When people think of the paper industry, they may think of International Paper or Dunder Mifflin. But today, The Wall Street Journal reported on two players looking to create a new industry behemoth.

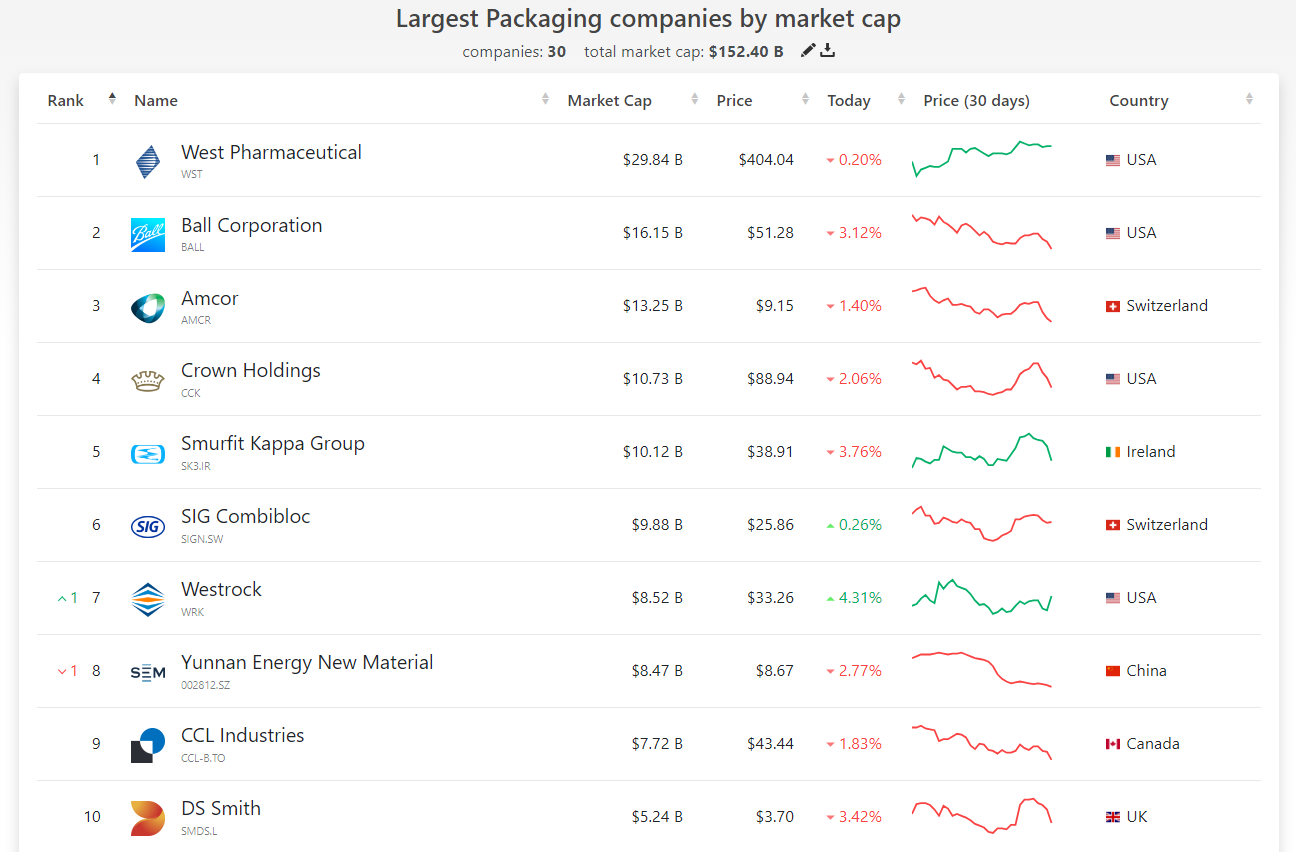

U.S. firm WestRock is reportedly nearing a deal to merge with Europe’s Smurfit Kappa Group, creating a global paper and packaging company valued at $20 billion. It would create a new company, which would become the second-largest packaging company by market capitalization.🤝

Atlanta-based WestRock makes packaging for products ranging from medicine to pizza and home-and-garden products. It was formed by a merger of MeadWestvaco and RockTenn in July 2015 and had $21.3 billion in revenues during 2022. Before the news, its market cap was $8.2 billion. 📦

Dublin-based Smurfit Kappa was founded in 1934 to make cardboard boxes and packing boxes for Ireland. However, a merger between Jefferson Smurfit and Dutch Kappa Packaging in 2005 created today’s company. It was approached in 2018 by rival International Paper but rejected several offers. Last year, it had roughly $13.5 billion in sales and has a current $10 billion market cap.

The proposed merger would accelerate Smurfit’s U.S. and Americas expansion while helping improve WestRock’s liquidity, as it has over $10 billion in acquisition-related debt. It could also improve overall performance in a cautious environment for the global paper business. After a pandemic boom, weakening demand and declining containerboard prices have weighed on results. 🔻

A deal could be announced next week if talks progress as anticipated. The combined company would be incorporated and domiciled in Ireland, with global headquarters in Dublin. However, its ordinary share listing would be on the New York Stock Exchange (NYSE), with a premium listing on the London Stock Exchange (LSE). 🌍