The bond market has finally gotten the Fed’s message that a March cut is unlikely, sending yields higher and pressuring stocks. Let’s see what else you missed. 👀

Today’s issue covers Palantir popping on earnings, another day of M&A activity, and a look at another semiconductor stock ahead of earnings. 📰

Here’s today’s heat map:

2 of 11 sectors closed green. Healthcare (+0.31%) led, & materials (-2.54%) lagged. 💚

ISM services PMI expanded for the thirteenth month as it continues to outperform the economy’s manufacturing sector. Meanwhile, the Fed’s Senior Loan Officer Opinion Survey (SLOOS) reported tighter lending standards and weaker demand for almost all types of loans during Q4. 🏭

It was a big day for blue-chip stock earnings. First, Caterpillar rose 2% after beating on earnings, with sales picking up steam in North America. McDonad’s shares did not fare as well, falling 4% after reporting mixed results and emphasizing that revenue took a hit due to the Middle East conflict. 🍟

Sentiment regarding the economy continues to pick up, with the Organization for Economic Co-operation and Development (OECD) raising its global growth forecast for the year. 👍

Other symbols active on the streams: $AMC (-8.48%), $SMCI (+14.44%), $DWAC (+17.19%), $PHUN (+19.92%), $BABA (+3.87%), $LLY (+5.77%), $ABT.X (+40.76%), and $SPA.X (+74.93%). 🔥

Here are the closing prices:

| S&P 500 | 4,943 | -0.32% |

| Nasdaq | 15,598 | -0.20% |

| Russell 2000 | 1,937 | -1.30% |

| Dow Jones | 38,380 | -0.71% |

Earnings

Palantir Pops On Earnings

Software company Palantir Technologies is back on investors’ radars after its earnings results. 💪

The company reported adjusted earnings per share of $0.08, which matched expectations—meanwhile, revenues of $608.40 million topped expectations of $602.40 million by about 1%.

Revenues were up 20% YoY, and management expects the momentum to continue. CEO Alex Karp said the company’s expansion and growth “have never been greater,” especially as demand for large language models in the U.S. “continues to be unrelenting.”

As for its defense and intelligence work with the U.S. government, U.S. commercial revenue rose 70% YoY, with customer count increasing 55% YoY to 221. 📊

In terms of numbers, management expects $612 to $616 million in revenues (slightly below estimates) and full-year revenue of $2.65 to $2.67 billion (matching estimates). However, investors are noting that the company reported its fourth-straight quarter of profitability, which would make it eligible to enter the S&P 500 index. 🤩

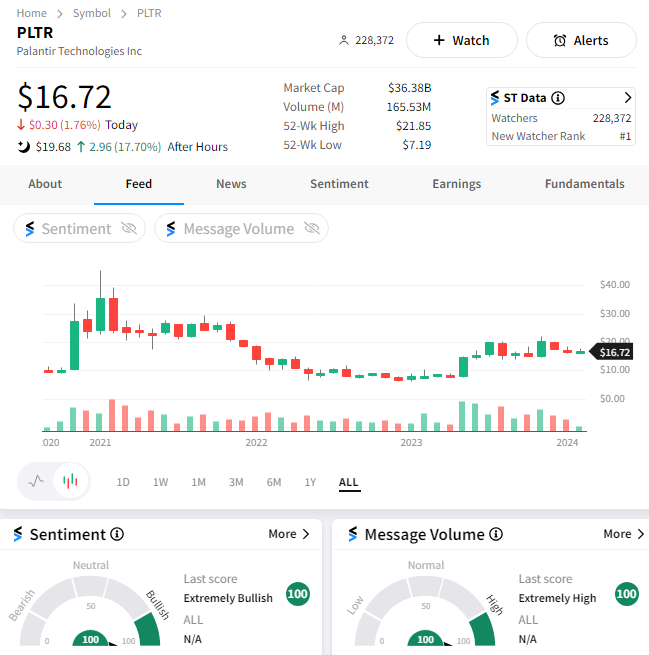

$PLTR shares rose 18% after hours and are again trying to emerge from the $16-$20 price range they’ve been stuck in for the last six months. As for the Stocktwits community, sentiment is leaning “extremely bullish,” with the stock adding the most watchers on the platform today. 🐂

Sponsored

The Godfather of A.I. Market Forecasting Reveals His Breakthrough

Witness the revelation of the Godfather of A.I. Market Forecasting as he unveils his breakthrough. When A.I. was still a distant concept, he pioneered its use in market forecasting, setting the stage for VantagePoint’s legacy as the original A.I. for market forecasting over 40 years ago. His foresight and innovation have validated VantagePoint’s unparalleled accuracy (documented and verified up to 87.4%), cementing its status as a trailblazer in the realm of market intelligence.

Whether you’re a stock trader, options trader, swing trader, or day trader, this A.I. “Brain” is predicting market movements days in advance.

This analysis can be applied to all types of trading, allowing you to find new strategies to make informed trades. Don’t miss out on this FREE opportunity to learn how to scan and find explosive trades using A.I.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

M&A

Another Day Of M&A

As usual, it was another busy Monday of mergers and acquisitions. Let’s recap the biggest deals. 📝

First, Danish pharmaceutical giant Novo Nordisk’s parent company is buying drug manufacturer Catelent for $16.5 billion to help boost the supply of popular weight loss injection Wegovy and diabetes shot Ozempic. Novo Nordisk will then buy three of Catalent’s manufacturing sites from its parent company for $11 billion, giving it further access to the fill-finish part of its Wegovy product. 🏭

Drug maker Novartis AG is reportedly in advanced talks to acquire MophoSys AG, a developer of cancer treatments currently worth about $1.7 billion. Novartis’ bid has topped rival drug maker Incyte Corp, but there’s no certainty that deal negotiations will end up in its favor. The target company develops drugs to fight deadly forms of cancers such as myelofibrosis, making it a highly sought-after asset. Its shares rose nearly 60% on the news. 🏭

Yandex NV has reached a $5.21 billion deal to sell what has been dubbed “Russia’s Google” to a group of Russian investors, making it the most significant corporate exit from the country since Moscow invaded Ukraine two years ago. It cements Yandex’s departure from Western tech circles and puts it directly under Russian ownership. Once seen as one of the few Russian companies with the potential to become a global business, fear of a technology brain drain ultimately kept that from becoming reality. 🌏

Lastly, U.S. private equity firm Thoma Bravo is taking software firm Everbridge for $1.5 billion, representing a 20% premium to its last closing price. The company helps businesses and governments anticipate, mitigate, respond to, and recover from critical events. It’ll become privately held after the deal closes in the second quarter. ⚠️

Stocktwits Spotlight:

Except for some names tied to the smartphone/personal computer market, the semiconductor space has been on fire. Super Micro Computer added another 15% today, while ON Semiconductor rallied 10% despite its first-quarter guidance failing to top Wall Street estimates.

Given the recent fanfare, it’s not surprising that other stocks in the sector are setting up. 🕵️♂️

Stocktwits user Dr_Stoxx pointed to British semiconductor and software design company Arm Holdings, which was one of the few big initial public offerings (IPO) of 2023. In his message, he points out that the stock looks to be setting up a potential breakout after finding support at a trendline and several moving averages. 🐂

However, the conundrum many traders are facing is just this. The company reports earnings after the bell on Wednesday, creating additional risk around an otherwise bullish setup. Some are willing to risk it, but based on Dr_Stoxx’s message, it sounds like he’ll avoid taking the stock into earnings and risk missing any post-event upside. ⚠️

We’ll have to wait and see how it all shakes out. In the meantime, for updates on this chart and more shares like it, make sure to follow Dr. Stoxx on Stocktwits! 👀

Bullets

Bullets From The Day:

💄 Estee Lauder to cut jobs as China’s slowdown persists. The global cosmetics giant saw shares surge after announcing plans to cut 3% to 5% of its global workforce to improve its margins. Chinese consumers continue to cut back on higher-priced luxury products, hurting companies like Estee, who were betting on a significant rebound in the country’s growth this year. However, organic net sales fell 7% during the fourth quarter while margins fell 60 basis points. The cuts allowed management to raise their 2025 and 2026 operating profit estimates. Reuters has more.

🤳 Snap lays off another 10% of its workforce ahead of earnings. The social media platform will cut another 500-plus employees to reduce more management layers and reorganize the company to support future growth. It will incur roughly $55 to $75 million in pre-tax charges related to the move. However, investors will get more color on the impact and management’s plans tomorrow after the bell when the company reports fourth-quarter results. More from TechCrunch.

✈️ Emirates boss says Boeing is in the “last chance saloon.” The high-profile airline executive warned that he’s seen a “progressive decline” in Boeing’s performance, adding to the scrutiny the manufacturing giant has faced since a panel on its 737 Max 9 passenger jet blew off mid-air last month. With Emirates one of Boeing’s biggest customers, it will be pushing heavily for the company to renew its cultural focus on safety over profits, which it has gotten away from over in recent years. BBC News has more.

🌎 Canadian asset manager raises $10 billion for new global transition fund. Brookfield Asset Management is launching the second fund of its kind that focuses on investments in the worldwide transition to a net zero economy. With climate concerns rising to the top of many governments’ concerns, investors are looking for ways to support (and capitalize on) this transition over the coming few decades. More from Reuters.

🤝 Culinary union reaches tentative contracts ahead of Super Bowl. A union representing hospitality workers has reached a deal with six more hotel-casinos in downtown Las Vegas and called off a strike deadline for another. With next weekend’s major sporting event expected to bring significant activity to the Las Vegas economy, business leaders want to ensure everything runs on all cylinders to meet demand. While this week’s crisis has been averted, the union will continue pushing for a new five-year contract while the labor market still provides leverage. ABC News has more.

Links

Links That Don’t Suck:

🕵️♂️ Discover Edge by Stocktwits: Cut through the noise with unique social data and no ads

🤑 Deepfake video call scams finance bro out of $25 million

🍴 McDonald’s brings back fan-favorite holiday treats earlier than expected

🏬 New Macy’s CEO grabs reins amid slowing sales growth, takeover threats

😡 Tesla stock drops as investors scrutinize board’s close personal ties to Elon Musk