Investors and traders must’ve extended their long weekend because it was another light-volume session, with the major indexes closing marginally negative. Let’s see what you missed. 👀

Today’s issue covers bulls scaling back optimism in Zscaler, Volkswagen failing to compete, and more from the day. 📰

Here’s today’s heat map:

3 of 11 sectors closed green. Real estate (+0.39%) led, & healthcare (-0.63%) lagged. 💚

Amazon and other e-commerce stocks saw a boost after a report from Adobe Analytics indicated Black Friday shoppers spent a record $9.8 billion (up 7.5% YoY). The news buoyed buy now pay later stock Affirm, online marketplaces like Shopify and Etsy, and others in the space. 🛒

Mid-cap healthcare company Xenon Pharmaceuticals jumped 18% after it reported mixed topline results from a study of its depression drug. Participants receiving the treatment experienced a “clinically meaningful” but not “statistically significant” reduction in depression symptoms. 🧠

Telecommunications stock Crown Castle rose 3% after Elliott Investment Management revealed a $2 billion stake and called for changes. The activist investor’s letter requested a restructuring of executive leadership and the board of directors, plus a strategic review of its fiber business. 📲

FootLocker shares fell 1% after a Citi analyst downgraded the retailer from neutral to sell ahead of its earnings report Wednesday morning. The analyst cited the challenging macroeconomic environment as a significant headwind in the company’s turnaround story. 👟

iRobot shares plummeted 17%, erasing half of last week’s gains after Amazon’s $1.4 billion acquisition plan received a warning from European Union (EU) regulators. It’ll need to fix a list of competition concerns in order for the EU’s antitrust arm to let the proposed deal proceed. ⚠️

Other symbols active on the streams: $CHWY (-9.61%), $COIN (+3.66%), $FSR (-17.94%), $APLM (+14.32%), $SHOT (+29.48%), $HKD (+11.59%), $BDRX (+83.15%), & $AVXL (-10.04%). 🔥

Here are the closing prices:

| S&P 500 | 4,550 | -0.20% |

| Nasdaq | 14,241 | -0.07% |

| Russell 2000 | 1,801 | -0.35% |

| Dow Jones | 35,333 | -0.16% |

Company News

Volkswagen Fails To Compete

It’s been a rough year for automakers, which continued today with Germany’s Volkswagen. 😨

The automobile company owns several brands, including Porsche, Audi, and its original brand, Volkswagen. However, the company’s CEO told staff at an internal meeting that its original brand is “no longer competitive” and that cuts are coming.

Like others in the industry, the parent company VW Group has been working to improve the financial performance of the Volkswagen brand to help fund its shift toward electric vehicles. Although the VW brand had the highest sales volumes, its operating profit margins remain well below its other mass-market brands. 🔻

CEO Thomas Schaefer said, “With many of our pre-existing structures, processes, and high costs, we are no longer competitive as the Volkswagen brand.”

VW Group hopes to raise the VW brand’s return on sales (ROS) from last year’s 3.6% to 6.5% by 2026, primarily driven by cost-cutting and better differentiation in the marketplace. The company will look to take advantage of its workforce’s “demographic curve,” using early or partial retirement agreements to trim its bloated staff levels. 🔺

Overall, the VW Group is looking to implement a nearly $11 billion savings program, which will have to include broad measures beyond headcount cuts. And it certainly needs to figure it out soon if it’s going to sustain the necessary support for its electric-vehicle push.

Its U.S.-listed ADR is trading back at more than 13-year lows as investors await executives’ plan to balance profitability and an electric-vehicle transition. 📉

Additionally, shares of Albermarle, the largest U.S. provider of lithium for electric vehicle batteries, fell another 6% today. The Global X Lithium and Battery Tech ETF ($LIT) continues its precipitous decline as consumers move away from electric vehicles, causing its inventories to climb far more than anticipated. 🪫

If the transition to electric vehicles wasn’t already difficult enough for traditional automakers, increased labor costs and lower consumer affordability have put additional pressure on all of the industry’s players. 🙃

Earnings

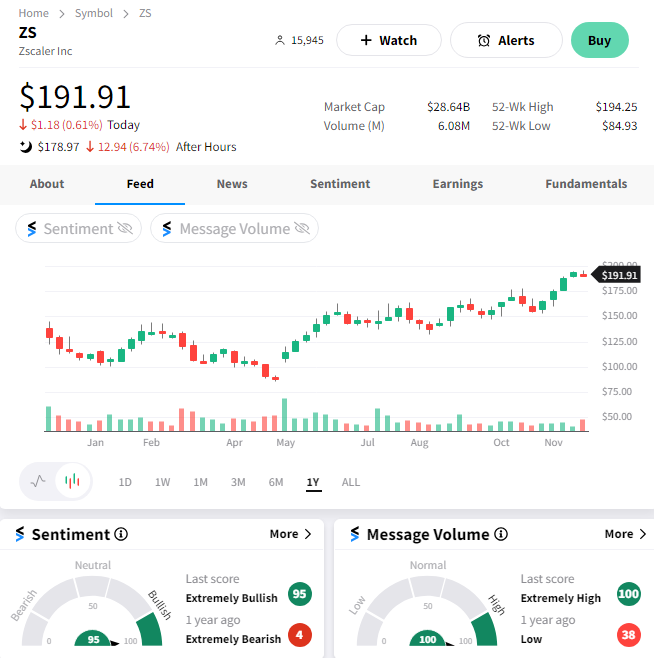

Bulls Scaling Back In Zscaler

Cybersecurity software stock Zscaler is falling despite its first-quarter results and full-year guidance beating expectations. 🤔

The company’s adjusted earnings per share of $0.67 topped the expected $0.49. Revenues of $496.7 million and billings of $456.6 million also beat the $473 million and $441 million anticipated.

However, the stock may be having trouble because CEO Jay Chaudhry said, “We are scaling our go-to-market and R&D organizations, strengthening our foundation for the long-term growth of our business.” While investing in these areas is a positive long-term, it does imply higher costs and potentially thinner margins in the near term. 🔻

Additionally, its full-year forecast of $2.52-$2.56 billion in billings stayed the same despite raising revenue and earnings guidance. Those two factors gave investors pause, especially since $ZS shares were already up nearly 75% YTD heading into this report.

The Stocktwits community remains extremely bullish on the stock, but for now, bears have the upper hand in the after-hours session, sending shares down nearly 7%.⏯️

Bullets

Bullets From The Day:

🎮 Mass layoffs reportedly hit ByteDance’s gaming subsidiary. According to a new report from Reuters, the Chinese tech giant is winding down its Nuverse gaming brand and walking away from the mainstream video game industry. A ByteDance spokesperson said, “…Following a recent review, we’ve made the difficult decision to restructure our gaming business.” The subsidiary was initially set up in 2019 to focus on standalone mobile and web games, including its most popular Marvel Snap game. It’s the latest move in ByteDance’s retreat from the gaming space. The Verge has more.

🕵️♂️ Chinese regulators probe ‘insolvent’ shadow bank. Beijing police initiated a criminal investigation into one of its biggest privately-owned financial conglomerates, Zhongzhi, targeting its wealth management unit. The announcement came just days after the company, which controls nearly a dozen asset and wealth management firms, told investors it is “severely insolvent.” Its letter to investors said it could not pay all of its bills given its total liabilities have risen to 460 billion yuan against just 200 billion yuan in assets. More from CNN Business.

💊 Real-world study shows Mounjaro beats Ozempic for weight loss. An extensive real-world data analysis suggests that Eli Lilly’s diabetes drug, Mounjaro, is more effective for weight loss than Novo Nordisk’s Ezempic in overweight or obese adults. Patients taking the medication were significantly more likely to lose 5%, 10%, and 15% of their overall body weight and saw more significant reductions in body weight after three, six, and twelve months. The study comes from Truveta Research, which compiles and analyzes patient data from a collection of healthcare systems. CNBC has more.

❌ Union fight escalates as Tesla sues Sweden’s postal agency. The electric vehicle maker is suing the Swedish government as it fights against union demands, as the country’s postal workers begin blocking the delivery of license plates in a show of solidarity. Tesla calls the postal workers’ delivery refusals a “discriminatory attack” and claims the Swedish government has a “constitutional obligation” to get plates to vehicle owners. About 130 Swedish workers at Tesla repair shops have walked out as their labor union pushes for a collective bargaining agreement. More from The Verge.

₿ Coinbase CEO says the crypto industry is turning a page. Brian Armstrong told a CNBC journalist that the U.S. government’s enforcement action against Binance will allow the crypto industry to “turn the page” and hopefully close that chapter of history. He pushed back on the suggestion that crypto is mainly used for nefarious purposes and suggested that the cleanup of bad actors in the space will only make it stronger over the long term. Regulatory clarity, once achieved, is expected to bring in more investment, particularly from institutional money. CNBC has more.

Links

Links That Don’t Suck:

✈️ U.S. airports on track for ‘busiest ever’ Thanksgiving season

🤑 Illinois man wins Michigan lottery after gas station employee’s mistake

🍏 U.S. apples are in surplus. They won’t all rot but go to feed hungry families

😢 Americans ditched big cities during the pandemic. Now many are regretting it.

🏦 These regional banks are at greatest risk of being taken over by rivals, according to KBW

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.