It’s the first few days of spring, and there are plenty of reasons to be pessimistic, so market participants are breaking out the shorts. Stocks started the day strong but faded throughout the session as bank weakness weighed on the markets. Let’s recap a busy session on Wall Street. 👀

Today’s issue covers a long week of central bank decisions, several earnings worth WATCHing, and why Block is Hindenburg Research’s next short-selling target. 📰

Check out today’s heat map:

2 of 11 sectors closed green. Communication services (+1.64%) led, and energy (-1.42%) lagged. 💚

AMC shares rose 3% on reports that Apple may spend $1 billion annually on theatrical releases. 🍿

Regeneron and Sanofi shares popped about 6% after their jointly-developed asthma drug Dupixent met all targets in its tests as a “smoker’s lung” treatment. 🫁

In crypto news, the U.S. Securities & Exchange Commission (SEC) has charged Tron founder Justin Sun and several celebrities, including Jake Paul and Lindsey Lohan, for promoting cryptocurrencies. Coinbase shares dropped 15% at the open after warning that it received a Wells notice from the SEC, signaling that it may have violated U.S. securities law. And the U.S. Internal Revenue Service (IRS) is considering taxing NFTs at the capital gains tax rate like other collectibles. ₿

Other symbols active on the streams included: $TRKA (+2.82%), $CDTX (-24.74%), $YS (-7.01%), $ZURA (+10.70%), $BOXD (+91.38%), $DHHC (+82.63%), and $BTC.X (+3.27%). 🔥

Here are the closing prices:

| S&P 500 | 3,949 | +0.30% |

| Nasdaq | 11,787 | +1.01% |

| Russell 2000 | 1,720 | -0.41% |

| Dow Jones | 32,105 | +0.23% |

Policy

Bears Lurk As Bankers Hike

The Federal Reserve’s 25 bp hike is getting all the attention this week, but several other central banks recently made policy decisions worth noting. 📝

- The European Central Bank (ECB) raised rates by 50 bps to 3.00%;

- The Swiss National Bank raised rates by 50 bps to 1.50%;

- The Bank of England raised rates by 25 bps to 4.25%;

- The Bank of Canada held rates at 4.50%;

- The Bank of Japan held rates at -0.1%; and

- Banco Central do Brasil held rates at 13.75%.

The overarching theme among central banks is that they remain hyper-focused on bringing down inflation. They’re not letting the many market/economic distractions take them off track. With that said, many have slowed their pace of hikes and are nearing their projected terminal rate, where they intend to leave policy to observe how the economy reacts. Additionally, officials have become more optimistic about their economies’ ability to avoid a recession while inflation comes down. 🔮

Meanwhile, here in the U.S., concerns over the regional banking crisis remain. Bill Ackman and others have been highly critical of Treasury Secretary Janet Yellen’s recent comments. She said that complete deposit protection for all banks was not being considered. Instead, the government is choosing only to protect deposits at banks that pose a risk of contagion to the system. 🏦

And in Europe, Swiss regulators are facing backlash over UBS’ takeover of Credit Suisse. In particular, Additional Tier 1( AT1) bondholders feel that their investments should not be entirely written down. Others are more concerned about the risk this “mega-bank” could pose to the country, as it’s now twice the size of Switzerland’s economy.

So far, the market’s reactions have been mixed. However, policymakers are staying steady on their hiking path despite the looming bearish sentiment. So, whether it’s central bank decisions or news about private sector banks, the sector will remain in focus for the foreseeable future. 👀

Sponsored

Morning Brew Just Launched a Podcast

You probably already know Morning Brew as the business newsletter read by millions of people every day. What you may not know is that they just launched a daily podcast show which runs down the most important and interesting business stories you need to know every morning. Check out Morning Brew Daily and get the Brew’s signature style served up to your ears every morning. Listen on Apple Podcasts, Spotify, watch on YouTube, or find it wherever you get your shows.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Company News

Another Stock On Hindenburg’s Chopping Block

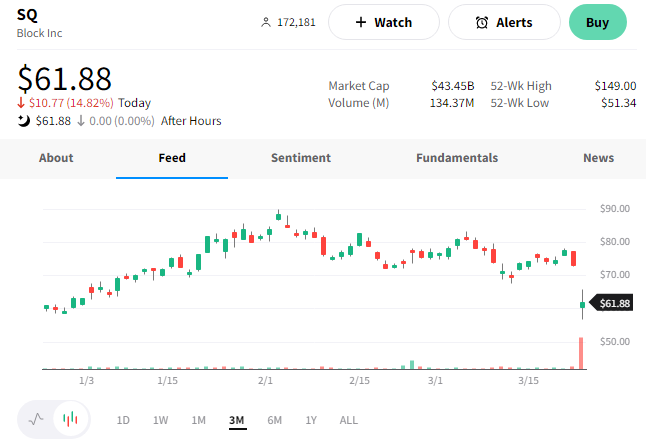

Short seller Hindenburg Research has found its next target, Jack Dorsey’s Block. 🎯

After completing a two-year investigation into its Cash App business practices, the infamous short-selling firm confirmed Block as its latest short position.

The report ultimately alleges that Block misled investors on key metrics such as “transacting user base” and juiced profits through predatory offerings and by strategically disregarding compliance best practices. 🤯

Its two-year research into the company included speaking with former employees, analyzing screenshots of internal systems and messages, and much more. 🕵️

Former employees claim management pressured them to disregard Anti-Money Laundering (AML) and Know Your Customer (KYC) laws. Additionally, they estimated that roughly 40%-75% of the accounts they reviewed were fake, involved in fraud, or were additional accounts tied to a single individual.

To test that theory, Hindenburg Research opened accounts under obviously fake names like Donald Trump and Elon Musk but received the Cash App card and account access anyway. These tests appeared to confirm what former employees suggested. 🪪

Hindenburg’s report was also critical of Cash App’s practices during the pandemic when it and other payment platforms convinced the government to issue stimulus checks to “unbanked” recipients through its platform. That practice ultimately boosted the platform’s transaction volumes, but at the inevitable cost of allowing fraudulent payments to go through. 💰

It also said up to 35% of Cash App’s revenue came from interchange fees, which should be capped under current regulations. However, the company avoids the cap by routing that revenue through a small bank. It’s a method used by competitor Paypal, which is currently under investigation by the Securities & Exchange Commission (SEC) over the practice. Hindenburg believes a similar investigation into Cash App is warranted. ⚠️

Overall it calls into question whether the “unbanked customers” Cash App serviced were unbanked for a reason. Perhaps it’s because they were involved in criminal or illicit activities and couldn’t bank elsewhere? And maybe Block was aware of this but chose profits over the rule of law?

Those are essentially the questions this report is posing to Block’s stakeholders. And ultimately, it will be up to them to decide for themselves. 🤔

Block executives responded with a brief statement, saying they intend to work with the Securities & Exchange Commission (SEC) and explore legal action against Hindenburg for its “factually inaccurate and misleading report.” They questioned the short-seller’s motives, saying they’d reviewed the report within the proper context and believed it was designed to deceive and confuse investors.

Whether Block facilitated fraud or not, Hindenburg won today’s skirmish as $SQ shares fell 16%. 🔻

For now, we’ll just have to wait and see who has the last laugh in this war. But clearly, there will be a renewed spotlight on Block as stakeholders reassess their view of the company and adjust their positions accordingly. 🔦

Earnings

Several Earnings Worth WATCHing

Earnings season is still hanging in, with dozens of companies reporting daily. Let’s recap some of today’s biggest movers. 👀

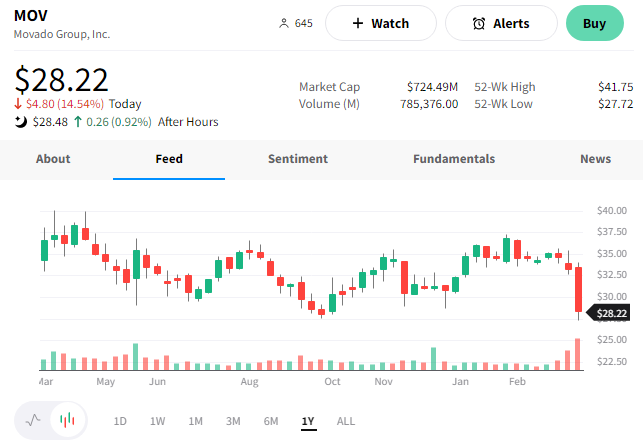

First up is American luxury watchmaker Movado. ⌚

The company reported fourth-quarter earnings per share of $1.03 on revenues of $194.3 million. That topped analyst estimates of $0.86 per share and $184.4 million in revenues. Diving into the numbers further, we see gross margins dropped 250 bps YoY to 56.2%. Operating income also fell roughly 30% YoY to $26.1 million. 🔻

Executives say the challenging economic environment is impacting the company. As a result, they’re maintaining a disciplined approach to managing expenses and inventory levels while making strategic investments to ensure their brands maintain market share.

They were also very cautious in their outlook for the fiscal year 2024. They expect net sales between $725 to $750 million, well below the $814 million consensus view. Their expected earnings per diluted share of $2.70 to $2.90 were also below the $4.61 estimate. ⚠️

Overall, investors were caught off guard that Movado’s sales did not hold up as well as its competitors. We’ve heard from many luxury brands this earnings season who have managed the downturn better and are still experiencing strong consumer demand.

The company tried to smooth the bad news over by returning cash to shareholders, but that had little impact. The Board of Directors approved a special cash dividend of $1.00 in addition to the regular quarterly dividend of $0.35 per share. It also had $21 million remaining under its share repurchase program at the end of the quarter. 💰

$MOV shares fell about 15% on the day to their lowest level of the last year. 📉

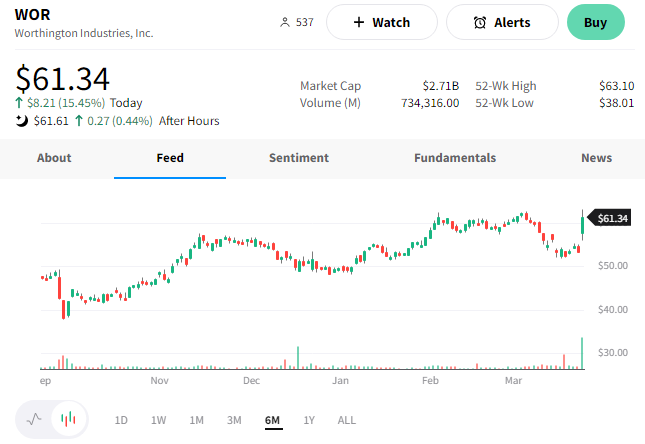

On the flip side of that big decline was the Industrial firm Worthington Industries. 🏭

The metals manufacturer reported third-quarter earnings per share of $0.94 on revenues of $1.1 billion. While that was below the $1.11 per share and revenues of $1.4 billion in the previous year, it still topped Wall Street’s low expectations.

Inflation continues to push up manufacturing expenses, but higher steel spreads and a favorable building products mix helped keep its gross margin flat. Like its industry peers, its 28% YoY decline in steel processing revenues was primarily driven by lower average selling prices.

Overall, stronger pricing and margins across all its segments helped drive the Q3 beat. $WOR shares rose 15% on the news. 👍

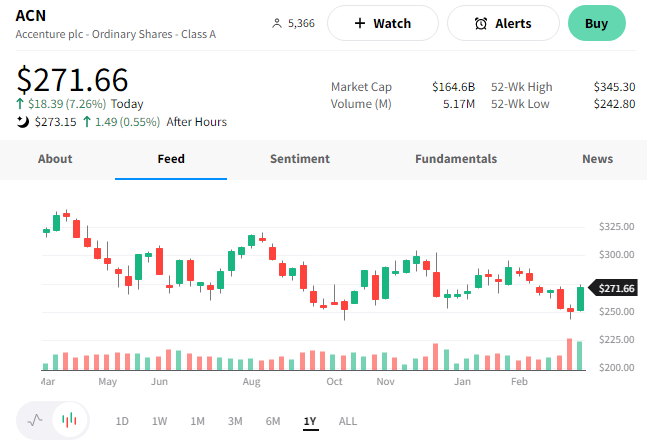

As the tech and media slowdowns continue, we’re beginning to see a tangible impact on the companies serving those industries. One of those is consulting, as Accenture confirmed today.

The professional services firm’s executives lowered their annual revenue and profit forecasts citing the broader tech slowdown. They also announced new cost-cutting measures, which include 19,000 jobs cuts (2.5% of the workforce) over the next eighteen months. ✂️

The company recognized weakness in Europe, where the Ukraine war has impacted client spending. IBM and India’s top IT services firm Tata Consultancy Services, noted a similar slowdown in the region. Overall, its clients are focusing more on executing compressed transformations as they look to become leaner in the weaker macroeconomic environment.

Accenture now expects annual revenue growth of 8 to 10%, down from 8 to 11%. Earnings per share estimates of $10.84 to $11.06 were down from $11.20 to $11.52. And it also anticipates $1.2 billion in severance costs through fiscal 2023 and 2024. 📉

Like its tech-sector clients, the market is looking past the growth slowdown and rewarding the company for its renewed focus on profitability.

$ACN shares rallied 7% on the news. 📈

Bullets

Bullets From The Day:

💉 Moderna CEO justifies a 400% increase in the company’s COVID-19 vaccine price in front of the Senate. During the hearing, Moderna CEO Stephane Bancel defended the company’s actions, citing the significant investment in research, development, and manufacturing. Bancel noted that the pricing aligns with other vaccines and therapies for rare diseases and that Moderna has been transparent about its pricing strategy. He also pointed out that the U.S. vaccination program has provided $5 trillion in economic value by preventing 18 million hospitalizations and 3 million deaths. Ars Technica has more.

✂️ Job platform Indeed cuts 15% of its workforce as the job market cools. CEO Chris Hyams announced the 2,200 job cuts as part of the company’s all-hands meeting, saying he expects the job market to continue slowing. Indeed, which makes money by allowing companies to sponsor job listings, saw last quarter’s sponsored job volumes fall 33% YoY while total job openings were down 3.5%. With future job openings at or below pre-pandemic levels, the company is too big and needs to be “right-sized.” The CEO will also take a 25% cut in base pay as the company refocuses on profitability. More from TechCrunch.

📈 Tencent’s ad revenue resumes growth for the first time in over a year. Chinese tech giant, Tencent, has reported growth in online advertising revenue for the first time since 2021, driven by an increase in demand from small and medium-sized businesses. The company’s ad revenue rose 4% year-over-year in Q4 2022, marking a significant turnaround from the 5% decline reported in Q3 2022. With that said, ads are still less than 20% of its overall revenue, which grew marginally in Q4 as the country’s broader tech/consumer slowdown continues. CNBC has more.

⚡ Ford reveals $2.1 billion in operating losses from its electric vehicle (EV) unit. As the automaker unveils its more detailed financial reporting, investors are finally getting a look at how its EV investments are faring. Higher demand for its vehicles and cost-cutting measures helped deliver a $10 billion operating profit in its two other units, more than offsetting EV losses. Executives expect 2023 to be similar, with an adjusted loss of $3 billion for its EV unit and $13 billion in earnings from its internal combustion unit and fleet business. They expect EBIT profit margins of 10% by 2026, when the company should build roughly 2 million EVs annually. More from CNBC.

💾 TikTok CEO grilled by Congress over security and privacy concerns. The potential for a U.S.-wide ban on TikTok has been around for several years, spreading to other countries as fears of the Chinese government’s access to user data proliferated. With tensions between the U.S. and China remaining heightened, U.S. lawmakers are asking the tough (and sometimes ridiculous) questions to TikTok CEO Shou Zi Chew as he tries to convince them the app is safe. TikTok’s efforts to calm global governments and the public haven’t seemed to impact perception yet. So far, the federal government, some universities, and other organizations have banned employees from installing the app on official devices. The Verge has more.

Links

Links That Don’t Suck:

📦 Walmart lays off hundreds of workers at e-commerce facilities

☕ Starbucks CEO says he’ll work a shift at the company’s cafes once a month

🚀 Startup’s 3D printed rocket delivers stunning night launch but fails to reach orbit

🚫 California could ban Red Dye No. 3 and other ingredients used in processed foods

🏀 Ex-Morgan Stanley advisor charged with defrauding NBA players out of $13 million

❌ Cancelling subscriptions is notoriously difficult. A proposed FTC rule wants to change that

🧑⚖️ After appeals loss, Johnson & Johnson will take Texas two-step case to the US Supreme Court