All eyes are on the consumer this week, with retail sales and Home Depot earnings leading weakness today. Target tomorrow and Walmart on Thursday should set the tone as bears look to take control. Let’s see what you missed. 👀

Today’s issue covers Home Depot chopping its forecast, investors seeing limited upside in a popular Chinese stock, and why investors can’t contain their disappointment about one retailer. 📰

Check out today’s heat map:

1 of 11 sectors closed green. Technology (+0.10%) led, and real estate (-2.65%) lagged. 💚

Weak auto sales weighed on April’s retail sales, which rose half of the 0.8% expected. March business inventories were mixed, with those at retailers +0.7%, no change at wholesalers, and -0.8% at manufacturers. April’s industrial output rose 0.5%, topping the 0.1% estimate. 🔻

Homebuilder sentiment rose to 50, pulling out of pessimistic territory for the first time in a year. Driving the increases was an uptick in current and six-month forward sales conditions, with buyer traffic remaining weak. 🏘️

Oil prices continue to sit near 70 on recession fears. The Biden administration says it’s “buying the dip,” planning to add 3 million barrels of oil to the country’s emergency oil stockpile. 🛢️

In travel news, 42 million Americans are expected to travel over Memorial Day weekend. The Texas Attorney General (AG) is suing Hyatt Hotels over misleading “hidden fees.” And the union for Canada’s second-largest airline says pilots will begin to strike in 72 hours. 🧳

Other symbols active on the streams included: $XELA (+103.90%), $OMH (-79.44%), $MULN (-2.40%), $APLD (+78.92%), $KSCP (-12.56%), $COYA (+10.00%), $TRKA (+23.36%), and $ELOX (-23.67%). 🔥

Here are the closing prices:

| S&P 500 | 4,110 | -0.64% |

| Nasdaq | 12,343 | -0.18% |

| Russell 2000 | 1,736 | -1.44% |

| Dow Jones | 33,012 | -1.01% |

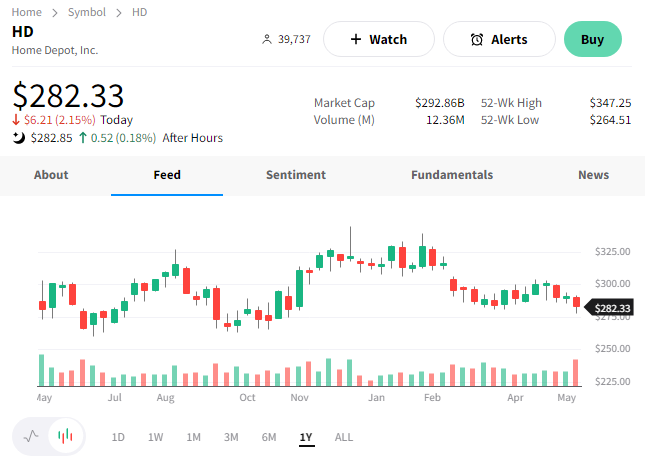

The biggest retail story today was from Home Depot, which reported its worst revenue miss in 20 years and cut its full-year outlook. 😧

The home improvement retailer’s adjusted earnings per share of $3.82 topped the $3.80 expected. On the surface, that looks all good and well. But its sales numbers are where things fell apart.

Chief Financial Officer Richard McPhail said the company anticipates 2023 as a “year of moderation” following an increased appetite for home improvement during the pandemic. Although the state of the consumer remains healthy regarding income and balance sheets, there is a shift from larger projects to smaller ones. 🏡

That resulted in revenues of $37.26 billion, which fell well short of the $38.28 billion anticipated by analysts. Comparable sales fell 4.5% in Q1, with lumber accounting for more than two percentage points of that decline. Executives also mentioned wetter and colder weather conditions in the western U.S. weighed on results.

Customer transactions fell 5%, with an average ticket of $91.92 staying flat. That’s a significant change from previous quarters, where price increases more than offset volume declines. 🤔

Sales trends were negative overall but were better among do-it-yourself customers vs. professionals. That’s notable, considering most of Home Depot’s business comes from professionals. That contrasts Lowe’s, which has the opposite customer demographic and reports next week. 👷

Overall, executives believe the medium to long-term fundamentals of home improvement are strong.

However, in the near term, the uncertain macroeconomic environment and slow housing market have consumers pulling back on discretionary purchases. Instead, they’re spending more on necessities. And when they do spend discretionary income, it’s going towards travel, dining out, and other experiences instead of home goods.

As a result, they now expect sales and comparable sales to decline by 2% to 5% for the fiscal year and an operating margin of 14% to 14.3%. That’s down from their previous outlook of flat sales and a 14.5% margin. ⚠️

This isn’t a major surprise for those of us tracking retailers every earnings season. For several quarters transaction volumes have been falling. Higher prices offset much of that weakness, but that is no longer. However, the most notable change in this report is management’s acknowledgment of the weakness they had brushed off in previous quarters.

With that said, investors may have priced in the slowdown already. $HD shares remain 35% off their 2021 highs, falling just 2% on the news. 🔻

Time will tell, though. We’ll get more information from Target, Walmart, Lowe’s, and others in the days ahead. 👀

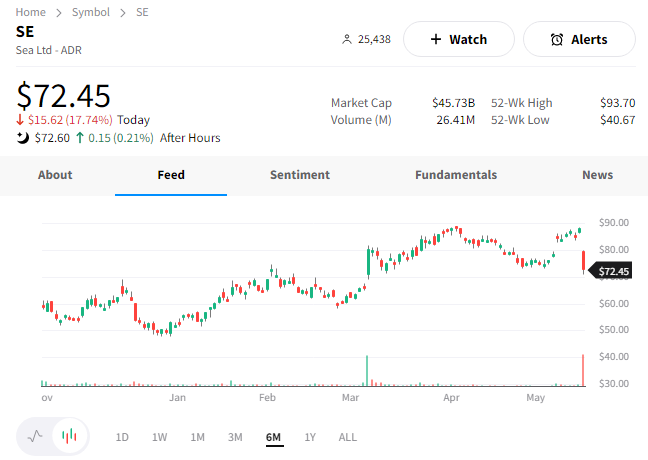

Singapore-based e-commerce and digital entertainment company Sea Ltd. reported weak results today, sending shares tumbling. 📉

The company’s adjusted earnings per share of $0.15 on revenues of $3.04 billion missed the $0.40 and $3.07 billion analysts expected.

A pandemic-era boom pushed the company to a $200 billion valuation at its peak. Tough comparables, contracting multiples, and slower growth caused it to fall nearly 90%, and it still remains 80% off all-time highs. As a result, executives shifted their focus to profitability in an effort to regain the favor of investors. ✂️

So far, it’s been able to achieve positive adjusted EBITDA, driven by strength in Asia markets. International markets remain a drag, though losses have improved significantly YoY. 🔺

With that said investors and executives are pushing for further progress. Part of that includes rationalizing its long-term investments and management team. That’s why, effective May 15, David Ma stepped down as Chief Investment Officer of Sea Capital and joined the board of directors. It’s unclear as of now who will assume that position. 🧑💼

Overall, executives remain focused on maximizing operational efficiency and improving user experiences. They’re pleased with the business’ improving fundamentals, which position them well long-term despite near-term macro uncertainties.

While management is confident in the future, investors appear less so. $SE shares fell nearly 18% on the day from the top of their year-long trading range. 👎

Earnings

Investors Can’t Contain Their Fears

With Bed Bath & Beyond riding off into the liquidation sunset, investors are turning their attention to other struggling retailers. And one of those is The Container Store, whose shares are approaching all-time lows again. 😬

The specialty retail chain reported adjusted earnings per share of $0.18, topping estimates by $0.02. However, revenues of $259.7 million fell short of the $265.72 million expected. 👎

A negative foreign currency impact partially explains the weakness, but the broader issue remains the weaker macroeconomic environment. Comparable store sales fell 13.1%, and e-commerce sales fell 6.2% YoY, though gross margins did expand 190 basis points to 58.9%.

Sales weakness was the driver of other retailers going out of business, so investors anxiously awaited management’s plans to reverse the negative trend. In their press release, executives said they continue to focus on cost management. Meanwhile, they are investing in long-term strategic initiatives like Custom Spaces, e-commerce, and new innovative products designed to drive market share gains. 📝

That said, there doesn’t appear to be an immediate solution to the retailer’s troubles. ⚠️

Executives offered a cautious outlook given what they’re seeing so far during the first quarter. They now expect fiscal year 2024 earnings per share of $0.21 to $0.31 on revenues of $885 to $900 million. Those missed estimates of $0.72 and $1.05 billion by a wide margin, as did their Q1 forecasts.

The gloomy outlook did little to contain investors’ fears that the retailer could be the next victim of the retail-pocalypse. $TCS shares added to regular session losses, falling another 15% after hours. 🔻

Bullets

Bullets From The Day:

⛔ Jamie Dimon says more JPMorgan bank rescues unlikely. If another regional bank fails, America’s largest bank likely won’t be there to buy it. The company’s CEO said it’s unlikely to acquire another lender after its government-backed acquisition of First Republic Bank. He responded to the question posed at the bank’s annual shareholder meeting, ultimately shifting to risks he’s more concerned with, including “large geopolitical events,” cyber attacks, and overall market turmoil. CNBC has more.

✂️ New Vodafone boss announces 11,000 job cuts. The telecom giant’s new CEO unveiled new plans to “simplify” the company, which includes cutting roughly 10% of its global workforce. Higher costs due to rising energy prices and weaker sales in its biggest market, Germany, have pressured profits in recent quarters. Della Vale, who took over as CEO in January, says, “My priorities are customers, simplicity, and growth. We will simplify our organization, cutting out complexity to regain our competitiveness.” Vodafone shares fell 7% to 20-year lows. More from BBC News.

🤔 CRM startup acquired by Meta last year spins out at a $250m valuation. It officially marks the end of Meta’s experiment in building an enterprise-ready customer service platform. It acquired the startup for roughly $1 billion last year but is spinning it out with a $60 million infusion from previous backers Battery, Redpoint, and Boldstart. Meta will keep a minority stake in the CRM business, allowing it to continue working with it to build our new products and service any current clients. The acquisition is added to one of many casualties in Meta’s “year of efficiency.” TechCrunch has more.

🚫 FTC sues to block Amgen’s $27.8 billion acquisition. The Federal Trade Commission (FTC) is again taking aim at the pharmaceutical industry, this time filing a lawsuit to block drug giant Amgen’s acquisition of Horizon Therapeutics on the grounds that it would “stifle competition.” More specifically, the FTC said it would allow Amgen to “entrench the monopoly positions” of Horizon’s fast-growing medications, Tepezza and Krystexxa, through a practice known as “cross-market bundling.” As expected, Amgen and Horizon say they are working with the agency to address its concerns and move the deal forward. More from CNBC.

🌮 Taco Bell heads to court over the “Taco Tuesday” trademark. The fast-food giant filed legal petitions to release the trademark that a smaller competitor has owned since 1989. Over the years, Taco John’s lawyers have sent cease-and-desist letters to restaurants, media outlets, and others for using the term. However, Taco Bell believes the “Taco Tuesday” phrase should belong to all who make, sell, eat, and celebrate tacos. As a result, it’s asking the Trademark Trial and Appeal Board to cancel the trademark, saying that it has unfairly restricted restaurants nationwide from using the popular phrase. Only time will tell who will win this “Mexican Standoff…” Axios has more.

Links

Links That Don’t Suck:

📝 IRS to launch free tax filing pilot program next year

😷 Record numbers not working due to ill health in the U.K.

₿ EU states approve world’s first comprehensive crypto rules

⚠️ A lot of offices are still empty — and it’s becoming a major risk for the economy

💰 Comcast sale of Hulu stake to Disney ‘more likely than not,’ CEO Brian Roberts says

🧑⚖️ DOJ charges former Apple engineer with theft of autonomous car tech for China

💬 Mr. ChatGPT goes to Washington: OpenAI CEO Sam Altman testifies before Congress on AI risks