It was a relatively quiet day in the market, with investors patiently awaiting a slew of retail earnings starting with Home Depot tomorrow. Let’s see what else you missed. 👀

Today’s issue covers a pretty good Monday for Monday.com, why traders are eyeing gasoline prices, and how a fake securities filing sent a Ripple through the crypto markets. 📰

Here’s today’s heat map:

5 of 11 sectors closed green. Energy (+0.72%) led, & utilities (-1.19%) lagged. 💚

Henry Schein, a distributor of healthcare products and services, jumped 5% after its third-quarter earnings were in line with estimates. It also repurchased $50 million of stock last quarter and expects insurance to pay for losses related to its recent cybersecurity incident. 💰

Aclaris Therapeutics gave investors their regular reminder that biotech investing is hard. The company is scrapping its lead asset after missing the main endpoints of its Phase 2b study for the treatment of moderate to severe rheumatoid arthritis, sending shares down 86% to all-time lows. 📉

Auto stocks remain in focus as investors await the United Auto Workers (UAW) “Big Three Automaker” deal votes. The historic contracts have pushed other non-union automakers like Honda to raise their wages as they compete for labor. Meanwhile, Stellantis is looking to cut its U.S. white-collar headcount by offering buyouts to roughly half its workers. 🚗

Electric vehicle startup Fisker fell 13% to all-time lows after the bell. The company’s quarterly loss widened while revenues missed expectations. However, it was the first quarter with “meaningful automotive sales revenues.” 🪫

Boeing shares popped 4% after receiving a $52 billion order from Emirates for 95 aircraft, the first major deal of the 2023 Dubai Airshow. ✈️

And online video platform Rumble returned to all-time lows after its third-quarter earnings and revenues missed expectations. 🖥️

Other symbols active on the streams: $RILY (-14.02%), $TSLA (+4.22%), $VERV (-40.83%), $OWLT (+18.11%), $LQR (-27.78%), $HUBC (-9.88%), & $BTC.X (-1.50%).🔥

Here are the closing prices:

| S&P 500 | 4,412 | -0.08% |

| Nasdaq | 13,768 | -0.22% |

| Russell 2000 | 1,706 | +0.01% |

| Dow Jones | 34,338 | +0.16% |

Earnings

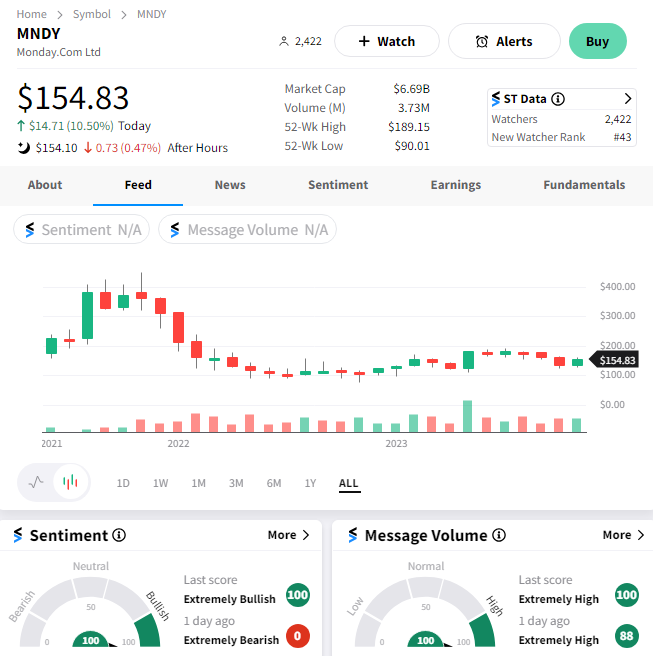

Monday.com’s Pretty Good Day

Monday’s can be rough, especially if you’re a pandemic-era software stock that isn’t growing enough to satisfy Wall Street. Luckily for Monday.com, it was able to hurdle over estimates and rise 11%. 👍

The work management platform reported adjusted earnings per share of $0.15, up from last year’s $0.51 loss. Meanwhile, revenues of $189.2 million topped the $182.5 million expected.

Looking ahead, the company now expects 2023 revenues of $723-$725 million and adjusted operating income of $47-$49 million. That was up from its previous forecast and was enough to get analysts excited that the company may have cut enough costs and stabilized its core business. 🔺

$MNDY shares rose 11% but remain stuck in an 18-month trading range and well off all-time highs above $400. 📊

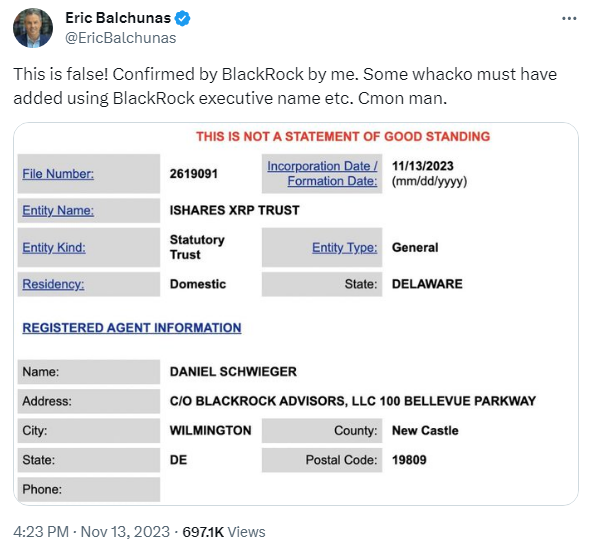

Crypto has been rallying lately on hopes that a spot Bitcoin ETF will soon be approved by the Securities & Exchange Commission. That would potentially lead to more widespread adoption of crypto, especially if other coins are also offered in this type of investment vehicle. 📝

With BlackRock leading the charge, traders are always looking for signs of more filings coming down the pike. And today, we got one. Or so we thought.

Shortly before the U.S. stock market’s closing bell, Ripple jumped about 12% on seemingly no news. However, shortly after that, rumors began to swirl that BlackRock had filed to register a new iShares XRP trust entity in Delaware. 👀

Bloomberg’s Eric Balchunas saw his initial tweet heavily circulated before it was deleted. It was then replaced by this after he confirmed directly with BlackRock that the filing was fake. 🤦

While the whole back and forth took less than 30 minutes, it did impact Ripple’s price sharply. Below is the intraday chart showing an initial spike that was given all back after the real news came in. 😬

We’ll have to wait and see what the rest of the week brings. But as usual, there’s always something happening in the crypto market to keep investors and traders on their toes…even on slow days. 🤷

Commodities

Traders Eye Gasoline Prices

Despite being a slow day overall, one chart in the commodities space had traders gassed up. Pun intended. 🙃

That commodity is gasoline, which is heavily tracked due to its impact on consumer confidence and the economy. And most recently, there’s been a significant decline in prices that’s helped cheer people up ahead of the holidays—case in point: the headlines below. 👇

However, some traders and technical analysts believe the market could start to heat up again.

They’re focusing on this chart of gasoline futures, which shows that 2.10 to 2.20 has been a significant transition area for the market since 2015. And now, with prices back at those levels following a sharp decline, some market participants are betting that buyers will reemerge again and push prices higher. 🐂

Meanwhile, fundamental analysts argue that recession fears, the winter season, and other fundamental factors are likely to keep a lid on gasoline going forward. 🐻

As always, we’ll have to wait and see. But we felt the need to mention this chart because regardless of which direction it decides to go, it will definitely be on traders’ and consumers’ radars. 👀

Bullets

Bullets From The Day:

🛒 Xiaomi claims a record Single Day with $3.11 billion in sales. During the Singles Day shopping festival, the smartphone and consumer electronics company saw record sales across platforms like Alibaba, JD.com, Pinduoduo, and Duoyin. Gross merchandise volume (GMV) from livestreaming rose by 19% YoY, according to data company Syntun. Despite Xiami’s strength, Alibaba and JD.com declined to share total figures for the second straight year, leading to speculation they weren’t great. CNBC has more.

💳 Payments app Zelle rolls out refunds for imposter scams. Banks on the payment app have begun issuing refunds to victims of imposter scams, a significant policy change that addresses consumer protection concerns raised by U.S. lawmakers and regulators. The 2,100 financial firms on the peer-to-peer network would previously reimburse customers for payments made without authorization, but not when the customers made the transfer. But as of August 30th, it introduced a new reimbursement benefit for “specific scam types.” More from Reuters.

🎮 Amazon makes deeper cuts to its gaming division. The tech giant is letting 180 workers in its game division go as it makes changes to its priorities. The changes include shutting down its Crown channel that streams on Twitch, Game Growth effort, and refocusing the work it does through Prime Gaming. This adds to the more than 100 staffers cut in April and shows a continued effort from even the largest companies to cut costs and reorganize around core initiatives. The Verge has more.

📱 Elon Musk says X’s algorithm will now highlight smaller creators. The social media platform says it’s preparing to roll out a “major update” to its algorithm. Currently, the app’s “For You” feed surfaces popular and trending posts from its broader network alongside highlights from those you follow. However, the new update will cause the feed to surface posts from smaller accounts. It comes as Musk pushes to make X the best place for creators to build and monetize their audience through ad revenue sharing and subscriptions. More from TechCrunch.

❌ The nation’s largest labor union just voted to authorize a strike. The National Education Association (NEA) field staff voted unanimously to authorize a strike. The union represents about 3 million education professionals from preschool to graduate school, but its tiny team of 48 employees has been without a contract since May. The employees are asking for the same kinds of benefits they’re going out and fighting for daily on behalf of the union’s members. Axios has more.

Links

Links That Don’t Suck:

⚔️ The fight to save old video games heats up

🛻 Tesla could sue Cybertruck resellers for $50K if they flip it too soon

⚠️ There’s a big warning sign that commercial real estate is in trouble

🏘️ To buy a house in today’s market, more people turn to an alternative lender: their parents

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.