The Federal Reserve was the main bank on people’s radar coming into the week as investors tuned into Powell’s testimony in front of Congress. Unfortunately, it turns out the market was focused on the wrong bank all along… Let’s recap the Silicon Valley Bank failure and what else you missed. 👀

Today’s issue covers the Silicon Valley Bank failure, a big move in the bond market, and more from the day. 📰

Check out today’s heat map:

Every sector closed red. Consumer staples (-0.48%) led, and real estate (-3.20%) lagged. 🔻

In economic news, nonfarm payrolls topped the 225,000 estimated jobs, rising by 311,000 in February. The unemployment rate rose to 3.6% as the labor force participation rate jumped to its highest level since March 2020. Average hourly earnings rose just 0.2% MoM to 4.6% YoY. 🧑💼

Internationally, the Bank of Japan’s Governor used his final meeting to stick with his dovish policy stance, making no changes to interest rates targets, the yield cap, or its broader bond yield control policy. His successor Kazuo Ueda will take the helm in April, with investors anticipating he’ll phase out the yield cap shortly into his tenure. 📆

Earnings were clearly not a focus today, but several stocks were on the move. JinkoSolar fell 13% after its Q4 earnings missed expectations, and its gross margin continued declining. 🌦️

Scooter company Bird Global popped then dropped 15% despite earnings matching and revenue topping estimates. 🛴

Airsculpt Technologies fell 22% after both the adjusted earnings and revenue missed forecasts. 🔻

Other symbols active on the streams included: $TRKA (-24.61%), $MULN (-6.23%), $OCEA (-24.62%), $NRBO (-10.75%), $MYO (-4.58%), $UNCY (+29.13%), $TENX (+22.14%), and $LYLT (-58.25%). 🔥

Here are the closing prices:

| S&P 500 | 3,862 | -1.45% |

| Nasdaq | 11,139 | -1.76% |

| Russell 2000 | 1,773 | -2.95% |

| Dow Jones | 31,910 | -1.07% |

Company News

A Classic Black Swan

It’s often said that the risks that will matter to the market are those we least expect. After all, the market is designed to fool the majority. And boy, did it do that this week… 🫢

Coming into the week, the bank people were watching was The Federal Reserve, as Jerome Powell testified in front of Congress on Tuesday and Wednesday. Naturally, the focus was on inflation and the central bank’s policy path.

However, the bank news that had a wider impact on the market was Silvergate Capital and Silicon Valley Bank, which we first covered yesterday. 📰

Since then, the story has escalated, culminating in the second-largest bank failure in U.S. history. As we discussed in yesterday’s newsletter, confidence is the name of the game in the financial sector. And right now, confidence has fallen sharply across the board.

Now, some of that concern is definitely warranted. But with people acting first and asking questions later, we’ve got a situation where the impact of one bank failing is spreading to other institutions, not necessarily because of direct exposure, but because people are acting out of fear that their money is unsafe wherever they’re holding it. 😨

First, we’ll try to quickly summarize what we know now. And then, we’ll discuss some of the impacts we’re seeing across the market. 📝

So what happened? Silicon Valley Bank services early-stage businesses and is the banking partner for a broad swath of venture-backed companies.

During the pandemic, when technology companies were growing like crazy and receiving massive valuations in the public and private markets, Silicon Valley Bank saw its deposits grow significantly (as did the entire U.S. banking sector). They grew from $61 billion to above $200 billion in a few years. As a bank, they’re in the business of taking deposits and loaning them out to make money. But, the demand for loans was much lower than the sheer amount of deposits they had.

So, to keep profits going, they decided to increase the amount of deposits they invested in securities. But since yields were so low, they had to invest in long-dated securities to earn any meaningful yield. As a result, they invested a large portion of their cash in mortgage-backed securities (MBS) and treasuries, many of which they intend to hold until maturity. And while rates remained low and the growth machine was humming, things worked out fine. 👍

However, when inflation began to rear its ugly head, and interest rates started rising, the bank was hit with a double whammy. Its business is extremely levered to long-dated, interest-rate sensitive assets. And now the investments it held were too. 👎

Many of the bank’s customers saw a significant slowdown in their business growth, valuations, and funding ability due to rising interest rates. That means they were depositing fewer funds into the bank and burning more of their cash on hand. Plus, fewer companies were raising money, which reduced the number of new customers Silicon Valley Bank was receiving.

Then, on the long-dated asset side of its balance sheet, the value of its investment holdings was also going down. And so, they reclassified a large portion of their “available for sale” securities into “held to maturity” securities so that they could take a one-time loss and not continue to reflect the unrealized losses in their financials each quarter. 🔻

The straw that broke the camel’s back was Wednesday when crypto-focused bank Silvergate Capital said it planned to wind down its operations and voluntarily liquidate. That started the market’s worry about the financial sector, which made Silicon Valley Bank’s announcement that it was raising $2 billion in additional capital and had sold some of its securities at a $1.8 billion loss a lot less palatable. Combine that with the CEO coming out and basically saying, “stay calm” and “don’t panic,” and you’ve got a market that completely lost confidence in the bank. 😱

How much confidence was lost? Well, about $42 billion was pulled from the bank by the close of business on Thursday. 😮

After shares of $SIVB fell over 70% on Thursday, they were set to open down another 60%+ on Friday. That was until the California Department of Financial Protection and Innovation announced it closed the bank and named the Federal Deposit Insurance Corporation as the receiver. Ultimately, it marked the second-largest U.S. bank failure and the biggest since Washington Mutual in 2008.

The lack of confidence spread throughout the financial sector, hitting many west-coast regional banks the hardest. PacWest Bancorp, Western Alliance Bancorp, First Republic Bank, and Signature Bank all fell sharply today, extending this week’s already steep declines.

Meanwhile, the 97% of startups and other depositors with more than the FDIC-insured $250,000 balance at Silicon Valley Bank are left picking up the pieces. It’s unclear how much of their money they’ll get back and when, so they have to figure out how to operate their businesses in the meantime. And others with money at related banks are left worrying about whether their deposits are safe where they’re at. 😟

So, that’s a quick summary of how we got here. Now, what happens next?

That’s a great question and one many are trying to figure out as we speak (type). The situation has left a lot of stakeholders in its wake, all facing unique issues of their own, including:

- Silicon Valley Bank’s customers (now unsecured creditors)

- Employees, vendors, and other stakeholders of impacted companies

- Investors with direct/indirect exposure to these institutions or affected parties

- Other financial institutions/the broader financial sector

- Regulators and government officials (including the Treasury & Fed)

- And many, many more.

In the short term, regulators are working out what’s left of the bank’s financials and how much they can pay out to customers. They recognize how fragile things are and want to get people answers as quickly as possible, but there’s a lot to unravel here. Meanwhile, other financial institutions and exposed companies will be working hard to shore up the confidence of their stakeholders. 💰

Confidence remains the name of the game. For now, people are acting first and asking questions later, exacerbating an already fragile system. Until people have enough information to feel confident that their money is safe, pressure will likely remain on the overall financial system. What will ultimately restore that confidence remains to be seen. 🤷

Needless to say, it’s going to be a long weekend for a lot of folks. This situation and the Federal Reserve’s next rate decision on March 22nd will be the main focus for the coming week(s).

And we’ll keep you updated as the story develops. 📝

Stocks

A Big Move In Bonds

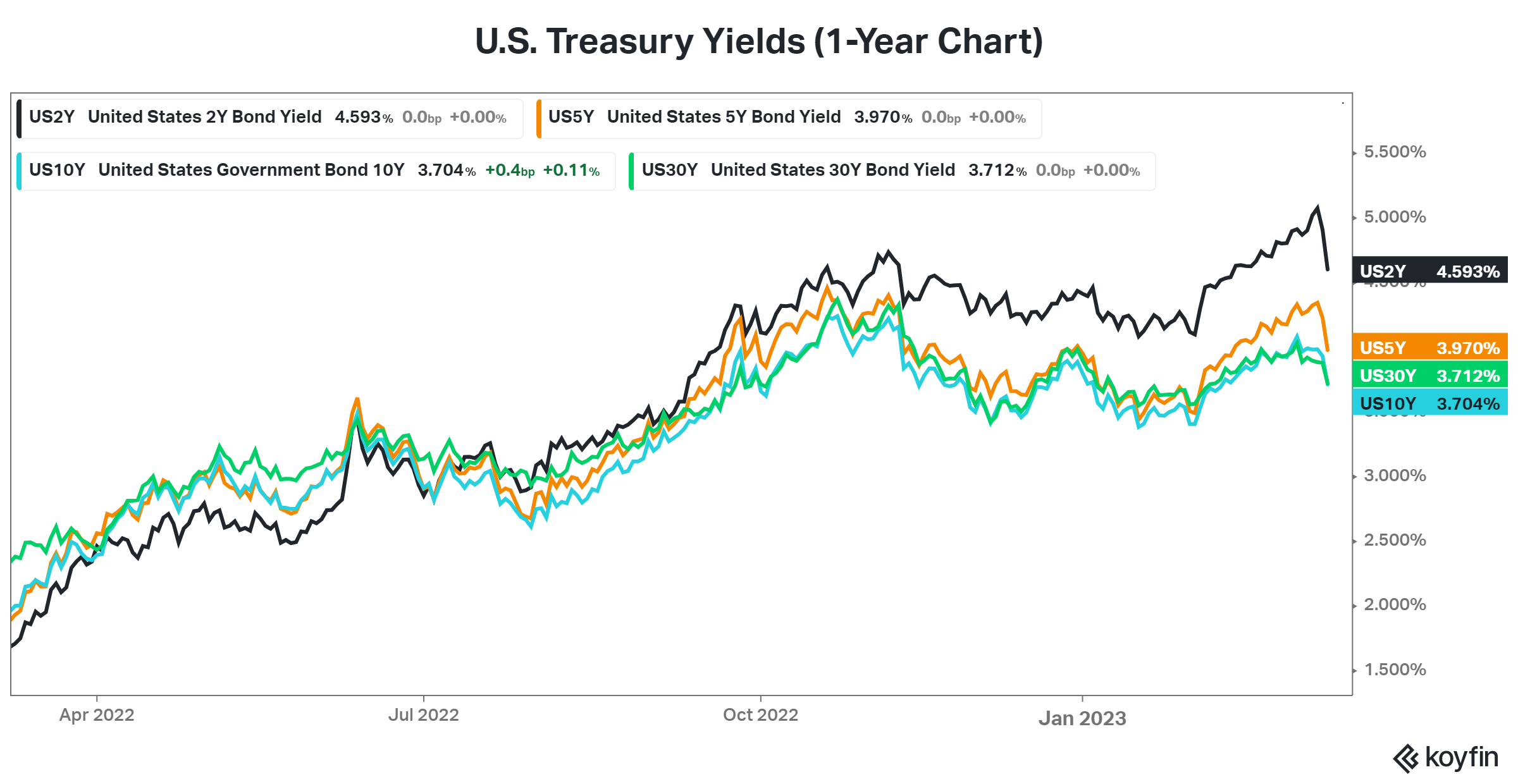

One of the market’s biggest beneficiaries of the current market turmoil has been bonds. Just days after the U.S. 2-Year Treasury Yield broke above 5%, it’s fallen roughly 50 bps in one of its sharpest declines ever. 😮

Analysts say Treasuries are again acting as a “flight to safety” trade. But they also benefit from the market adjusting its views on the Fed’s next move. Given what’s happening in the financial sector, the bond market has priced in the potential for the Fed to be less aggressive than currently expected. Or at least intervene in some way to restore confidence in the financial system.

We’ll have to see whether or not that theory comes true, but for now, Treasuries are “cool again” among active market participants. 🤷

Bullets

Bullets From The Day:

🕵️ Astra investigates short-selling activity as its delisting deadline approaches. The spacecraft engine manufacturer is looking into “potential illegal short selling” in its common stock. The announcement comes as Astra faces an April 4th delisting deadline issued by the Nasdaq exchange last year. Its shares are only at 47 cents and must stay above $1 for at least ten consecutive business days to avoid delisting. With its time running short, it’s enlisted ShareIntel to assist with reviewing “suspicious, aberrant, or unusual trading activity.” CNBC has more.

🫠 Unfortunately for Allbirds’ investors, its share price is as soft as its shoes. The American footwear and apparel company saw shares fall 47% to fresh all-time lows after it acknowledged poor results after its adjusted loss per share and revenue fell short of expectations. Its brick-and-mortar expansion and new product lines did not produce the desired results, so the company is betting on a new strategy that refocuses on its core consumers. An executive shakeup is also accompanying the strategy shift. More from CNBC.

🚫 U.S. FTC seeks to prevent a monopoly in the mortgage loan technology industry. The Federal Trade Commission is taking action to stop New York Stock Exchange parent Intercontinental Exchange from acquiring mortgage data vendor Black Knight for $13.1 billion. The agency is concerned the takeover would result in higher fees, less innovation, and few choices in financing a home purchase. The Community Home Lenders Association also opposes the deal, saying the two companies currently control more than 60% of the market. Reuters has more.

🐦 Meta explores creating a new Twitter competitor. The social media giant is reportedly exploring a new decentralized, text-based social network that could compete with Twitter. The project, codenamed P92, would be a stand-alone app that users log into with their Instagram credentials. A Meta spokesperson said, “We believe there’s an opportunity for a separate space where creators and public figures can share timely updates about their interests.” With Twitter’s turmoil continuing, many players are rushing in to capitalize on the potential market void. More from CNBC.

🏬 Has Gap given up on turning itself around? The retailer, which operates Gap, Banana Republic, Old Navy, and Athleta, is again shaking its c-suite up after results fell short of Wall Street estimates. In addition to executive changes, it’s also looking to reduce its footprint by closing 50 to 55 Gap and Banana Republic stores while opening 30 to 35 Athleta and Old Navy stores. As it continues its turnaround attempt, it expects fiscal 2023 net sales to fall in the low to mid-single-digit range. However, the challenging macroeconomic and funding environment will make that attempt all the more difficult. CNBC has more.

Links

Links That Don’t Suck:

🤷 The future of TV is up in the air

💿 Vinyl overtakes CD sales for the first time since 1987

🍦 Ranch-dressing flavored ice cream from Hidden Valley coming to Walmart

👍 FDA approves new nasal spray to treat migraine headaches in adults, Pfizer says

😮 People were unwittingly implanted with fake devices in medical scam, FBI alleges

🤝 Roku partners with Best Buy and its advertising business to get first-party shopper data

🚗 31% of new cars sold for above sticker price last month. These 10 models have the biggest premiums