Welcome to the Stocktwits Top 25 Newsletter for Week 22 of 2023!

The Stocktwits Top 25 reports the 25 best-performing stocks in the S&P 500, Nasdaq 100, and Russell 2000 year to date (YTD) and tracks their performances over time.

Here are the Stocktwits Top 25 Lists for Week 22:

P.S. To help you understand this data further, check out our FAQ page, and feel free to reach out if you have questions!

Standard and Poor's 500

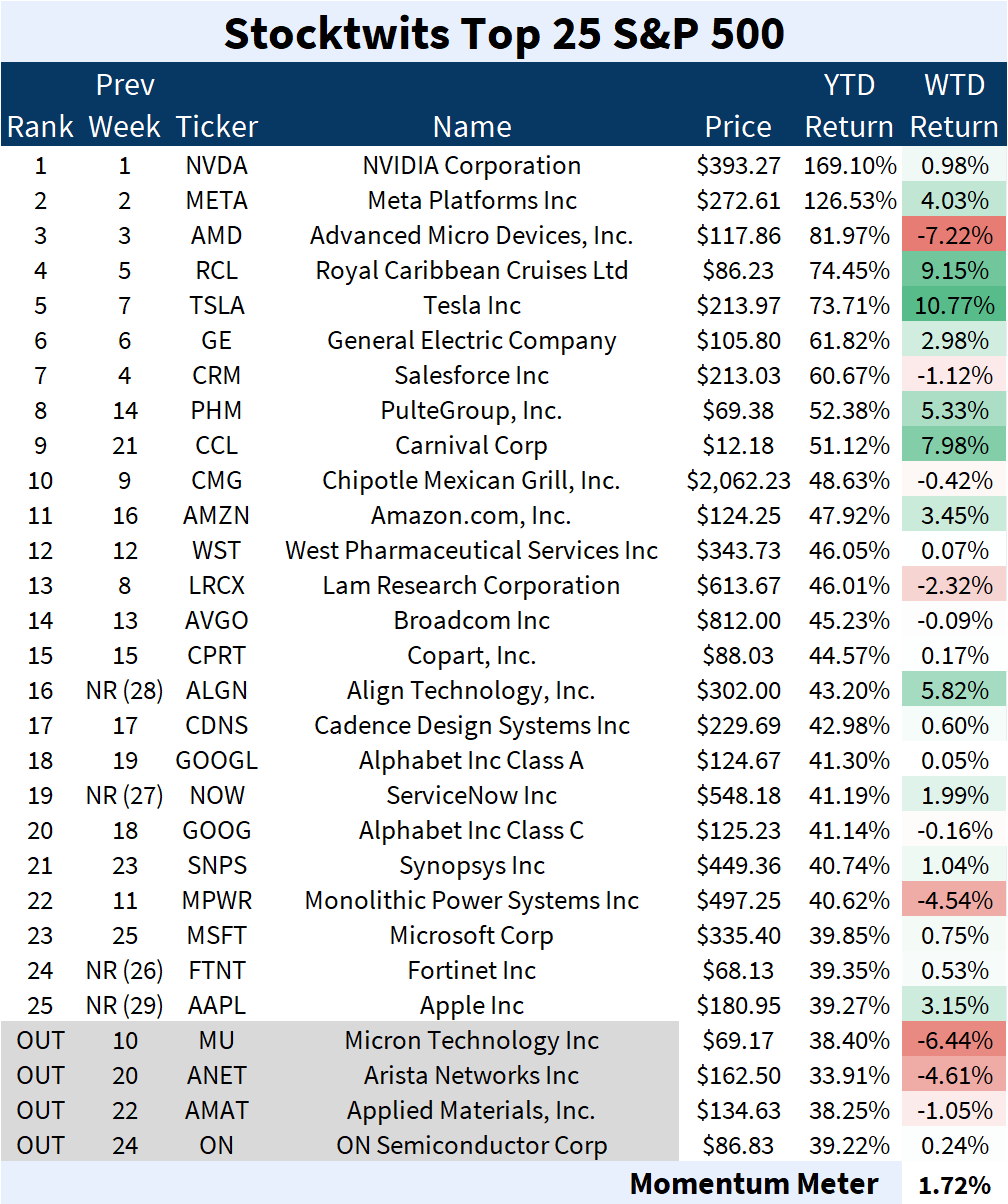

ST Top 25 S&P 500

The S&P 500 Top 25 list (+1.72%) performed in line with the S&P 500 index (+1.83%).

There were four major changes to the list this week.

Joining: Align Technology (+5.82%), ServiceNow (+1.99%), Fortinet (+0.53%), and Apple (+3.15%).

Leaving: Micron Technology (-6.44%), Arista Networks (-4.61%), Applied Materials (-1.05%), and ON Semiconductor (+0.24%).

Check out how the momentum meter has performed vs. the S&P 500 index this year:

NASDAQ 100

The Large-Cap Nasdaq 100

The Nasdaq 100 Top 25 list (+1.12%) underperformed the Nasdaq 100 index (+1.74%).

There were two major changes to the list this week.

Joining: Atlassian Corp (+10.68%) and Airbnb (+10.53%).

Leaving: ASML Holding NV (-1.53%) and ANSYS, Inc. (+1.75%).

RUSSELL 2000

The Growth-Centric Russell 2000

The Russell 2000 Top 25 list (+7.93%) outperformed the Russell 2000 index (+3.26%).

There were three major changes to the list this week.

Joining: Diversified Healthcare Trust (+48.25%), P3 Health Partners (+36.60%), and Evolv Technologies (+6.07%).

Leaving: Terawulf Inc (-0.67%), Hovnanian Enterprises (-4.99%), and Aurinia Pharmaceuticals (+0.53%).

🐶🐶🐶

ST Top 25 TOP DAWG OF THE WEEK 🐶

The Top 25 lists’ Top Dawg was Diversified Healthcare Trust, which rallied 48.25%. 📈

The healthcare-focused real estate investment trust (REIT) is merging with Office Properties Income Trust. OPI will be the surviving entity and change its name to Diversified Properties Trust when the transaction closes in the third quarter. 🤝

Under the terms of the agreement, DHC shareholders will receive 0.147 shares of OPI for each common share they own, representing an implied value of $1.70. DHC shareholders will own roughly 42% of the combined company, with OPI shareholders owning the remaining 58%. 📝

The combined portfolio will comprise roughly 40% senior living, 35% office, 12% medical office, and 9% life science properties. 🏢

$DHC is up 160.00% YTD.

See Y’all Next Week 🤙