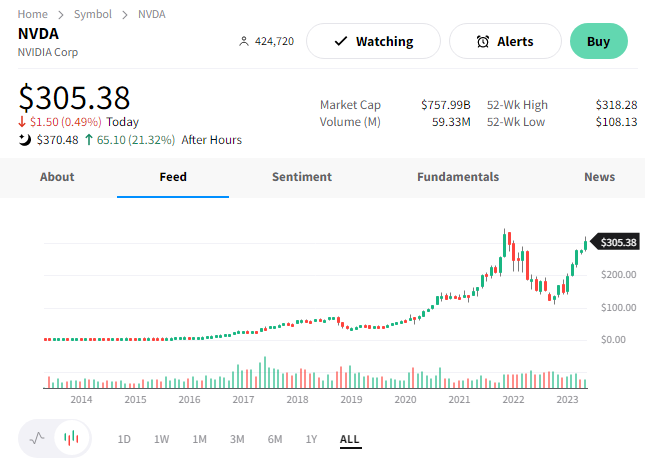

Expectations for chipmaker Nvidia were pretty high coming into its earnings report, as shares were up almost 200% since October. Despite all the hype, the stock still beat expectations and hit new all-time highs after hours. Let’s see why. 👇

Its first-quarter adjusted earnings per share were $1.09 vs. the $0.92 expected. Revenues of $7.19 billion also topped the consensus view. Helping drive the strength was record Data Center revenue of $4.28 billion. 💾

The market was focused heavily on artificial intelligence (AI) as the company’s next primary growth driver…and it delivered. Executives now expect second-quarter revenue of $11 billion (+-2%), far surpassing the $7.15 billion expected by analysts.

CEO Jensen Huang’s comments provided more color on the trends Nvidia seeks to capitalize on. 💬

- “The computer industry is going through two simultaneous transitions – accelerated computing and generative AI.”

- “A trillion dollars of installed global data center infrastructure will transition from general-purpose to accelerated computing as companies race to apply generative AI into every product, service, and business process.”

- “Our entire data center family of products ….. is in production. We are significantly increasing our supply to meet surging demand for them.”

Clearly, investors are excited about what the future holds, as $NVDA shares rise 28% after hours to new all-time highs. We’ll have to see if Nvidia can continue to deliver on these high expectations in the future. 😮

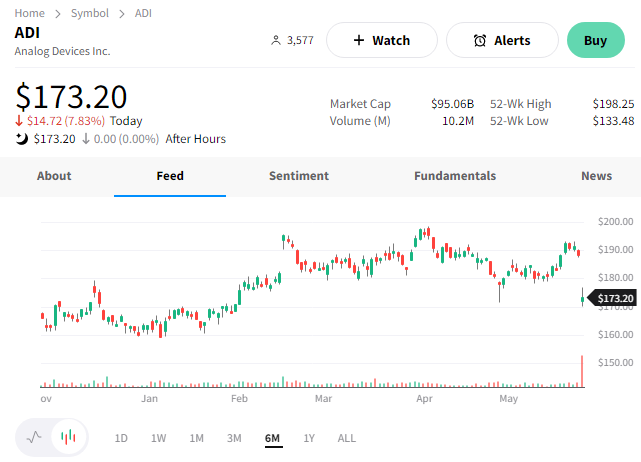

Meanwhile, competitor Analog Devices sunk after beating estimates but warning of a slowdown. ⚠️

The semiconductor company, specializing in data conversion, signal processing, and power management technology, reported adjusted earnings per share (EPS) of $2.83 on revenues of $3.26 billion. That topped the $2.75 and $3.21 billion consensus estimates.

Its CEO said, “Looking into the second half, we expect revenue to moderate given the continued economic uncertainty and normalizing supply chains.” As a result, the company expects third-quarter adjusted EPS of $2.42 to $2.62 and revenues of $3 to $3.2 billion. That was mixed vs. Wall Street’s view of $2.65 and $3.16 billion. 🔺

$ADI shares fell more than 8% as investors processed the news.