The U.S. stock market continued its levitation act as earnings optimism lifted the technology and consumer discretionary sectors. Let’s see what else you missed. 👀

Today’s issue covers SoFi Technologies’ first quarterly profit, FanDuel’s parent company listing on the NYSE, and a beaten-down tech stock under accumulation. 📰

Here’s today’s heat map:

10 of 11 sectors closed green. Consumer discretionary (+1.46%) led, & energy (-0.14%) lagged. 💚

The Dallas Fed’s Texas Manufacturing Outlook Survey showed that general business activity fell again in January, marking its 21st consecutive month in contraction territory. The state is second behind California in factory activity and first as an exporter of manufactured goods. 🏭

iRobot shares fell another 8% after Amazon officially called off its planned acquisition, saying there is “no path” to regulatory approval. In response, iRobot will lay off around 350 employees, and its founder and CEO will step down as the company explores its next steps. 🤖

Shipping stocks remain in focus due to the Middle East’s geopolitical issues, with Jeffries upgrading Zim Integrated Shipping Services due to the recent rise in spot rates. The international shipping company’s shares popped 8% and are trading near 6-month highs. 🚢

Electronic manufacturer Sanmina soared 17% after earnings beat and revenue matched expectations. Meanwhile, telecommunications company Calix fell 22% after beating expectations but forecasting guidance for its current quarter well below consensus estimates. 📊

German pharmaceutical giant Bayer fell nearly 5% after the company was ordered to pay $2.25 billion in damages, marking the highest amount paid in connection to the alleged carcinogenic effect of its Roundup weedkiller. CEO Bill Anderson continues to explore options for the diversified group as it struggles with heavy debt burdens and low free cash flow. 📉

Other symbols active on the streams: $FSR (+13.55%), $LCID (+27.17%), $MULN (+16.62%), $AMC (+4.91%), $SMCI (+14.97%), $ALT (+8.57%), $RILY (+22.09%), & $MSFT (+1.43%). 🔥

Here are the closing prices:

| S&P 500 | 4,928 | +0.76% |

| Nasdaq | 15,628 | +1.12% |

| Russell 2000 | 2,011 | +1.67% |

| Dow Jones | 38,333 | +0.59% |

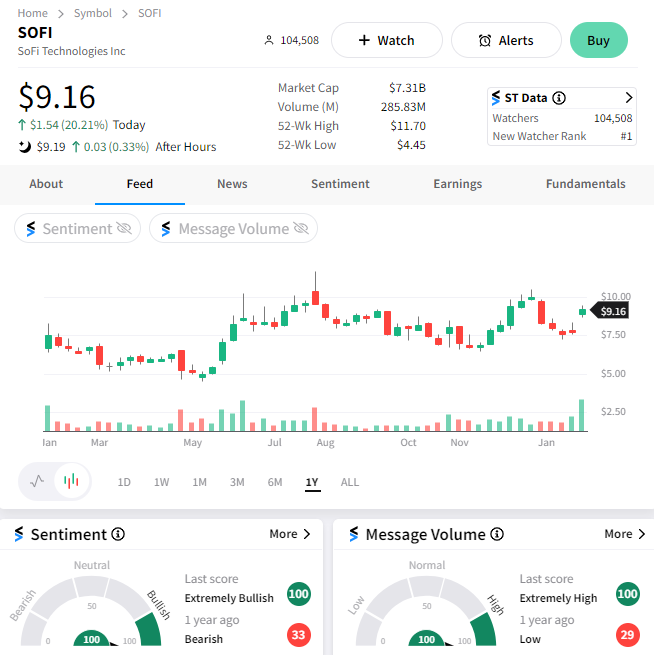

Popular fintech giant SoFi Technologies rose sharply today after its earnings impressed Wall Street. Let’s see how it did. 👇

The neobank earned $0.02 per share, topping last year’s $0.05 per share loss and analyst expectations for a breakeven quarter. Adjusted net revenue rose 34% YoY to $594.25 million, beating expectations for $572 million. 💪

With interest rates rising, student loan payments restarting, and inflation continuing to hit people’s pockets, the lender saw a significant increase in volumes. Personal, student, and home loan origination volumes rose 31%, 95%, and 193% YoY, respectively. 📊

However, CEO Anthony Noto says investors are focused too much on lending and not on its other two businesses. On its earnings call, executives called 2024 a “transitional year,” forecasting the technology platform and financial services segments to contribute more revenue growth as lending shrinks slightly from 2023.

As a result, it expects $0.07 to $0.08 per share in earnings for the fiscal year, topping estimates of $0.05. Beyond 2024, it’s looking for 20% to 25% compound revenue growth from 2023 to 2026 and annual earnings per share at the end of that period to be in the range of $0.55 to $0.80. 🔮

Despite the positive developments and cheery outlook from management, some analysts fear that momentum could slow in 2024. With its high valuation relative to its peers, the stock could be vulnerable if it encounters any operational missteps. ⚠️

$SOFI shares jumped 20% on the news, with the Stocktwits community rallying behind it. Sentiment reached “extremely bullish” territory, with the stock becoming the #1 most newly watched on the platform today. 🐂

Find Your Edge With Stocktwits:

Our brand new Edge subscription plan helps you unlock your investing potential with unique social data, an Ad-Free experience, and more!

Company News

FanDuel Parent Lists On NYSE

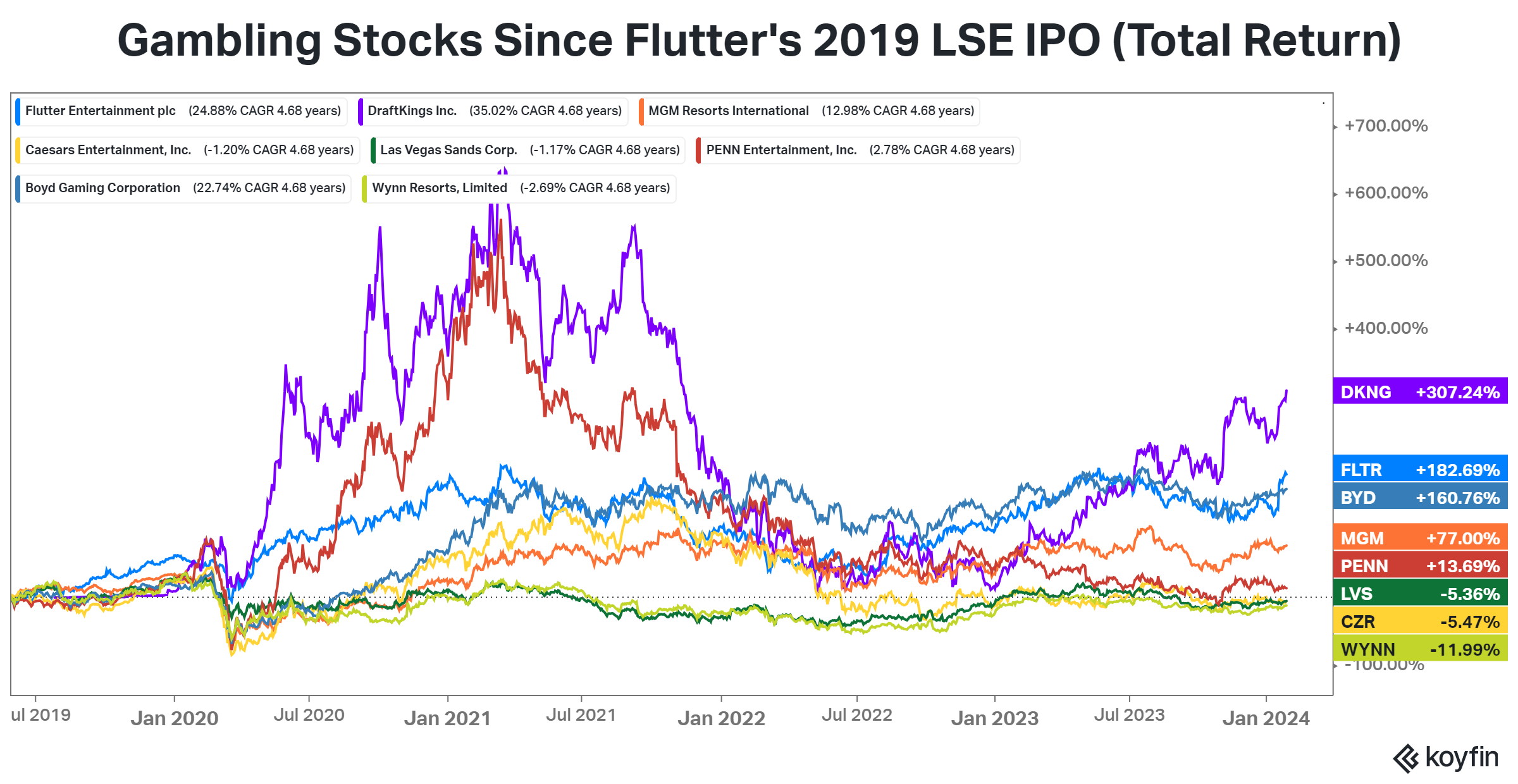

The U.S. “degenerate economy” is getting its latest entrant, with FanDuel parent company Flutter Entertainment making its debut on the New York Stock Exchange (NYSE) today. 🤩

With that said, the company did not receive the traditional fanfare it would in a standard initial public offering (IPO). That’s because it was listed on the London Stock Exchange (LSE) in May 2019, and its American depository receipts (ADR) have traded over the counter under the ticker $PDYPY for years.

However, this secondary listing on the NYSE is the first step in the company’s seeking shareholder approval to make the U.S. exchange its primary listing. While the company says it makes sense because the U.S. is its biggest customer market, others have pointed out that the London Stock Exchange has recently lost its luster with many companies. 👎

The exchange has been plagued with depressed valuations, especially since Brexit, as investor appetite shifted elsewhere. So, with U.S. exchanges and investors able to offer better fundraising potential, we’re seeing more and more companies turn to U.S. markets.

Although $FLUT shares were essentially unchanged in their debut, it’s important to note that Flutter has been one of the better-performing stocks in the industry since going public almost five years ago. Whether or not that will continue remains to be seen, but the company has caught investors’ attention before a bet-heavy Super Bowl Sunday. 💸

Stocktwits Spotlight:

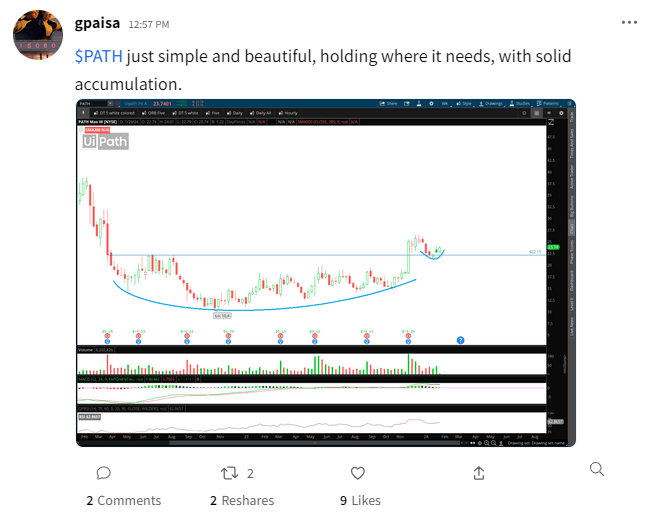

With the technology sector remaining hot and the broader stock market indexes at all-time highs, some market participants are looking for beaten-down names to get back on the right path. 🕵️♂️

Speaking of better paths, one of those stocks is UiPath, which makes robotic process automation software. The stock came public in mid-2021 and fell close to 90% through the end of 2022, but spent most of last year building what many technical traders are calling a constructive base.

One of those people is Stocktwits user gpaise, who outlined an “accumulation” pattern forming on the chart above. The simple candlestick chart shows buyers stepping in at a former resistance level from the summer of 2022, just as the textbooks say they should. And with earnings not expected until March 13th, there’s potential for the stock to put on a show before then. 📈

It’s easy for these types of developments to fly under the radar, so we appreciate GP pointing it out. If you like simple charts and ideas like this one, be sure to follow gpaisa on Stocktwits! 👀

Bullets

Bullets From The Day:

📱 Instagram wants to turn “finstas” into an official product. A finsta is a separate, private, and more personal account that people use to connect with close friends. After years of users creating these types of accounts, Instagram head Adam Mosseri confirmed the company is testing a new product feature called “Flipside” to make the whole process easier. It builds on other developments the social giant has rolled out to allow more personal and private sharing, like the “Close Friends” option for stories. TechCrunch has more.

🏘️ More millennials are living with their parents, especially in HCOL areas. The latest census figures indicated that nearly 16% of U.S. millennials lived with their parents in 2022, as younger people increasingly struggle with high housing costs. The number of Americans aged 25-34 living at home jumped over 87% in the past two decades as real incomes have failed to keep up with record real estate prices. This trend is particularly prevalent in high-cost-of-living areas like coastal cities. More from Axios.

💸 Media streamer Plex raises new capital to close its profitability gap. The company began as a media organization startup and has become a one-stop shop for all your media, including ad-supported streaming. The new round has not yet been disclosed but is larger than the $50 million it raised a few years ago. With the company on track to achieve profitability within the next year, the cash infusion will allow it to stay on track in an increasingly challenging media environment. TechCrunch has more.

🤑 Walmart ups the ante with stock grants to attract and retain managers. After raising its store manager pay for the first time in over a decade, the nation’s largest retailer and private employer is taking things a step further to stand out in a competitive labor market. U.S. store managers will receive up to $20,000 in Walmart stock grants every year, based on store format. The grants will vest quarterly over a three-year period, which will hopefully help further incentivize managers to act and think like owners. AP News has more.

💰 Dividend recaps rise as the deal market remains sluggish. A dividend recapitalization deal occurs when companies issue debt and use some of the proceeds to pay shareholders dividends. With private equity exits plummeting over the last two years, more firms are leaning on this financial engineering method to recoup some of their investment. Of course, this type of transaction raises the risk for the company’s eventual owner and often puts employees and other stakeholders at risk. Axios has more.

Links

Links That Don’t Suck:

🔍 Stocktwits data has signal. Our new Edge product helps you level up with unique social data!

🎰 Americans’ casino spending is soaring

🔺 Fidelity marks up the value of Elon Musk’s X

🥑 The $10 trillion benefits of overhauling our food system

📝 Tax season is here: What to know about filing taxes, refunds

📰 Drone that killed U.S. soldiers in Joran followed American drone onto base, causing confusion