It remains a chaotic environment, but the major stock market indexes continue to trade around the same level they started the year. So it’s not quite armageddon. Let’s recap what you missed. 👀

Today’s issue covers First Citizen BancShares’ deal for SVB’s assets, why Carnival Cruise Lines remains in rough waters, and an update on the state of retail from PVH. 📰

Check out today’s heat map:

8 of 11 sectors closed green. Energy (+2.13%) led, and technology (-0.77%) lagged. 💚

Disney shares jumped as CEO Bob Iger announced via an internal memo that the company will start its 7,000 layoffs this week. ✂️

News that Lyft’s CEO and president will step down in mid-April drove its shares up 5% after hours. Former Amazon executive David Risher will replace him. 👨💼

Micro and small-cap biotechs continue to trend among investors. Codiak BioSciences filed for U.S. bankruptcy protection as its struggles to make a COVID-19 vaccine continue. And Gamida Cell reported weaker-than-expected results as its cash runway dwindles. Their shares fell 57% & 50%. 🧬

In crypto news, the Commodity Futures and Trading Commission (CFTC) alleged that Binance and founder CZ violated compliance rules to attract U.S. users to the platform. Nvidia’s Chief Technology Officer (CTO) made headlines after saying crypto is ‘not useful for society,’ but artificial intelligence (AI) is. And some things in crypto are getting hairy, as a self-proclaimed “crypto king” was reportedly kidnapped and tortured by disgruntled creditors. ₿

Other symbols active on the streams included: $TRKA (+2.45%), $FRC (+11.81%), $SI (+14.54%), $WISA (+89.47%), $MYO (+3.54%), $PYXS (+22.17%), $ONCS (-3.30%), and $BTC.X (-2.86%). 🔥

Here are the closing prices:

| S&P 500 | 3,978 | +0.16% |

| Nasdaq | 11,769 | -0.47% |

| Russell 2000 | 1,754 | +1.08% |

| Dow Jones | 32,432 | +0.60% |

Company News

FDIC Finds Buyer For Some SVB Assets

Today’s big news in banking was that First Citizens BancShares is acquiring $72 billion in Silicon Valley Bank (SVB) assets from the Federal Deposit Insurance Corporation (FDIC). But it’s doing so at a significant discount…let’s talk about it.

First off, the deal comes after the FDIC split the auction into two segments and opened up bidding to non-financial institutions. It did so because the appetite for the auction was low, and it could not find a suitable buyer for the entire company in a timely manner. As a result, it split the auction into two: one for the traditional deposits unit and one for its private bank. 🖖

The auction for its traditional deposits unit ended with First Citizens BancShares acquiring all the loans and deposits of SVB and 17 branches for about $55.5 billion. That represents a roughly 23% discount on the $72 billion in assets its acquiring.

In addition to the steep discount, the FDIC agreed to an eight-year loss-sharing deal on the commercial loans it’s taking over and a $70 billion credit line for “contingent liquidity purposes.” The FDIC is also giving First Citizens a five-year, $35 billion loan to finance the deal. In exchange, they’re receiving equity rights in the bank that could be worth up to $500 million in the future. 😮

As for why so many incentives were offered…simply put, finding a suitable deal was taking too long. And time kills deals, especially in a market where confidence remains shaky at best. Additionally, with other banks on not-so-solid footing, more assets could be on the market soon. That would give suitable buyers more options and bargaining power.

Ultimately the FDIC decided taking the costliest loss in its ~90-year history ($20 billion) was the best outcome it could achieve under the current circumstances. That said, those losses could balloon further as it still has about $90 billion in assets in its receivership that it needs to find a home for. 🏠

$FCNCA shareholders were happy with the “sweetheart deal” it received. Shares rose over 50% today, closing back near their all-time highs. 🤩

The many pieces to this complex situation continue to fall in place. Regional banks experienced a small pop. However, uncertainty remains high, leaving many investors on the sidelines. 🙅♂️

Earnings

Stuck In Rough Waters

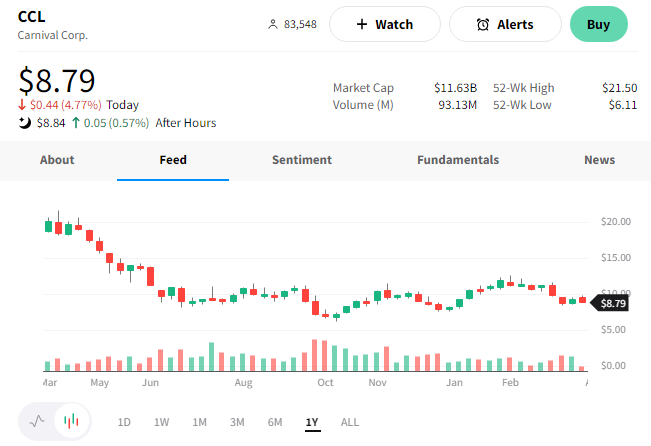

It’s been anything but smooth sailing for cruise lines since the pandemic. And that trend is continuing today after Carnival Cruse Lines disappointed investors with its 2023 outlook. 😞

The company’s fiscal first-quarter adjusted loss per share was $0.55 on $4.43 billion in revenues. Both figures topped the expected $0.60 per share loss and $4.32 billion in revenues.

Driving the strong results was a “phenomenal wave season,” where it experienced its highest-ever quarterly booking volumes. Its effort to drive demand appears to be working, as it continues to close the gap relative to its pre-pandemic results (2019). 🛳️

Several other stats worth mentioning:

- Passenger-ticket revenue rose 229% from 2019 to $2.87 billion;

- Onboarding and other revenues rose 108% from 2019 to $1.56 billion;

- Passenger cruise days increased 181% from 2019 to 20.2 million; and

- Net per diems per passenger cruise day was up 4.89% from 2019 to $162.96

Cash flow from operations was positive during the current quarter. Executives expect continued growth in cash from operations to drive its debt pay down over time, and the company ended Q1 with $8.1 billion in liquidity.

With that said, the company’s guidance was slightly worse than expected. Executives forecast an adjusted loss of $0.28 to $0.44 per share for fiscal 2023, much wider than the $0.07 loss expected. Net per diems is also anticipated to be above 2019 levels by 1-2%. 🔮

They also expect adjusted non-fuel cruising costs to rise 6.5-7.5% from 2019 levels, up from previous guidance of 5-6%. On a constant-currency basis, estimates rose by 1% to 8.5-9.5%. 📈

While investors are happy to see revenues back on track amid solid travel demand, rising costs remain their primary concern. To pay down its debt and return cash to shareholders, the company must keep some of that record revenue as profits. But, apparently, the market is questioning just how well the company can manage those non-fuel costs if inflation remains elevated.

$CCL shares were down about 5% on the day and have traded in a range near all-time lows for the last nine months. 🔻

Earnings

PVH’s Update On Retail

The owner of Calvin Klein, Tommy Hilfiger, and other fashion brands, PVH, reported better-than-expected fourth-quarter earnings. 👕

The company’s adjusted earnings per share were $2.38 on $2.49 billion in revenues. That topped the estimated $1.64 and $2.34 billion expected. 💪

Revenues in the fourth quarter rose 2% YoY (8% on a constant currency basis), well above executives’ original guidance. They were expecting a 4% decline and a 4% increase on a constant currency basis. Full-year revenues fell 1% YoY but again beat guidance of a 3% decline.

Driving the strength was the company’s continued execution of its PVH+ plan, focusing on its Calvin Klein and Tommy Hilfiger brands and investing heavily in its direct-to-consumer efforts. The company is prioritizing a digital-leg strategy to deliver value via the channels consumers use most. These channels also tend to have higher margins than wholesale partnerships, which is why many companies embrace them. 🛒

Those efforts look to be paying off, given digital penetration as a percentage of total revenue rose to 20%.

On the negative side, its gross margin fell by 240 bps YoY. Higher costs and increased promotional activity to reduce inventory levels from elevated levels offset gains from price increases and a favorable shift in channel mix. Executives acknowledged the challenging macroeconomic environment but noted that they remain cost-disciplined and well-positioned for a slowdown. 🔻

Looking ahead, the company expects full-year 2023 revenue growth of 3 to 4%, an operating margin of 10%, and $10 in earnings per share. It also has about $600 million remaining in the stock repurchase program it authorized in 2022. 🔮

$PVH shares are up about 10% on the news. 👍

Bullets

Bullets From The Day:

📝 Parts of Twitter’s source code were leaked online. The company said parts of its proprietary code were posted to the online software repository GitHub last week. Twitter immediately filed a DMCA Subpoena to help identify the alleged copyright infringer(s) and hold them accountable. It also had the leaked information removed from GitHub through the copyright claim takedown request system. It’s yet another hurdle faced by Elon Musk as he tries to turn around the social media giant, which is reportedly now being valued at less than half its acquisition price according to recent employee stock incentives. CNN Business has more.

💾 Apple acquires an AI video compression startup. The tech giant quietly acquired WaveOne, which was developing AI algorithms for compressing video. Although Apple didn’t confirm the acquisition, WaveOne’s website was shut down in January, and several former employees are now working within Apple’s machine learning groups. A former employee also celebrated the official sale via a LinkedIn post last month. WaveOne’s “content-aware” video compression and decompression algorithm allowed it to “understand” a video frame and prioritize certain elements. This technology could help Apple make its streaming more efficient and apply it to broader use cases in the future. More from TechCrunch.

❌ France’s strikes have greatly affected diesel production, giving Russia a big boost. Diesel barge margins in northwest Europe dropped below $30 a barrel on Monday due to the ongoing disruptions at French refineries and rising Russian diesel exports to new markets. Industrial action at several French refineries continued, with TotalEnergies’ 240,000 barrel-per-day Gonfreville refinery remaining closed. Meanwhile, diesel exports from Russia to Brazil, Turkey, and Africa are expected to reach new highs in March, according to traders and Refinitiv data. Diesel exports to Europe are expected to reach 7.43 million tonnes in March, up from February’s 5.8 million. Reuters has more.

🏭 Apple CEO meets with China’s commerce minister about supply chain issues. Tim Cook met with China’s minister of commerce, Wang Wentao, to discuss China’s economic reopening and broader supply chain issues from the last few years. This comes at a time when Apple has urged its suppliers to move away from relying heavily on China to meet production needs. As political and corporate pressures heat up, the Communist Party’s officials are now working overtime to reassure corporate leaders from around the globe that its country can remain a reliable source of productivity. More from the CNBC.

✍️ So let it be written, so let it be done. According to a memorandum released by the White House, U.S. President Joe Biden used the Defense Production Act on Monday to encourage the domestic production of printed circuit boards and related components, citing their significance to national defense. Analysts say this will speed up the fulfillment of government contracts by streamlining and prioritizing the procurement processes for these key technologies. This move is expected to help fill the gap between current U.S. production capabilities and demand. Reuters has more.

Links

Links That Don’t Suck:

📈 21 largest stock exchanges in the world

😲 Jack Ma: Alibaba founder seen in China after long absence

📱 Some Chinese apps beyond TikTok have hooked American consumers

🚜 How a video game has revolutionized the way farmers are buying tractors

🌬️ This industry predicts significant “tailwinds” in 2023, making it poised for rapid growth

💰 Chipotle to pay ex-employees $240,000 after closing Maine location that tried to unionize