We know you’re headed out to get your three-day weekend started (we are, too), but let’s quickly recap what you missed. Stocks closed with mixed performance, awaiting March’s nonfarm payrolls data tomorrow. With that said investors’ reaction will have to wait, as U.S. stock and bond markets are closed for Good Friday. 👀

Today’s issue covers two meme stocks on the move, struggles at Levi Strauss, and which name is trading like it’s 2008 again. 📰

Check out today’s heat map:

8 of 11 sectors closed green. Communication services (+1.27%) led, and energy (-1.51%) lagged. 💚

In economic news, the Reserve Bank of India joins a host of central banks pausing its rate hikes to assess their impact but leaving options open for more. The International Monetary Fund (IMF) expects global growth to be around 3% in the next five years, its lowest medium-term forecast since 1990. And U.S. initial jobless claims grew to 228,000, well above the 200,000 expected. 🌎

Meta published an artificial intelligence model that can pick out individual objects from within an image. It also released “the largest ever” dataset of image annotations. 🤖

Meanwhile, tech companies continue to slim down their headcount and benefits. Amazon is reportedly planning to reduce employee stock awards beginning in 2025. ✂️

Sweetgreen rose 9%, renaming its menu item after Chipotle sued it for trademark infringement. 🥗

Costco fell 2% after its March same-store sales fell for the first time in nearly three years. 🛒

Other symbols active on the streams included: $TRKA (-4.18%), $AI (+8.30%), $GFAI (+43.42%), $SCLX (+4.03%), $IMUX (-10.32%), $YVR (+87.42%), and $FOA (+30.41%). 🔥

Here are the closing prices:

| S&P 500 | 4,105 | +0.36% |

| Nasdaq | 12,088 | +0.76% |

| Russell 2000 | 1,754 | +0.13% |

| Dow Jones | 33,485 | +0.01% |

Company News

Meme Stocks On The Move

Meme stocks are always on the move, but two stood out today. So let’s take a look. 👀

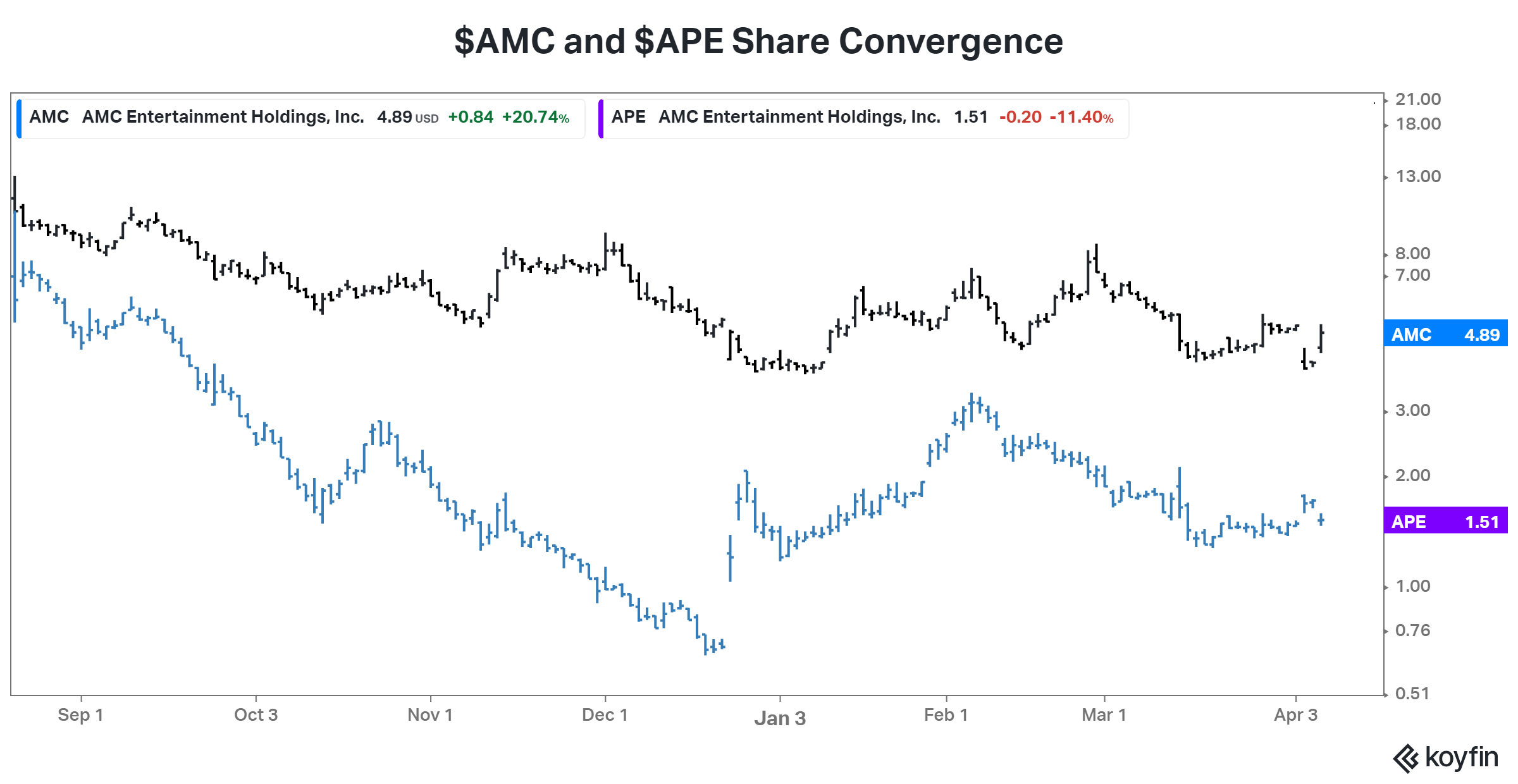

We covered AMC on Tuesday after it settled a shareholder lawsuit preventing its approved share conversion and reverse split. However, we noted that it would need court approval to perform those actions before the scheduled April 27th court date. 🧑⚖️

And today, shares were back on the move because a U.S. court denied AMC’s request to lift a status quo order on converting the APE units into AMC common shares. Delaware Chancery Court judge Morgan Zurn said, “The parties offer no good cause to lift the status quo order.”

While she didn’t address the deal’s merits, she reiterated that class action settlements require court approval to protect the interests of outside parties, such as investors not involved in the litigation. As a reminder, the settlement would pay the plaintiffs one share for every 7.5 shares they own, amounting to a roughly $100 million payout. 🤑

The slower-than-expected conversion caused $AMC shares to rally 21% and $APE units to fall 11%. Unfortunately, that essentially wiped out all of this week’s convergence progress.

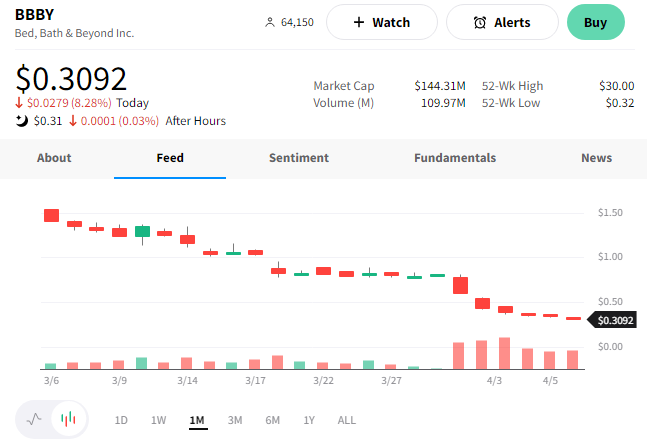

Meanwhile, Bed Bath & Beyond shares cratered again. The struggling retailer has called a meeting on May 9th, asking shareholders to approve a reverse stock split in the range of 1:10 to 1:20. 🗳️

Management warned that the company could face bankruptcy if this measure isn’t approved. The filing said, “The Company may be unable to avoid bankruptcy if the Reverse Split Proposal fails to obtain shareholder approval. We need to raise equity capital to have the necessary cash resources to fund operations and service obligations under our Credit Agreement…”

The news comes a day after the company secured a $120 million vendor consignment agreement designed to help it keep inventory on its shelves. Yet, even with that lifeline, its situation remains dire. And without this reverse split and additional equity capital, many believe bankruptcy is the most likely outcome. 😬

As a result, $BBBY shares fell another 8% to fresh all-time lows. 🔻

Earnings

Struggles At Levi Strauss

Despite a better-than-expected fiscal first quarter, Levi Strauss suffered its worst daily decline as a public company. 😱

The jeans maker earned an adjusted 34 cents per share, ahead of the 32 cents per share expected. Revenues of $1.689 billion also topped the $1.623 billion consensus view. Strength in the company’s direct-to-consumer and international businesses helped offset some U.S. weakness. 🛒

While the headline numbers seem positive, investors are concerned about the retailer’s inventory levels. They’ve improved from last quarter due to its procurement and promotional efforts, but are still up 33% on a dollar basis. Executives are now expecting inventory to align with sales by year-end. They had previously expected that in the second fiscal quarter. 📦

Overall, the company faces many of the same issues as its competitors. An uncertain macro environment, shifts in consumer spending, and inflation pinching its customers’ wallets remain a headwind. But the company’s execution problems around inventory prove that it’s not faring as well as many had hoped.

Management reiterated their cautious full-year guidance, reflecting the above factors. ⚠️

$LEVI shares traded heavily today, falling 16% to their lowest level since January. 📉

Company News

It’s 2008 Again For This Stock

There’s no shortage of interesting charts or data out there. But this morning, our scan of the best-performing stocks in the S&P 500 brought up DISH Network Corporation. And once we pulled up its long-term chart, we realized we’d been teleported back over a decade. 🕰️

The American television provider and owner of direct-broadcast satellite provider Dish is trading back at its 2008 lows. The mid-cap ($4.6 billion) stock has seen better days, falling roughly 90% from its all-time highs in 2015. 📡

Analysts say weakness in its core business and legal troubles over its recent cybersecurity incident are reasons to be cautious. Additionally, it faces a class-action lawsuit from shareholders claiming it made false and misleading statements about its operational efficiency and IT infrastructure.

Where $DISH shares head from here is anyone’s guess. Nonetheless, it’s popping up on some people’s radars now that’s it back to the same levels it fell to during the financial crisis. 🤷

Bullets

Bullets From The Day:

🏦 U.S. regulators enlist BlackRock to help sell $114 billion of failed lenders’ securities. The firm will conduct sales of $27 billion in securities from Signature Bank and $87 billion from Silicon Valley Bank, currently held by the Federal Deposit Insurance Corp. (FDIC). Their holdings are primarily agency mortgage-backed securities (MBS), collateralized mortgage obligations, and commercial MBS for which the government could not find a buyer. BlackRock will aim to make “gradual and orderly” sales that minimize potential adverse impacts on the market. Yahoo Finance has more.

📱 Twitter lands on showing ‘half ads’ to Blue subscribers. As Elon Musk’s Twitter changes continue, the company is rolling out additional features for Blue subscribers. One of those will include half the ads in their timeline compared to non-paid users. However, the feature doesn’t apply to ads shown on the profile or in replies, promoted accounts and trends, and promoted events on the Explore page. Additionally, the company is providing a visibility boost to verified users in search. More from TechCrunch.

🎯 Amazon is back in the crosshairs of U.K. regulators. Regulators in the U.S. and Europe continue to push back on tech giants, with the U.K.’s Competition and Markets Authority (CMA) looking into whether Amazon’s takeover of Roomba would create “a substantial lessening of competition.” The agency has two ongoing investigations into Amazon, one related to fake online reviews and another around its suspected anti-competitive practices when listing its products versus third-party sellers. BBC News has more.

⚡ Toyota’s new CEO is overhauling the company’s EV strategy. In addition to sweeping changes to its leadership team, the Japanese automaker is shaking up its factory floor to improve its competitiveness in the electric vehicle space. Previous executives had leaned hard into the hybrid space while competitors invested heavily in all-electric vehicles and battery technology. Shareholders, suppliers, industry experts, and other stakeholders have been critical of the move. But if these reported changes are true, the company may finally be listening to the market and embracing the practices its competitors have used for years. More from Yahoo Finance.

🐌 Slowdown in tech-adjacent industries continues. We’ve heard from consulting firm Accenture of a slowdown in tech spending, but layoffs are also spreading to big law firms. For example, silicon Valley-founded law firm Gunderson Dettmer Stough Villeneuve Franklin & Hachigian cut 10% of its staff in U.S. offices in response to the current macroeconomic and market conditions. Like their clients, many law firms overhired to meet demand during the pandemic but now have to “right-size” for a more challenging environment. Reuters has more.

Links

Links That Don’t Suck:

👋 Apple says ‘Hello Mumbai’ at first India store launch

🦾 Are robot waiters the future? Some restaurants think so

🤑 The 2023 Forbes billionaire ranking: Crypto down, sports up

🐭 Disney names first brand chief as Iger refocuses on core properties

✈️ Airlines’ answer for congested airports and rising costs: Bigger planes

😠 Texas dad says glitch in ‘Find My iPhone’ app directs angry strangers to his home

🚧 Where did the workers go? Construction jobs are plentiful, but workers are scarce

📝 ChatGPT is the hottest new job skill that can help you get hired, according to HR experts