Cybersecurity software stock Zscaler is falling despite its first-quarter results and full-year guidance beating expectations. 🤔

The company’s adjusted earnings per share of $0.67 topped the expected $0.49. Revenues of $496.7 million and billings of $456.6 million also beat the $473 million and $441 million anticipated.

However, the stock may be having trouble because CEO Jay Chaudhry said, “We are scaling our go-to-market and R&D organizations, strengthening our foundation for the long-term growth of our business.” While investing in these areas is a positive long-term, it does imply higher costs and potentially thinner margins in the near term. 🔻

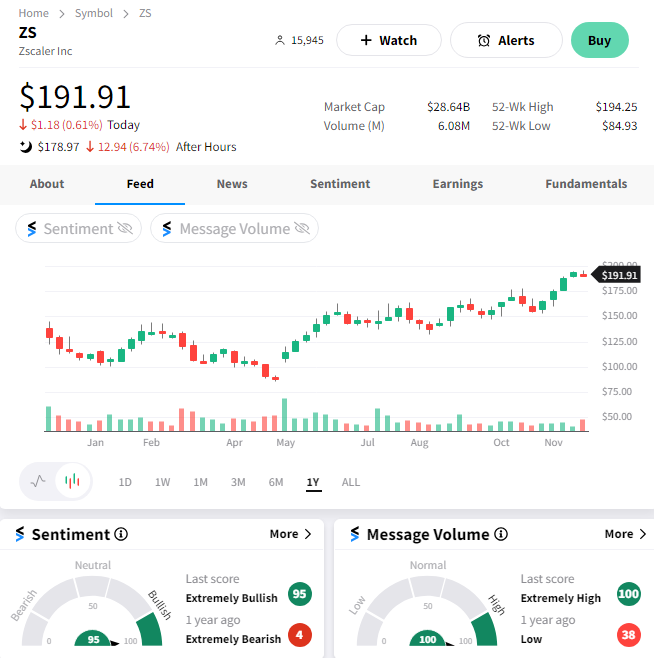

Additionally, its full-year forecast of $2.52-$2.56 billion in billings stayed the same despite raising revenue and earnings guidance. Those two factors gave investors pause, especially since $ZS shares were already up nearly 75% YTD heading into this report.

The Stocktwits community remains extremely bullish on the stock, but for now, bears have the upper hand in the after-hours session, sending shares down nearly 7%.⏯️