The cryptocurrency market is hanging by a thread and flirting with another leg south. In particular, Bitcoin ($BTC.X) has hit several major bearish milestones from a technical and fundamental perspective. Some of the levels from the bearish outlooks identified last week are very close to triggering.

Today’s Litepaper looks at what’s happening with Bitcoin after its big drop on Tuesday. We’ll also take a peek at what’s happening with some crypto exchanges – specifically, Binance effectively giving all US-based stablecoins the boot.

Oh, and did you know there’s a David Bowie-themed NFT series coming?

Before we do that, though, here’s how the market looked at the end of the regular trading day:

| Cardano (ADA) |

$0.47

|

2.16% |

| Binance Coin (BNB) |

$270.90

|

3.28% |

| Bitcoin (BTC) | $19,058 | 1.43% |

| Dogecoin (DOGE) |

$0.06

|

2.89% |

| Ethereum (ETH) |

$1,575

|

1.08% |

| Polkadot (DOT) | $7.15 | 4.08% |

| Solana (SOL) |

$32.06

|

3.82% |

| XRP (XRP) |

$0.33

|

4.08% |

| Altcoin Market Cap |

$565 Billion

|

1.59% |

| Total Market Cap |

$927 Billion

|

1.52% |

While today ended mostly in the green for crypto, it’s still ugly for Bitcoin ($BTC.X) and the broader crypto market. Yesterday’s daily close was the lowest for Bitcoin in just over 20 months – December 13, 2020. The slide below $19,000 is the first time since July 4, 2022.

Today’s price action is a little more upbeat but certainly not anywhere close to regaining even half of yesterday’s losses. Beyond the technical levels, though, there is a collection of important fundamental considerations.

Just like Bitcoin’s overall price action, the market dominance percentage BTC makes up of the entire crypto market cap has dropped. Currently, BTC dominance sits a hair below the 40% level at 39.23% – the lowest in 4.5 years.

However, despite the drops in price and dominance, many Bitcoin hodlers remain in profit, even after a 60% crash.

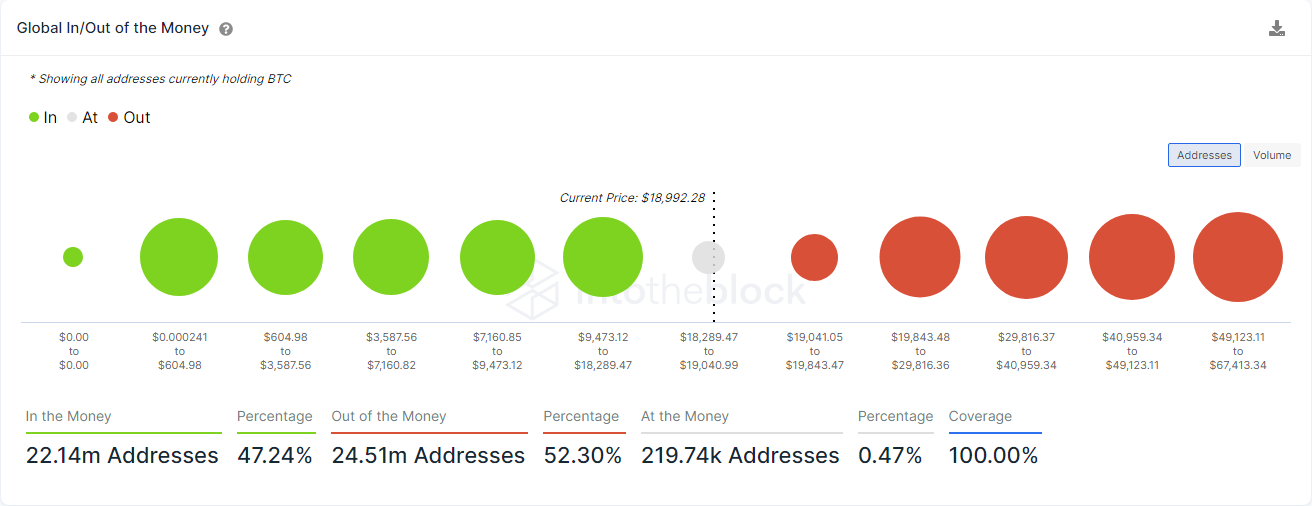

IntoTheBlock, an on-chain analytics service, reports that 47% of hodlers are in profit – that’s less than 50% and not even a simple majority, but it’s certainly more than the graphic below:

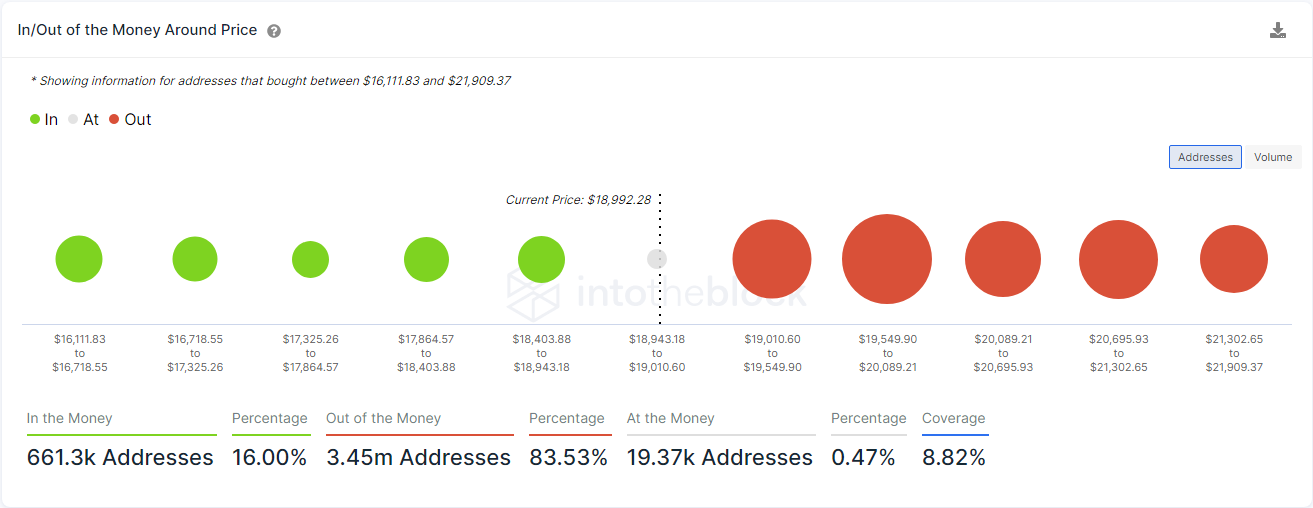

The graphic above shows the In/Out of the Money of addresses that bought BTC between $16,111.83 and $21,090.37. A staggering 83.53% of those addresses are in the red and down, while only 16% are in the green.

Despite the bearish nature and positioning, the market has not displayed a massive lower breakdown. Follow-through is necessary. 🧠

Binance

Binance.US just announced staking for Ethereum today via its blog. Binance is offering rewards up to 6.00% APY. Instead of acquiring the minimum 32 ETH to stake on the network, Binance.US allows users to stake with as little as 0.001 ETH.

The Swiss-regulated crypto bank, SEBA, also announced Ethereum staking on its platform – but is more geared towards institutions rather than individual investors.

Binance also announced that they’re pretty much getting rid of all stablecoins except for their own US Dollar stablecoin, Binance UDS ($BUSD.X). Starting on September 29, 2022 at 0300 UTC, any users USD Coin ($USDC.X), Pax Dollar, or True USD will automatically convert into BUSD at a 1:1 ratio.

Oh wait, they’re not getting rid of all the stablecoins, just the ones headquartered in the United States. Tether ($USDT.X) is still there.

Zipmex

The possible take over of Zipmex by the Thailand based Country Group Holdings hit a snag today. The Thai SEC is filed a police complaint against Zipmex and its co-founder Akalarp Yimwilai for non-compliance. The penalty is up to 100,000 Thai baht (US$2,700) and a year in jail. Zipmex reported they are currently collection the necessary information requested.

Mt. Gox

Fears about a major dump of Bitcoin ($BTC.X) into the marketplace after Mt. Gox creditors see some of their BTC returned have returned. The trustee, Nobuaki Kobayashi, issued a Notice of Confirmation Order of Rehabilitation Plan becoming Final and Binding today, giving a deadline of Sept 15 to make or transfer a claim.

Coincidence that this occurs on the expected date of the Ethereum ($ETH.X) Merge?

Voyager

A court filing on Tuesday announced that an auction of Voyager’s ($VGX.X) assets would commence at 1000 EST on September 13, 2022. Think you can get some crypto on the cheap, though? Naw, you need to be a qualified bidder, which usually means you need to already have a shite ton of money. And you need to have a pretty good legal team that specializes in how to handle bankruptcy issues.

Also, the deadline was on September 6 to put in a bid.

Bidders are confidential, but Alameda (part of FTX) made its bid public in July. Voyager’s legal counsel will ultimately pick which bid/proposal will be best for all stakeholders. 🤒

Bullets

Bullets From The Day:

💅 A David Bowie NFT? Yup, that is happening. Bowie’s estate is releasing a series of Bowie-inspired NFTs with 100% of the proceeds going to the non-profit CARE. Bowie was married to Iman, a supermodel who’s an advocate for CARE. What do Bowie fans think? They’re about as happy as a lobster at Red Lobster. Read more at Decrypto

♠️ If you’re a PC gamer or someone who likes to build/upgrade their own PCs, you’re no doubt aware of the stupidly high prices that video cards have faced in the last few years. Now, they’ve been tanking. That might be why a major Bitcoin ($BTC.X) mining operation, CleanSpark, was able to grab 10,000 ASIC miners at a crazy discount. Full story at TheBlock

🐩 You can’t keep them meme coins down, and certainly not Shiba Inu ($SHIB.X). Shiba’s been on a tear with its trading volume, spiking more than 23% over the past 30+ hours. How much Shiba Inu is that? Don’t laugh: 35 Trillion – with a capital T. U.today has the scoop