It’s a quiet week in the markets, but that isn’t stopping bulls from taking advantage of a seasonally bullish period dubbed the “Santa Claus” rally. Let’s see what you missed. 👀

Today’s issue covers the biotech buying spree, a chip off the old news flow, and Thailand’s major electric vehicle (EV) win. 📰

Here’s today’s heat map:

11 of 11 sectors closed green. Energy (+0.89%) led, & healthcare (+0.22%) lagged. 💚

Reports are that holiday shopping remained strong this year, with consumer spending rising 3.1% YoY. That’s down from last year’s 7.6% YoY growth but is far better than many anticipated. Mastercard SpendingPulse showed that online retail sales rose 6.3% YoY, compared with a 2.2% in-store rise. 🛍️

The S&P Case-Shiller Index showed that home prices jumped for the ninth consecutive month in October, rising to record levels after jumping 4.8% YoY. 🏘️

As for business activity, the Chicago Fed Activity Index showed an uptick in industrial production and employment-related indicators during November. The Dallas Fed Manufacturing Index rose in December but remained in contraction territory for the twentieth straight month. 🏭

Manchester United jumped 3% after British billionaire Jim Ratcliffe finalized a deal to buy a quarter of the soccer club for $33 per share. ⚽

Other symbols active on the streams: $MULN (+12.14%), $BOWL (+4.68%), $OCGN (+15.33%), $ALT (+18.34%), $ARBB (+172.63%), $SNCE (+33.87%), $BLNK (+14.76%), & $MATIC.X (+12.31%). 🔥

Here are the closing prices:

| S&P 500 | 4,775 | +0.42% |

| Nasdaq | 15,075 | +0.54% |

| Russell 2000 | 2,059 | +1.24% |

| Dow Jones | 37,545 | +0.43% |

Company News

Biotech Buyout Spree Continues

It may be the last week of the year, but many companies are rushing to get deals done before year-end. Two significant transactions in the biotech space were announced today, so let’s dive in. 👇

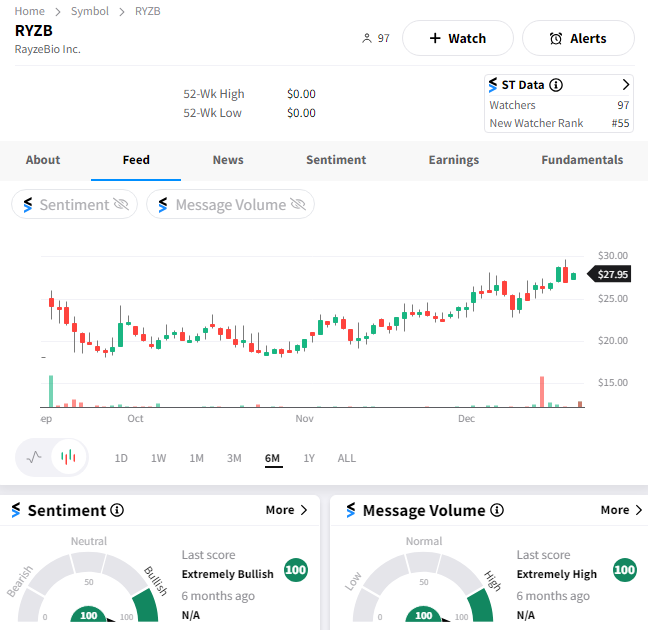

The first deal involves RayzeBio, which raised $358 million via an initial public offering (IPO) just three months ago. However, its time as a public company is being cut short by Bristol Myers Squibb, which is acquiring the radiopharmaceutical therapeutics company for $62.50 per share in cash. 💰

That represents a 100% premium to Friday’s closing price and values the company at $4.1 billion. Bristol Myer’s CEO said, “This transaction enhances our increasingly diversified oncology portfolio by bringing a differentiated platform and pipeline, and further strengthens our growth opportunities in the back half of the decade and beyond.”

$RYZB shares doubled on the day, giving investors a rare, quick win in the 2023 IPO market. 🤑

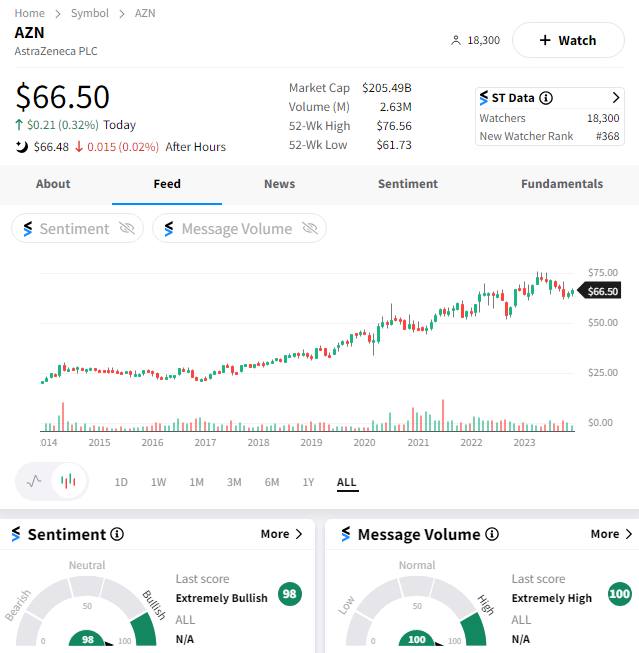

Next up, AstraZeneca is buying China-based cell therapy biotech Gracell for $1.2 billion. The Anglo-Swedish pharmaceuticals giant is one of the biggest drugmakers in China but is reportedly planning to spin off that part of its business to shield it from growing geopolitical tensions. 🧬

As for this acquisition, AstraZeneca looks to expand its cell therapies for cancer and autoimmune diseases. It’s hoping to challenge the likes of Gilead Sciences, Novartis, and Bristol Myers, which currently dominate the cell therapy space.

$AZN shares were up marginally on the news. 🔺

Stocktwits’ Trading Competition lets you compete with traders from across the country. Watch as you rise in the ranks towards the top spot on the leaderboard! Do you have what it takes to be #1?

Company News

A Chip Off The Holiday News Flow

It’s a slow week in the market, but as usual, there’s some news out of the semiconductor space. Let’s take a look. 👀

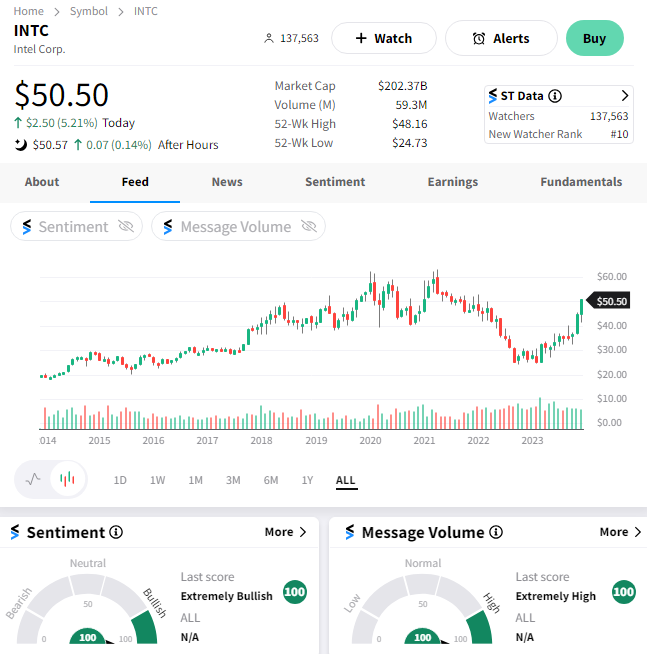

First up is Israel granting Intel $3.2 billion to support the company’s biggest investment in the country. Intel will not only build a $25 billion factory that creates thousands of jobs but will also buy $16.6 billion in goods and services from Israeli suppliers over the next decade. It is anticipated that the plant will open in 2028 and operate through at least 2035. 🏭

Intel has invested billions in building factories across three continents to compete better with AMD, Nvidia, and Samsung. It says this Israeli plant investment “…is an important part of Intel’s efforts to foster a more resilient global supply chain, alongside the company’s ongoing and planned manufacturing investments in Europe and the United States.”

Meanwhile, Israel’s finance and economic ministries said Intel’s investment is a significant expression of confidence in the country’s economy. It also highlights the highly competitive nature of the semiconductor industry as countries across the globe look to bring investment to their borders. 🌍

$INTC shares popped 5% on the day but remain about 30% below all-time highs.

While most semiconductor companies are optimistic about the industry’s long-term outlook, some are still concerned about the short term. For example, Samsung says it is delaying chip production at its new Texas plant until 2025, joining competitor Taiwan Semiconductor (TSM), which delayed the opening of its Arizona plant.

Although high-end chip products for artificial intelligence (AI) and cloud space remain strong, the market for chips in consumer electronics remains soft, given there’s yet to be a meaningful rebound in consumer demand for those products. Although Micron, Dell, and several other companies have hinted at an improving outlook, it’s expected that this market segment won’t pick up meaningfully until late 2024 or early 2025. ⚠️

With semiconductor stocks among the market’s best-performing sectors in 2023, investors are anxiously waiting to see what 2024 brings for the industry. 😰

Company News

Thailand Scores Major EV Win

Thailand has been helping lead the electric vehicle (EV) push, with the second-biggest economy in Southeast Asia looking to achieve carbon neutrality by 2050. ♻️

The country is known as the “Detroit of Asia,” serving as a major manufacturing hub. As part of that, it’s looking to make 30% of its car output electric by 2030 so that it doesn’t lose its leadership position in the EV transition. Its government is putting up major funds to help fund that, approving $970 million in tax cuts and subsidies to help encourage demand and boost local production. ⚡

Now, it’s also getting a major push from other country’s automakers, with Japan investing $4.3 billion in Thailand over the next five years. It’s reported that Toyota Motor and Honda Motor will invest 50 billion baht each, followed by Isuzu Motors’ 30 billion, and Mitsubishi Motors’ 20 billion. 💰

While Japanese automakers have head a leading presence in Thailand, recent investments from Chinese EV makers have threatened the country’s dominance. As a result, these investments are likely being made to ward off competition and keep up with the global electric vehicle transition.

And while only loosely related, we need to mention that Chinese electric vehicle maker Nio rose 11% after announcing a flagship sedan at its annual customer event over the weekend. 🤩

As always, investors have high hopes for the industry in 2024. We’ll have to see if it can shake off the troubles of 2023 and have another strong year in 2024. 👀

Bullets

Bullets From The Day:

📺 2024 may be the year of the streaming bundle. Media companies are re-embracing the bundle this year, with deals like the one between Disney and Charter potentially creating a framework for bundles in the coming years. Increased competition, rising prices, and a more discerning consumer have companies looking for new ways to drive both engagement and revenue growth. Mergers and acquisitions should also lead to more bundling, with Paramount and Warner Bros. Discovery meeting last week to discuss a potential merger. CNBC has more.

🚫 While House declines to overturn Apple Watch ban. The Biden Administration did not issue a last-minute emergency action to keep Apple’s best-selling smartwatch on store shelves. It had until the end of Christmas day to overturn a U.S. International Trade Commission ruling that prevented the tech giant from selling several models that violated patents registered to medical technology company Masimo. Apple has filed an appeal to the Federal Circuit Court to overturn the ITC ruling but has stopped selling the watches for now. More from CNN Business.

₿ Grayscale board sees several resignations as the spot Bitcoin ETF race continues. Digital Currency Group CEO Barry Silbert and DCG President Mark Murphy have resigned from the board of subsidiary Grayscale Investment. It comes as Grayscale and a dozen other applicants race to finalize applications for spot Bitcoin ETFs after the Securities and Exchange Commission (SEC) instructed them to submit changes before year-end. No reason was given for the resignations, but many suspect it has to do with removing any potential conflicts that would weaken Grayscale’s ETF approval odds. Axios has more.

🌾 Dry weather and export curbs could pressure 2024 food supplies. Although high food prices have prompted farmers around the globe to plant more cereals and oilseeds, consumers could still see tighter supplies well into next year. Experts cite El Nino weather, export restrictions, and higher biofuel mandates as the reasons why wheat, corn, and soybean prices could see upward pressure in 2024. Fears of a global recession have kept a lid on price advances in 2024, but with the consensus view shifting towards growth next year, that could also strengthen them. More from Reuters.

🤷 Amazon and Starbucks worker unions remain in limbo. It was a strong year for union workers, with UPS drivers, airline pilots, auto workers, and more securing significant pay raises, benefits, and working conditions. However, established unions with sizable coffers secured most of those gains. Newly minted unions like those at Amazon and Starbucks have not made much progress, with the companies saying these groups don’t accurately represent what the majority of their workers want. NPR has more.

Links

Links That Don’t Suck:

☕ Study seems to confirm secret ingredient for better coffee

💵 Minimum-wage workers in 22 states will be getting raises on Jan. 1

🪦 Here are 7 of the well-known companies that went bankrupt in 2023

🤖 OpenAI investor Vinod Khosla predicts AI will deflate the economy over the next 25 years

🎀 Americans spent $30 billion on gift cards this holiday season; where do the unspent ones go?

🧑⚖️ Elon Musk’s X, accused of withholding bonuses promised to staff, will have to face a court battle