The market celebrated today’s blowout jobs number, despite making the Fed’s inflation fight trickier. Stocks pushed to new heights, with the small-cap Russell 2000 and beaten-down regional banks leading the charge. Let’s see what else you missed. 👀

Today’s issue covers May’s juicy jobs report, Amazon entering the telecom space, and the $SPY flying high. 📰

Check out today’s heat map:

Every sector closed green. Materials (+3.35%) led, and communication services (+0.11%) lagged. 💚

The only stock reporting earnings today, Yunji Inc. jumped 200% intraday following the Chinese e-commerce company’s first-quarter results. Despite earnings per share and revenue declining YoY, it still topped expectations. 🛒

Chemical companies made headlines after the top U.S. firms agreed to pay $1.2 billion to settle various water contamination lawsuits. 3M is also reportedly considering a $10 billion pollution settlement with several U.S. cities. ☣️

Crude oil prices rebounded with risk assets this week, though many expect OPEC+ is unlikely to make further production cuts at its Sunday meeting. Meanwhile, Exxon and Chevron are nearing deals to drill in the North African country Algeria as they look to put last year’s record profits to work. 🛢️

Other symbols active on the streams included: $UCAR (+18.71%), $TRKA (-10.26%), $S (-35.13%), $AI (-7.08%), $TYGO (-22.07%), $MMV (+113.61%), $HKD (+2.75%), and $SOFI (+3.08%). 🔥

Here are the closing prices:

| S&P 500 | 4,282 | +1.45% |

| Nasdaq | 13,241 | +1.07% |

| Russell 2000 | 1,831 | +3.59% |

| Dow Jones | 33,763 | +2.12% |

Economy

A Juicy Jobs Report

If there’s been one economic data point that forecasters and the Federal Reserve have had a difficult time getting a handle on, it’s been the labor market. And that continued this week, with a slew of data beating Wall Street’s expectations. 😮

Nonfarm payrolls rose 339,000 in May, topping the 190,000 estimate by a wide margin. This marked the 29th straight month of positive job growth, bringing the number of jobs created in 2023 to nearly 1.6 million. It also aligned with the 12-month average, showing that the labor market remains strong despite the Fed’s efforts to cool it.

The labor force participation rate was unchanged. However, a 369,000 decline in self-employment pushed the unemployment rate to 3.7%. 🔺

A 0.3% MoM increase in average hourly earnings aligned with estimates. Meanwhile, the 4.3% YoY increase was 0.1% below expectations. Additionally, the average workweek fell by 0.1 hours to 34.3 hours.

April’s JOLTs report from earlier in the week indicated 1.8 job openings for every unemployed person. That increased from 1.7 in March, as job openings jumped to 10.1 million. And the initial and continuing jobless claims trends remain volatile and near historic lows.

Overall, this combination of data keeps the Federal Reserve in a difficult spot. It recently came out and signaled a likely pause at the June meeting. However, its assumption that inflation will continue to trend lower includes a weaker labor market and reduced consumer spending. ⏯️

So far, we’ve not seen that. At best, we’ve gotten mixed signals from companies this earnings season about their view of the consumer. Many are baffled at how well spending has held up in the face of many challenges. But baffling aside, that’s what is happening. 🤷

The news sent treasury yields higher and stocks soaring. But, despite higher yields putting pressure on multiples and economic growth prospects, the market remains optimistic that corporate earnings can hold up in the current environment. As a result, stocks are going up.

The Federal Reserve’s next meeting is on June 13-14. Investors will be watching closely to see how the Fed interprets the current environment and adjusts its policy outlook. As of today, the bond market is pricing in a 70% chance of a June pause and a 30% chance for another 25 bp hike. And expectations for the first rate cut have been pushed out to January of 2024. 📆

Only time will tell who is right. But for now, optimism is reigning supreme. 🌞

Stocks

$SPY Flies High

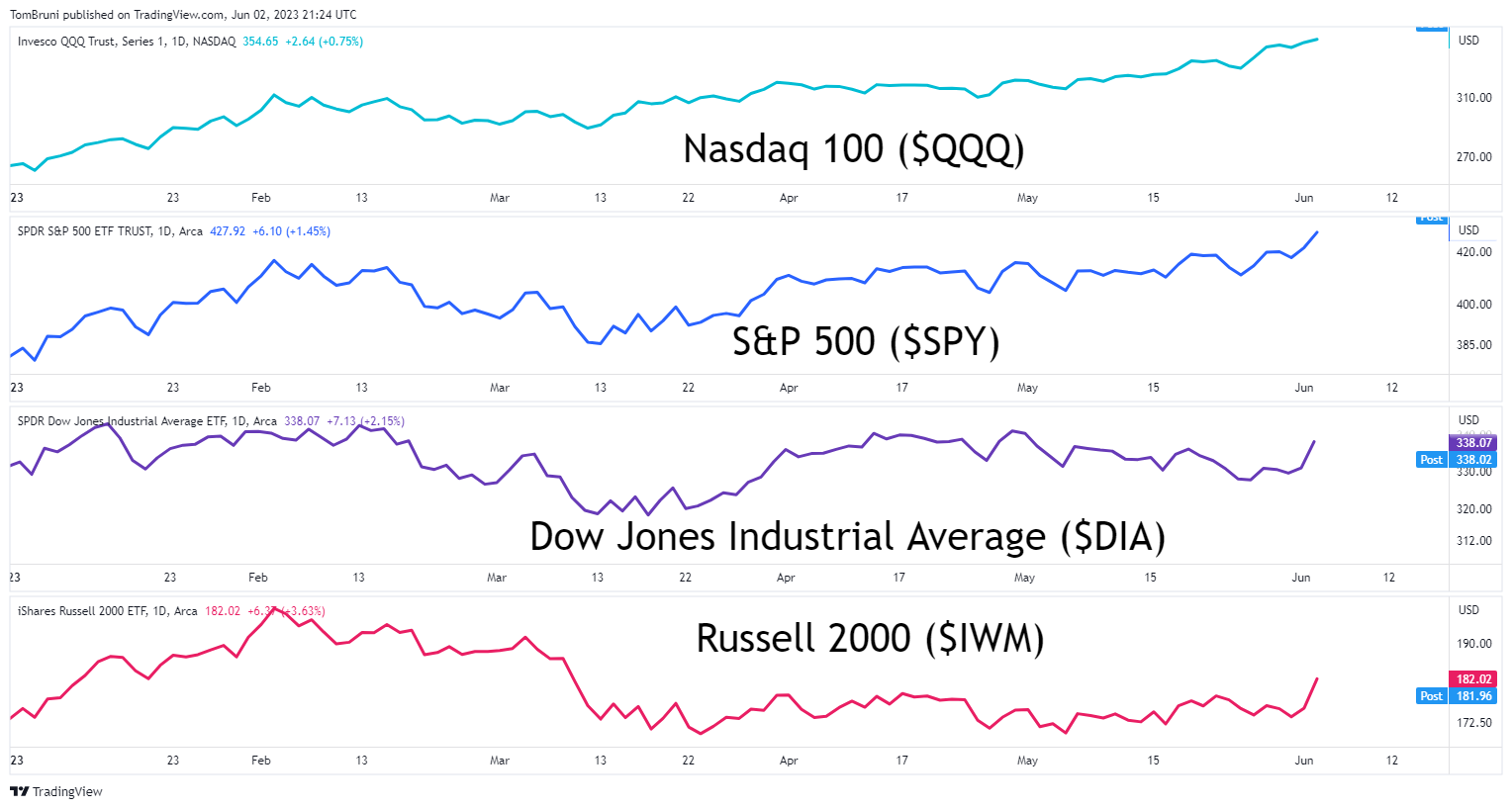

By far, the most talked about chart today was the S&P 500, which broke out to a new year-to-date high. The index joins the Nasdaq 100, which has been leading the U.S. stock market higher, marking two of the four major indexes breaking out. 📈

Bullish investors view this as a broadening out of market participation and the potential nail in the coffin of the “bear market” narrative. However, bearish investors suggest that the overlap between holdings skews the results, as only a few mega-cap stocks account for most of the gains. 🐻🐂

Regardless of your side, all eyes are on whether the Dow Jones Industrial Average and Russell 2000 begin to play catch up. Both indexes have lagged their counterparts off their October lows, so the bulls want to see them play catch up. The more stocks that are participating, the better the argument for a “new bull market” becomes.

That’s particularly true of the small-cap Russell 2000, which has been sitting near year-to-date lows since March. Whether or not today’s 3.63% rally in the index is the start of its move higher remains to be seen. Rest assured, investors will be watching this development in the coming weeks. 👀

Company News

Telecoms Tank As Amazon Enters Space

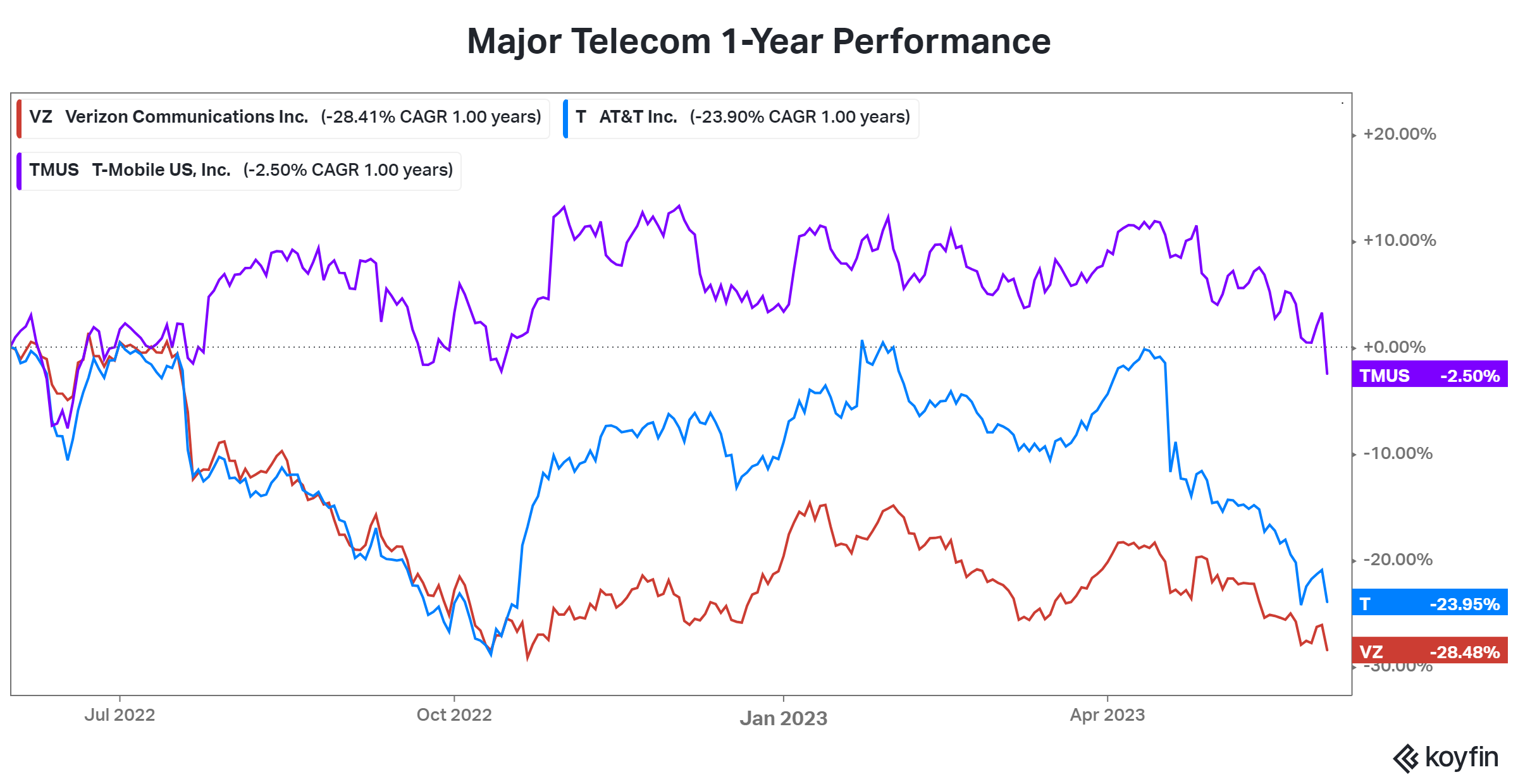

It’s been a rough environment for telecom stocks, particularly the largest ones with diversified media businesses. However, things may get more challenging as Amazon enters the fray. So let’s see what today’s news and initial reaction were. 👇

The original report was from Bloomberg, which stated that Amazon was in talks to offer free or discounted mobile service to U.S. Prime Members. It indicated the tech giant had been talking with wireless carriers, negotiating with Verizon, T-Mobile, and Dish Networks to get the lowest wholesale prices possible. 📱

However, T-Mobile and Verizon both denied discussions, and Dish declined to comment. That’s likely because this represents a catch-22 for them.

While this offering would give the big carriers another major distribution network to expand their 5G networks, it would come at the cost of margins. The big carriers’ unlimited plans start at roughly $60. So if Amazon does offer a free or $10/month plan to its prime members, that would pose significant competition to those regular-priced bundles. 🛒

The move would likely mean more customers on their networks but less profit per customer. 🔻

Ultimately, the telecom giants will have difficulty saying no to Amazon for several reasons. First, they need new distribution channels to grow the 5G network. And second, the tech giant has shown it’s willing to lose billions on certain member perks to maintain its edge against Walmart+ and other alternatives. If Amazon wants to enter a specific industry, it will do it, with or without cooperation.

So these companies will likely cooperate; it’s just unclear how the final deal will look.

In the meantime, investors are ratcheting down their earnings expectations. That weighed on already heavy stock prices. 📉

Bullets

Bullets From The Day:

❌ West Coast ports shut as wage negotiations break down. Union workers were a “no show” after tense talks with port management broke down. As a result, the Port of Oakland shut down on Friday morning due to insufficient labor, quickly followed by Los Angeles operations. While the actions are not a formal strike, the stoppages are sending a message at a time when activity at West Coast ports had just begun to rebound. They had previously lost a lot of volume to East Coast ports due to the volatile labor situation…which has proved to be a reasonable concern. CNBC has more.

💾 Company file transfer tools targeted in another wave of hacks. Security researchers warn that they caught hackers exploiting a newly discovered vulnerability in a popular file transfer tool called MOVEit. It warned that the exploit could allow hackers to gain escalated privileges and unauthorized access to a company’s online environment. Patches have been made available, with Progress Software urging all its customers to apply them swiftly. More from TechCrunch.

💰 3D Systems confirms its takeover bid for Stratasys. Shortly after Stratasys announced merger plans with Desktop Metal, it’s now being offered a buyout from 3D Systems. The company has proposed to combine with Stratasys via a cash and stock merger that would convert each $SSYS share into $7.50 in cash and 1.2507 newly issued shares of 3D Systems. It would create an industry pure-play that Stratasys shareholders would own 40% of, in addition to the $540 million in cash. Yahoo Finance has more.

⚠️ U.S. regulator warns consumers not to store cash in Venmo and PayPal. The Consumer Financial Protection Bureau (CFPB) wants people to know that payment apps are convenient but are not banks and do not offer the same level of protection. Its warning comes in the wake of several high-profile bank failures that have reduced Americans’ confidence in the overall financial system. Ultimately, it wants consumers to know that payment apps are not federally insured on the institution level, so customers could lose funds if the companies go under. More from CNN Business.

🦺 Twitter’s head of trust and safety resigned. Ella Irwin resigned from the Musk-owned social media platform after serving just seven months in the role. She ran the Twitter team that fought disinformation, removed offensive content, and helped maintain the platform’s integrity. However, the company has experienced significant challenges in stemming that behavior since Musk began serving as CEO and regularly making off-the-cuff platform changes. It remains a challenging role to fill, as Irwin’s predecessor quit just two weeks after Musk took over. ABC News has more.

Links

Links That Don’t Suck:

🐕 Elon ‘The Dogefather’ Musk accused of insider trading

🤔 An app might rewrite this clickbait headline – here’s why

❌ Carvana cancels $1 billion debt swap as creditors hold out

✂️ Fidelity has cut Reddit valuation by 41% since 2021 investment

👶 Buy Buy Baby draws sale interest as one bidder looks to save stores

✍️ Supreme Court sides with Slack, putting direct listings into jeopardy

👎 Netflix shareholders decline to back executive compensation packages amid WGA strike