Buyers paused as we approach next week’s debt ceiling deadline, though tech is rebounding after Nvidia’s earnings propelled it to all-time highs in extended hours. Let’s see what else you missed. 👀

Today’s issue covers Nvidia’s chipper results, a trip down mall-mory lane, and other tech earnings from the day. 📰

Check out today’s heat map:

1 of 11 sectors closed green. Energy (+0.44%) led, and real estate (-2.22%) lagged. 💚

In economic news, the U.K.’s headline inflation continues to slow at a weaker-than-expected pace. Core inflation hit a new 31-year high, setting the Bank of England up for additional rate hikes. 🥵

Meanwhile, May’s FOMC Minutes indicated that Fed officials remain divided over whether further interest-rate hikes are necessary because of “unacceptably slow” progress in inflation returning to 2%. Others suggested the regional banking crisis had already done enough to tighten conditions and that the Fed should wait to see if economic growth slows as expected. 🌡️

The 2024 race for the White House is beginning to heat up, with Florida Governor Ron DeSantis officially launching his presidential bid. 🗳️

Oil prices bounced after the Energy Information Administration’s weekly report showed a major crude oil draw last week. 🛢️

And electric vehicle stocks were on the move after Chinese manufacturer Xpeng missed earnings expectations and forewarned of a plunge in car sales. ⚡

Other symbols active on the streams included: $MULN (-12.03%), $OCGN (-35.05%), $GCT (+26.50%), $MEOA (+140.18%), $ZURA (+25.23%), $UTRS (+83.01%), $ENG (+8.39%), and $EEIQ (+63.70%). 🔥

Here are the closing prices:

| S&P 500 | 4,115 | -0.73% |

| Nasdaq | 12,484 | -0.61% |

| Russell 2000 | 1,767 | -1.16% |

| Dow Jones | 32,800 | -0.77% |

Earnings

Nvidia’s Chipper Earnings Report

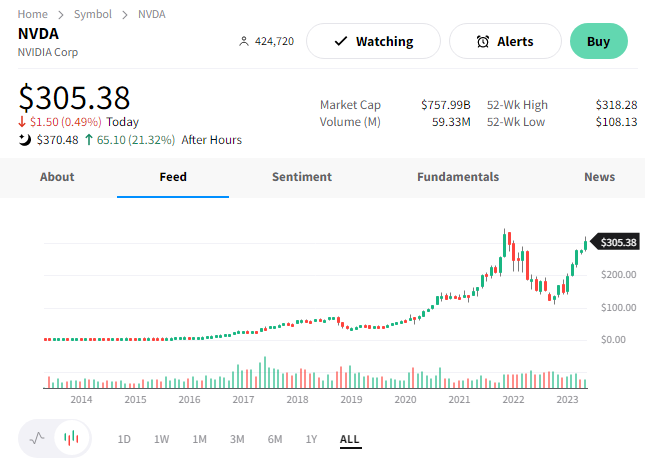

Expectations for chipmaker Nvidia were pretty high coming into its earnings report, as shares were up almost 200% since October. Despite all the hype, the stock still beat expectations and hit new all-time highs after hours. Let’s see why. 👇

Its first-quarter adjusted earnings per share were $1.09 vs. the $0.92 expected. Revenues of $7.19 billion also topped the consensus view. Helping drive the strength was record Data Center revenue of $4.28 billion. 💾

The market was focused heavily on artificial intelligence (AI) as the company’s next primary growth driver…and it delivered. Executives now expect second-quarter revenue of $11 billion (+-2%), far surpassing the $7.15 billion expected by analysts.

CEO Jensen Huang’s comments provided more color on the trends Nvidia seeks to capitalize on. 💬

- “The computer industry is going through two simultaneous transitions – accelerated computing and generative AI.”

- “A trillion dollars of installed global data center infrastructure will transition from general-purpose to accelerated computing as companies race to apply generative AI into every product, service, and business process.”

- “Our entire data center family of products ….. is in production. We are significantly increasing our supply to meet surging demand for them.”

Clearly, investors are excited about what the future holds, as $NVDA shares rise 28% after hours to new all-time highs. We’ll have to see if Nvidia can continue to deliver on these high expectations in the future. 😮

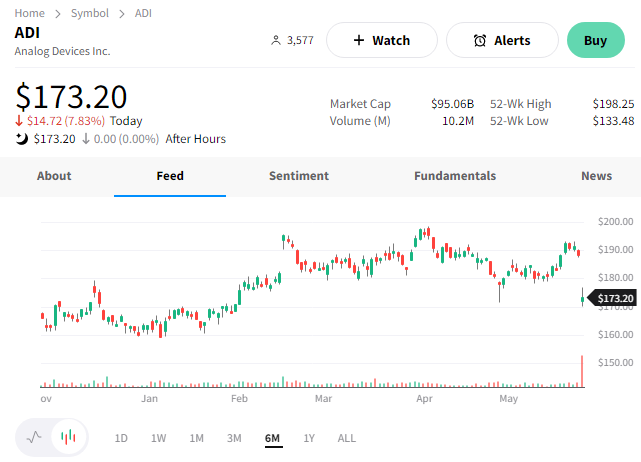

Meanwhile, competitor Analog Devices sunk after beating estimates but warning of a slowdown. ⚠️

The semiconductor company, specializing in data conversion, signal processing, and power management technology, reported adjusted earnings per share (EPS) of $2.83 on revenues of $3.26 billion. That topped the $2.75 and $3.21 billion consensus estimates.

Its CEO said, “Looking into the second half, we expect revenue to moderate given the continued economic uncertainty and normalizing supply chains.” As a result, the company expects third-quarter adjusted EPS of $2.42 to $2.62 and revenues of $3 to $3.2 billion. That was mixed vs. Wall Street’s view of $2.65 and $3.16 billion. 🔺

$ADI shares fell more than 8% as investors processed the news.

Earnings

A Trip Down Mall-mory Lane

Several retailers reported today, many of which have a significant mall presence. Let’s see how they fared and what they said about the U.S. consumer. 🏬

First up is Kohl’s, which reported an unexpected first-quarter profit. Profitability improved as freight costs declined, and the company became more pointed with its promotional activity after getting inventory levels back under control. That led to adjusted earnings per share of $0.13, beating the $0.42 loss expected. Revenue of $3.36 billion and comparable-store sales declines of 4.3% were essentially in line with expectations.

The Kohl’s brand has struggled to remain relevant among consumers, but executives stressed the changes they’re making are paying dividends. The company is opening more Sephora shops, expanding into categories like pet and home decor, and featuring gift-giving items ahead of key holidays. With that said, the “middle-income consumer,” which is the core of its customer base, remains pinched by high inflation and economic uncertainty. 😬

The company remains the target of activist investors who have successfully pushed a CEO and board of directors. Last year, it also failed to sell itself to Vitamin Shoppe owner Franchise Group.

Like other “old school” retailers, Kohl’s has a lot of work to do in reinventing itself for today’s consumers. $KSS shares rose 7% today but are still trading at the same level as the late 1990s. 🤷

Abercrombie & Fitch also reported a surprise profit and raised its guidance. Its adjusted earnings per share of $0.39 on revenues of $836 million beat the expected $0.05 loss and $815 million in revenues. Same-store sales were also up 3% vs. the 1% decline expected. Additionally, executives raised their net sales growth from 1%-3% to 2%-4%. They also increased their operating margin outlook from 4%-5% to 5%-6%. That sent $ANF shares up over 30% on the day. 🤩

Next up is Express, which we spoke about two months ago as bankruptcy fears rose. While shares rebounded with the market since then, today’s earnings have it pushing back toward their all-time lows. $EXPR shares were down more than 15% on the day. 📉

Its adjusted loss per share of $0.99 and revenues of $383.3 million missed the $0.79 and $389 million consensus estimates. Same-store sales fell 14% due to what executives described as “a combination of external factors and challenges in our product assortments.” Consumers remain price sensitive as they reduce discretionary spending, causing Express and its competitors to increase promotions. As a result, it’s being hit on both the revenue and margin side, as its financials reflect.

American Eagle Outfitters also didn’t fare well. Although its adjusted earnings per share and revenue matched estimates, it cut its operating income outlook. It now expects $250 to $270 million vs. the $270 to $310 million range it forecasted in March. It also anticipates full-year revenue to be flat to down low single-digits vs. flat to up single-digits. Its brand performance remains mixed, with Aerie’s comparable-store sales up 2% and American Eagle’s down 2%. Lastly, store revenue rose 5% while digital revenue fell 4%. $AEO shares are down 16% after the bell. 🦅

Lastly, we’ll mention Guess. The retailer lost $0.22 per share on revenues of $570 million. That compared to estimates of a $0.28 per share loss on $556 million in revenue. Executives expect fiscal 2024 revenue growth of 2% to 4% and adjusted earnings per share of $2.60 to $2.90. They also increased the dividend from 22.5 cents per share to 30 cents. $GES shares are up about 2% after hours. 🔺

Earnings

Is Snow On The Right Path?

This issue is already very beefy, but we can’t go without at least mentioning two tech stocks falling after hours. ✌️

First up is Snowflake, which is melting down after issuing a weaker-than-expected forecast. 🫠

The cloud-based data storage company’s adjusted earnings per share of $0.15 beat Wall Street’s view by $0.10. And revenues of $623.6 million also topped the $609 million estimate. More specifically, product revenue of $590.1 million beat the company’s guidance of $568 to $573 million. And its net retention rate was 151%

However, its guidance is where things fell apart. 😬

Executives now expect product revenue of $620 to $625 million in Q2 vs. the $649 million consensus view. They also expect a non-GAAP operating margin of 2%. For the full year, they see product revenue of $2.6 billion vs. their last estimate of $2.7 billion. Non-GAAP operating margin of 5% was down from 6%. And to end positively, they raised adjusted free cash flow margin expectations by 1% to 26%.

Despite management’s attempt to reassure shareholders, the market remains unsure whether the company is headed in the right direction. $SNOW shares are down 11% after the bell. ❄️

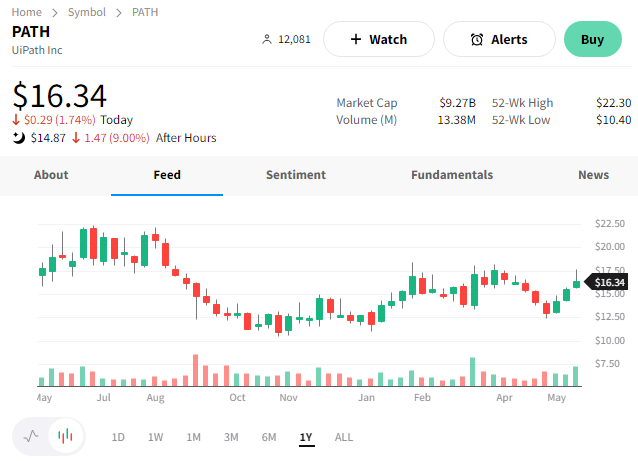

Meanwhile, global software company UiPath didn’t fare much better. The maker of robotic process automation software also failed to impress Wall Street with its forecast. 👎

Its Q1 non-GAAP earnings per share of $0.11 beat by $0.02. Revenues of $289.59 million and annual recurring revenue (ARR) of $1.249 billion also topped estimates. However, executives forecast second-quarter revenues of $279 to $284 million, below the $284 million expected.

With so many companies meeting (or beating) expectations this earnings season, the market is showing little mercy towards those with weak forecasts. As a result, $PATH shares fell 9% after hours. 📉

Bullets

Bullets From The Day:

🤖 Google applies AI to improve YouTube Shorts’ discoverability. The company’s DeepMind AI language model is creating descriptions for YouTube Shorts content to improve discoverability on the platform. TikTok’s algorithm is known for serving users a constant feed of interesting content, but users of YouTube’s competing feature have complained that they do not see enough variety in their recommendations. As a result, the company is hoping that tagging videos for creators will help improve the overall experience. TheVerge has more.

❌ Amazon corporate workers test the bounds of their negotiating leverage. Despite many tech giants cutting jobs, a group of Amazon workers is moving ahead with plans to walk off the job next week over frustration with the company’s return-to-work policies. The participating works have two main demands; greater flexibility for how and where employees work and the e-commerce giant putting climate impact at the forefront of its decision-making. More from CNN Business.

🛒 Buzzfeed is diversifying away from affiliate and partnership revenue. The struggling media company is debuting a new online retail storefront for the lifestyle commerce brand it launched in 2016, Goodful. Its store will be powered by the luxury e-commerce site Verishop, founded by former Snapchat and Amazon executives. Goodful plans to offer hundreds of licensed and curated goods, according to BuzzFeed’s head of content. The site will also launch in conjunction with a group of eight online content creators who are tied to the Goodful brand. Axios has more.

🔍 Microsoft launches a new end-to-end data and analytics platform. The new platform centers around its OneLake data lake but can pull data from Amazon S3 and Google Cloud platforms. It boasts features like a Spark-based data engineering platform, a real-time analytics platform, and an easy-to-use visualization and AI-based analytics tool. It also offers no-code developer experience to help those less technically inclined utilize the platform. More from TechCrunch.

✂️ Meta begins its latest round of layoffs, focused on business groups. The “year of efficiency” continues at Meta as the company begins its final round of layoffs. The April cuts impacted technical roles, expanding to business roles in user experience, marketing, recruiting, and engineering. Between the April and May cuts, it’s estimated that about 10,000 workers will have been impacted. With revenue reaccelerating in recent quarters, we’ll see if these are indeed the last cuts the company will have to make or if more are necessary to continue funding its longer-term metaverse and AI bets. CNBC has more.

Links

Links That Don’t Suck:

🤔 How some people get away with doing nothing at work

💰 Citigroup to spin off its Mexico business, Banamex, after sale efforts collapse

📉 World’s richest person Bernard Arnault’s wealth drops by $11 billion in one day

💥 Embracer Group stock drops 40% after $2 billion mystery deal self-destructs

🚀 Virgin Orbit shuts down after selling assets for just $36 million via bankruptcy auction

🍼 Feds probe whether baby formula makers broke the law in bidding for state contracts