Interest rates continued their upward ascent after September’s consumer price index came in hotter than expected. Meanwhile, stocks broke their recent win streak and were led lower by the small-cap Russell 2000. Let’s see what else you missed. 👀

Today’s issue covers an update on the Fed’s inflation battle, two stocks popping on leadership shakeups, and Delta Air Lines failing to take flight after a strong summer profit. 📰

Here’s today’s heat map:

2 of 11 sectors closed green. Energy (+0.11%) led, & utilities (-1.54%) lagged. 💚

The U.S. is announcing new measures to prevent or deter Russia from skirting the price cap put on its oil a year ago. The new actions primarily target the Kremlin’s illicit fleet of ships built to transport oil products to countries not included in the price cap agreement. 🛢️

The Big Three automakers fell today after the United Auto Workers (UAW) union surprisingly expanded strikes to Ford’s largest and most profitable factory. However, Ford executives said they have “reached their limit” in the talks and are not prepared to offer more economic value to workers than has already been discussed. ❌

Hormel Foods shares plummeted 10% after the United Food and Commercial Workers International Union secured a historic contract that included $3 to $6 an hour in hourly wage increases. It represents 1.3 million workers in grocery, meatpacking, and other industries. 💰

Solar stocks popped but gave back all their intraday gains after Barclays upgraded First Solar, citing an attractive valuation. Meanwhile, car retailer Carvana dipped 10% after BNP Paribas downgraded the stock to “neutral.” 📉

Recent initial public offerings (IPOs) remain heavy in the market, with Birkenstock losing another 7% on its second day of trading. And retail investor favorite T2 Biosystems fell sharply after announcing a 1-for-100 reverse stock split as it tries to maintain compliance with the Nasdaq’s minimum price requirement of $1. 😮

Other symbols active on the streams: $AABB (-18.13%), $AVTX (-8.43%), $BCEL (+61.06%), $MTNB (-60.69%), $JD (-8.27%), $BCRX (-6.56%), $REQ.X (-5.24%). 🔥

Here are the closing prices:

| S&P 500 | 4,350 | -0.62% |

| Nasdaq | 13,574 | -0.63% |

| Russell 2000 | 1,734 | -2.20% |

| Dow Jones | 33,631 | -0.51% |

Economy

The War On Inflation Is Won

It wouldn’t be an inflation data day without some drama, so let’s get into what happened. 👇

First off, the headline consumer price index (CPI) rose 0.4% MoM and 3.7% YoY. That was ten bps above estimates, driven primarily by higher energy prices. As for core consumer prices, they rose 0.3% MoM and 4.1% YoY, as expected.

Services prices rose 0.6% when excluding energy services and were up 5.7% YoY. Within that number, shelter prices remain the main culprit in sticky services inflation, accounting for more than half the rise in September’s CPI reading. 🏘️

Overall, it was not a terrible reading. Core prices continue to decline, albeit at a slower pace each month. Ultimately, the market didn’t react much because it doesn’t think this report will do anything to change the Fed’s recent hawkish guidance. 😴

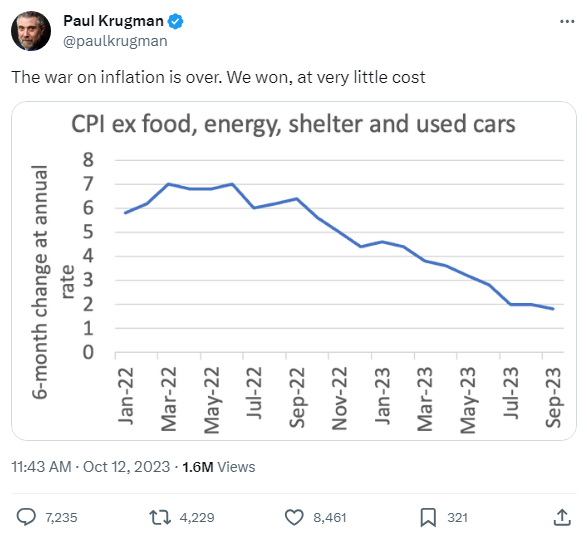

But the inflation take that got the internet riled up was from famed economist Paul Krugman, who tweeted the chart and caption below. In it, he essentially declares victory in the Fed’s war on inflation. Well, that is if you exclude basically all the items people buy regularly. 🤦

This chart, which excludes food, energy, shelter, and used cars, highlights the difference between how economists/analysts view inflation and how consumers experience it. 🙄

While economists are worried about the slope of price changes, consumers are worried about the absolute price changes. Prices rising a little less each month is undoubtedly a sign of progress, but it means that prices are still growing (just more slowly). That’s the reality consumers are experiencing in their everyday lives.

And that’s likely why recent data suggests that consumers remain concerned about inflation and are turning more pessimistic about the U.S. economic outlook. Energy prices have jumped significantly over the last four months, which has a way of impacting people’s mood about their wallets and the overall economy. 👎

That essentially explains the dunk fest Paul Krugman experienced on X today. But other than that, it was a pretty uneventful inflation report. 🤷

Earnings

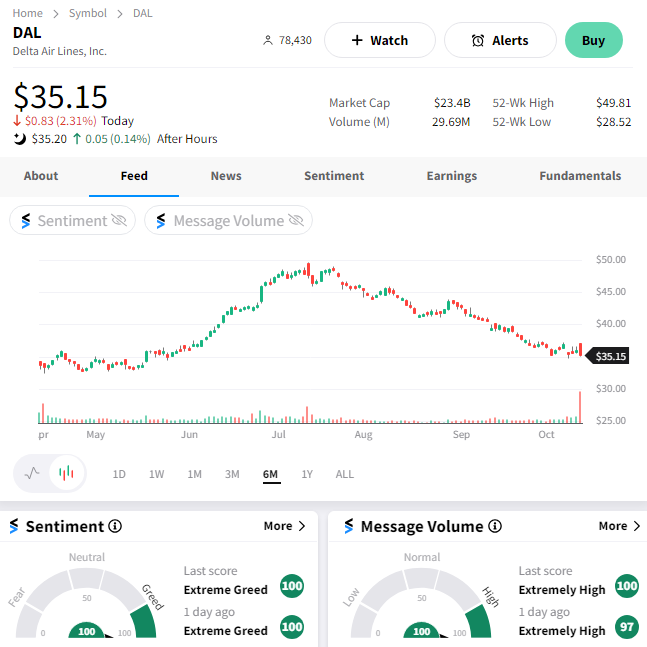

$DAL Fails To Take Flight

Shares of Delta Air Lines failed to gain any altitude despite third-quarter profits rising 60% YoY. 😮

The airline’s adjusted earnings per share of $2.03 topped estimates of $1.95. However, adjusted revenues of $14.55 billion vs. the $14.56 billion expected.

Like its peers, it cited strength in international travel as revenues grew 34% YoY in that segment. Overall, its fleet of planes flew 88% full during the quarter, up 100 bps YoY, even as it added additional domestic and international capacity. However, passenger unit revenue fell 1.5% YoY as ticket prices pulled back from their peaks. 🔺

Additionally, it’s seeing a sharp increase in demand for premium seats, with revenues rising 17% YoY vs. 12% for its main cabin tickets. Meanwhile, business travel is recovering still, about 80% of the way back to pre-pandemic levels.

As for negatives, higher fuel costs will continue to pressure results in the short term. And while overall demand remains strong, the company is cautious about consumers’ health and ability to keep up their spending levels as the economy slows. ⛽

Nevertheless, Delta expects strong demand in the final three months of 2023, estimating a 9% to 12% YoY revenue increase and $1.05 to $1.30 in earnings per share. That was roughly in line with estimates. 🔮

Despite the generally positive tone from executives, investors were quick to sell the pop in $DAL shares. They’ve fallen 30% from their July peak and are struggling to regain traction in the current environment. With that said, activity on our platform was high today, with sentiment still leaning towards “extreme greed.” 🤑

Company News

Stocks Pop On Leadership Shakeup

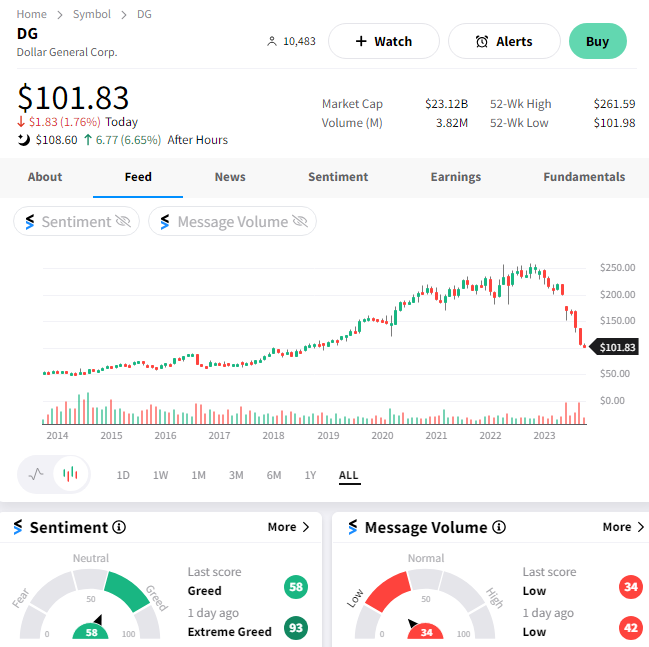

Two struggling retailers saw their shares pop today on news of leadership shakeups. 🔀

Dollar General announced former CEO Todd Vasos will return to lead the company again. Its stock price has fallen about 60% over the last year, driven by slowing sales growth and stakeholders criticizing the company for having an unsafe environment for employees and customers. 📉

He’ll replace Jeff Owen after less than a year in the role. Alongside this news, the company again reduced its full-year profit and same-store sales guidance.

$DG shares jumped 7% after the bell, with sentiment on our platform leaning slightly toward “greedy.” However, we’ll have to wait and see how quickly its new CEO can turn the company and its share price around. 💵

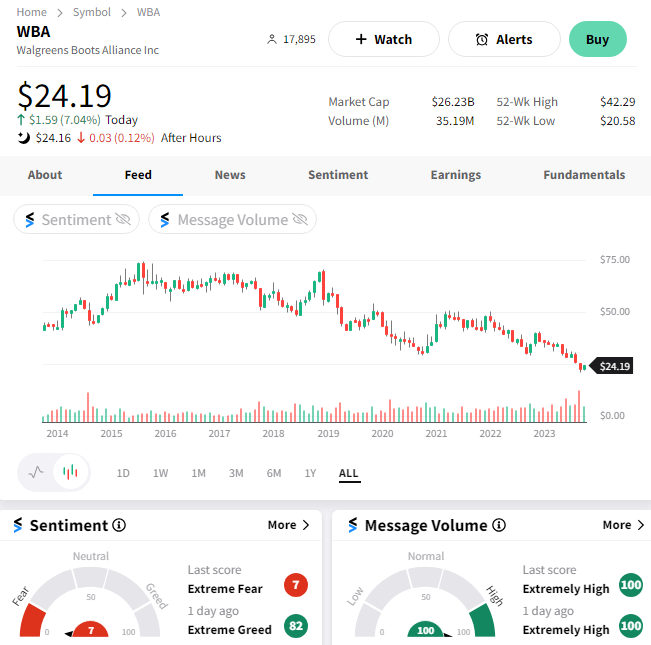

Meanwhile, Walgreens Boots Alliance has tapped a healthcare industry veteran, Tim Wentworth, as CEO. He was most recently the CEO of a Cigna division that includes its pharmacy benefit manager. And was also the CEO of Express Scripts until Cigna’s 2018 acquisition of the company. 👨⚕️

The pharmacy chain is making a big bet on transforming itself into a broader healthcare company. With a healthcare veteran taking charge here, investors appear to be turning slightly more optimistic about its longer-term plans.

That optimism overshadowed the adjusted profit miss and downbeat full-year outlook the company delivered before the bell. $WBA shares rose 7% on the day, though sentiment on our platform remained firmly in the negative. So, we’ll have to see how things shake out as this leadership transition progresses. 👀

Bullets

Bullets From The Day:

🤔 Target’s CEO is still trying to figure out U.S. consumers. The struggling big-box retailer’s CEO and other company execs are headed to the White House to meet with President Joe Biden to figure out what’s happening with U.S. consumers. Both the White House and the retailer are at critical points over how they’ve navigated inflation and the overall economy over the last eighteen months, with one aiming for reelection and the other looking to bolster slowing business growth and a floundering stock price. CNBC has more.

🕵️♂️ AMC Theatres CEO was the victim of an elaborate extortion attempt. While he didn’t reveal details about the “blackmail attempt,” besides denouncing false allegations about his personal life, Adam Aaron said he chose to fight his blackmailer despite significant personal risk. His extortionist was investigated and sentenced in July 2023, ultimately being arrested, convicted of a felony, and spending nearly a year in jail. He and the AMC Board of Directors confirmed that it was entirely a personal matter that is now closed. More from Variety.

📱 Threads is getting an edit button, with another new feature. Mark Zuckerberg’s X competitor announced that an edit button is rolling out on the platform, allowing users to edit posts for five minutes after publication. And the best part is, the feature is free! It also began rolling out another highly-request feature called “voice threads.” While the company has steadily added features to the platform since its launch, it’s still unclear whether user growth and engagement are back on the rise. The Verge has more.

🤝 Comcast and Disney hire advisers as the Hulu sale process progresses. Investment bankers have been hired to help assign a value to Hulu before the November first date, allowing either Disney or Comcast to trigger a sale process where the former will acquire the latter’s minority stake. As set in 2019, the streaming platform has a minimum valuation of $27.5 billion, but Comcast CEO Brian Roberts said last month that he believes Hulu is ‘way more valuable today.’ We’ll have to wait and see what the bankers come up with in the weeks ahead. More from CNBC.

📝 X rushes to improve community notes feature as misinformation spreads rapidly. The platform’s crowdsourced fact-checking system recently faced multi-day delays to correct misinformation, which many speculate has grown significantly since the outbreak of the Israel-Hamas war. X told users that it was rolling out several updates to improve the speed and availability of community notes. However, with more than 50 million posts globally referencing the weekend’s terrorist attack, it’s clear the company is already well behind the curve on how it’s managing information shared on its platform. TechCrunch has more.

Links

Links That Don’t Suck:

📈 Find top stocks using a 3-step system—book a free 30-minute showcase with MarketSmith by IBD!*

🌎 Climate rules are coming for corporate America

💵 IRS assesses that Microsoft owes the U.S. $29 billion in back taxes

🏬 Walmart will be closed on Thanksgiving for the fourth straight year

🔍 Google allegedly pays over $18 billion a year to be Apple’s favorite search engine

🚫 Former Barclays CEO Staley fined and banned by U.K. regulator over Epstein links

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.