Technology shares continued to lead the market’s weakness, while defensive sectors like utilities and healthcare caught a bid. Let’s see what else you missed. 👀

Today’s issue covers Pepsi’s plan to drive beverage growth, the paper industry’s mega-merger, and RH’s trouble in luxury retail land. 📰

Check out today’s heat map:

5 of 11 sectors closed green. Utilities (+1.28%) led, and technology (-1.46%) lagged. 💚

Internationally, China’s exports fell 8.8% in August, with imports falling YoY every month this year. German industrial output also fell more than expected in July as the largest economy in Europe continues to limp along. 🔻

Apple shares continued their decline today on news that China could seek to expand its iPhone ban to state firms and agencies. Meanwhile, U.S. lawmakers are calling for additional sanctions after its largest contract chipmaker, SMIC, created a chip specifically for Huawei’s new smartphone. It marks a significant breakthrough for the country in its current “tech war” with the West. 🚫

Traditional automakers remain under pressure as next week’s United Auto Workers (UAW) strike deadline approaches. UAW President Shawn Fain called GM’s recent offer ‘insulting,’ suggesting there’s still a long way to go in the negotiations. 🚗

Automation software company UiPath jumped 11% after its revenue growth topped expectations. However, analysts remain unclear on how artificial intelligence will materially benefit it. 💻

Speaking of artificial intelligence (AI), the topic remains in focus with public and private companies. Tencent and IBM both rolled out new generative AI tools, while startup Imbue raised $200 million for its AI models that can ‘robustly reason.’ 🤖

Other symbols active on the streams: $AI (-12.24%), $TTOO (+13.93%), $MULN (-5.64%), $CHPT (-10.91%), $EZGO (-32.67%), $AMC (-5.80%), $WHLR (+40.75%), and $HKIT (+17.78%). 🔥

Here are the closing prices:

| S&P 500 | 4,451 | -0.32% |

| Nasdaq | 13,749 | -0.89% |

| Russell 2000 | 1,856 | -0.99% |

| Dow Jones | 34,501 | +0.17% |

Company News

Pepsi Eyes Beverage Growth

Seemingly everyone from global conglomerates to content creators is getting in on the beverage space. That’s because beverage products tend to have much higher margins than food products. And if you can market your way through the competitive space, you can make a pretty penny. 🧃

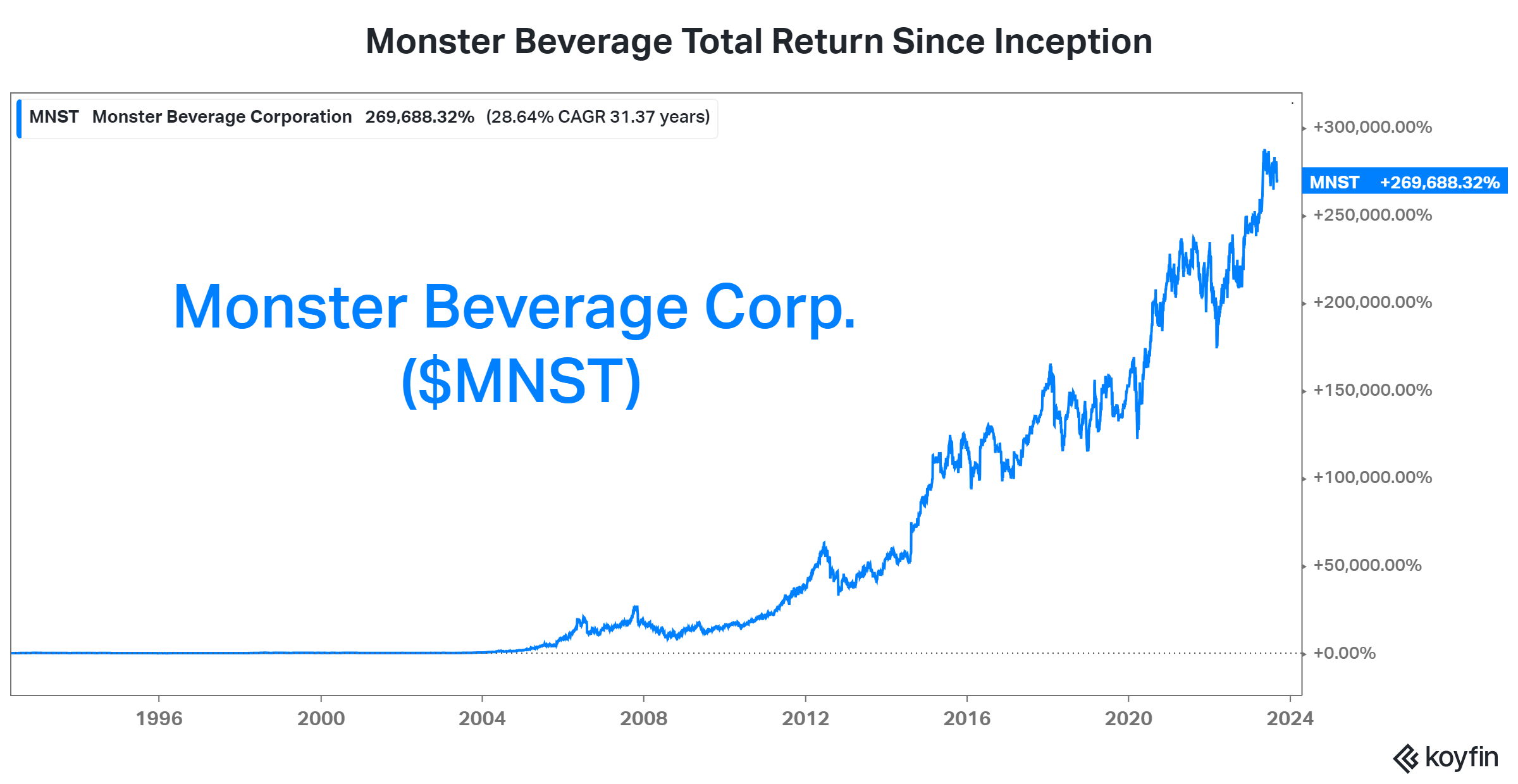

If you need evidence of that, just look at one of the best-performing stocks in the market, Monster Beverage. Since going public about thirty years ago, it has returned nearly 270,000%. It’s almost as if its stock price drank a lot of monster energy. 🤩

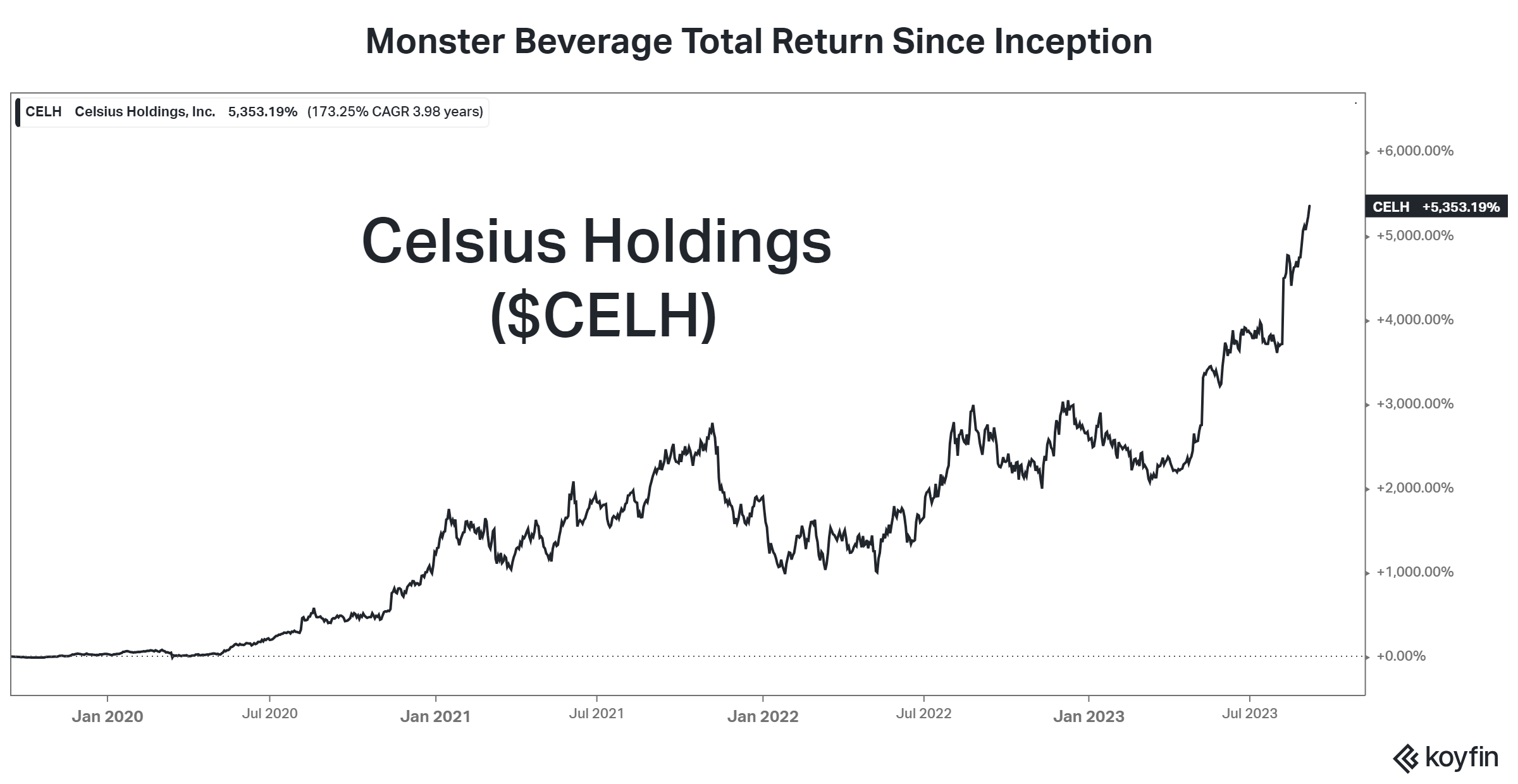

Or check out Celsius Holdings continuing the epic run that began when it went public. 🗓️

Or the many creator or celebrity-driven drink brands like Logan Paul’s Prime and Ryan Reynolds’ Aviation Gin. The point is that the beverage space can be a very profitable one. 🍸

And with pricing power on its current products diminishing, Pepsi is looking to beverages to help drive growth. Its newest idea is an expansion to the Gatorade brand, with a new “Gatorade Water.” It’ll launch early next year as an electrolyte-infused, unflavored water product that’s filtered with a seven-step inflation process and contains alkaline and enhanced pH levels. 🌊

The company says roughly 30 million consumers do not buy enhanced water at all. But it’s making the bet that the primary reason is because it’s not from a brand they know and trust. Thus, offering the product under the Gatorade name and packaging could pull new customers into the market.

The brand remains the recovery drink category leader, but Gatorade sales haven’t experienced as strong growth as some competitors. That led to the company expanding its portfolio into energy beverages, protein powders, capsules, and more aimed at those looking to improve their health.

We’ll have to wait and see if this bet pays off. But with the popularity of water brands like “Liquid Death,” anything is possible. 🤷

Company News

Paper Industry Eyes Mega-Merger

When people think of the paper industry, they may think of International Paper or Dunder Mifflin. But today, The Wall Street Journal reported on two players looking to create a new industry behemoth.

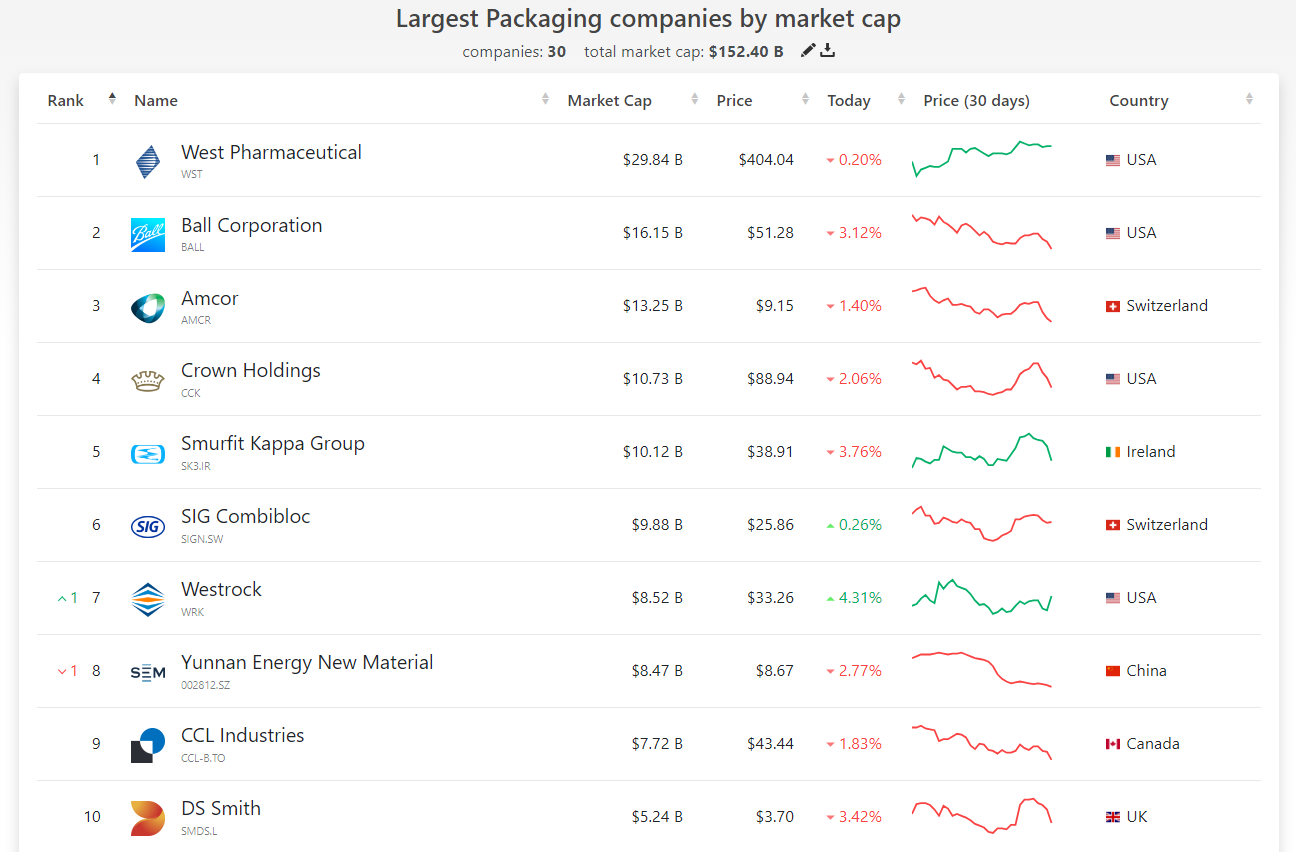

U.S. firm WestRock is reportedly nearing a deal to merge with Europe’s Smurfit Kappa Group, creating a global paper and packaging company valued at $20 billion. It would create a new company, which would become the second-largest packaging company by market capitalization.🤝

Atlanta-based WestRock makes packaging for products ranging from medicine to pizza and home-and-garden products. It was formed by a merger of MeadWestvaco and RockTenn in July 2015 and had $21.3 billion in revenues during 2022. Before the news, its market cap was $8.2 billion. 📦

Dublin-based Smurfit Kappa was founded in 1934 to make cardboard boxes and packing boxes for Ireland. However, a merger between Jefferson Smurfit and Dutch Kappa Packaging in 2005 created today’s company. It was approached in 2018 by rival International Paper but rejected several offers. Last year, it had roughly $13.5 billion in sales and has a current $10 billion market cap.

The proposed merger would accelerate Smurfit’s U.S. and Americas expansion while helping improve WestRock’s liquidity, as it has over $10 billion in acquisition-related debt. It could also improve overall performance in a cautious environment for the global paper business. After a pandemic boom, weakening demand and declining containerboard prices have weighed on results. 🔻

A deal could be announced next week if talks progress as anticipated. The combined company would be incorporated and domiciled in Ireland, with global headquarters in Dublin. However, its ordinary share listing would be on the New York Stock Exchange (NYSE), with a premium listing on the London Stock Exchange (LSE). 🌍

Earnings

No Rest For Retailer RH

Home goods retailers have had a rough time in a post-pandemic environment. That’s because consumers’ discretionary spending has moved from goods to experiences, and housing activity has ground to a halt by high prices, high interest rates, and low existing inventory. And that holds true even in the luxury market, where RH operates. 😬

The luxury home goods company reported adjusted EPS of $3.93 on revenues of $800 million. That topped estimates of $2.60 per share on $786 million in revenues. Operating margins of 20.2% also exceeded guidance, primarily due to faster-than-expected deliveries and a shift of $40 million in advertising costs to the next quarter. 🔺

Looking ahead, executives remain cautiously optimistic. “We continue to expect the luxury housing market and the broader economy to remain challenging throughout fiscal 2023 and into next year as mortgage rates continue to trend at 20-year highs and the current outlook is for rates to remain unchanged until the second quarter of 2024.”

Their longer-term strategy of moving beyond curating and selling products to conceptualizing and selling spaces remains an attractive proposition for investors. It would move the company beyond the $170 billion home furnishings market and into the $1.7 trillion North American housing market.

However, the company still has many steps ahead of it to execute that vision successfully. And for now, the growth slowdown and cautious outlook into 2024 remain the focus of investors.

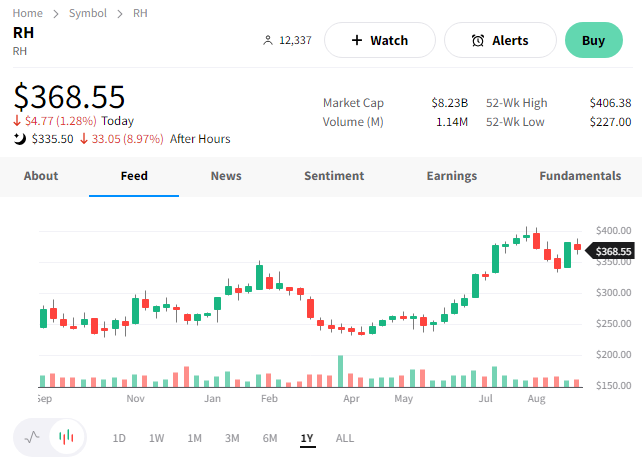

$RH shares fell about 9% on the news, trading roughly 55% below their all-time highs. 📉

Bullets

Bullets From The Day:

🔌 Tesla to install charging stations at 2,000 Hilton hotels. The electric vehicle maker will bring 20,000 charging stations to the hotel’s properties in the U.S., Mexico, and Canada beginning next year. For Hilton, the move could help attract business customers, while Tesla removes another barrier to adoption. Also, Honda is the latest automaker to adopt Tesla’s North American Charging Standard (NACS) beginning in 2025. CNBC has more.

💰 Majority stake in Creative Artists Agency (CAA) sold to French billionaire. Through his family investment company Artemis, Francois-Henri Pinault replaces private equity player TPG as the primary holder of one of Hollywood’s top talent agencies. The deal values CAA at roughly $7 billion, and the size of Artemis’ stake is unclear but firmly under majority control. More from Variety.

🏈 Google attempts to YouTube-ify the way we watch football. For the first time in almost three decades, NFL Sunday Ticket is on a new platform, switching from DirecTV to YouTube, which paid $2 billion yearly for the rights. Users can subscribe to the content through YouTube or YouTube TV, beginning at $350 for the season. But streaming games is just the start, as YouTube looks to improve the watching experience with live chat and polls, creators making content at the games, and more. The Verge has more.

🏗️ Apartment construction on track to hit record high. It’s on track to hit a 50-year high, with roughly 461,000 units expected to be built across the U.S. this year. Most new apartments are located in 20 metro areas where approximately 41% of U.S. renters live, as the nation faces a housing shortage and affordability crisis. However, around 89% of units completed from 2020 through 2022 are high-end, further pressuring affordability. With many renters eventually looking to buy, the current market has them stuck between a rock and a hard place. More from Axios.

⚔️ Threads now has a search feature in most English and Spanish-speaking countries. The text-based competitor to Elon Musk’s X is slowly but surely building out the app’s most requested features, this week adding search. Third-party researchers suggest that Thread’s daily active users have fallen roughly 80% since its launch, which is partially why the company is rushing to improve its overall experience and hopefully retain/reattract users. TechCrunch has more.

Links

Links That Don’t Suck:

📈 Find top stocks using a 3-step system—book a free 30-minute showcase with MarketSmith by IBD!*

🚀 SpaceX is not yet cleared for another Starship Super Heavy test flight, FAA says

🤝 Tom Brady joins Delta as strategic advisor: NFL legend discusses new partnership

⚠️ Google will require political ads ‘prominently disclose’ their AI-generated aspects

🏘️ Americans’ homes are worth more than ever, but tapping into that value isn’t easy

📧 Chinese hack of Microsoft engineer led to breach of U.S. officials’ emails, company says

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.