Bonds popped, and stocks flopped after the Federal Reserve raised rates by 25 bp, keeping its terminal rate projection at 5.1%. Let’s recap a Fed-filled session. 👀

Today’s issue covers the Federal Reserve’s policy decision, earnings that had investors saying WOOF, and better-than-expected results from KB Home. 📰

Check out today’s heat map:

Every sector closed red. Consumer staples (-0.92%) led, and real estate (-3.68%) lagged. 🔻

The focus on regional banks continues, with PacWest Bancorp as the market’s next target. Its shares dropped 17% after saying deposits fell 20% between December 31, 2022, and March 20, 2023. Executives had explored a potential capital raise but instead accessed $1.4 billion through a new senior asset-backed financing facility from Apollo’s Atlas SP Partners. They also borrowed $16.3 billion from various government programs. 🏦

Used car retailer Carvana said its cost-cutting measures are paying off and expects a smaller core loss in its current quarter. It also offered creditors an option to exchange unsecured notes due as early as 2025 for secured notes due in 2028. Shares rallied 6% on the news. 🚗

Virgin Orbit jumped 33% after raising $200 million from investor Matthew Brown, stemming immediate bankruptcy fears. 🚀

Zura Bio had a lackluster start after going public via SPAC but soared over 315% on its second trading day. Meanwhile, 89bio rose 25% after its NASH drug succeeded in a mid-stage study. 🔬

Other symbols active on the streams included: $TRKA (-16.94%), $GME (+35.24%), $MULN (-16.81%), $FRC (-15.47%), $MARA (-12.29%), $XRP.X (-13.77%), and $BTC.X (-3.43%). 🔥

Here are the closing prices:

| S&P 500 | 3,937 | -1.65% |

| Nasdaq | 11,670 | -1.60% |

| Russell 2000 | 1,727 | -2.83% |

| Dow Jones | 32,030 | -1.63% |

Policy

A Unanimous Decision

After a hectic few weeks in the banking sector, most of the market expected a 25 bp rate hike at today’s meeting. And that’s what the Fed delivered. 👍

Let’s start with the redlined version of the FOMC’s statement from Nick Timiraos:

The Fed raised rates 25 bps

The decision was unanimous

The terminal rate projection is unchanged at 5.1%

FOMC statement modifies guidance: “The committee anticipates that some additional policy firming may be appropriate.” pic.twitter.com/HUMdU1TaTQ

— Nick Timiraos (@NickTimiraos) March 22, 2023

The main change was the fed modifying its guidance, saying, “The committee anticipates that some additional policy firming may be appropriate…” in order to attain a monetary policy stance that’s sufficiently restrictive to return inflation to 2 percent over time. 🕵️

It also added language to reiterate that the banking system is sound and resilient. And while the impact will likely be tighter credit conditions, the extent of the effects is unknown. Besides that, its normal tune continued, acknowledging that employment remains robust and inflation elevated.

The Federal Reserve has reiterated time and time again that its primary goal is bringing inflation down. And recent data shows inflation is still too high, so it was a unanimous decision among policymakers to raise rates by 25 bp. 🗳️

The market was highly anticipating the Federal Open Market Committee’s (FOMC) economic projections, which haven’t been updated since December. Well, there wasn’t much of a change in this month’s figures. Instead, they showed that 17 of 18 officials expect the fed-funds rate to rise to at least 5.1% and stay there through year-end. That implies a single quarter-point increase next meeting before pausing.

Overall, the Fed stuck to its data-dependent narrative. Inflation remains too high, so it’s likely to bring rates to their projected terminal rate of 5.1% and then wait to see what happens. 📝

Stocks and bonds were volatile, as expected. However, they really started to move after Janet Yellen said the Treasury “…is not considering or working on a unilateral expansion of deposit insurance.” That seemed to contradict her earlier comments that more could be done to backstop banks that pose a risk of contagion. Regional bank stocks fell sharply following the comments. 📉

Meanwhile, across the pond, the U.K.’s inflation rate surprised investors by rising to 10.4% in February. And European Central Bank (ECB) President Christine Lagarde gave a speech today titled “The path ahead.” Within it, she reiterated the central bank’s fight against inflation by saying, “But the public can be certain about one thing: we will deliver price stability, and bringing inflation back to 2% over the medium term is non-negotiable.”

In conclusion, today’s meeting was more of the same as the Fed. It and other global central banks continue their fight against inflation and are not backing down despite the recent banking sector troubles. Unless the data changes dramatically, we can expect one more 25 bp hike on May 3rd and then a long pause as the Fed observes the impact of its policies on the economy. ⚔️

For now, we’ll have to see if the market’s initial reaction sticks through the end of the week. 🤷

Earnings

Investors Say $WOOF To Weak Earnings

It was a rough day for pet retailers, with Petco Health & Wellness and Chewy shares both falling on earnings. 😬

Petco reported fourth-quarter adjusted earnings per share of $0.23 vs. the $0.24 expected. Revenues of $1.577 billion rose 4.2% YoY and barely beat the expected $1.57 billion.

Comparable sales rose 5.3% YoY and 18.8% on a two-year basis, with gross profit margins falling 1% YoY to 39.7%. Looking at segments, its consumables business grew 12.1% YoY, and “services and other business” rose 17% YoY. Meanwhile, its supplies and companion business fell 7.8% YoY. 🕵️

While the macro environment has impacted some consumers at the lower end of the income spectrum, those at the top end continue to spend on their pets. As a result, the company says it’s continuing its push into more premium products and expanding its service offerings.

Executives’ outlook for fiscal 2023 was weaker than expected. They now see net sales of $6.15 to $6.275 billion vs. the $6.36 billion analyst estimate. And adjusted EPS to be down $0.21 to $0.13. They also expect to make $100 million in principal payments on their term loan, with free cash flow of $70.6 million and cash and equivalents of $201.9 million last quarter. Petco’s CEO also pointed out that the company has no exposure to any banks currently facing turmoil.

$WOOF shares fell 17.50% to a fresh all-time low on the news. 🙃

Meanwhile, online pet retailer Chewy reported adjusted earnings per share of $0.16, beating analysts’ expectations for a $0.12 loss. Its revenue of $2.71 billion also topped the expected $2.64 billion.

The company expects $2.72 to $2.74 billion in revenue this quarter and full-year revenue of $11.1 to $11.3 billion. However, executives guided for a flat to declining adjusted margin and a continued decline in active customers this year. 🔻

Its downbeat guidance took precedence over the surprise profit, sending $CHWY shares down about 1% after hours. 👎

Earnings

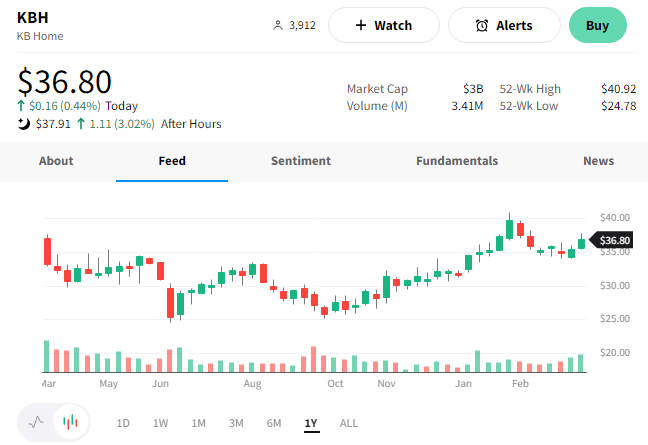

$KBH Brings Home The Goods

Homebuilder KB Home and another name brought home the goods after hours, reporting better-than-expected results. 👍

KB Home reported first-quarter earnings per share of $1.45, down $0.02 YoY. Analysts had expected $1.17 per share. Meanwhile, revenues of $1.38 billion also topped estimates of $1.32 billion, falling $0.02 billion YoY. 💪

Other relevant stats included:

- Ending backlog down from $5.71 billion to $3.31 billion. In units, it’s down from 11,886 to 7,016.

- Net orders fell 39% to 2,142, and net order value fell 53% YoY to $1 billion.

- The cancellation rate as a percentage of gross orders was 36%. (Up from 11% YoY, but down from 68% QoQ)

- Land and land development expenditures fell 48% YoY to $367 million, with the land investment portion down 86% YoY.

For fiscal 2023, executives forecasted housing revenue of $5.2 to $5.9 billion, an average selling price of $480,000 to $490,000, and a return on equity in the lower double digits. 🔮

Overall, the housing market remains soft, and builders are still dealing with tough comps from last year. However, KB and others are adjusting to the weakening housing market by reducing investment, working through their backlog, and using promotions to pull buyers in. 🏘️

Executives say they’re seeing a slight uptick in demand as the Spring selling season begins. However, the volatility in mortgage rates and the macroeconomic environment remain significant headwinds for the company. 🌬️

Investors appear happy with how the company’s managing the downturn. $KBH shares rose 3%.

While this is unrelated to housing, it’s worth mentioning another name that fared well today.

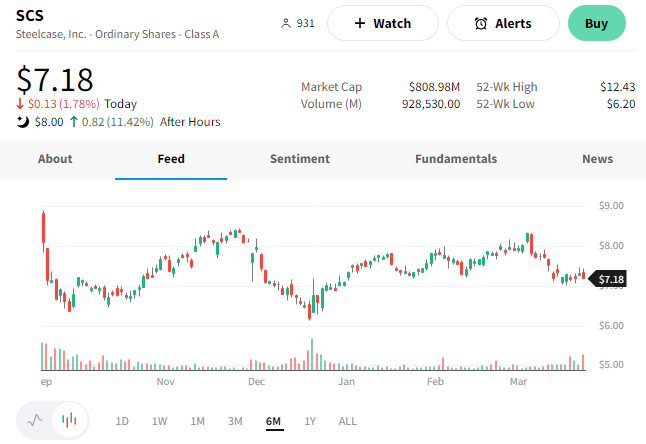

Steelcase is a small-cap industrial company that provides furniture and architectural products in the U.S. and abroad. Its adjusted earnings per share of $0.19 and revenues of $801.7 million both topped estimates by $0.08 and $51 million, respectively. Its full-year guidance also beat expectations. 🏋️

$SCS shares rose over 11% on the news, though they’re fading a bit after hours. 🥀

Bullets

Bullets From The Day:

💾 JPMorgan targets venture capital investors with a new startup data platform acquisition. North America’s largest bank purchased a data analytics provider for startup investors called Alumni at a price roughly equivalent to its valuation during its 2021 fundraising round, $232 million. The company’s software looks to disrupt excel by helping users analyze and understand their holdings in a simple dashboard format. It’s the latest fintech investment the bank has made to bolster its capabilities in payments, ESG investing, and other areas. CNBC has more.

🤖 GitHub’s Copilot X does more than complete code. The software company is launching a code-centric chat mode for Copilot that helps developers write and debug their code. Its new initiative is an extension of its popular Copilot code completion tool, originally launched in 2021. It’s also launching Copilot for pull requests, AI-generated answers about documentation, and more. It hopes these tools will help increase developer productivity and broaden the accessibility of the technology. More from TechCrunch.

⚔️ Tensions remain high between content owners and distribution partners. After a months-long spat over the finances of a deal, DirecTV and Newsmax Media finally agreed to bring the right-wing network to its satellite TV and streaming packages at no extra cost to consumers. Newsmax had been pushing to receive fees after initially relying solely on advertising revenue, which is typical for new TV channels. The dispute left consumers caught in the middle. However, the two parties chose to resolve their difference and resume coverage since consumers have alternatives. CNBC has more.

🫳 Amazon partners with Panera Bread to test its palm-scanning technology. The bakery-cafe fast-casual restaurant chain is testing Amazon’s palm-scanning technology at two St. Louis locations. Customers can connect to their loyalty program accounts and pay for their orders using their palms. As Amazon looks to expand its Amazon One technology, loyalty programs like Panera, which has 52 million users, are an important distribution channel. That said, Amazon has faced backlash over its use of biometrics, including an Amazon Go customer filing a lawsuit claiming that he was not informed its NYC store was using facial recognition. More from CNBC.

🛒 Inflation has consumers flocking to cheaper products/brands across most categories. Two years of high inflation have pushed consumers down the value chain, with new research from Adobe Analytics showing a meaningful decline across eleven e-commerce categories. A clear example is personal care products, where the most expensive quartile fell from 31% to 7% of the market from January 2019 to February 2023. Consumers will likely remain price-conscious as the uncertain economic times continue and inflation remains above the Fed’s 2% target. CNN Business has more.

Links

Links That Don’t Suck:

💉 China OKs its first mRNA vaccine, from drugmaker CSPC

🕵️ Ford is about to break out big EV losses for the first time ever

🧫 Lab-grown chicken is one step closer to being sold in the U.S.

⚠️ Drug shortages are rising and pose a national security risk, new report warns

📝 Bill Gates just published a 7-page letter about AI and his predictions for its future

❌ Starbucks workers welcomed their new CEO with a strike ahead of the company’s annual meeting