The S&P 500 and Nasdaq 100 made new all-time closing highs today as the bulls’ optimism continued in the face of persistent inflation. Under the surface, the market activity keeps getting sillier. Let’s see what you missed. 👀

Today’s issue covers stocks ending “frothy February” on a high, a growing number of accounting issues, and AMD’s fresh breakout. 📰

P.S. Over the next month, we’ll be transitioning our newsletter platform to Beehiiv. To help ensure our emails keep making it to your inbox, please whitelist newsletter@thedailyrip.stocktwits.com.

Here’s today’s heat map:

8 of 11 sectors closed green. Technology (+1.11%) led, & healthcare (-0.82%) lagged. 💚

The Fed’s key inflation measure, core PCE, rose 0.40% MoM and 2.80% YoY. That was in line with expectations, but an unexpected jump in personal income of 1% kept inflation risk on the table. Spending fell 0.10% vs. an estimate for a 0.20% gain, with consumers remaining cautious about the labor market and economy. 🥵

Chicago PMI fell for the third straight month in February, with manufacturing activity stuck in contraction territory. The Kansas City Fed manufacturing index also fell slightly in February, with nondurable goods activity leading the decline. Meanwhile, rising mortgage rates caused pending home sales to drop 4.90%, their most in five months. 🏭

Energy drink maker Celsius soared to new all-time highs after posting better-than-expected earnings and revenues. Monster Beverage also rose on strong January sales and gross margin expansion, ending the day just below all-time highs. ⚡

Hormel Foods jumped 15% after the food processing company’s earnings and revenue beat expectations, driven by growth in its food service and international segments. 😋

Two retail favorites continue to disappoint investors, with electric vehicle startup Fisker stock plunging 36% to all-time lows after issuing a “going concern” warning in its latest earnings report. And WeightWatchers stock fell to all-time lows on news that Oprah Winfrey is leaving the company’s board and donating all her stock to charity as it faces the existential crisis of weight-loss drugs. 😭

Other symbols active on the streams: $SIDU (+61.22%), $AMC (-13.43%), $JL (-84.38%), $SOUN (+4.03%), $AI (+24.52%), $MARA (-16.53%), $SOL.X (+7.49%), & $BONK.X (+28.52%). 🔥

Here are the closing prices:

| S&P 500 | 5,096 | +0.52% |

| Nasdaq | 16,092 | +0.90% |

| Russell 2000 | 2,055 | +0.71% |

| Dow Jones | 38,996 | +0.12% |

Signs of froth in the market have been building since November and accelerated up in February, with the major indexes adding to their gains and tech giants becoming giant-er. Timing when the music will stop is a fool’s errand, but when it does end, we all inevitably look back through the lens of hindsight at the “obvious” signs things had gotten a bit crazy. 🤪

Some more of those signs of at least a short-term peak in sentiment appeared today, so let’s check them out. 👀

The first is the cover of The Economist, which asks how high markets can go. The consensus view has quietly been that a soft economic landing, AI boom, and resilient consumers would keep the stock market going higher and higher. But this magazine cover (along with the article quote below) is as “in your face” as it gets.

“.. two years of interest-rate rises .. A trade war is raging .. actual wars are raging .. If all that has not extinguished this rally, whatever will?” – The Economist 🫢

Still, others in the Stocktwits community don’t see this “magazine indicator” as useful in the current environment. Instead, they’re staying focused on their specific process and market objectives without getting sucked into all the noise.

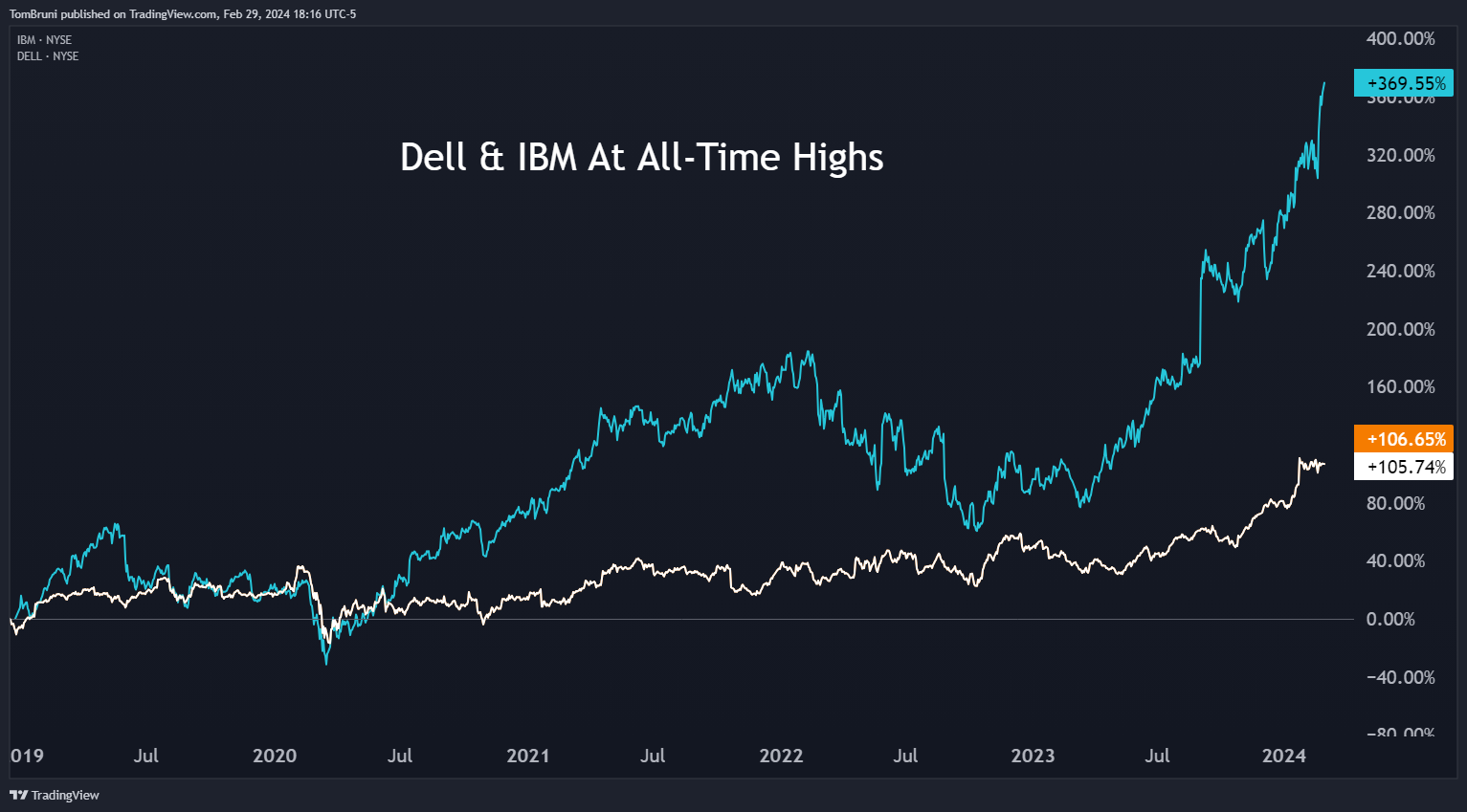

Speaking of artificial intelligence (AI), the new gold rush has helped even the dinosaurs of the tech industry return from the dead. Dell shares are surging after the bell to new all-time highs after the company cited rising demand for AI servers as the driver of its earnings beat. Meanwhile, IBM has quietly been trending higher for similar reasons after over a decade of nothingness. 👴

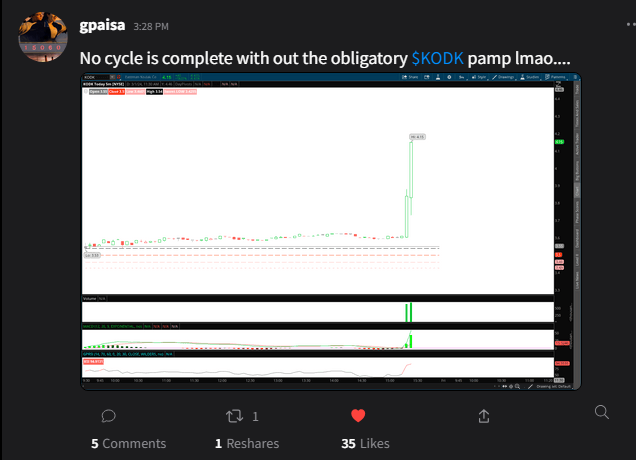

While at least part of Dell and IBM’s stock price advance is rooted in fundamentals, others like Eastman Kodak are just rampant speculation. The COVID-era darling jumped more than 50% today on no news, with Stocktwits user gpaisa rightly pointing out that no market cycle would be complete without these types of “crazy” pumps. 🫨

Fundamentals have again taken a back seat to FOMO, with investors and traders abandoning risk management in hopes of striking gold. Of course, we don’t mean actual gold, which continues to do nothing but frustrate everyone who owns it. But digital gold in the form of crypto, AI, and other tech continues to be the vehicle of choice for the current bout of speculation. 🤑

Meanwhile, some market bears are pointing to Apple as a potential warning sign of downside to come. The stock is trading at the same level it was in late 2021, with its hourly chart below showing sellers continue to push prices down to that 180 level. If it breaks, it could spell trouble for the now second-largest company on the planet and the many passive indexes that hold it. ⚠️

We’ll have to see how this all plays out, but as we’ve been saying, having a risk management plan for this type of market environment is essential. It can stay silly for longer than many expect, but fundamentals eventually shift the market’s tone from FOMO back to fear. And when that happens, prices can fall just as quickly (if not quicker) than they rose. 🙃

P.S. If you want more info on the Apple thesis above and its impact on the market, check out the latest episode of Trends With Friends below, where Howard, Phil, and JC discuss it at length. 👇

This Week’s Must-Watch Podcast

Stocktwits co-founder Howard Lindzon chops it up with pals JC Parets and Phil Pearlman every Thursday on “Trends With Friends.”

In this week’s episode, the friends and Frec founder Mo Al Adham discuss:

- Innovation: Why tax losses are the investor version of credit card points 💳

- Markets: Home country bias and the case for investing in foreign markets 🌍

- Health: Self-care and rest’s role in maintaining a motivated mindset 🛌

Watch it now on YouTube and Spotify, and subscribe to catch each episode when it goes live!

Company News

What’s With All The Accounting Issues?

Accounting is the practice of using numbers to tell the story of a company’s past, present, and future. For an investor, these numbers and stories are the foundation of all decisions, so it’s imperative that they’re done correctly. And generally, they are.

But lately, there’s been an uptick in the number of accounting mishaps making their way into the financial markets. Today we got a few more instances of this problem, so let’s take a look. 📝

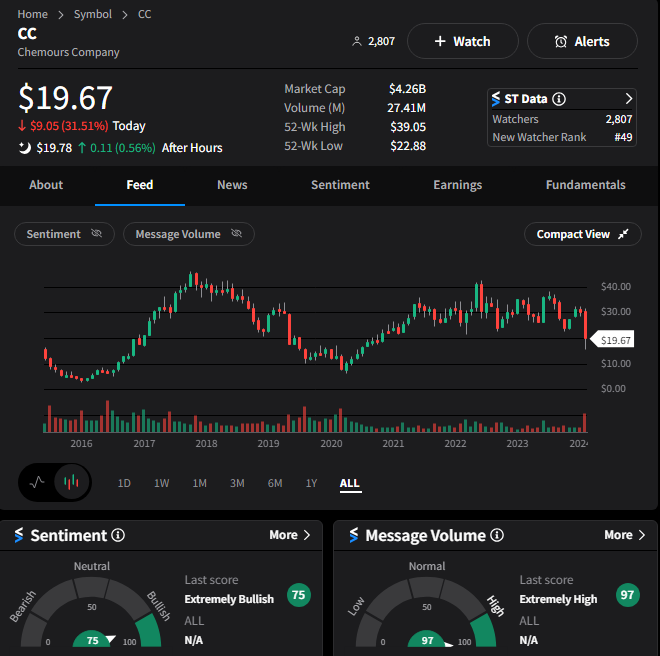

First up, we had chemical maker Chemours plunging to more than a three-year low after placing its top three executives on administration leave. It says it’s looking into potential “material weaknesses” in its financial reporting, which could further delay the reporting of its fourth-quarter and full-year results. 😮

Analysts say what was perceived as a relatively minor accounting hangup when initially disclosed two weeks ago has escalated into something with much wider and material ramifications.

$CC shares fell more than 30% as investors digested the news. Interestingly, the Stocktwits community remains “extremely bullish” on the stock despite the selloff, with some viewing it as a potential buying opportunity. 🤔

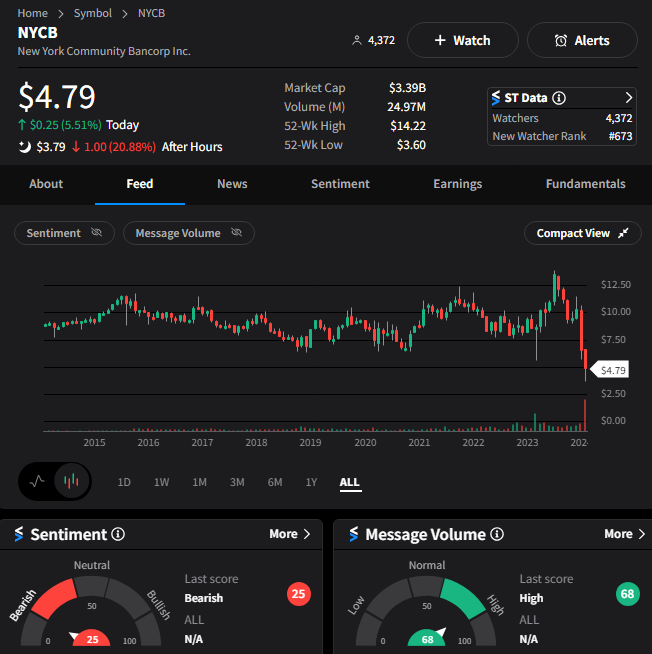

Regional bank New York Community Bancorp’s struggles continue, with the company announcing its executive chairman, Alessandro DiNello, is taking on the roles of president and CEO immediately. It also amended its fourth-quarter results, adding a disclosure about its internal risk management. ⚠️

Internal controls over financial reporting are pretty important for a bank (or any company, really). As a result, $NYCB shares plunged another 21% after hours as investors assessed the bank’s longer-term prospects. Unlike Chemcour, Stocktwits community sentiment is more mixed on this stock given its ongoing structural problems. 🏦

And lastly, the Securities and Exchange Commission is charging Lordstown Motors with exaggerating demand for its EV pickup. As the quote “lies, damned lies, and statistics” implies, you can definitely lie with numbers. But unfortunately, if you “fake it until you make it” in the financial markets, you’ll be expected to pay the piper if you end up never making it. 🤷

Stocktwits Spotlight:

While some investors are looking to time their exit from the market, others are still finding opportunities in various sectors and industry groups. Although we’ve discussed breakouts in healthcare, industrials, and other market areas, today’s idea is back in the familiar tech sector. 🔍

Stocktwits user Microm shared the chart above, highlighting a breakout to all-time highs in Advanced Micro Devices, which broke above the $300 billion market cap value for the first time. The technical setup appears pretty clear, with the stock breakout out of a one-month consolidation as the MACD momentum indicator crosses over into bullish territory. 📈

We’ll have to wait and see how this setup develops. But if you enjoy technical analysis and clean chart setups, make sure you’re following microm on Stocktwits! 👀

Bullets

Bullets From The Day:

🤩 Mark Zuckerberg’s brand image bounces back. The Meta founder and CEO has a reputation as a robotic tech villain, but a series of authentic and charismatic communication choices has investors, employees, and other stakeholders warming up to him. From a bigger-picture perspective, companies are increasingly positioning their executives to serve as the human faces or walking embodiments of their brand to better connect with audiences. With all eyes on big tech, Zuckerberg may be rising to the occasion to meet that need. Axios has more.

🎮 Subscription services are shaking up the gaming industry. The soaring cost of video games is leaving many players behind, especially in countries like Argentina, where hyperinflation and economic issues have caused these experiences to become a luxury. Additionally, with physical copies becoming more scarce due to subscription services like Xbox Game Pass becoming the prevalent way to purchase and play games, players are beginning to lose the sense of ownership and pride over the titles they’re playing. More from The Verge.

🧑⚖️ Trump Media sued by co-founders ahead of DWAC merger. United Atlantic Ventures is suing the former president with a lawsuit that accuses him of trying to “drastically dilute” the value of stock shares in his social media company. The company alleges Trump Media & Technology Group engaged in a “wrongful 11th-hour maneuvering” to dilute UAV’s minority stake in the media company. The suit comes before the planned merger between TMTG and shell company Digital World Acquisition Group, which could net Trump billions of dollars in proceeds. CNBC has more.

Link

Links That Don’t Suck:

📈 Step-by-Step Guide to Revolutionize Your Options Trading with VantagePoint A.I.*

₿ Crypto firm Gemini to pay over $1 billion back to customers in settlement

🔌 Ford EV owners can now use Tesla’s supercharger network — here’s how it works

🥩 New York sues beef producer JBS for ‘fraudulent’ marketing around climate change

🔮 Spotify’s new ‘Song Psychic’ is like a Magic 8-Ball that answers your questions with music

🍔 Burger King burns Wendy’s by offering Free Whoppers after surge-pricing plans announced

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.