Today’s headline is an inflammatory one, but for many reasons, we are pleased to say happy Monday! It’s May 2, 2022.

Today’s read has been days in the making — but we’ll start by saying that a number of top 10 cryptos traded places this week. Markets gonna market.

The broader crypto economy traded sideways today, with top 25 cryptos trading somewhere in the realm of +/- 2%. Just to paint the picture: Bitcoin was down –0.07%, while Ethereum was up +0.8%. All in all, very mundane.

However, this weekend was far from mundane. You might be perplexed, because there wasn’t really a whole lot of price action. But as we’ve said once, and we’ll say again: there’s more to crypto than price action…

On Saturday, The Bored Ape creators lit Ethereum on fire during an NFT mint… which we touch on that at length below. The same day, stablecoin protocol Fei saw more than $80 million of its stablecoin taken in a hack levied against Rari, a protocol which it merged with last year. And on Sunday, crypto.com burned some of its most dedicated users after announcing changes to one of its most important consumer products.

Oh yeah, I think Solana went down sometime during all of this… for like eight hours? Nobody cared, because they were too busy watching the world burn on Ethereum.

We touch on all of that below, plus some extra exciting bits. In case that all sort of went over your head, here’s the rundown:

📈 A new Litepaper franchise about “money moves”, where are billions of dollars worth of crypto being put to work?

🏞️ The Bored Ape Yacht Club creators sold over $285 million worth of virtual land called Otherdeeds

💳 crypto.com announces sweeping changes to one of its most important consumer products

As of this moment, here’s how the market is looking:

| Bitcoin (BTC) |

$38,519

|

-0.07% |

| Ether (ETH) |

$2,856

|

+0.80% |

| Binance Coin (BNB) |

$390.14

|

-0.26% |

| Ripple (XRP) |

$0.6159

|

+1.29% |

| Solana (SOL) |

$87.54

|

-2.69% |

| Terra (LUNA) |

$84.22

|

+1.65% |

| Cardano (ADA) |

$0.7809

|

-1.22% |

| Dogecoin (DOGE) |

$0.1309

|

-1.73% |

| Avalanche (AVAX) |

$60.43

|

+2.45% |

| Polkadot (DOT) |

$14.97

|

-3.05% |

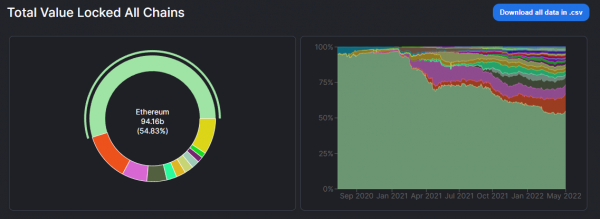

Price action is fun, but it turns out there’s a lot of different ways to gauge the amount of value moving around the crypto ecosystem. One metric called Total Value Locked (TVL) captures a different kind of value than market caps or price per coin. Simply put: it looks at how much money is stewing in protocols and on blockchains. If it helps you remember, think of “TVL”/”Total Value Locked” as Assets Under Custody.

It’s not always an exact science, but TVL has become a trusty metric when it comes to stacking up various blockchains and protocols. Not only does it gauge “confidence” (which can be measured by the amount of money in an ecosystem) in various chains or protocols, but it can value cryptos in a more inclusive manner and even foresee coming shifts in the world of DeFi and crypto.

That’s why we’re going to spend more time looking at TVL in The Litepaper, including “lookbacks” like these every month. We’ll use trusted sources like DeFi Llama and other sources as our north star. These might take on the form of bullets, screenshots, and some other tidbits along the way. However, it’s all intended to plot some dots on a chart and let you form your own conclusions:

📊 In TVL dominance for the month of April, Ethereum was still up top and in charge at more than 54.8% dominance according to DeFi Llama. There was more than $94 billion in TVL on Ethereum being tracked by the site, which was majority-held in Curve, MakerDAO, and Aave.

⚓ The next chain in the pecking order was Terra, which sat at a TVL of $21 billion. The majority of that money was stewing in Anchor Protocol, which represented more than 78% of the chain’s total value locked. That can be credited to Anchor’s sky-high interest rate offering on the $UST stablecoin. Terra was the only chain in the top 10 chains (both ranked by TVL and market cap) to see a one-month increase in its TVL.

🌌 A lesser-known chain called Aurora saw its TVL nearly double in the last month, eclipsing a $1 billion TVL. The lesser-known chain has, in its own words: “Ethereum compatibility, NEAR Protocol scalability, and industry-first user experience through affordable transactions.” The crypto has dumped over the same period, with investors citing concerns about the crypto’s available supply.

📈 Aave V3 saw a 2,732% MoM change in TVL. This makes a lot of sense, because Aave V3 launched on Mar. 16, 2022. The protocol’s third version offers support for a swath of “EVM chains” (which are chains that operate on the same foundational tech as Ethereum), including Optimism and Fantom.

👀 Among the fastest-growing protocols and projects from the month over a $50 million TVL were:

- WingRiders, a Cardano-based DEX;

- Risk Harbor, an insurance protocol popular on the Terra blockchain;

- and Aperture Finance, a protocol on Terra which specializes in cross-chain investments.

We’ll make sure to cover chains and protocols on the rise as relevant news arises, but let this stand as our model “first edition” for an aspirational segment of the Litepaper where we demystify where money is moving on chain.

Yuga Labs, the creators of the Bored Ape Yacht Club NFT collection, is in their bag right now. The team held a “land sale” for their new metaverse, Otherside, which generated over $285 million for the company this weekend. It was successful for Yuga, but an absolute disaster for just about everybody else.

Weeks before the company began dropping hints about their new metaverse, Yuga Labs announced that they would form a DAO (and launch an accompanying token, $APE.) The airdrop of these highly-valuable tokens made Bored Ape and Mutant Ape holders even more rich than they already were. However, it also kicked off a weeks-long speculation campaign about how the token would be used. Its first use-case? The currency-of-choice for the sale, which took place on Saturday.

305 ApeCoin would get you one of the so-called “Otherdeeds”, which aren’t actually the land in the game more than an IOU for a plot of land in the forthcoming experience. There were 55,000 Otherdeeds for sale, with a limit imposed of two per person. They sold out in under 30 minutes. However, those 30 minutes were hell on Earth for the Ethereum blockchain (and many users vying for a swath of digital real estate.)

As the auction commenced, gas fees on the Ethereum network soared to thousands of gwei. Gwei, a measurement of Ethereum, helps measure the “gas” or transaction fee of an Ethereum transaction. In the best case scenario, users paid thousands of dollars in fees on top of the ~$6,000 that they spent to acquire the land. Worst case, you had spent nearly 1 ETH on gas fees just to come out emptyhanded on the other end. The company later apologized for “turning out the lights”, indicating its desire that the newly-formed DAO start to think about ways to move their activities off of Ethereum and onto another chain. That aroused controversy in crypto circles on Twitter, Discord, Telegram, and beyond for the remainder of the weekend.

However, drama aside, the sale of the Otherdeeds underscores two massive staying trends in cryptoland: the first is the arbitrary, but staying power, of digital collectables and virtual assets. This concept is not outside convention for gamers who speculated in TF2 and CS:GO skins as teenagers, but to the layperson, the idea that something online could be worth thousands of dollars might boggle the mind. Nonetheless, the Otherdeeds follow in the path of many other blockchain-based games and projects which have done virtual land sales. Turns out that virtual real estate, like its realer compatriot, has commanded considerable value as well.

And the second factor? Well, Yuga Labs, of course. Just a year out from its formation, the company is now worth over $4 billion. That deserves underlining, circling, and bolding all its own.

The era of easy money has come to a close — and nowhere is that more obvious than in traditional markets, where major indexes have posted double-digit losses YTD. Right now, discourse about “interest rates” and “monetary policy” are all the rage.

Some of that has boiled over to the world of crypto, with coins like Bitcoin — and consequently, the rest of the crypto market — tracking the ebbs and flows of the S&P 500 and Nasdaq. However, given concerns about recession and the “end of easy money”, crypto companies appear to be scaling back their ambitious spending.

crypto.com, which shelled out $700 million in November 2021 to acquire the naming rights for the Staples Center, announced sweeping changes to one of its most valuable consumer-facing products: its credit card. The company offered several different tiers of their card, which could be unlocked by staking the crypto exchange’s token, $CRO. This weekend, those rewards on the various tiers ranged from 1% to 8%.

By staking more $CRO, and unlocking higher-tiered cards, you would also unlock higher reward tiers and cashback — some even offered reimbursements on purchases at Netflix, Amazon Prime, Expedia, and Airbnb among other “premium” benefits.

Those premium benefits and sky-high cashback figures (which were, of course, paid in $CRO) were initially a huge draw for high net worth users willing to dabble in cryptocurrency. However, this weekend, crypto.com made sweeping changes to its fancy VISA Metal Credit Cards. They are already very unpopular.

Effective Jun. 1, 2022, crypto.com will massively reduce card rewards across the board. The lowest tier cards will receive virtually no card rewards and see a “rewards cap” imposed on the card. The higher-tiered “Icy White/Frosted Rose Gold” and “Obsidian” cards, which require users to stake $40,000 USD and $400,000 USD of $CRO to unlock them, will see rewards of no more than 5%.

In a r/CreditCards thread pertaining to the “slashed rewards”, cardholders and onlookers discussed the gravity of the move. One user, u/kinuipanui123 put it best when he said, “They just killed themselves with this.” Others remarked how the cards were “worthless” after the changes. In many ways, they’re right: the credit card space is an extremely competitive one, and reward reductions like this are extremely unpopular with cardholders.

Enter: the exodus.

In the aftermath of the announcement, the crypto.com coin ($CRO) fell more than 10% as people redeemed their tokens. Now, after two days and some change, the exchange’s crypto has lost over 32% of its value. Picture that… or well, you don’t have to… because we got you this lovely chart to paint the picture:

Those four consecutive red candles are the latest nail in the coffin for crypto.com coin, which has been in decline since it peaked in November 2021. It’s down more than -73% since it peaked on Nov. 24, 2021… and there’s little evidence that the credit card-related selling will stop here.

Ultimately, the reduction in rewards points to a number of pain points for crypto.com, but also for the broader industry: fintechs and crypto companies don’t have access to the same unlimited VC money, and with both traditional and untraditional markets no longer “printing” for retail investors, these companies are facing broad slowdowns in YoY growth. Unfortunately for many companies, YoY growth in Q1 2022 will be upside down (or to the tune of low single-digit growth.) However, seeing as though this once high-flying and ambitious consumer brand has come to heel on one of its most costly products, it’s unlikely that they’ll be the only ones peeling back the tape and spend in their marketing and acquisition departments. It’s a shame, but it’s a given for an industry and space that has grown so fast, spent so much, and can’t keep pace.