It was an optimistic week for stocks following the debt ceiling deal and strong labor market data. 👀

Let’s recap and prep you for the week ahead. 📝

What Happened?

📈 The optimism continued this week, with the S&P 500 making new year-to-date highs following strong labor market data.

🤩 This week’s Stocktwits Top 25 report showed slight outperformance relative to the indexes.

🤑 Nvidia joined the $1 trillion club as the artificial intelligence (AI) hype continues. Meanwhile, we summarized big days of tech earnings on Wednesday and Thursday. And both Hewlett-Packard companies reported disappointing results.

🛍️Most companies remain cautiously optimistic about the state of the U.S. consumer. Dollar General raised the alarm on the low-income consumer, while Lululemon’s high-income customer base continues to shop. Advanced Auto Parts, Nordstrom and PVH, and U-Haul all reported.

📱 Telecom stocks extended their declines on reports that Amazon wants to enter the space by offering Prime members free or discounted wireless plans.

🔥 Several names were on the Stocktwits trending tab for most of the week, including $TOP, $UCAR, $TRKA, $AI, $SOFI, and $PLTR.

Here are the closing prices:

| S&P 500 | 4,282 | +1.83% |

| Nasdaq | 13,241 | +2.04% |

| Russell 2000 | 1,831 | +3.27% |

| Dow Jones | 33,763 | +2.02% |

Bullets

Bullets From The Weekend

📆 Shareholders may have to wait for UBS’ financials. The Swiss bank is considering delaying its quarterly results at least until the end of August as it deals with the complexities of its takeover of its failed rival, Credit Suisse. This comes at the same time that executives warned of painful decisions to come, including job cuts and other restructuring efforts. While UBS will be the country’s sole big bank following this merger, its path to get there remains riddled with challenges. Yahoo Finance has more.

🔻 Asset managers continue to mark down their private investments. While many of the high-flying private investments in technology and other pandemic-fueled growth companies were written down by Japan’s Softbank and others like it, more traditional asset managers have been slower to adjust the value of their holdings. Last week we saw cuts to the private valuations of Twitter and Reddit, with T. Rowe Price joining the party by marking down its stake in Canva by 67.6%. This follows one of Australia’s largest venture operations, Blackbird’s, own 36% valuation adjustment. More from TechCrunch.

🛢️ Saudi Arabia plans new oil cuts as part of OPEC+ deal. The country will make deep production cuts in July as the output-limiting OPEC+ deal looks to combat falling oil prices and a potential supply glut. Saudi Energy Minister Prince Abdulaziz said the cut of 1 million barrels per day (bpd) could be extended beyond July if necessary. Overall, the group decided to reduce production targets from 2024 by a total of 1.4 million bpd. However, analysts say many of these adjustments reflect already reduced production levels in Russia, Nigeria, and Angola. Reuters has more.

The Brief

Need a concise summary of what’s going on this week? Look no further. Here’s an overview of important earnings and economic data for the trading week ahead.

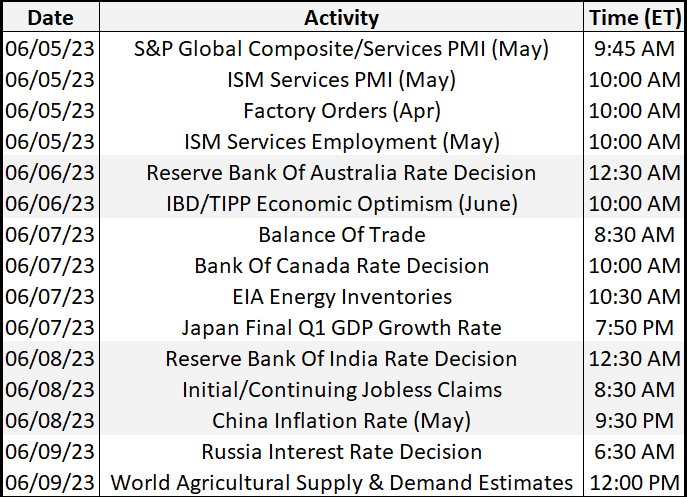

Economic Calendar

It’s a short week on the economic data front, though investors will be watching several interest rate decisions from around the globe. In addition to the above, check out this week’s complete list of economic releases.

Earnings This Week

Earnings season is nearing its last legs, with 76 companies reporting. Some tickers you may recognize are $GTLB, $SFIX, $GME, $MOMO, $DOCU, $NIO, $FCEL, $TCOM, $MTN, and more.

Above is a quick summary. Check out the full Stocktwits earnings calendar for the other names reporting this week.

Links

Links That Don’t Suck:

📝 Disney gets big write-off after pulling its streaming shows

📮 Dogs attacked more than 5,300 mail carriers last year, the Postal Service says

⚠️ US credit rating downgrade may be coming despite debt ceiling deal, Fitch says

🧠 Drug developer Servier’s brain cancer drug slows tumor progression considerably