Happy Monday, y’all. What a great way to start the week! The crypto market saw a sharp rise this weekend, adding $120 billion in the past 24 hours.

Bitcoin ($BTC.X), the largest cryptocurrency by market cap, surged over 6%, trading at $47,000. Experts say the Luna Foundation Guard’s continuous purchases have helped Bitcoin reach its three-month high. The non-profit organization that focuses on stablecoin TerraUSD (UST) recently raised $1 billion so that it can be backed by Bitcoin.

With a 7% gain, Ethereum ($ETH.X) hit its highest level in 2.5 months at $3,300. There’s a lot of talk about Ether around these days, leading to a surge in its price – read more below.

Major altcoins like Solana ($SOL.X) and Shiba Inu ($SHIB.X) picked up double-digit gains today as well, paving the way for a happy end to Q1 2022.

Today’s stories:

- India passes controversial new crypto tax law

- ‘Ethereum Merge’ Google searches track with Ethereum’s hot price action

- Coins are doing well… because updates

Here’s how the crypto market is looking:

| Bitcoin (BTC) |

$47,566.68

|

+2.44% |

| Ether (ETH) |

$3,374.80

|

+3.16% |

| Binance Coin (BNB) |

$434.84

|

+1.53% |

| XRP (XRP) |

$0.89

|

+4.43% |

| Cardano (ADA) |

$1.20

|

+2.58% |

| Solana (SOL) |

$110.10

|

+4.58% |

| Terra (LUNA) |

$99.21

|

+7.01% |

| Avalanche (AVAX) |

$92.58

|

+5.48% |

| Polkadot (DOT) |

$22.56

|

+2.73% |

| Dogecoin (DOGE) |

$0.1472

|

+3.01% |

A long-debated crypto tax law was passed by the Indian parliament last week, causing uproar and disappointment within the crypto community.

In India, crypto transactions will now be subject to a capital gains tax of 30%. Transactions will also be treated under a similar regime to gambling wins and losses in the country, meaning that losses can’t be written off – but gains will be taxed. Moreover, those who buy or sell crypto will have to pay a 1% tax deducted at source (TDS).

India’s government has been hostile to crypto from the start of the proposal, which materialized after Finance Minister Nirmala Sitharaman’s statement in November 2021 that the government would not recognize bitcoin as a currency. And last week, while discussing the tax proposal, she said that the government is taxing cryptocurrency because people are making money.

Some Parliamentarians and the crypto industry in India reacted strongly against the bill, saying that it would do more harm than good and eventually end the crypto industry.

Nischal Shetty, CEO of India’s largest crypto exchange WazirX, took to Twitter to voice his frustration by starting campaigns such as #ReduceCryptoTax and #UnfairCryptoTax, saying that India will lose talent and capital will flow to other foreign crypto exchanges.

There is a sense of betrayal among crypto leaders in India who have been waiting for constructive regulations, especially since they collaborated with government agencies to set the rules, but now it feels like all their efforts were in vain. Sathvik Vishwanath, co-founder and CEO of Unocoin, told CoinDesk that he’s sad that none of the requests of the industry have been fulfilled.

The crypto industry in India will obviously experience setbacks from the new taxes, which will go into effect on Apr. 1 and the TDS will start on Jul. 1. However, it doesn’t seem like the crypto leaders are going to give up so easily. They could go to the Supreme Court and challenge the new crypto tax law – which is a cumbersome and time-consuming process.

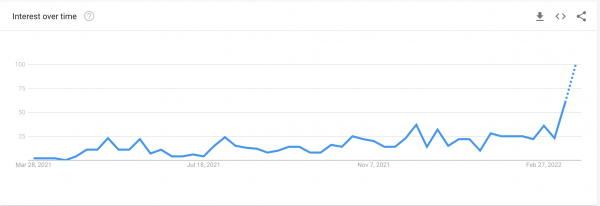

Ethereum is on the verge of a major upgrade – and people are hungry to find out more. Google Trends data shows that people across the world are curious about what the heck the “Ethereum Merge” is.

Interest in the term hit 52/100 during the week of Mar. 13 to Mar. 19. The chart shows the score could potentially hit a 100 in the latest week, but data is incomplete for the period still. Per data, Canadians, Australians, and Singaporeans are the most interested in Ethereum’s upgrade.

The short of the “Ethereum Merge” or “The Merge” is: Ethereum is throwing in the towel on its age-old “consensus mechanism.” It will part from age-old convention, pivoting from Proof of Work (PoW) to Proof of Stake (PoS). With that, the days of GPU mining will end – and be replaced by a far more efficient and environmentally-friendly way of confirming transactions.

Broadly, The Merge is a part of a multi-part upgrade called Ethereum 2.0 or Eth2. The Merge is the part where Ethereum’s legacy chain – and its PoW implementation – will be bridged over to the new Beacon Chain (which will add the Proof of Stake element). The chain will then be upgraded to the PoS Ethereum and will change from a PoW protocol to a PoS protocol.

The Merge is reportedly expected to launch in the Q2 2022. Maxis expect that the upgrade will resolve many of Ethereum’s famous pain points – namely transaction fees and speed. However, it’s too early to say whether or not the network’s many problems will be “fixed” by the upgrade – or if the problem will grow to its newfound capacity.

Today, the second-largest cryptocurrency by market cap surged 7%, trading at $3,300.

After a Sunday surge, there is a bullish sentiment washing over the crypto market. Some tokens are performing exceptionally well. Here’s a shortlist of three we’ve singled out for their movement:

1. Shiba Inu: The second-most popular meme coin is in the news due to its token-burning mechanism. The burning of tokens helps to permanently remove some tokens from circulation, which should theoretically result in an increase in the price of the remaining tokens.

There are reports that the meme-inspired cryptocurrency’s burn rate has increased by more than 12,000%, and over 263 billion tokens have been burned since October 2021.

The news caused $SHIB.X to jump over 17%, trading at $0.00002877. Currently, the token sits at number 15 on the list of cryptocurrencies by market cap, with a trading volume of $2.8 billion over the past 24 hours.

2. Filecoin: Filecoin is a decentralized storage system that aims to “store humanity’s most important information.” This week, it launched a marketplace called FilSwan, a multi-chain platform that allows users to integrate data, computing, and payment in one place.

Over the past few months, Filecoin’s token ($FIL.X) has seen a clear downtrend, but now, it’s back on an uptrend due to the latest launch. $FIL.X traded at $26.10 today, up 18% today and 43% over the past seven days.

3. Waves: Waves is a multipurpose blockchain platform that supports decentralized applications (dApps) and uses ERC-20 smart contract technology. The token has been on the rise since Russia invaded Ukraine because its founder, Alexander Ivanov (also known as Sasha Ivanov), is from Ukraine. The blockchain network has received a tremendous amount of support from the world, which is why the native token, $WAVES.X, has gained over 230% during the past month.

$WAVES.X stands out due to a 23% increase in price in the past 24 hours, ranking 40 on the list of top cryptocurrencies. The current price per token is $39.12.

Tl; DR

Bulles For The Day

💵 Lawmakers introduce ‘ECASH’ Bill: Members of the U.S. Congress have asked the Treasury Department to issue a digital dollar rather than the Federal Reserve. Stephen Lynch (D-MA) introduced the Electronic Currency and Secure Hardware (ECASH) Act today that would mandate that Janet Yellen, the Secretary of the Treasury, prepare a digital dollar for individuals. Read more in CoinDesk.

⚖️ Grayscale considers suing the SEC: Grayscale has been working to convert its Grayscale Bitcoin Trust into a Bitcoin exchange-traded fund. However, the SEC has not approved any Bitcoin ETFs. It is possible that the crypto investment firm will file a lawsuit against the financial watchdog. Read more in Bloomberg.

🤯 BAYC NFT only for $115: The biggest and most expensive NFT collection Bored Ape Yacht Club ($BAYC.NFT), saw something unusual today. By mistake, a seller sold an NFT for 115 $DAI.X, thinking it was $ETH.X. The price of the NFT was approximately $393,000. Read more in Decrypt.