The market made it through another week of financial sector turmoil and central bank decisions. 😌

Let’s recap and prep you for the last week of Q1. 📝

What Happened?

💚 Bonds and stocks ended slightly in the green after the Federal Reserve unanimously decided to raise rates by 25 bp. Overall, central banks across the globe remain hyper-focused on their primary goal of bringing down inflation. And stock market watchers have one chart on their radar into the end of the quarter.

🤩 This week’s Stocktwits Top 25 report showed outperformance relative to the indexes.

🏦 Banking fears spread to Deutsche Bank, causing Treasury Secretary Janet Yellen to call an impromptu U.S. Financial Stability Oversight Council (FSOC) meeting. They concluded that the U.S. banking system remains “sound and resilient” despite the recent banking turmoil.

🛍️ Retailers continue to paint a cautious picture of consumer spending. Foot Locker’s struggles remain, though its renewed partnership with Nike has executives optimistic. Meanwhile, Nike’s rising costs and slowing revenue growth has investors concerned. In addition, a slowdown at pet retailers Petco and Chewy had the market saying “woof.” And Express reported a weaker-than-expected holiday quarter.

🎮 GameStop shares jumped after its business appeared to reach a checkpoint in its turnaround. Its first profit in two years and stabilizing scales had investors thinking its recent quarter may be the start of something more.

📉 Short seller Hindenburg Research found its next target, Jack Dorsey’s Block. Its report sent $SQ shares plummeting late in the week, saying the company facilitated fraud through its “Cash App” business.

📰 Other than that, many other companies reported earnings, including Canadian Solar, KB Home, Accenture, and Pinduoduo.

🔥 Several names were on the Stocktwits trending tab for most of the week, including $FRC, $NVOS, $ZURA, $DWAC, $TRKA, $HUBC, and $BTC.X.

Here are the closing prices:

| S&P 500 | 3,971 | +1.39% |

| Nasdaq | 11,824 | +1.66% |

| Russell 2000 | 1,735 | +0.52% |

| Dow Jones | 32,238 | +1.18% |

Bullets

Bullets From The Weekend

📚 The Internet Archive loses its lawsuit to book publishers. A federal judge ruled against the Internet Archive (IA) and in favor of the four book publishers who brought the suit. The court ruled the website does not have the right to scan books and lend them out like a library. It found that the Archive had done nothing more than create “derivative works” and so would have needed authorization from the publishers who own the copyright before lending them out through its National Emergency Library program. The judge dismissed all of the IA’s fair use arguments as well. The Verge has more.

🔻 Employee compensation suggests Musk is now valuing Twitter at $20 billion. Elon Musk may be looking at a Twitter valuation that’s less than half of what he paid for the company back in October. In an email sent to employees, he acknowledged that the company has been through a period of radical change. The email also said that current employee stock grants are based on a $20 billion valuation but that Musk sees a ‘clear but difficult path’ to a $250 billion valuation. Like SpaceX, Twitter will also do periodic liquidity events so that people can sell, helping incentivize remaining employees and attract future talent. More from Yahoo Finance.

🏦 Valley National is reportedly bidding for Silicon Valley Bank assets. The regional bank has submitted a bid to the Federal Deposit Insurance Corporation (FDIC) as competition for the assets heats up. First Citizens BancShares, one of the biggest buyers of failed U.S. lenders, has also submitted a bid for all of Silicon Valley Bank. The bids as the FDIC split the bank into two separate auctions, one for the bank and one for its private arm. They’ve also opened the bidding up to non-financial institutions after failing to secure a buyer in the weeks earlier. Reuters has more.

The Brief

Need a concise summary of what’s going on this week? Look no further. Here’s an overview of important earnings and economic data for the trading week ahead.

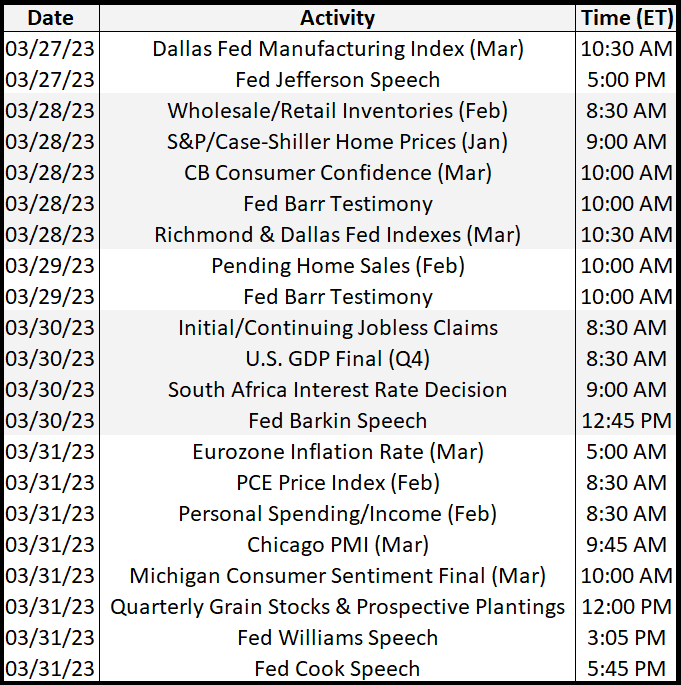

Economic Calendar

It’s a busy week in economic data, but Friday’s personal consumption expenditures price index (PCE) as it’s the Fed’s preferred inflation measure. In addition to the above, check out this week’s complete list of economic releases.

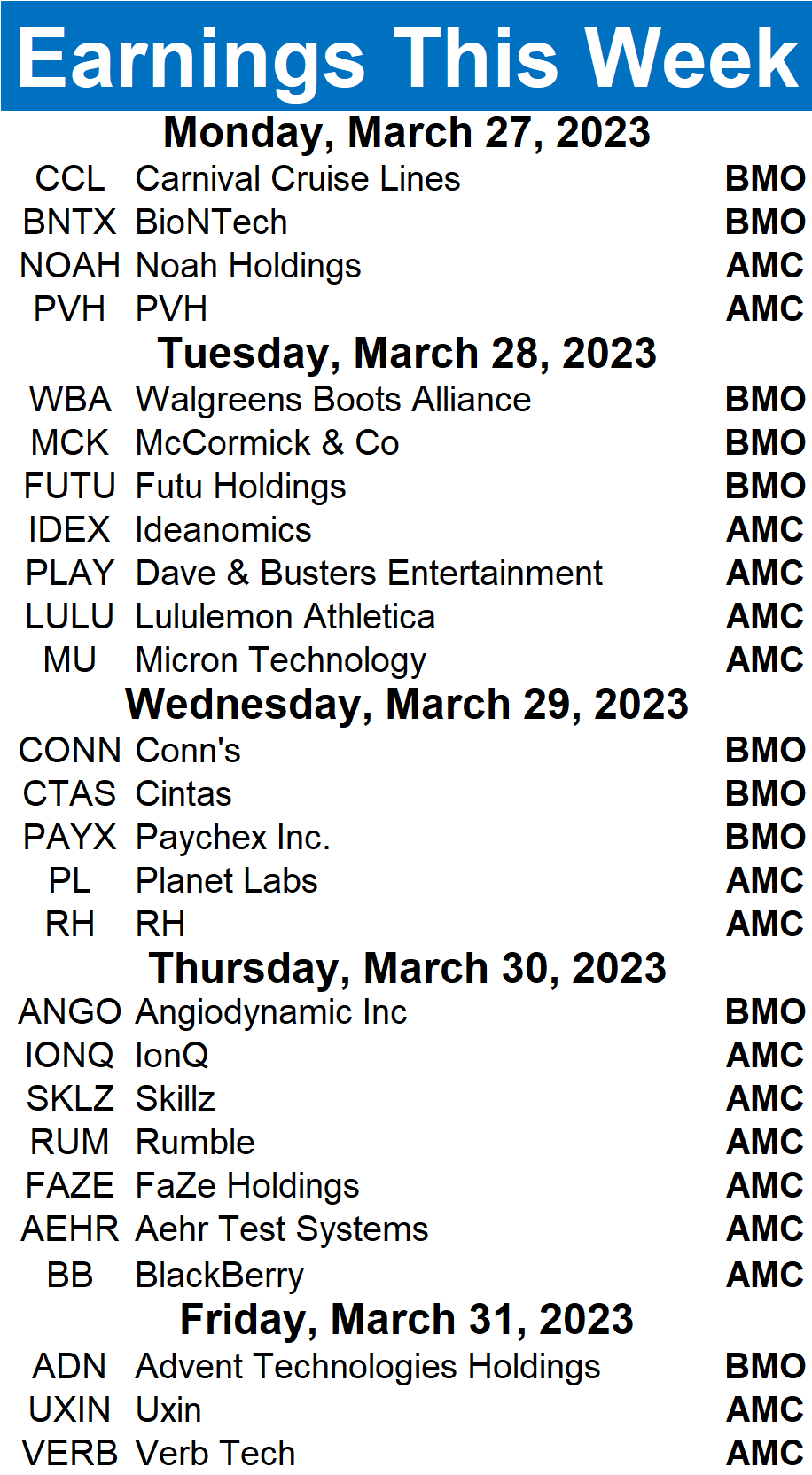

Earnings This Week

Earnings season is slowing down, with 227 companies reporting this week. Some tickers you may recognize are $MU, $LULU, $FUTU, $RH, $FAZE, $RUM, $CTAS, $PLAY, $CCL, and more.

Above is a quick summary. Check out the full Stocktwits earnings calendar for the other names reporting this week.

Links

Links That Don’t Suck:

🪫 Ford CEO on EV transition: ‘Batteries are the constraint’

⌚ This Patek Philippe is most expensive watch ever sold at online auction

🚕 Flying taxi service to transport Chicago-area residents to O’Hare by 2025

😁 After TikTok chief’s grilling in Washington, Apple’s Tim Cook is all smiles in Beijing

🛢️ Chad nationalizes assets by oil giant Exxon after controversial sale, says government

📰 Gordon Moore, Intel co-founder, philanthropist and author of Moore’s law, dies at age 94