It was another slightly green day in the markets, with earnings taking center stage and driving loads of individual stock movement. Let’s see what you missed. 👀

Today’s issue covers Snap being full of crap, Toyota topping Tesla, and a technical look at Disney ahead of earnings. 📰

Here’s today’s heat map:

9 of 11 sectors closed green. Materials (+1.77%) led, & technology (-0.46%) lagged. 💚

The Reserve Bank of Australia held rates steady as inflation continued its downward path but warned that it’s not in a hurry to start easing policy anytime soon. Along those same lines, the Cleveland Fed president says she may be confident enough in falling inflation to ease policy ‘later this year.’ ⏸️

The RCM/TIPP economic optimism index remained in negative territory for the 30th straight month in February, with consumers’ personal financial outlook leading the decline. Speaking of sentiment, Chinese regulators are looking to boost the mood around the country’s stock market by adding more short-selling restrictions. 🙃

The regional bank rout continued, with New York Community Bancorp falling to its lowest level in nearly three decades. Meanwhile, Swiss bank UBS dropped 6% after reporting its second consecutive quarterly loss and missing revenue expectations. 🏦

It was a mixed bag of chemical stock earnings, with DuPont de Nemours’ stock soaring 7% after profit topped prior guidance, and it increased its buyback and dividend programs. Meanwhile, FMC’s stock slid 12% after issuing weaker-than-expected earnings and revenue and poor guidance. ☢️

And Swedish streaming giant Spotify jumped 4% after reporting a record increase in users during its year of cost-cutting and price hikes. 🎶

Other symbols active on the streams: $ENPH (+16.23%), $ELF (+6.28%), $PLTR (+30.80%), $CMG (+4.05%), $MDGL (-11.28%), $BABA (+4.82%), $AI (+7.84%), & $AMC (+10.90%). 🔥

Here are the closing prices:

| S&P 500 | 4,954 | +0.23% |

| Nasdaq | 15,609 | +0.07% |

| Russell 2000 | 1,954 | +0.85% |

| Dow Jones | 38,521 | +0.37% |

Earnings

Snap Is Full Of Crap

Pardon our French in the title, but we’ve given Snap the benefit of the doubt in our coverage for quite some time now. And yet, the company and its management continue to pass the buck for poor results onto external factors. 🤨

If you don’t believe us, let’s guess what the company blamed its revenue miss and light guidance on this time. We’ll give you a few seconds to think before moving to the next line… Lock in your answer

…Ok, times up. ⏳

If you guessed the Middle East conflict, you’re correct. You may also be creative enough to work on a flailing tech company’s executive or investor relations teams, so congrats on that. 🤦

More specifically, here’s what the company’s investor letter said about reporting six straight quarters of single-digit growth or sales declines:

“While we are encouraged by the progress we are making with our ad platform and the improved results we are delivering for many of our advertising partners, we estimate that the onset of the conflict in the Middle East was a headwind to year-over-year growth of approximately 2 percentage points in Q4…”

In the past, Snap has had some “cover” for weakness in the advertising market. But with industry leaders like Meta, Google, Amazon, and others firing on all cylinders, it’s clear these quarterly misses are primarily driven by internal issues, not external ones.

On that note, analyst Sean D. Emory made the excellent point that the company’s core revenue source is degrading. Although it has added millions of paid subscribers, its non-subscriber revenue (aka ad revenue) has declined materially. 📉

Until the company can address its revenue problems, it’s stuck cutting costs and preserving cash to buy more time. And investors are getting tired of being handed one giant L after another every time the company reports results.

We mean a literal L, too. Look at it painted in its stock chart after hours as shares crater 30% and the Stocktwits community reads “extremely bearish.” 🐻

We’ll have to wait and see if tomorrow’s market action changes anything, but it looks like another tough session ahead for the company. And personally, we’re over it. 🙄

Your Market Edge Unleashed:

Unleash your potential with our Edge subscription plan—bringing you unique social data, an ad-free experience, and a host of extra perks!

Earnings

Toyota Tops Tesla (For Now)

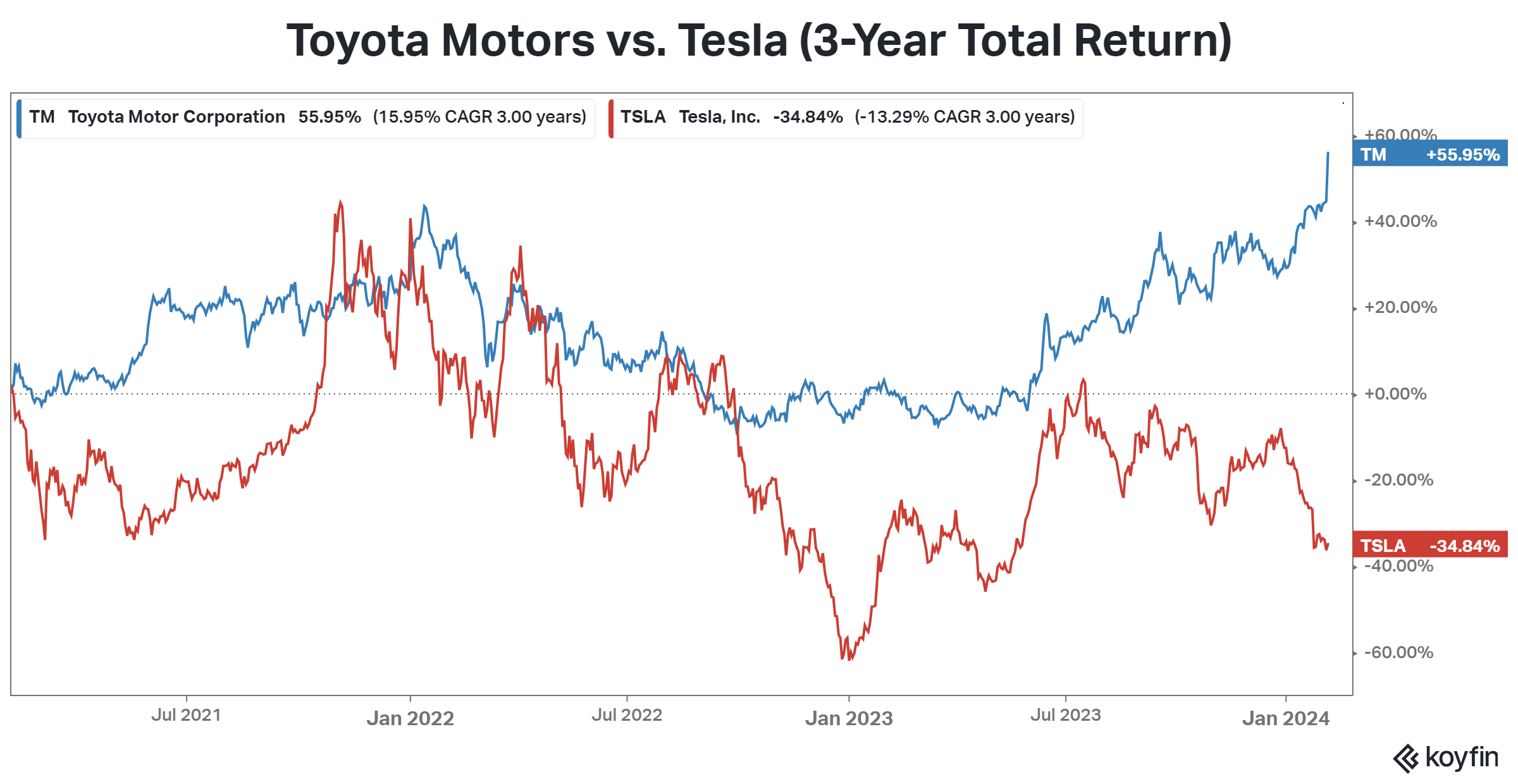

If you’ve been reading our newsletter (or anything market-related) for the last year, you know the electric vehicle (EV) industry’s current challenges. But while Tesla and other pure-EV players are selling off, investors continue to find opportunities in more diversified automakers like Toyota. 😮

Investors left the Japanese automaker behind during the EV boom because it refused to go all-in on battery-powered vehicles. Instead, it stuck with its hybrid vehicle strategy, which began with its Prius model several decades ago. And it turns out that strategy is paying dividends in an environment where demand for fully electric vehicles remains weak.

Last year, about a third of the vehicles its Toyota and Lexus brands sold were hybrids. In the third quarter alone, hybrid sales rose 46% YoY, with North America reporting a 28% overall vehicle sales surge. The company also retained its crown as the world’s top-selling automaker for the fourth consecutive year, posting a record 11.2 million in vehicle sales. 👑

Management expects the momentum to continue into 2024, raising its full-year operating profit forecast by nearly 9% thanks to a weaker yen and strong sales of its high-margin cars and hybrid vehicles. Add to this the fact that Japan’s stock market has been one of the best performing in the world over the last few years, and you’ve got significant tailwinds for the company. 🔋

Until Tesla and other EV makers can lower their prices to mass-market levels, they will likely struggle to drive growth. Heavy competition, high financing costs, and the lack of sufficient EV infrastructure are just a few of the issues leading even “climate-conscious” consumers to go with hybrids right now.

While the stocks had been trading together for most of the last three years, they began to diverge last summer when it was clear that industry headwinds were likely to persist. Retail investors expect this trend to continue for now, with Toyota’s Stocktwits stream consistently reading “extremely bullish” while Tesla’s gyrates wildly. 📊

Lastly, it’s important to note that despite the short-term advantage, Toyota will have to invest in all battery EVs sooner rather than later. They currently account for less than 1% of total sales, so management is investing selectively in expanding its product mix to stay competitive in the long term. Bearish investors say the risk is they move too slowly and are left behind, but time will tell. 🤷

Stocktwits Spotlight:

The lively debate around Disney’s value continues as news swirls about activist investors, management’s strategy, streaming changes, and other noise. 🫨

However, ahead of the company’s earnings report tomorrow after the bell, Stocktwits user Kay Kim offered the community a “less noisy” perspective using some simple technical analysis.

In his monthly stock chart, which dates back to the late 1990s, he shows several instances where price and a momentum measure flashed a divergence before leading to a reversal. Although the sample size is small, the last two occurrences proved to be great buying opportunities for long-term investors. 🤔

While it’s unclear whether this pattern will play out again this time, the historical drawdown Disney shares have experienced over the last few years has undoubtedly attracted many “buy the dippers.” Stocks tend to bottom well before the company’s fundamental story becomes clear, so many analysts are arguing that’s playing out here.

With Stocktwits’ sentiment leaning “extremely bullish” ahead of earnings, it seems retail investors agree with the above thesis. We’ll have to wait to see if it works out for the bulls. 🐂

Big ups to Kay Kim for sharing this perspective with the community today. If you’re a fan of simple technical analysis like this, make sure to follow 2kaykim on Stocktwits for more! 👀

Bullets

Bullets From The Day:

🏢 Adam Neumann is trying to buy back WeWork. The billionaire is trying to buy back the bankrupt real estate company he founded in 2010 and was ousted from in 2019. However, Neumann’s counsel said it had the support of Dan Loeb’s Third Point, but the hedge fund said financing discussions were only preliminary. CNBC has more.

📝 U.S. SEC adopts Treasury market dealer rule. The Securities and Exchange Commission’s new rule will require proprietary traders and other firms routinely dealing in government bonds and other securities to register as broker-dealers, increasing oversight. Market participants say the regulator’s broader effort to fix structural issues impacting liquidity in the $26 trillion Treasury market is the most significant overhaul in decades. More from Reuters.

✂️ DocuSign announces more layoffs as PE takeover talks stall. The e-signature company’s latest restructuring plan will impact those in its sales and marketing teams and will likely cost between $28 and $32 million. Rumors were that Bain Capital and Hellman & Friedman were fighting to take over the company, but Reuters reports indicate interest had cooled after failing to reach an agreement on fees. For now, the former growth stock is left trying to stabilize its core business and stage a return to profitability. TechCrunch has more.

📺 A joint sports streaming platform is launching later this year. ESPN, Fox, and Warner Bros. Discovery plan to launch the service later this year, which will be owned by a newly formed company with its own leadership team. With streaming competition increasing exponentially, the product aims to be a skinnier bundle of linear networks than a standard cable TV, superficially tailored for sports fans. However, the new company has no name, price, or other public details yet. More from CNBC.

⚠️ New York Fed flags trouble in auto borrowing as debt levels rise. A new Federal Reserve report shows that total household debt rose by $212 billion during the fourth quarter, bringing it to $17.50 trillion. As interest rates rose and the labor market softened, delinquency rates also began to tick up. While overall delinquency rates are 1.6% percentage points lower than pre-pandemic levels, a material rise in credit card and auto loans facing trouble has bankers and regulators on watch for further signs of stress. Reuters has more.

Links

Links That Don’t Suck:

🧑💼 Costco veteran CFO to exit, Kroger’s Millerchip to take over

📍 The U.S. cities with high wages, lots of jobs and low living costs

🌤️ As Bluesky opens to the public, CEO Jay Graber faces her biggest challenge yet

💔 Break-up pizza: Goodbye Pies from Pizza Hut will end your relationship for you

🍔 Burger King offering $1 million prize to fan who can devise the best new Whopper

🚀 Virgin Galactic mothership loses alignment pin during space plane launch, FAA investigating

🍟 McDonald’s CEO promises ‘affordability’ amid backlash over $18 Big Mac combos, $6 hash browns