It was primarily a down day for stocks, with the consumer discretionary sector buoyed by a 5% rally in Tesla. Let’s see what you else missed. 👀

Today’s issue covers FedEx shipping the bed, the best housing start growth in three decades, and money flowing into AI startups. 📰

Check out today’s heat map:

1 of 11 sectors closed green. Consumer discretionary (+0.56%) led, and energy (-3.09%) lagged. 💚

Internationally, Qatar signed a second 27-year deal to supply China with liquified natural gas (LNG). The world’s second-largest economy will buy 4 million metric tons of LNG from Qatar annually during the contract. 🤝

Dice Therapeutics popped 38% on news that Eli Lilly is buying the company for $2.4 billion as it bets on oral IL-17 inhibitors. 💊

Civitas Resources fell 6% after announcing it will enter the Permian basin by buying operations from private equity firm NGP Energy Capital Management for $4.7 billion. 🛢️

In crypto news, the International Monetary Fund (IMF) is currently working on a global central bank digital currency platform. EDX Markets, a crypto exchange backed by financial giants Charles Schwab, Fidelity Digital Assets, and Citadel Securities, has launched trading for four crypto assets. And Marathon Digital Holdings and other crypto-related equities rallied as Bitcoin passed $28k. ₿

Other symbols active on the streams included: $MULN (-29.91%), $SPCE (+27.06%), $VCIG (+156.18%), $FFIE (-37.57%), $DFLI (-46.24%), $ICAD (+11.11%), $EBET (-7.31%), and $VJET (+8.54%). 🔥

Here are the closing prices:

| S&P 500 | 4,389 | -0.47% |

| Nasdaq | 13,667 | -0.16% |

| Russell 2000 | 1,867 | -0.47% |

| Dow Jones | 34,054 | -0.72% |

Earnings

FedEx Ships The Bed

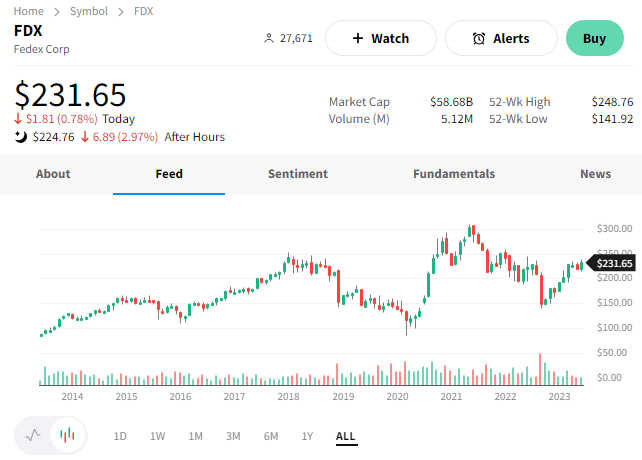

Global transportation company FedEx is falling after reporting weaker-than-anticipated fourth-quarter results. 🔻

Its adjusted earnings per share of $4.94 topped the $4.85 analyst estimate. The company continues to struggle with cost inflation but has spent most of the last year drastically cutting costs, leading to an $800 million (15%) increase in operating profit vs. the fiscal year 2022. ✂️

However, revenues of $21.9 billion were down about 10% YoY and missed the $22.55 billion expected by Wall Street. Executives blamed a “dynamic demand environment,” where daily package volumes in its Express business fell 10% YoY and average daily freight pounds shipped dumped 14% YoY. 📦

The company expects to realize about $4 billion in profit-margin improvements from its DRIVE program by the end of fiscal 2025, though roughly half of that was realized last year.

Looking ahead, it forecasts fiscal-year sales to be flat or experience low single-digit growth and earnings per share of $16.50 to $18.50. It also earmarked $5.7 billion in capital spending, primarily for investments to improve efficiency and lower long-term costs. And lastly, after eighteen years with FedEx, CFO Mike Lenz announced his retirement on July 31. His replacement is TBD. 🔮

Overall, executives believe the economic environment remains uncertain. Clearly, based on their forecast and operational priorities, they’re expecting lean demand and upward cost pressures to stay for the foreseeable future.

With $FDX shares up 50% since their September lows, today’s news wasn’t enough to get it going. The stock initially fell as much as 8% after the bell but settled down around 3% as of writing this. 👎

Economy

The Best In Three Decades

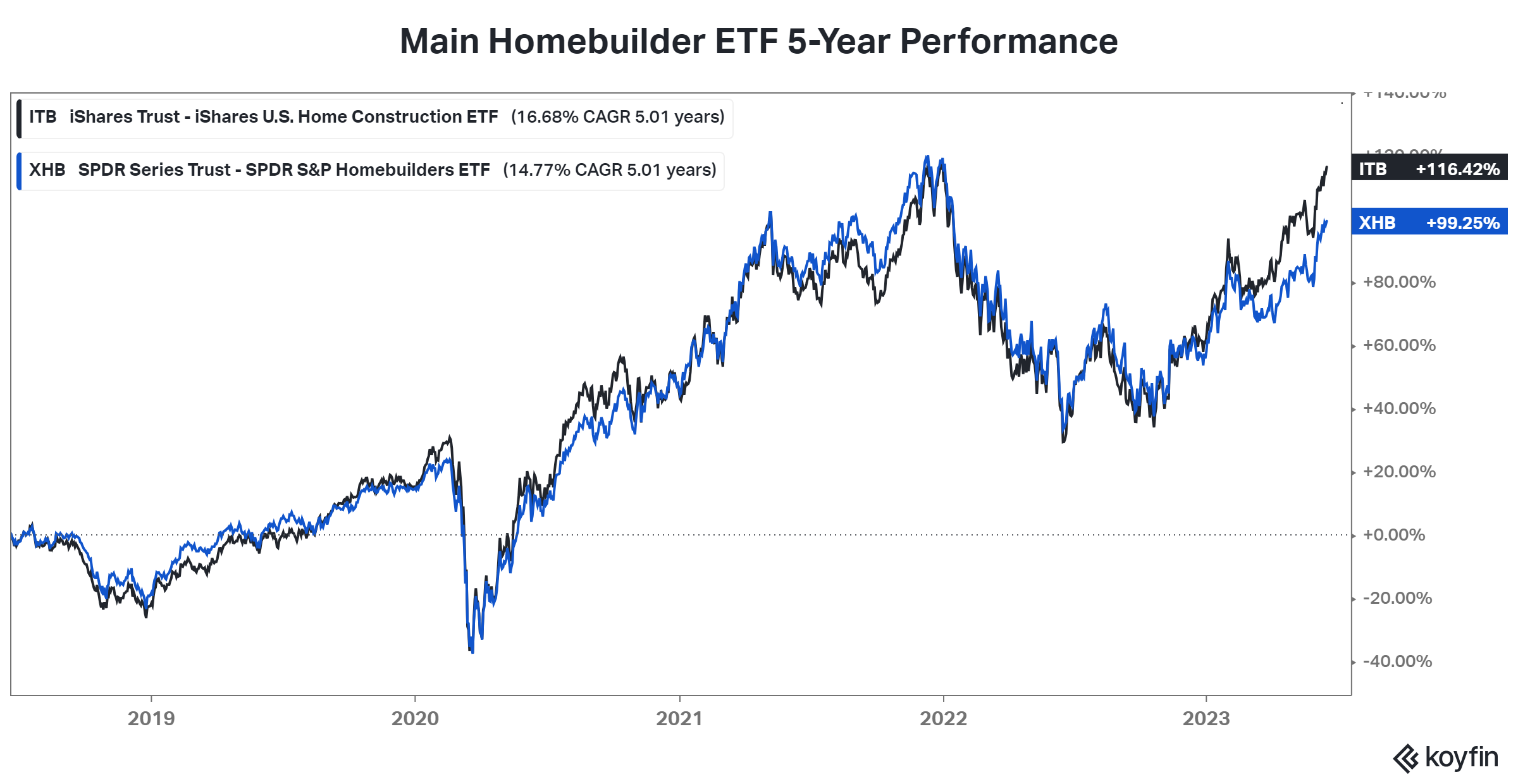

While elevated interest rates and low affordability continue to weigh on the overall housing sector, signs have emerged that housing’s decline has plateaued recently. Even Federal Reserve Chairman Jerome Powell said in his speech last week that housing is “putting in a bottom.” And today’s surprise data adds fuel to that narrative.

Let’s take a look. 👇

U.S. housing starts jumped 21.7% MoM in May. The 291,000-unit increase was the most since January 1990, and the 21.7% MoM increase was the largest percentage gain since October 2016. That soared past economists’ expectations for a 0.8% MoM decline, with the actual annual pace rising to 1.63 million. 🏘️

Leading the charge was an 18.5% rise in single-family homes, the largest segment of the U.S. housing market. Meanwhile, apartment building stars rose 28.1%. As for what part of the country saw the most increase? Midwest housing starts jumped 67% MoM, leading the nation in single-family construction growth.

U.S. building permits jumped 5.2% to an annualized 1.49 million rate. Single-family home permits rose 5.2%, while those for buildings with five or more units jumped 7.8%. 📋

While this housing dataset is among the most volatile, the sharp increase shows a continued appetite for new housing. We’ve heard from homebuilders that low existing home inventory continues to push buyers into the new home market. 💰

That’s likely why many homebuilder stocks, and the ETFs that track them, are at or approaching all-time highs. $ITB, which is more heavily weighted towards homebuilders, sits just below its 2021 highs. Meanwhile, $XHB, which is more equally weighted, is about 12% below its highs. 📈

Since housing is such a large driver of economic activity, the Fed will be watching closely to see if it’s truly bottomed. If it has, the Fed will be fighting a war against the labor and housing markets to reduce inflation further, likely meaning a longer period of tight policy and potentially more hikes.

We’ll have to see how the stats shake out as we head past peak season and into the summer. 📆

Private Markets

Money Continues Flowing Into AI Startups

While these were just three deals announced today, a significant appetite remains for artificial intelligence (AI)-related companies in public and private markets. For example, one company raised $113 million last week, despite being founded a month ago and having no product. 😮

Nonetheless, let’s recap today’s deals:

Parrot, an AI-powered transcription platform, raised an $11 million Series A round. The transcription platform offers speech-to-text depositions for the legal and insurance industry, also unveiling a new feature to summarize depositions within seconds.

Amplify Partners and XYZ Venture Capital co-led the round at an undisclosed valuation, bringing its total raised to $14 million. The company will use the proceeds to continue investing in AI for the legal and insurance domains, developing tools to address the industries’ core challenges. 🦜

The voice-generating platform ElevenLabs raised a $19 million Series A round. The round was co-led by Nat Friedman and Daniel Gross, alongside Andreessen Horowitz, and gives the company a post-money valuation of $99 million.

The company’s technology turns text into speech using synthetic voices, cloned voices, or entirely novel “artificial” voices that mimic the sounds of people of various backgrounds. They’re also language-agnostic, meaning customers can fine-tune them and build proprietary speech models on top of it. Overall, the investment will continue building ElevenLab’s research hub for voice AI and launch additional products to support market verticals like publishing, gaming, entertainment, and conversational applications. 🤖

JPMorgan Chase made a strategic investment in Cleareye.ai. The fintech firm claims its platform can expedite trade finance processes and compliance by analyzing documents and data, reducing the need for manual checks.

The two did not disclose the financial terms of the investment, but it builds on a commercial relationship that began last year. JPMorgan receives 4 million documents yearly related to its trade finance business, so it’s leveraging Cleareye.ai’s tech to improve its back-office operations. 📝

Bullets

Bullets From The Day:

🏦 SVB Financial Group finds a familiar buyer for its investment bank. The bank’s wild journey has come full circle, with SVB Securities being sold to a group led by former division CEO Jeff Leerink. It will acquire the company for cash, repayment of an inter-company note, and a 5% equity instrument. However, Moffett Nathanson, a sell-side business SVB previously acquired, is not part of the deal. The court will weigh in on the offer on June 29. Axios has more.

🏭 More big tech production is moving to India. Alphabet’s Google is looking to source suppliers in India to assemble its Pixel smartphones as it follows Apple’s plans to diversify away from China. Initial reports are that early conversations have occurred with Lava International Ltd., Dixon Technologies India Ltd., and Foxconn Technology Group’s Indian unit Bharat FIH. Google produced 9 million Pixel smartphones last year and continues to bet on the product. This highlights a need to move production beyond just China and Vietnam. More from Yahoo Finance.

💵 Rivian adopts Tesla’s charging standard. The luxury electric SUV maker is the latest to conform to Tesla’s standard, giving customers access to 12,000 supercharger stations across North America. It’s looking increasingly likely that Tesla will become the “de facto” EV charging standard in the U.S. despite the government’s efforts to encourage the adoption of the incumbent charging standard CCS (Combined Charging Standard). Still, Rivian says it will install 3,500 fast chargers at over 600 locations in the coming years. It’s simply giving customers more options as it builds out its infrastructure. The Verge has more.

💰 Intel commits to a $33-billion chip plant in Germany. The chipmaker continues its historic investments across the globe, making the largest foreign investment in Germany’s history. It plans to spend over $33 billion to develop two chip-making plants in the country, with the German government subsidizing nearly a third of the cost. It’s the company’s third major investment in the last week, as it invested $4.6 billion in Poland and $25 billion in Israel, snatching up significant government incentives. More from Reuters.

💸 PayPal offloads billions in BNPL loans to global investment managers. KKR & Co. will purchase as much as $44 billion in buy-now-pay-later loan receivables from PayPal Holdings as it frees up cash to do more shore repurchases. It’s part of a commitment that allows private credit funds and accounts managed by KKR to purchase loans originated by PayPal across Europe. PayPal anticipates it will generate $1.8 billion in proceeds, of which $1 billion will be used to repurchase shares. It also highlights the increasing popularity of private credit products across the industry. Yahoo Finance has more.

Links

Links That Don’t Suck:

😐 John Oliver is the new face of the Reddit API protest

🧑⚖️ Carlos Ghosn sues Nissan for $1bn in defamation suit

🧑💼 Alibaba names new chairman and CEO in major shakeup

🍕 Just drop a pin to get Domino’s pizza delivered to wherever you are

✈️ Airbus wins record order for 500 jets from India’s IndiGo at Paris Air Show

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.