizable declines today. $XLF fell 4%, $KRE declined 8% on its highest volume ever, and on and on. The overall impact of these events on the market remains to be seen. But what’s clear is that with the sector accounting for ~11% of the S&P 500’s weighting, this news will likely weigh on sentiment in the short term.

We’ll cover this more as the story develops and the market implications become clearer. 🤷

Earnings

Tech’s Revenue Slowdown Continues

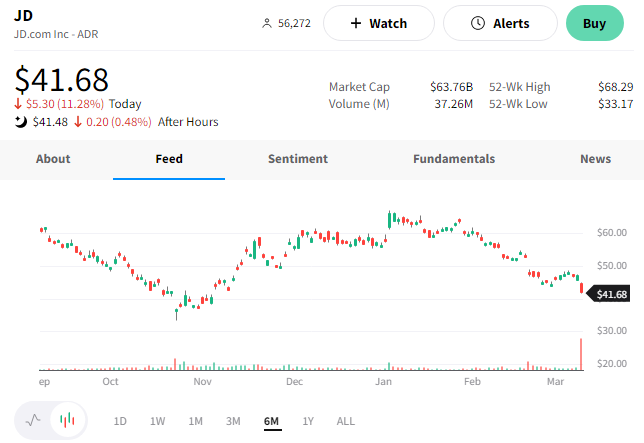

Chinese e-commerce giant JD.com posted better-than-expected fourth-quarter earnings and revenue. However, its weak outlook left investors hoping for more. 🙁

The company’s adjusted earnings per share of $0.70 and revenues of $42.80 billion topped the expected $0.51 and $42.53 billion.

While China’s zero-Covid policy weighed on the results of the country’s largest companies, JD focused on improving its operations and preparing for the future. Those efforts helped boost its earnings in a challenging environment. 🔺

With that said, executives expect the macro challenges to continue this year, saying they remain focused on lowering costs, increasing efficiency, and improving the user experience. They also announced a $0.62 quarterly dividend payment to help appease investors. 💰

Overall though, investors remain concerned with the slowing pace of revenue growth. Sales grew just 7% YoY during the quarter, down again from the previous year despite China’s economy reopening. Like other tech giants, JD must identify new ways to reaccelerate its growth to regain the market’s favor.

$JD shares fell 11% on their highest volume since last May. 😮

Earnings

DocuSign, More Like DocuDecline

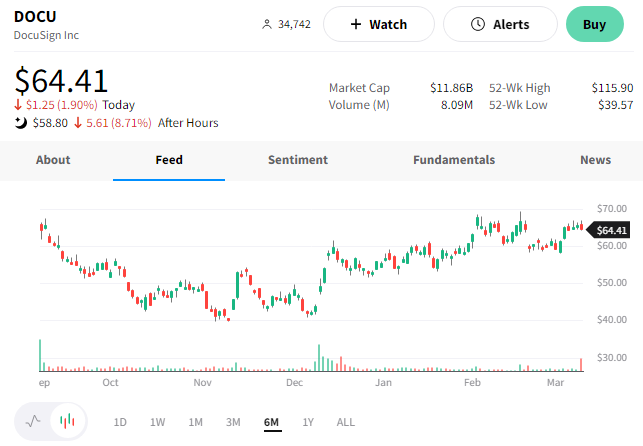

Speaking of challenged tech companies, DocuSign also released results today. 📰

The company reported adjusted earnings per share of $0.65 on revenue of $659.6 million. Both beat expectations for $0.52 and revenue of $639.49 million. Its first-quarter sales forecast of $639 million to $643 million also topped the $640.9 million consensus estimate.

With that said, executive transitions overshadowed the strong results. Here’s a quick summary of the changes: 📝

- CFO Cynthia Gaylor is stepping down from her role later in the year;

- Robert Chatwani is leaving Atlassian to join as President & General Manager of Growth; and

- Anwar Akram is leaving Google to join as Chief Operating Officer.

The shakeup is weighing on $DOCU shares after hours, as they fall 9%. 🔻

Bullets

Bullets From The Day:

😓 EY’s plan to split its business turns out to be more “taxing” than initially planned. The Big Four accounting firm’s plans to separate its audit and consulting practices have hit a snag, with its partners unable to agree on what to do with the tax practice. The Big Four firms have faced much regulatory scrutiny over their cross-selling of advisory services to audit clients, which could impair their ability to conduct independent reviews. EY’s final vote on the split is scheduled for April, but clearly, there are still some details to hash out. Reuters has more.

📝 Credit Suisse receives SEC call, delays annual report filing. The Swiss bank is postponing the publication of its annual report indefinitely after a last-minute call from the U.S. Securities and Exchange Commission (SEC) raised questions about financial statements it issued for earlier periods. For example, it had revised how it booked a series of cash flows like share-based compensation and foreign exchange hedges in 2020 and 2019, so the SEC raised concerns about the decision and controls surrounding it. It’s yet another blow to the confidence of a company trying to stage a dramatic turnaround in a challenging market environment. More from Reuters.

🚫 The Netherlands follows the U.S.’s lead on semiconductor export controls. The Netherlands is caught between the U.S. and China political tensions as the west looks to prevent the most advanced chip technology from getting to Beijing. China remains well behind the curve of Taiwan, South Korea, and the U.S. regarding domestic semiconductor production, so further import restrictions pose a significant risk to its economy. The Dutch Foreign Trade Minister, where semiconductor equipment-maker ASML is based, has raised questions about the country’s existing export control framework, citing national and international security concerns. CNBC has more.

🤝 Doctors and insurers unite in concerns over Medicare Advantage payment proposal. Changes to the Medicare Advantage risk adjustment model would tweak plan payments based on an enrollee’s health and demographic statuses, ultimately resulting in a net cut in 2024. Physicians and other healthcare providers say the proposed updates could hurt their practices and patients. Many stakeholders claim that the change would effectively cut Medicare, which has left it with few supporters so far unless it’s delayed to allow more studies on the potential impact. More from Axios.

🎶 TikTok’s influence spreads to Spotify. Every social media company seems to be taking pages from TikTok’s book, but that trend is spreading to other industries. At Spotify’s Stream On event in LA, executives introduced a significant redesign of the app, which further relies on personalization technology and adopts a short-form video feed like other platforms have. The changes hope to create improved discoverability of the platform’s features and content, ultimately driving further engagement and monetization of its users. TechCrunch has more.

Links

Links That Don’t Suck:

🚗 Used vehicle prices rising at an unreasonably strong rate

🤑 Cathie Wood’s ARKK fund pockets $300 million in fees despite poor show

🏘️ Lawsuit sheds light on racial bias in appraisals for Black and Latino homeowners

🍪 There’s a big Girl Scout cookie shortage, and the group is frustrated with its main baker

⚡ Airstream and Porsche unveil camping trailer ‘optimized for EVs’ that fits in your garage

💳 Credit card debt is at an all-time high, putting households near ‘breaking point,’ study shows