This issue is already very beefy, but we can’t go without at least mentioning two tech stocks falling after hours. ✌️

First up is Snowflake, which is melting down after issuing a weaker-than-expected forecast. 🫠

The cloud-based data storage company’s adjusted earnings per share of $0.15 beat Wall Street’s view by $0.10. And revenues of $623.6 million also topped the $609 million estimate. More specifically, product revenue of $590.1 million beat the company’s guidance of $568 to $573 million. And its net retention rate was 151%

However, its guidance is where things fell apart. 😬

Executives now expect product revenue of $620 to $625 million in Q2 vs. the $649 million consensus view. They also expect a non-GAAP operating margin of 2%. For the full year, they see product revenue of $2.6 billion vs. their last estimate of $2.7 billion. Non-GAAP operating margin of 5% was down from 6%. And to end positively, they raised adjusted free cash flow margin expectations by 1% to 26%.

Despite management’s attempt to reassure shareholders, the market remains unsure whether the company is headed in the right direction. $SNOW shares are down 11% after the bell. ❄️

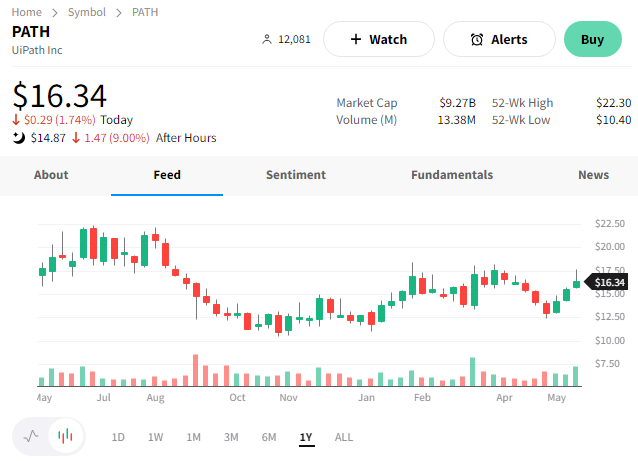

Meanwhile, global software company UiPath didn’t fare much better. The maker of robotic process automation software also failed to impress Wall Street with its forecast. 👎

Its Q1 non-GAAP earnings per share of $0.11 beat by $0.02. Revenues of $289.59 million and annual recurring revenue (ARR) of $1.249 billion also topped estimates. However, executives forecast second-quarter revenues of $279 to $284 million, below the $284 million expected.

With so many companies meeting (or beating) expectations this earnings season, the market is showing little mercy towards those with weak forecasts. As a result, $PATH shares fell 9% after hours. 📉