Meme stocks are always on the move, but two stood out today. So let’s take a look. 👀

We covered AMC on Tuesday after it settled a shareholder lawsuit preventing its approved share conversion and reverse split. However, we noted that it would need court approval to perform those actions before the scheduled April 27th court date. 🧑⚖️

And today, shares were back on the move because a U.S. court denied AMC’s request to lift a status quo order on converting the APE units into AMC common shares. Delaware Chancery Court judge Morgan Zurn said, “The parties offer no good cause to lift the status quo order.”

While she didn’t address the deal’s merits, she reiterated that class action settlements require court approval to protect the interests of outside parties, such as investors not involved in the litigation. As a reminder, the settlement would pay the plaintiffs one share for every 7.5 shares they own, amounting to a roughly $100 million payout. 🤑

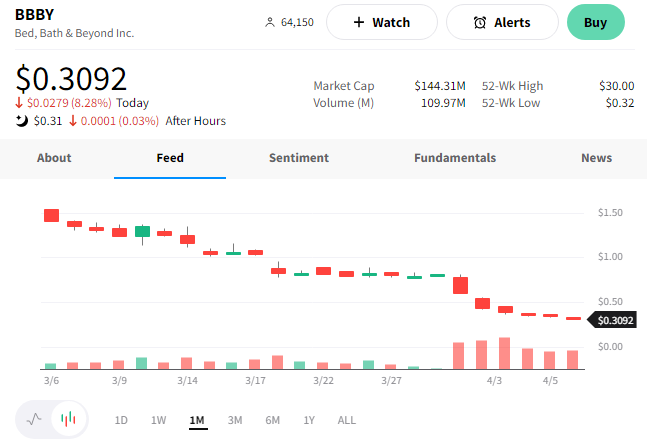

The slower-than-expected conversion caused $AMC shares to rally 21% and $APE units to fall 11%. Unfortunately, that essentially wiped out all of this week’s convergence progress.

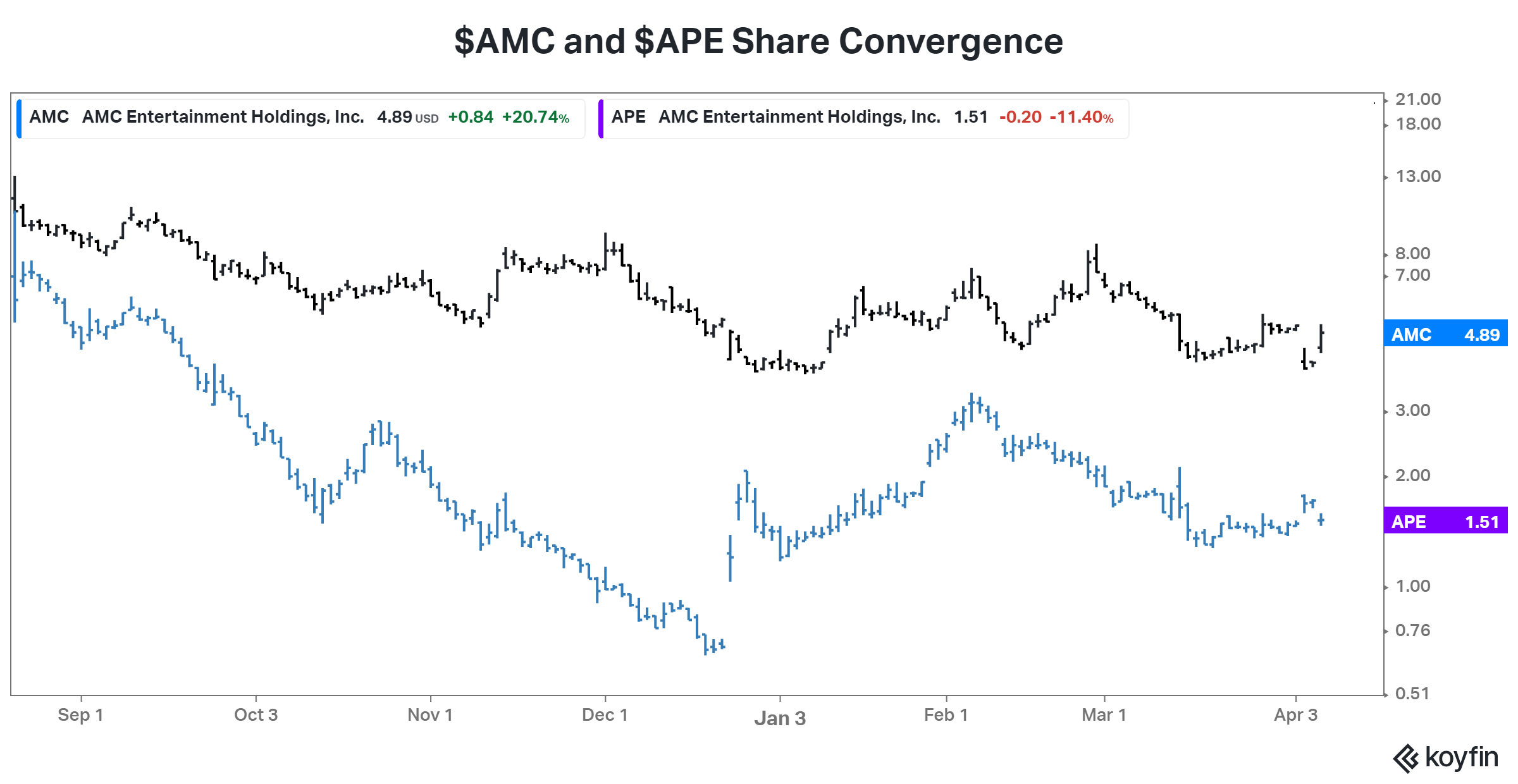

Meanwhile, Bed Bath & Beyond shares cratered again. The struggling retailer has called a meeting on May 9th, asking shareholders to approve a reverse stock split in the range of 1:10 to 1:20. 🗳️

Management warned that the company could face bankruptcy if this measure isn’t approved. The filing said, “The Company may be unable to avoid bankruptcy if the Reverse Split Proposal fails to obtain shareholder approval. We need to raise equity capital to have the necessary cash resources to fund operations and service obligations under our Credit Agreement…”

The news comes a day after the company secured a $120 million vendor consignment agreement designed to help it keep inventory on its shelves. Yet, even with that lifeline, its situation remains dire. And without this reverse split and additional equity capital, many believe bankruptcy is the most likely outcome. 😬

As a result, $BBBY shares fell another 8% to fresh all-time lows. 🔻