It was a mixed week for U.S. stocks after the Federal Reserve took a March rate cut off the table. The bulls still came out *mostly* on top, with three of the four major indexes closing green. 👀

Let’s recap and prep you for the week ahead. P.S. We’ve added a few more sections to the Sunday issue, so check them out! 📝

What Happened?

🦅 The U.S. bond market has been forecasting six rate cuts vs. the Fed’s three. As a result, Federal Reserve Chairman Jerome Powell reiterated that more work needs to be done on inflation before adjusting policy. After an initial selloff, stocks recovered late in the week to close green.

🤩 This week’s Stocktwits Top 25 report showed outperformance relative to the indexes.

🌟 Meta was the star of the stock market this week, with the company setting the record for most market cap gained in a single day. Zuckerberg has seemingly “righted” the ship and is rewarding shareholders for sticking by him with a $50 billion buyback program and $0.50 per share quarterly dividend. Meanwhile, Apple, Microsoft, and Amazon sold off after their results failed to impress.

📦 Concerns about the global goods market remain, with UPS failing to deliver solid earnings again. The shipper’s full-year 2024 guidance for most metrics was below consensus estimates, with higher prices unable to offset weak package volumes.

🐻 Bears ravaged New York Community Bancorp after the regional bank took a significant write-down on two commercial real estate loans. Management cut the stock’s quarterly dividend to help it shore up liquidity. Still, investors are worried about more pain ahead since 46% of the bank’s loans are related to the commercial real estate sector.

📰 Several other topics made headlines, including Ferrari racing while Peloton plummeted and investors cutting the Charter Communications cord.

🔥 Certain symbols were on the Stocktwits trending tab for most of the week, including $SMCI, $ZIM, $MSOS, $PLUG, $SOFI, and $LINK.X.

Here are the closing prices:

| S&P 500 | 4,959 | +1.38% |

| Nasdaq | 15,629 | +1.12% |

| Russell 2000 | 1,963 | -0.79% |

| Dow Jones | 38,654 | +1.43% |

Bullets

Bullets From The Weekend:

🚨 Regulators may have solved the $400 million FTX crypto hack. Three people were indicted for an identity theft conspiracy that allegedly included the $400 million hack in late 2022 of the defunct cryptocurrency exchange FTX. The alleged ringleader of the SIM-card swapping group, Robert Powell, is due to appear in federal court. He and two others are charged with conspiracy to commit wire fraud and conspiracy to commit aggravated identity theft and access device fraud. CNBC has more.

🌝 Secretive moon startup raises a sizeable new tranche of funding. A stealth startup led by ex-Blue Origin leaders focused on harvesting resources from the moon has attracted more investors despite the funding market slowdown. Interlune has been around for at least three years but has made virtually no public announcements about its technology. Despite that, it’s raised $15.5 million in new funding and aims to close another $2 million. It’s one of several startups working on in-situ resource utilization (ISRU), the process of transforming space resources into valuable commodities. More from TechCrunch.

🧑💼 New “gag rule” draws dissent from SEC commissioner. The U.S. Securities and Exchange Commission (SEC) said it would not amend its controversial gag rule tied to settlement agreements. The long-standing policy has been in place since the 1970s and made it policy that the regulator would only settle with parties that agreed not to deny the commission’s claims. However, SEC commissioner Hester Peirce says the rule makes the SEC less accountable and focuses on protecting the agency over the public interest. Axios has more.

Your New Weekend Watch: “Trends With Friends”

Need something to watch on the weekends? Stocktwits co-founder Howard Lindzon chops it up with pals JC Parets and Phil Pearlman every Thursday on “Trends With Friends.”

In this week’s episode, the friends discuss:

- Markets: Sector rotation, JC’s favorite stock, and Chinese ETFs 🤩

- Health: The pivotal role of sleep and the importance of limiting unforced errors 🛌

- WTF Moment: How Howard’s friend lost his finger to an alligator 🤯

Watch it now on YouTube and Spotify, and subscribe to catch each episode when it goes live!

The Brief

Need a concise summary of what’s going on this week? Look no further. Here’s an overview of important earnings and economic data for the trading week ahead.

Economic Calendar

It’s a very light week of economic data, with investors watching several overseas interest rate decisions. In addition to the above, check out this week’s complete list of economic releases.

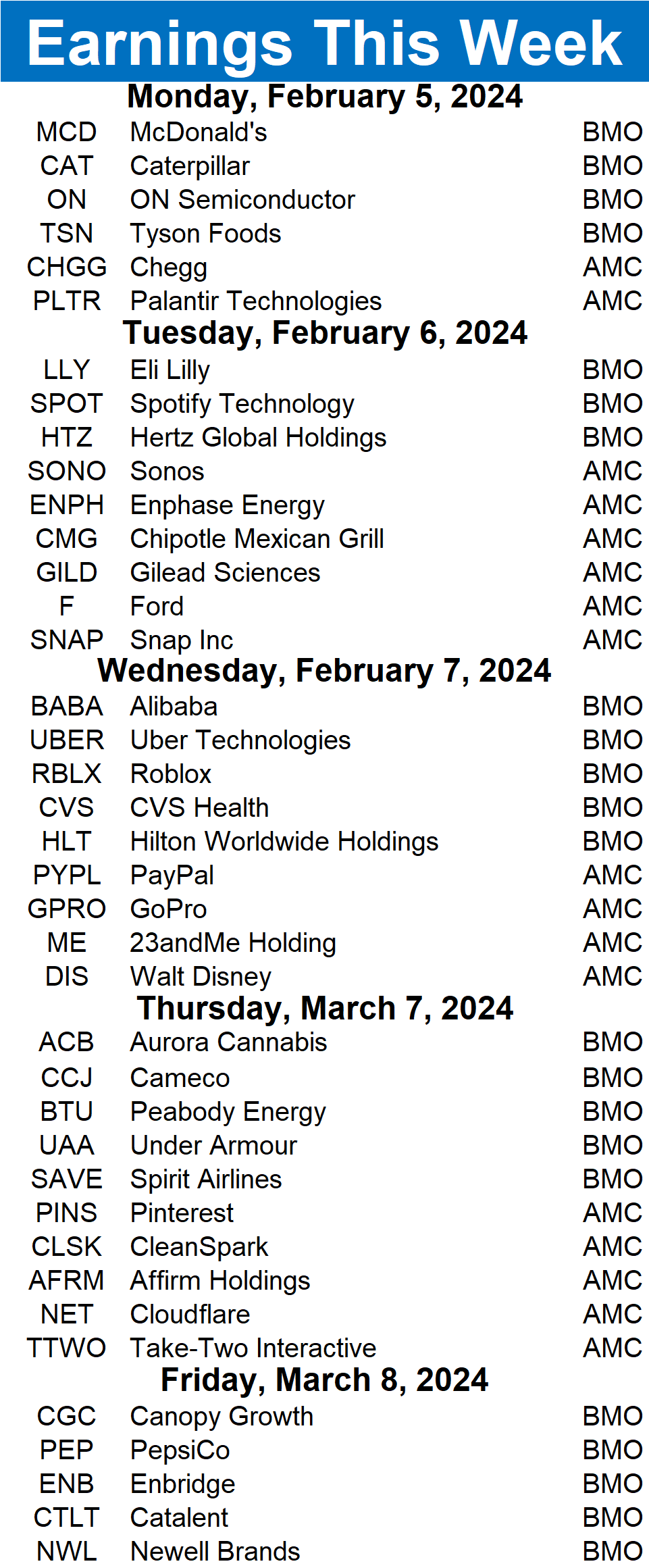

Earnings This Week

Earnings season is in full swing, with 492 total companies reporting this week. Some tickers you may recognize are $SPOT, $PLTR, $SNAP, $PYPL, $BABA, $MCD, $CMG, $LLY, $ACB, and more.

Above is a quick summary. Check out the full Stocktwits earnings calendar for the other names reporting this week.

Stocktwits Spotlight:

One of the most interesting things about markets is that even people with similar approaches to markets can use the same tools or techniques in very different ways. 🤔

For example, it’s easy to say, “Just trade the trend,” but there are a variety of ways to identify trends. Indicators like the moving average or the average directional index (ADX) are one option. Trendlines and looking at prices directly are another.

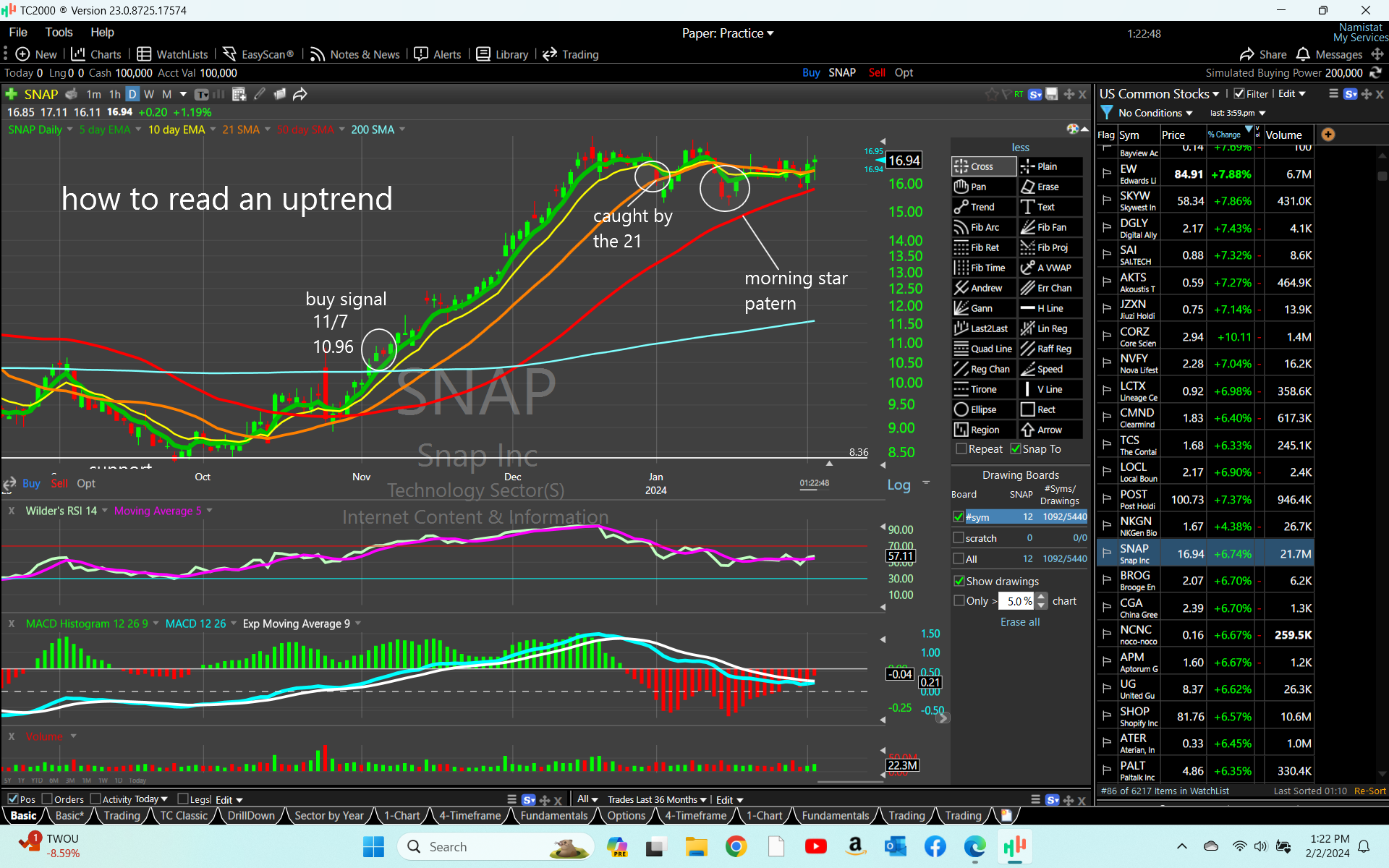

This week, Stocktwits user dojidad shared his thoughts on how he reads and trades an uptrend using $SNAP as an example. Below is the commentary associated with his chart above:

“$SNAP This is how I read an uptrend. A buy signal was 3 complete candles over the 200 (blue line) with higher highs. (the red candle closed higher than the previous candle). Now after your entry, just follow the green line, which measures momentum. As long as it trades over the green line, it’s in an uptrend.

There are two areas where it traded below the 5. The first, it was “caught” by another moving average, the 21 (orange line). The 2nd time a morning star pattern formed, telling us a possible reversal to the upside would happen, which it did. It recently traded below again, but was caught by the 50-day Red line).

Follow the rules and be patient. Usually pays off. Have a terrific weekend.”

It’s a great look at how a self-described “conservative technical trader” approaches the markets to find and manage high reward-to-risk setups. 🔍

Big ups to John for sharing this great knowledge consistently on his stream. If you like his approach to technical analysis and markets, follow dojidad on Stocktwits for more! 👀

Links

Links That Don’t Suck:

🕵️♂️ Discover Edge by Stocktwits: Cut through the noise with unique social data and no ads

💵 Why U.S. debt markets are “shifting in a big way”

📝 What employees are owed if their company collapses

📺 From Oikos to Oreo, Super Bowl ads you can watch now

🗺️ Google Maps is getting ‘supercharged’ with generative AI

🚗 A year after bankruptcy concerns, Carvana is leaner and ready for its Wall Street redemption