The DOW, S&P 500, and NASDAQ just had their best week of 2023. The Russell? Best week since February 2021. Let’s see what else you missed. 👀

Today’s issue covers the payroll and job numbers, Draft Kings’ earnings, and the Yen. 📰

Here’s today’s heat map:

10 of 11 sectors closed green. Real Estate (+2.35%) led, & energy (-1.01%) lagged. 💚

Fox Factory ($FOXF) closed lower by -27.11%. The UAW strike resulted in the company cutting its full-year sales guidance.

Investors and traders appeared happy with Edita Medicine’s ($EDIT) results and guidance, closing up +18.21% for the day to top off a weekly gain of +32.75%

Other symbols active on the streams: $PLTR (+4.396%), $NVDA (3.46%), $WW (-11.98%), $BILL (-25.11%), $FTNT (-12.35%), and $AUPH (+4.57). 🔥

Here are the closing prices:

| S&P 500 | 4,358 | +0.94% |

| Nasdaq | 13,478 | +1.38% |

| Russell 2000 | 1,760 | +1.01% |

| Dow Jones | 34,061 | +0.66% |

Jobs numbers today showed that the U.S. labor market is showing signs of cooling faster than an iced latte in a polar vortex. Analysts expected 180k, but the number came in lower at 150k, missing the mark like a North Korean rocket test. 👨🚀

The Good 😃

- Health care and social assistance were the stars of the show, adding over 77,000 jobs, with ambulatory health care coming in with 32,000.

- If private education were lumped in, that number would jump to 89,000. And government employment puffed up its chest with 51,000 new gigs, hitting pre-pandemic levels.

The Bad 😟

- But it wasn’t all standing ovations. Mining, logging, utilities, and retail trade added a measly 2,500 jobs, and information lost 9,000, while transportation and warehousing dropped over 12,000.

- Manufacturing took a nosedive, shedding 35,000 jobs, mostly thanks to strike action. But it’s expected to rebound now that the United Auto Workers union and Detroit’s big three have shaken hands on a deal.

The Ugly 💩

- The unemployment rate did a sneaky uptick to 3.9%, giving the Fed a reason to smile.

- The number of workers laid off rose by 92,000, making job security shaky.

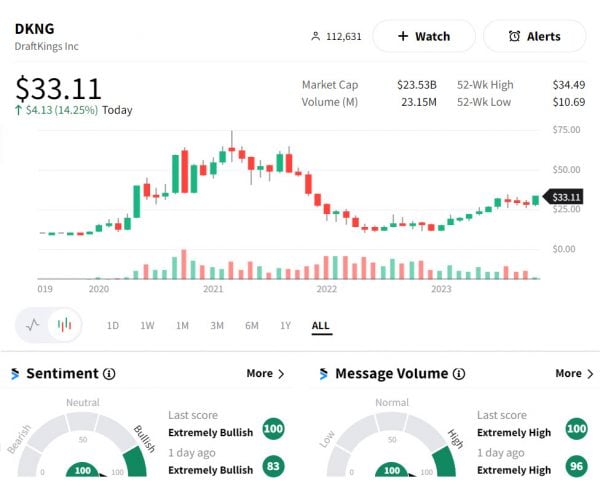

There’s positive news, guidance, and fundamentals, and then there’s whatever $DKNG‘s earnings are. 😲

- Loss Per Share (LPS): DraftKings is trimming the fat, slimming down to a 61-cent loss per share, a solid sprint from last year’s $1 loss.

- Total Revenue: $790 million in revenue, a 57% jump that’s got investors doing the touchdown dance.

- Customer Acquisition: They’re reeling in the bettors like a pro, with monthly unique payers spiking 40% YoY.

- Average Revenue Per User (ARPU): Each user is now worth $114 on average, up 14%.

- Expansion Plays: With Kentucky in the pocket and Maine and North Carolina warming up, DraftKings is spreading faster than strep throat in a coed dorm.

- Market Share Mojo: DraftKings just outflanked FanDuel, seizing the throne with 31% of the online gambling kingdom.

- Revenue Outlook: They’re forecasting $3.67 billion to $3.72 billion for the fiscal year. And a cool $4.50 billion to $4.80 billion projected for 2024.

If confidence were currency, DraftKings would be minting its own money. It’s up +16.46% today and nearly +27% for the week! 🪙

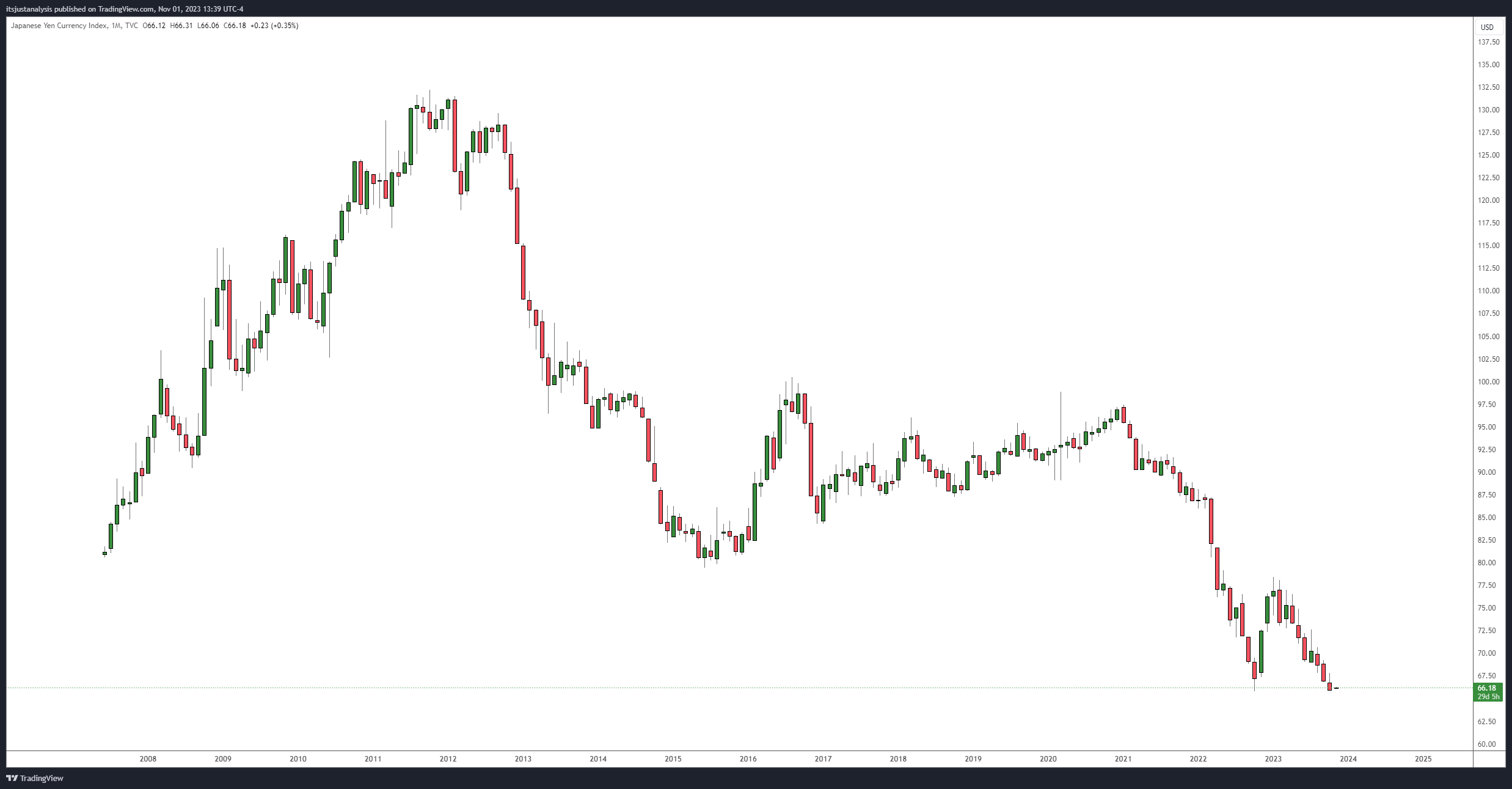

With all eyes on bonds, eyes should also be on currencies, and one of the scariest-looking charts out there is most definitely the Yen Index (JXY). 👀

When October came to an end, the lowest daily, weekly, and monthly close in the JXY’s history occurred. 😲

Why are traders and investors nervous? Unlike the USD and Euro currencies, which are considered clean floats, the Yen is considered a dirty float – meaning the government/central bank intervenes.

And talking heads from Japan’s Prime Minister to the big wigs at the Ministry of Finance and Bank of Japan have all basically said, “F*ck around, find out.” Multiple times. Warning everyone.

The last time Japan’s Ministry of Finance and Bank of Japan intervened was late October 2022, and the Yen rallied nearly +19% into mid-January 2023. At the same time that occurred, the $SPY moved as much as +12.43% and the $QQQ up +10.70%.

Buffet Loves Japan

And Warren Buffet is in love with Japan right now. In the words of Charlie Munger, the decision to invest billions into Japan “…was like having God just opening a chest and just pouring money into it.” 💰

Berkshire Hathaway veered off its usual U.S.-centric course, striking investment gold in Japan. Diving into Japan’s low-interest-rate waters, Berkshire borrowed Yen cheaply to invest in dividend-rich trading houses, turning a $6 billion stake into a whopping $17 billion.

Buffett himself praised the undervalued nature of Japan’s markets at Berkshire’s annual meeting, aligning perfectly with their long-term strategy. ♟️

Crypto

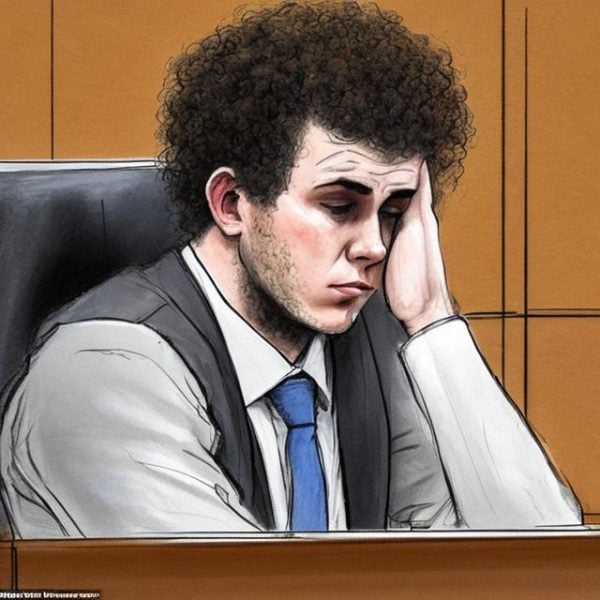

Guilty

“The cryptocurrency industry might be new; the players like Bankman-Fried might be new, But this kind of fraud, this kind of corruption, is as old as time. And we have no patience for it.” – US Attorney Damian Williams. ☠️

After a month of testimony, it only took the jury four hours to find Sam Bankman-Fried guilty on all seven counts.

How did SBF and his parents react? According to NBC News:

“Bankman-Fried was asked to rise and face the jury as the verdicts were read Thursday, and he did so. He showed little emotion as each verdict was read.

His father slumped in his seat, hunched over as each guilty verdict came in. His mother was visibly emotional.”

His sentencing is scheduled for March 2024, and he’s facing a possibility of 100+ years.

To make a final point, US Attorney Williams reminded the public that this case stands as a stark warning to the untouchable: “I promise we have enough handcuffs for all of them.” 💀

Bullets

Bullets From The Day:

🚗 Ford’s Credit Upgrade Fuels Bond Market Buzz: Ford’s back to cruising in the investment-grade lane after S&P slapped a shiny BBB- on its credit rating. This upgrade is sending positive shockwaves through the bond markets, with index funds adjusting and junk bond investors on the hunt for the next big winner. Ford’s credit glow-up comes after a labor strike resolution and a fresh $2.75 billion bond issue that had investors lining up like it’s Black Friday. Investment-grade bonds are seeing inflows, but will this be a smooth ride or are there speed bumps ahead? Reuters has more

🚢 Maersk Waves Goodbye to 10,000 Employees: The shipping titan Maersk is trimming its sails and crew, announcing a workforce reduction that’ll see over 10,000 employees walk the plank. With the global trade winds dying down, Maersk’s profits are expected to hit the shallow end of their forecast. Shares took a dive, dropping 18% to a two-year low. The CEO is battening down the hatches, facing overcapacity and inflation head-on, but the market’s as forgiving as a pirate with a grudge. More from CNBC

🏠 Luxury Homes: The Real Estate Market’s Cash Kings: Luxury home prices are up 9% to record third-quarter highs. The rich are dropping cash on these mansions, with 43% of luxury purchases made in cold, hard cash. Meanwhile, the non-luxury market is looking haggard, with a modest 3.3% increase. Supply is up in the high-end sector, while the rest of the market is tighter than a celebrity’s botox schedule. And in places like Tampa, luxury home sales are up nearly 36%. High mortgage rates? Not a concern for the cash-rich elite. MarketScreener has more

💸 Fed’s Reverse Repo: The Balancing Act Continues: The Fed’s reverse repo program, the financial world’s favorite parking lot for cash, is seeing less action these days. As the Fed pulls back on its pandemic generosity, the reverse repo’s dwindling numbers are the tea leaves some are reading to predict the end of the bond drawdown bash. But with bank reserves playing it cool, the Fed’s got its work cut out in figuring out when to call it a day on its balance sheet slimming regime. More from Reuters

Links

Links That Don’t Suck:

👿 European stocks are still cheap for a reason

😊 Elon Musk tells Rishi Sunak AI will put an end to work

⏰ Matthew Perry reportedly got $20 million a year in ‘Friends’ residuals

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.