$NFLX‘s recent crackdown on password-sharing has sparked family disputes over streaming bills, but it has also generated positive effects for the company’s stock. 😆

Goldman Sachs ($GS), joining a growing list of Wall Street firms, now considers the streaming giant a more attractive buy due to its advancements in password enforcement.

In a note issued by Goldman Sachs analyst Eric Sheridan, he praised Netflix’s execution of the password-sharing initiative, the resurgence of content creation, and the reduced competition from traditional media companies. This prompted Sheridan to upgrade the stock from Sell to Neutral and raise the price target from $230 to $400.

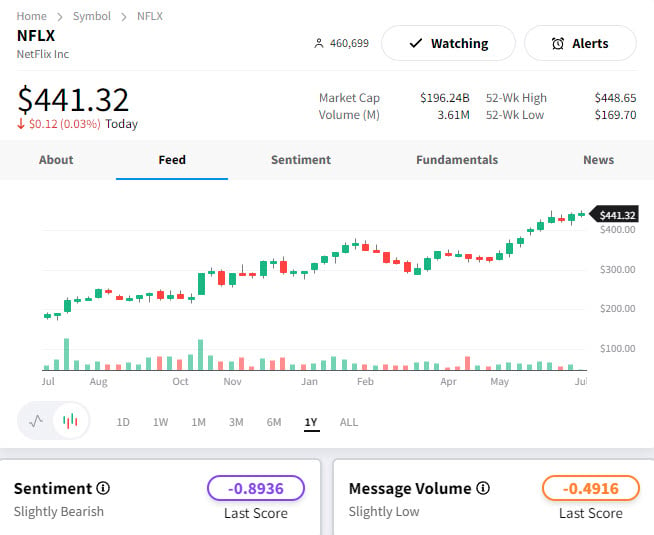

Over the past year, Netflix has attracted 5 million monthly active users to its ad-supported tier and experiences new subscriptions in the US after implementing password-sharing restrictions. As a result, Netflix’s stock has surged, witnessing a remarkable 135% increase since Goldman Sachs issued its sell rating.

Goldman Sachs envisions a scenario where 40 million sharers become add-on members, generating $7.99 per month, while 30 million sharers transition to the ad-supported tier, yielding an average monthly revenue of $15 per user.

Goldman Sachs envisions a scenario where 40 million sharers become add-on members, generating $7.99 per month, while 30 million sharers transition to the ad-supported tier, yielding an average monthly revenue of $15 per user.

These estimations lead Goldman Sachs to project a revenue increase from $31.62 billion in 2022 to approximately $49 billion in 2025. 😱