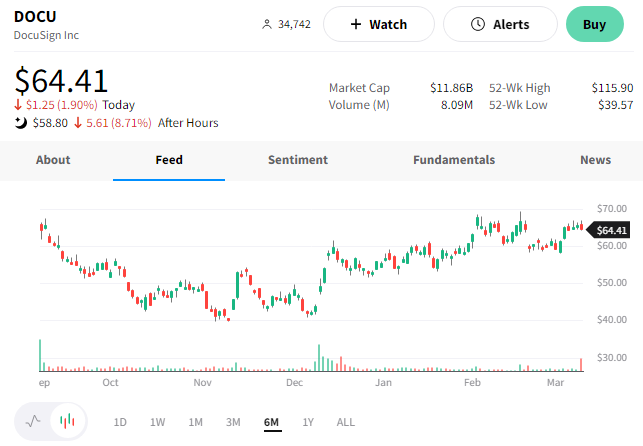

Speaking of challenged tech companies, DocuSign also released results today. 📰

The company reported adjusted earnings per share of $0.65 on revenue of $659.6 million. Both beat expectations for $0.52 and revenue of $639.49 million. Its first-quarter sales forecast of $639 million to $643 million also topped the $640.9 million consensus estimate.

With that said, executive transitions overshadowed the strong results. Here’s a quick summary of the changes: 📝

- CFO Cynthia Gaylor is stepping down from her role later in the year;

- Robert Chatwani is leaving Atlassian to join as President & General Manager of Growth; and

- Anwar Akram is leaving Google to join as Chief Operating Officer.

The shakeup is weighing on $DOCU shares after hours, as they fall 9%. 🔻