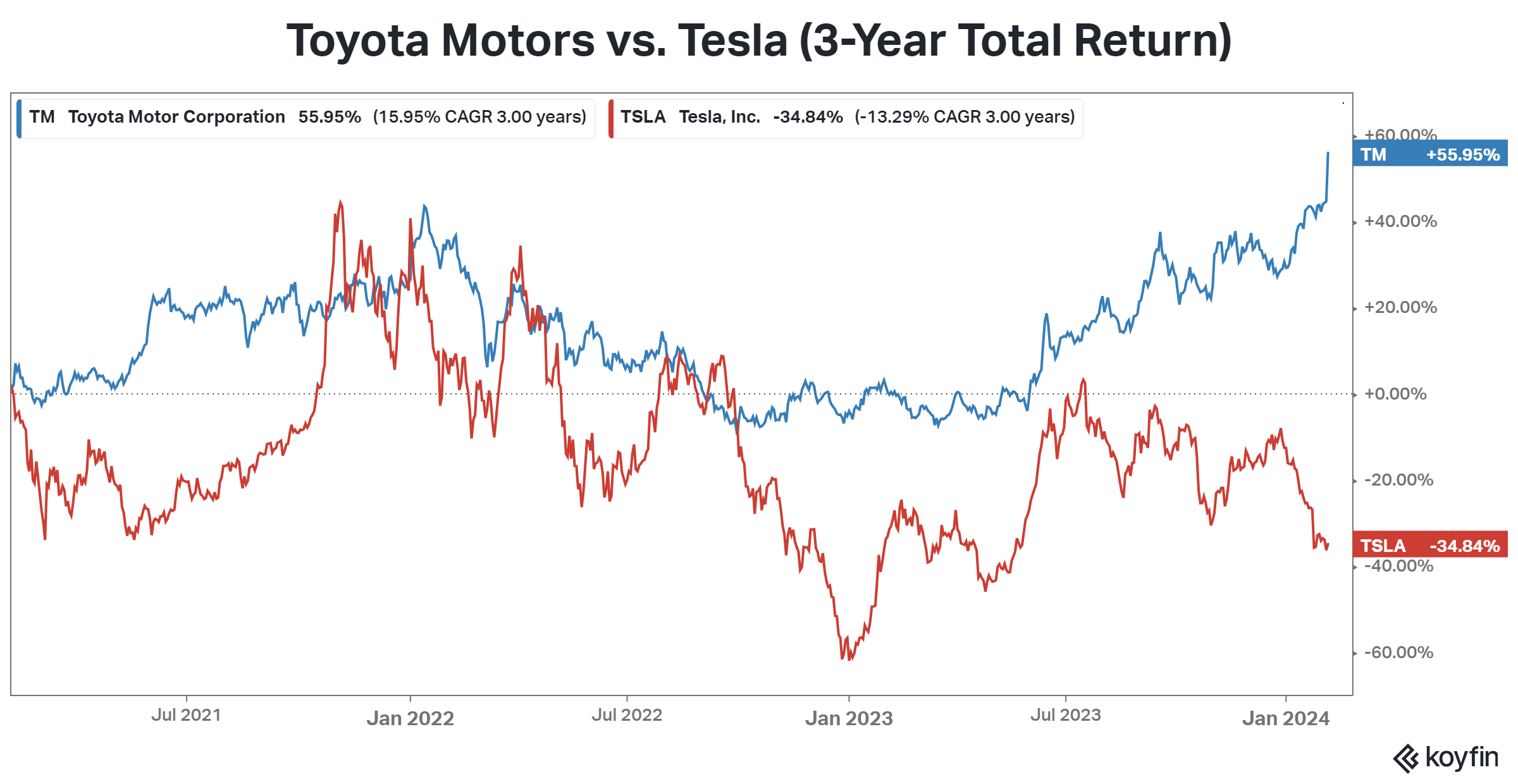

If you’ve been reading our newsletter (or anything market-related) for the last year, you know the electric vehicle (EV) industry’s current challenges. But while Tesla and other pure-EV players are selling off, investors continue to find opportunities in more diversified automakers like Toyota. 😮

Investors left the Japanese automaker behind during the EV boom because it refused to go all-in on battery-powered vehicles. Instead, it stuck with its hybrid vehicle strategy, which began with its Prius model several decades ago. And it turns out that strategy is paying dividends in an environment where demand for fully electric vehicles remains weak.

Last year, about a third of the vehicles its Toyota and Lexus brands sold were hybrids. In the third quarter alone, hybrid sales rose 46% YoY, with North America reporting a 28% overall vehicle sales surge. The company also retained its crown as the world’s top-selling automaker for the fourth consecutive year, posting a record 11.2 million in vehicle sales. 👑

Management expects the momentum to continue into 2024, raising its full-year operating profit forecast by nearly 9% thanks to a weaker yen and strong sales of its high-margin cars and hybrid vehicles. Add to this the fact that Japan’s stock market has been one of the best performing in the world over the last few years, and you’ve got significant tailwinds for the company. 🔋

Until Tesla and other EV makers can lower their prices to mass-market levels, they will likely struggle to drive growth. Heavy competition, high financing costs, and the lack of sufficient EV infrastructure are just a few of the issues leading even “climate-conscious” consumers to go with hybrids right now.

While the stocks had been trading together for most of the last three years, they began to diverge last summer when it was clear that industry headwinds were likely to persist. Retail investors expect this trend to continue for now, with Toyota’s Stocktwits stream consistently reading “extremely bullish” while Tesla’s gyrates wildly. 📊

Lastly, it’s important to note that despite the short-term advantage, Toyota will have to invest in all battery EVs sooner rather than later. They currently account for less than 1% of total sales, so management is investing selectively in expanding its product mix to stay competitive in the long term. Bearish investors say the risk is they move too slowly and are left behind, but time will tell. 🤷