Singapore-based e-commerce and digital entertainment company Sea Ltd. reported weak results today, sending shares tumbling. 📉

The company’s adjusted earnings per share of $0.15 on revenues of $3.04 billion missed the $0.40 and $3.07 billion analysts expected.

A pandemic-era boom pushed the company to a $200 billion valuation at its peak. Tough comparables, contracting multiples, and slower growth caused it to fall nearly 90%, and it still remains 80% off all-time highs. As a result, executives shifted their focus to profitability in an effort to regain the favor of investors. ✂️

So far, it’s been able to achieve positive adjusted EBITDA, driven by strength in Asia markets. International markets remain a drag, though losses have improved significantly YoY. 🔺

With that said investors and executives are pushing for further progress. Part of that includes rationalizing its long-term investments and management team. That’s why, effective May 15, David Ma stepped down as Chief Investment Officer of Sea Capital and joined the board of directors. It’s unclear as of now who will assume that position. 🧑💼

Overall, executives remain focused on maximizing operational efficiency and improving user experiences. They’re pleased with the business’ improving fundamentals, which position them well long-term despite near-term macro uncertainties.

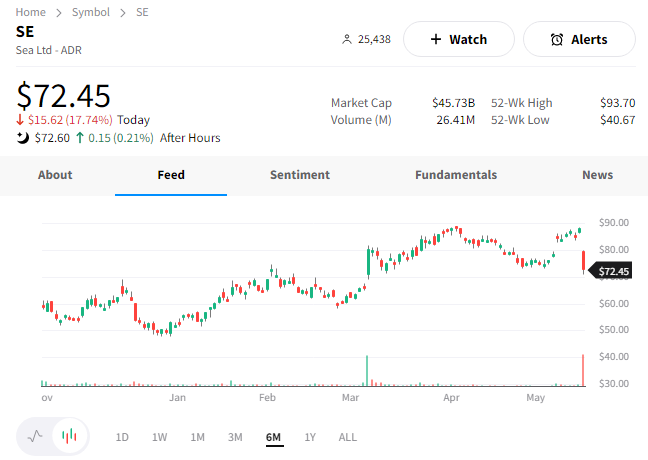

While management is confident in the future, investors appear less so. $SE shares fell nearly 18% on the day from the top of their year-long trading range. 👎