Two struggling retailers saw their shares pop today on news of leadership shakeups. 🔀

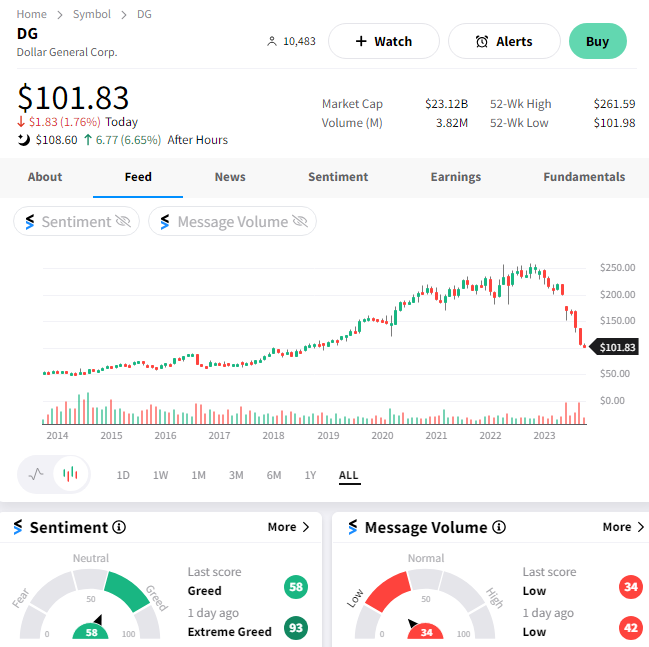

Dollar General announced former CEO Todd Vasos will return to lead the company again. Its stock price has fallen about 60% over the last year, driven by slowing sales growth and stakeholders criticizing the company for having an unsafe environment for employees and customers. 📉

He’ll replace Jeff Owen after less than a year in the role. Alongside this news, the company again reduced its full-year profit and same-store sales guidance.

$DG shares jumped 7% after the bell, with sentiment on our platform leaning slightly toward “greedy.” However, we’ll have to wait and see how quickly its new CEO can turn the company and its share price around. 💵

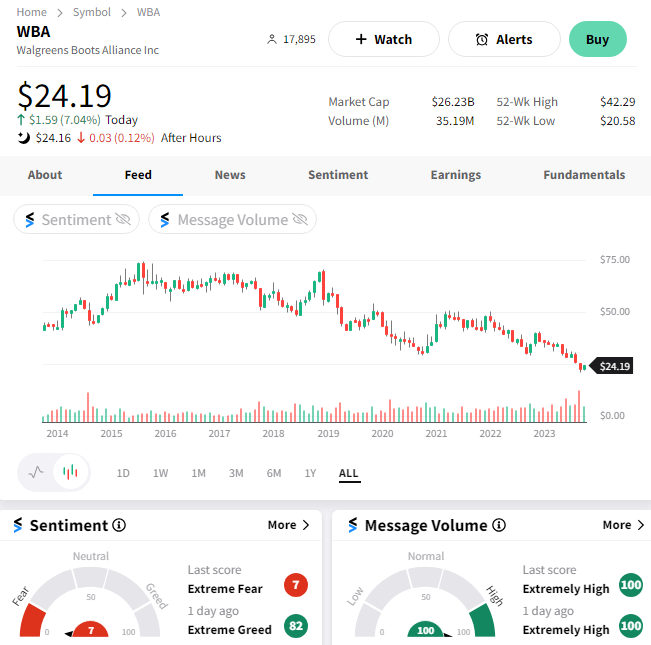

Meanwhile, Walgreens Boots Alliance has tapped a healthcare industry veteran, Tim Wentworth, as CEO. He was most recently the CEO of a Cigna division that includes its pharmacy benefit manager. And was also the CEO of Express Scripts until Cigna’s 2018 acquisition of the company. 👨⚕️

The pharmacy chain is making a big bet on transforming itself into a broader healthcare company. With a healthcare veteran taking charge here, investors appear to be turning slightly more optimistic about its longer-term plans.

That optimism overshadowed the adjusted profit miss and downbeat full-year outlook the company delivered before the bell. $WBA shares rose 7% on the day, though sentiment on our platform remained firmly in the negative. So, we’ll have to see how things shake out as this leadership transition progresses. 👀