While elevated interest rates and low affordability continue to weigh on the overall housing sector, signs have emerged that housing’s decline has plateaued recently. Even Federal Reserve Chairman Jerome Powell said in his speech last week that housing is “putting in a bottom.” And today’s surprise data adds fuel to that narrative.

Let’s take a look. 👇

U.S. housing starts jumped 21.7% MoM in May. The 291,000-unit increase was the most since January 1990, and the 21.7% MoM increase was the largest percentage gain since October 2016. That soared past economists’ expectations for a 0.8% MoM decline, with the actual annual pace rising to 1.63 million. 🏘️

Leading the charge was an 18.5% rise in single-family homes, the largest segment of the U.S. housing market. Meanwhile, apartment building stars rose 28.1%. As for what part of the country saw the most increase? Midwest housing starts jumped 67% MoM, leading the nation in single-family construction growth.

U.S. building permits jumped 5.2% to an annualized 1.49 million rate. Single-family home permits rose 5.2%, while those for buildings with five or more units jumped 7.8%. 📋

While this housing dataset is among the most volatile, the sharp increase shows a continued appetite for new housing. We’ve heard from homebuilders that low existing home inventory continues to push buyers into the new home market. 💰

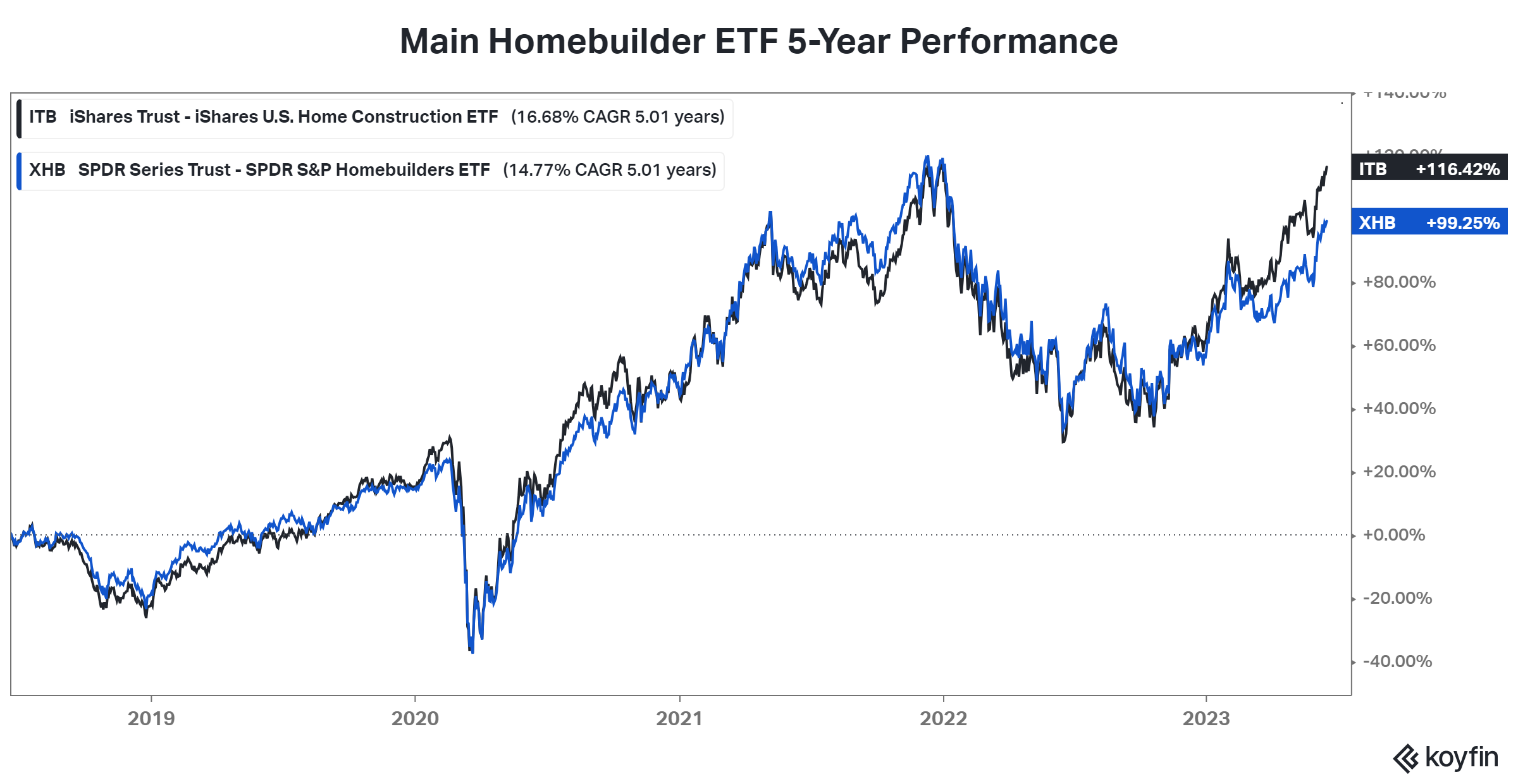

That’s likely why many homebuilder stocks, and the ETFs that track them, are at or approaching all-time highs. $ITB, which is more heavily weighted towards homebuilders, sits just below its 2021 highs. Meanwhile, $XHB, which is more equally weighted, is about 12% below its highs. 📈

Since housing is such a large driver of economic activity, the Fed will be watching closely to see if it’s truly bottomed. If it has, the Fed will be fighting a war against the labor and housing markets to reduce inflation further, likely meaning a longer period of tight policy and potentially more hikes.

We’ll have to see how the stats shake out as we head past peak season and into the summer. 📆