A volatile day capped off a volatile week as market participants adjusted their positions ahead of next week’s quarter end. Let’s recap Friday’s session and get your weekend started. 👀

Today’s issue covers Treasury Secretary Yellen’s emergency FSOC meeting, another retailer potentially on an Express path to bankruptcy, and one chart everyone’s watching. 📰

Check out today’s heat map:

9 of 11 sectors closed green. Utilities (+3.16%) led, and consumer discretionary (-0.31%) lagged. 💚

In economic news, durable goods orders fell 1% in February vs. the 0.6% gain expected. Falling demand for passenger planes and new cars impacted the numbers was to blame. S&P Global’s U.S. Composite PMI rose to 53.3 in March, marking its second straight month above 50. That signals growth in the private sector, which rebounded across most major countries to start this year. 🏭

In crypto news, Binance is resuming withdrawals and spot trading after a glitch caused a two-hour outage on the platform. The Nasdaq will reportedly start to offer custody services for digital assets by the end of June 2023. And Interpol confirmed the arrest of Terra’s founder and crypto fugitive, Do Kwon, in Montenegro. ₿

Other symbols active on the streams included: $TRKA (+21.12%), $DRMA (-8.33%), $SQ (-1.94%), $NVDA (-1.51%), $CDTX (-18.88%), and $BTC.X (-3.43%). 🔥

Here are the closing prices:

| S&P 500 | 3,971 | +0.56% |

| Nasdaq | 11,824 | +0.31% |

| Russell 2000 | 1,735 | +0.85% |

| Dow Jones | 32,238 | +0.41% |

Policy

A “Meeting Of The Minds”

Investors’ game of “whack a mole” continues as banking sector fears continue. As one bank’s crisis is seemingly avoided, the market moves on to its next potential victim.

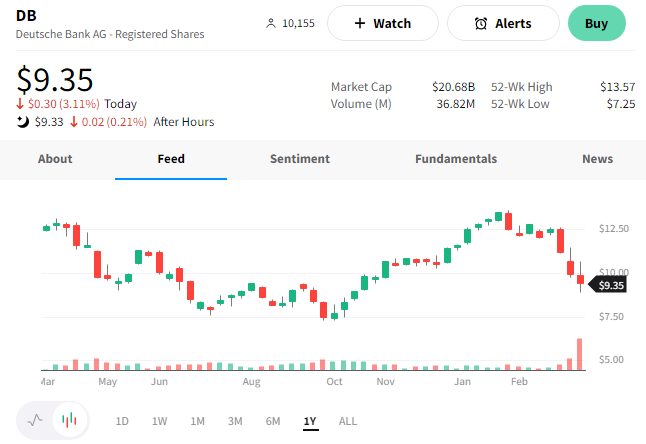

Today that victim was Deutsche Bank. The German lender’s shares extended their decline after a sudden spike in the bank’s Credit Default Swaps (CDS). This asset is essentially an insurance policy against the bank’s failure, so a jump in price means the market is pricing in a rising risk of failure.

Some came to the bank’s defense, saying it’s reported ten straight quarters of profit and has stronger liquidity measures than the recently failed banks. Even Jim Cramer used a similar argument to defend Deutsche Bank, though some suggested that’s exactly why they should be concerned. 😅

Shares of $DB closed down 3%, marking their third straight weekly decline. 📉

As the banking fears continue, global officials are working overtime to restore the market’s confidence. ⌚

Treasury Secretary Janet Yellen called an impromptu, closed-door U.S. Financial Stability Oversight Council (FSOC) meeting on today. The multi-regulator participants received a briefing on market developments from Federal Reserve Bank of New York staff. 📝

Following the briefing, FSOC released a statement, essentially saying that the U.S. banking system “is fine.” The post-meeting readout stated, “The Council discussed current conditions in the banking sector and noted that while some institutions have come under stress, the U.S. banking system remains sound and resilient.”

Three Federal Reserve bank presidents also chimed in today. Their separate remarks indicated that “there was no indication that financial stress was worsening this week,” allowing the Fed to continue tightening by 25 bp. 💬

Ultimately where we stand is that the government will only backstop depositors at banks who pose a risk of contagion. They will not bail out shareholders, bondholders, or other stakeholders. Protecting depositors and confidence in the overall banking system remains their primary goal.

For now, they will sit back and see how it all plays out, acting only as needed. 🤷

Earnings

A Bankruptcy Express Lane?

Shares of fashion retailer Express have seen better days. And in a difficult environment, its poor holiday-quarter results have investors wondering whether they’re headed for zero. 🤔

The company’s loss per share of $0.63 beat the $0.72 expected. However, revenues of $514.3 million fell well short of the $536.68 million estimate.

Executives’ strategy to elevate the brand with higher average unit retails and reduced promotions had worked well in the first half of 2022. However, the weakening macroeconomic environment, inflationary pressures, and changing consumer preferences challenged that approach in the back half of the year. 🛒

The company expects those headwinds to continue into 2023 and has begun to refocus on profitability, identifying $40 million in annualized expenses savings so far this year. In addition, it’ll continue to identify opportunities as it pursues long-term, profitable growth for the Express brand.

Regarding numbers, executives forecasted full-year 2023 comparable sales of positive low-single digits. They’re also looking for a diluted loss per share of $0.85 to $1.05, including capital expenditures of $55 million as it restructures its stores. 🔮

While Express isn’t quite on the brink of collapse like Bed Bath & Beyond or other struggling retailers, investors are rightfully concerned. Retailers and adjacent industries have painted a very cautious picture for consumer spending in 2023. That, plus a weak funding environment, could make it difficult for Express to stage a proper turnaround. Not to mention, a stock price nearing its all-time lows doesn’t inspire confidence. 😬

Overall, the negatives outweighed the positives today. $EXPR shares regained some ground throughout the session but closed down 12%. 🔻

Stocks

Approaching Q1’s End

The days are short, but the quarters are long. And this first quarter has felt like a year of action in and of itself. So as we head into Q1’s last week of trading, we thought it’d make sense to check how the various asset classes are performing. 📆

Below is a chart of ETFs tracking stocks, bonds, commodities, and currencies at a high level. 👇

Despite the last month of volatility, most asset classes are still positive for the year. And within stocks, developed markets (ex-North America) are outperforming, and emerging markets are underperforming, albeit marginally.

The lone standout here is commodities, which are decisively negative for the year. Of course, this ETF weighs energy heavily, which accounts for much of the underperformance. But overall, it’s clear this asset class does not look like the others. 🛢️

And lastly, we’ve got one chart that almost every technical analyst is talking about this week. 💬

Below is a weekly chart of the financial sector ETF $XLF. As you can see, there are no indicators, nothing fancy. Just prices and simple support and resistance analysis.

Technical analysts argue that this sector is a key barometer for where the market is headed next. Prices are currently sitting above their 2007, 2018, and 2020 highs. But if the market is sniffing out more significant issues ahead, this ETF will likely break below its crucial support level.

Theoretically, it makes sense why this would be of interest. Many of the market’s recent concerns revolve around the U.S./global financial system. If systemic issues exist and start playing out, this ETF tracking the U.S.’s largest financial institutions is going to get hit. How could it not? 🤔

So far, prices have managed to hold above this “key level” of support that analysts are pointing to. As we head into the end of the quarter, they’ll be watching to see whether that holds true. Because if it doesn’t, that could indicate more trouble is ahead. ⚠️

In the meantime, we’ll have to wait and see whether their theory is correct. 🤷

Bullets

Bullets From The Day:

📦 Amazon and other retailers rethink “free shipping” as costs soar. There is no such thing as free shipping, as someone somewhere pays the cost. Over the last decade, Amazon and other retailers have used the “free delivery” tactic to drive customer loyalty. However, record shipping prices have all of them trying to figure out how to balance consumer benefits while maintaining their profit margins. Some are adding fees for faster service, raising minimum purchase requirements, and using other methods to avoid the costs or shift them back to consumers. Clearly, the race to be the cheapest and fastest may have backfired on the industry, as consumers’ expectations have never been higher. Reuters has more.

🏦 Citi says China could be a “safe haven” for investors amid global banking stress. Citi economists have been discussing their view that China can be an effective growth hedge in 2023 and believe the recent banking stress has strengthened their thesis. They say the People’s Bank of China’s supportive policy decisions, a net-positive regulatory environment, Yuan strength, and the country’s continued reopening make it an attractive market. However, critics of the thesis question the country’s regulatory environment, raising concerns that money or assets could get stuck in the country if a global crisis spreads or geopolitical tensions escalate to extremes. More from CNBC.

✅ Come April 1st, only Twitter Blue subscribers will have verified checkmarks. We knew it was coming; we didn’t know when. Elon Musk confirmed that Twitter’s previous blue checkmark verification system would be wound down next week. That means anyone who wishes to have a blue checkmark on the platform will need to subscribe to Twitter Blue for $8-$11/month, and organizations will need to pay $1,000/month to keep their gold checkmark. Meanwhile, rumors continue to fly about new features and requirements, including a verification process that includes government-issued IDs. The Verge has more.

🤝 Toshiba accepts a $15bn buyout offer from a Japanese consortium. The Japanese multinational conglomerate has faced many issues since 2015, when accounting irregularities surfaced and its U.S. nuclear power plant subsidiary suffered significant losses. As a result, it raised 600 billion yen in 2017 to avoid delisting and has struggled to stage a turnaround since. However, activist investors and other stakeholders have pushed the troubled industrial group toward a new 2 trillion yen ($15.3bn) buyout led by Japan Industrial Partners. A special committee and the Board of Directors have already voted for the deal, as they believe it will create the most shareholder value. More from Nikkei Asia.

📝 Evergrande Group is finally restructuring its debt two years after its collapse. China’s second-largest property developer revealed a multi-billion dollar restructuring plan that it hopes will make peace with its international creditors. The company offered its international creditors two options: swapping their holdings for 10 to 12-year notes or converting them into new 5-9 year notes and equity-linked instruments. As a reminder, Evergrande’s 2021 collapse sparked China’s worst property market crisis in history, so this could help restore some confidence and encourage further investment in the space. Roughly 84% of the company’s offshore debt holders have approved the proposal so far. CNN Business has more.

Links

Links That Don’t Suck:

🕵️ Meet the mysterious buyer of the Flatiron Building

🌊 Startup says the seaweed bobbing toward Florida has a silver lining

📱 A first look at using iMessage from a PC with Microsoft’s Phone Link app

👩💼 How to play the long game, with New York Times CEO Meredith Kopit Levien

🛍️ Secondhand resale is getting cutthroat as platforms like Depop and Poshmark boom

🚀 Blue Origin says it finally knows what caused its New Shepard rocket launch to fail last year