Talk about a one-eighty! Stonks, crypto, the US Dollar, almost everything has whipsawed in the opposite direction. When writing this Litepaper, Bitcoin ($BTC.X) just hit a +10% intraday gain, recapturing the $21,250 value area.

Most important, though, is the total market cap regaining the $1 trillion level. But this is the crypto market, and we’re headed into a weekend after a big pamp, so by the time you read this, it would very normal for those gains to be massively different!

Also on deck for the Friday Litepaper: big updates in the Metaverse and NFT space. Crazy how much news has come out in those spaces over the past 36ish hours. Apecoin bounces big and Cardano’s biggest Metaverse, Cardalonia, just got listed on another exchange. Japan just gave out the digital equivalent of gold stars, and the EU wants to stop counterfeit real-world goods with NFTs.

Here’s how the market looked at the end of the regular trading day:

| Cardano (ADA) |

$0.49

|

3.13% |

| Binance Coin (BNB) |

$291.87

|

4.03% |

| Bitcoin (BTC) | $21,303 | 10.28% |

| Dogecoin (DOGE) |

$0.063

|

4.11% |

| Ethereum (ETH) |

$1,720

|

5.04% |

| Polkadot (DOT) | $7.74 | 4.60% |

| Solana (SOL) |

$34.07

|

3.42% |

| XRP (XRP) |

$0.35

|

3.59% |

| Altcoin Market Cap |

$598 Billion

|

3.65% |

| Total Market Cap |

$1.004 Trillion

|

6.11% |

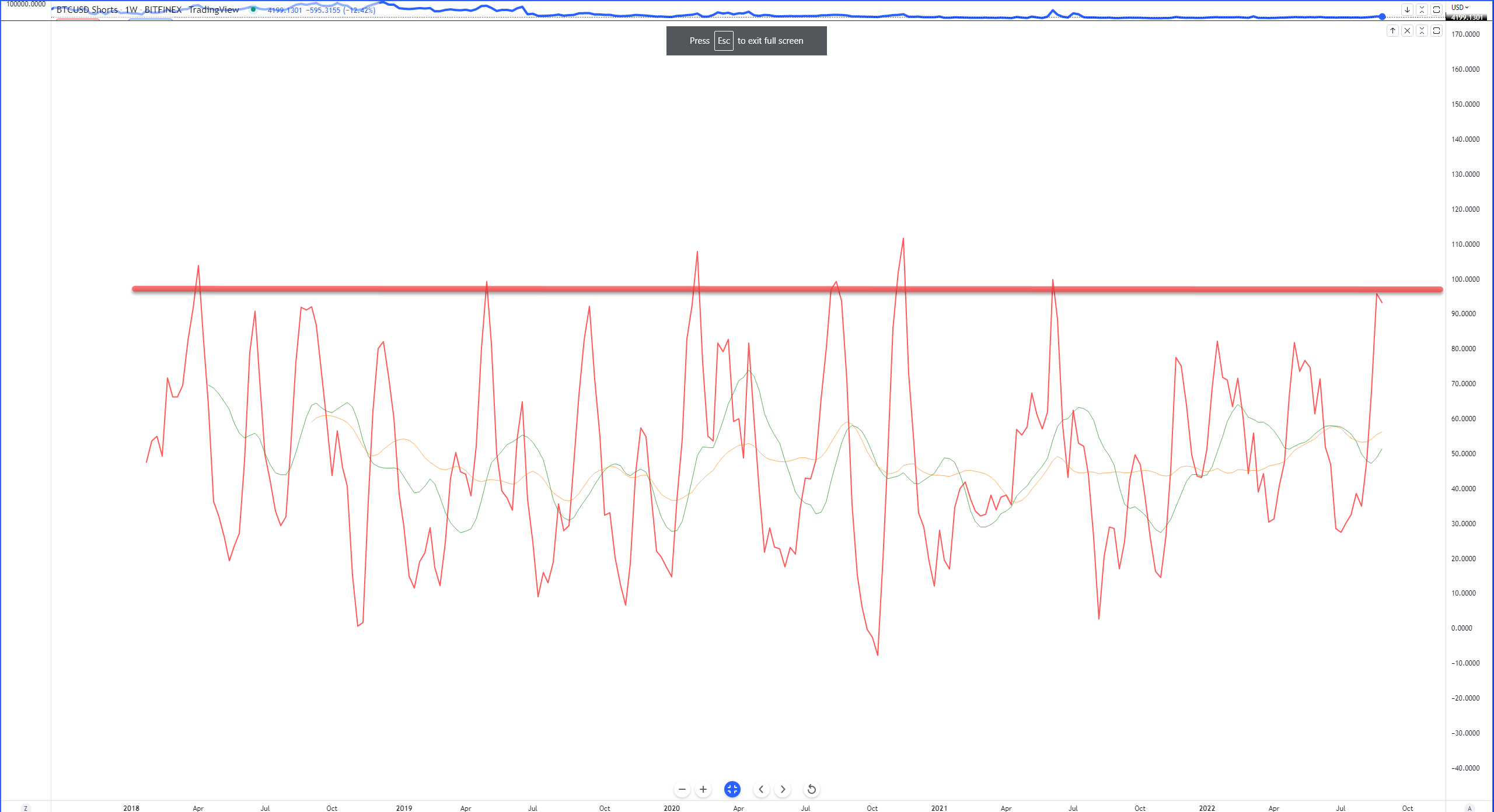

Last Wednesday (August 31, 2022), the Litepaper focused on a possible short squeeze occurring for Bitcoin. The image below is the weekly Composite Index of the BTCUSDT Shorts chart from August 31.

One of the closing points made in the August 31, 2022 Litepaper was, “Historically, massive gaps between the Composite Index’s line and its moving averages don’t last long.”

Note how much the Composite Index has moved in the past 9 days:

There was clear rejection against the red horizontal line that demarcates where many of the major peaks exist on the weekly chart.

So does this mean a turnaround is going to happen soon? Is the cryptocurrency market poised for a massive rally? Is the doom and gloom over? Maybe – but a few things have to happen before the bulls can take over.

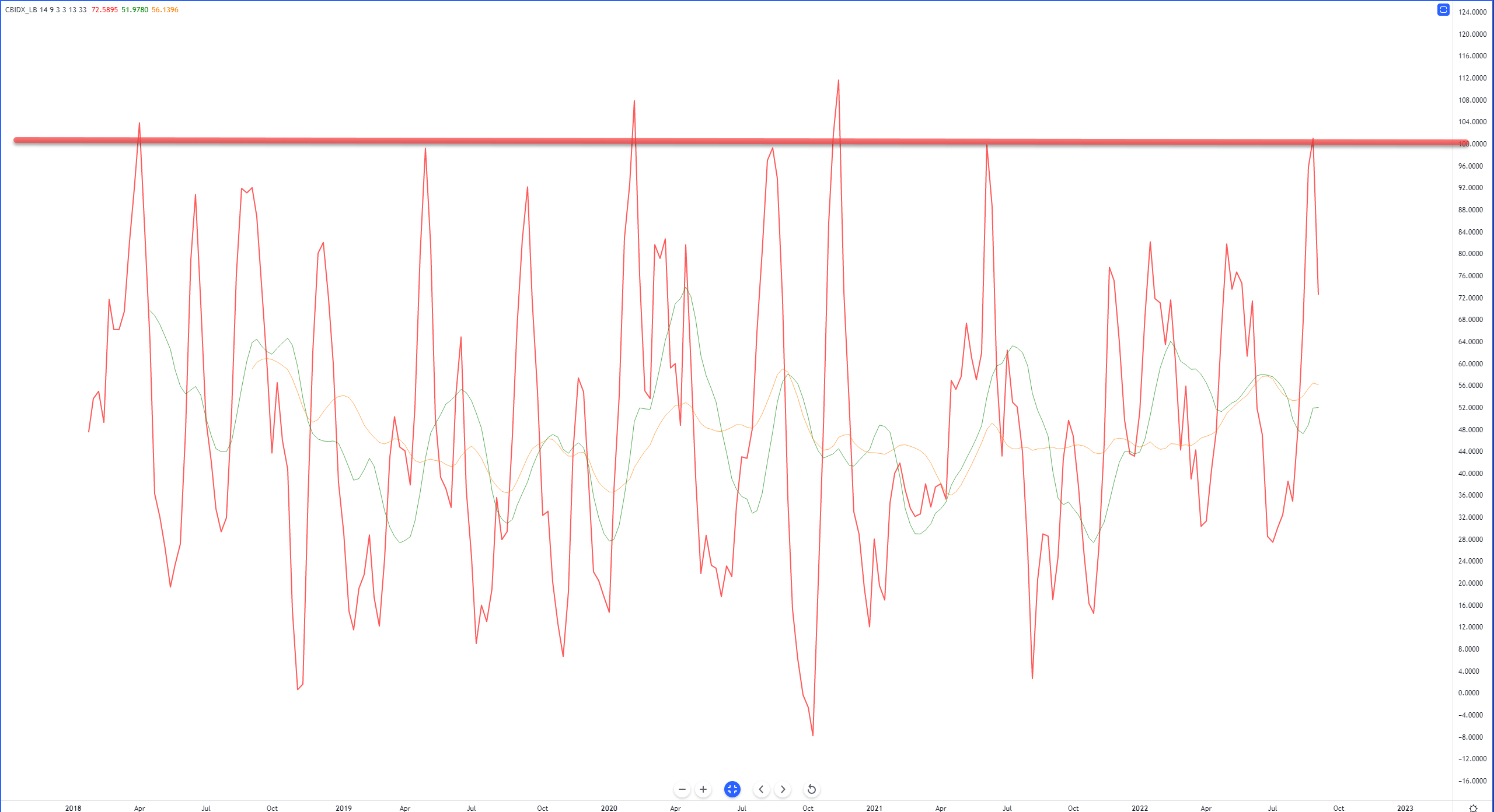

The image above shows the weekly chart of the Total Crypto Market Cap with the Ichimoku Kinko Hyo System (Read the Introduction to Ichimoku here). The most powerful support/resistance level within the Ichimoku system is Senkou Span B – which is exactly where the current price level is fighting against.

The daily candlestick is just above Senkou Span B ($999 Billion) and inside the Cloud. Which, if you’ve read our introduction to Ichimoku, is a horrible, horrible place. Above Senkou Span B is the Kijun-Sen, another strong resistance level ($1.04 Trillion).

The bearish energy here isn’t done – note the Relative Strength (RSI) Index below the candlestick chart. The RSI is set up for bear market conditions, so the overbought levels are 55 and 65. The RSI is parked right up against that first overbought level at 55.

So how is this interpreted?

For bears, it looks pretty good. For bulls, it’s a little nerve-wracking. The combination of the RSI up against 55 while price shows difficulty crossing Senkou Span B is a major boon for bears.

Psychologically, the massive intraday gains have given crypto traders/investors a sense of relief, but imagine how demoralizing that would be if the market clawed back 50% of today’s gains and positioned the daily close below Senkou Span B? Short sellers would like that a bunch.

For bulls, the path to a clear and sustained bull run requires more waiting. Sorry, that’s the name of the game in any market and it’s the hardest thing to do: wait. Bulls really need to wait for an Ideal Bullish Ichimoku Breakout setup.

Without going into the entirety of the Ideal Bullish Ichimoku Breakout, the two primary things that need to happen on the daily chart are a close above the Cloud and the Chikou Span above the bodies of the candlesticks.

For those two conditions to be true, today’s market cap needs to return to $1.15 trillion. That might prove difficult given there’s a weekend coming up, but the threshold drops from $1.15 Trillion to $1.09 Trillion by next Tuesday.

We’ll keep you updated as this market continues to progress. 📈

For whatever reason, there’s been a dearth of metaverse and NFT news between yesterday and today. Given that the NFT space, in particular, has seen a greater than 90% drop in volume since the beginning of 2022, and given the recent uptick in risk-on assets (stocks, crypto, etc.), it makes sense that that NFTs might be catching a bid and a subsequent rise in news volume.

Apecoin

Apecoin ($APE.X) has been one of the clear leaders in this space, rallying nearly 18% before noon (EST). If APE can close the day near its current high of $5.21, it would be the highest close of the past 15 days.

Ford

Ford Motor Company ($F) isn’t acting like an old fuddy-duddy company. Never mind the EV space it’s trying to eat away at – Ford is entering the Metaverse and NFT space. They’ve filed 19 trademark applications with the US Patent and Trade Office.

Ford plans to offer an online marketplace where people can download digital trucks, cars, SUVs, etc for use in a virtual world – they didn’t specify which virtual world that would be, but probably not World of Warcraft or The Elder Scrolls Online.

Cardalonia

The Play-To-Earn Metaverse world on the Cardano blockchain, Cardalnoia, announced its token listing ($LONIA.X) on the P2PB2B cryptocurrency exchange. Beyond some exclusives in that virtual world, a stake of 7000 LONIA locks up your tokens for the upcoming Cardalonia Land Presale event – sometime in Q4 2022 according to the roadmap.

EU and Japan using NFTs

Japan’s government recently rewarded NFTs to entities that ‘excelled at using digital technology to solve local challenges.’ One such award was given for a platform that utilizes mobile device cameras to track traffic conditions changes. Those NFTs issued by Japanese authorities are non-transferable, so they can’t be swapped/traded on a secondary market.

Sounds like the NFTs awarded were more like gold stars you would get in grade school for doing a good job. Yippy.

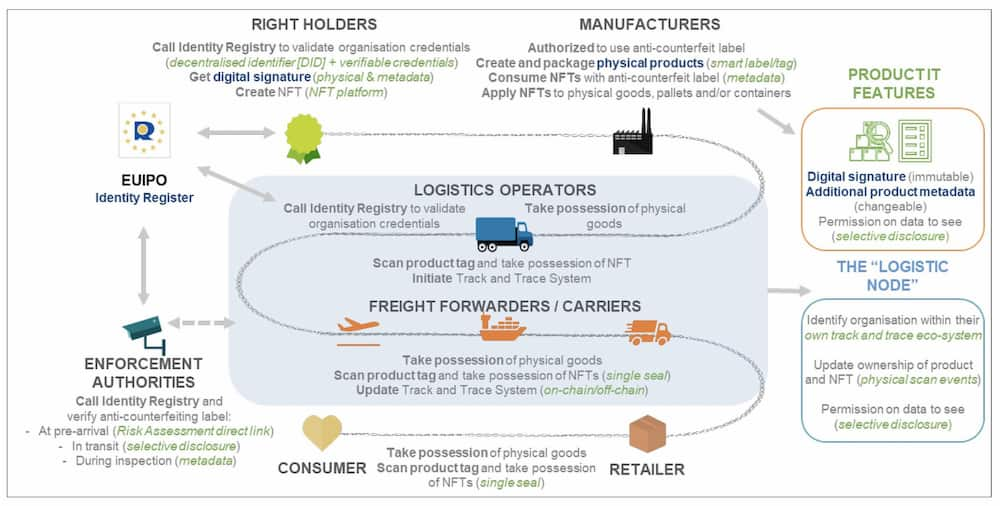

The EU wants to use NFTs to combat counterfeiting. Take a looks at this infographic explaining how it will work. You probably grasp the graphic if you’re reading the Litepaper; think a politician will understand it? Definitely looks like a committee created this monster:

Joking aside, the EU wants to tackle real-world goods counterfeiting. Finally, something with NFTs that doesn’t have to do with high-as-a-kite-looking monkeys smoking cigars. The EU wants the ability to track the entirety of a supply chain with various checkpoints/validators.

Long story short, the intent of the European Union Intellectual Property Office is to ensure that the owners of IP are assured their products are being sold in authentic places – also lets consumers know the product is authentic.

What Ain’t No Country I Ever Heard Of

Quentin Tarantino and Miramax finally settle their lawsuit over the former’s Pulp Fiction NFT collection. A notice of settlement was released by lawyers from both sides today. No details of the settlement were provided.

However, it is interesting that the lawsuit began near the top of the NFT insanity – and the settlement comes after volume in the NFT space has nosedived by over 90%. Coincidence? Naw. 😻

Bullets

Bullets From The Day:

⛏️ CleanSpark is a crypto mining company we recently discussed in Wednesday’s Litepaper. They recently got a big chunk (10,000) of Bitcoin ($BTC.X) ASIC miners on the cheap and are continuing to make more expansion moves. The latest is buying a mining facility in Georgia from the Aussie firm Mawson Infrastructure Group. It’s the second mining facility in two months after buying a 36-megawatt mining facility in Georgia from Waha Technologies. More from TheBlock

🥉 One of crypto’s biggest critics, Peter Schiff, tweeted this morning that “The US company that intended to buy my bank and greatly expand its operations in Puerto Rico, has acquired virtually all of its assets out of receivership instead.” Back in July, he was asked if he could accept Bitcoin for his bank – Schiff agreed he would if regulators approved it. Full story at u.today

🤑Like CleanSpark, FTX ($FTT.X) Ventures (the venture capital arm of FTX) making more expansionist moves. FTX Ventures invested a good chunk of Anthony Scaramucci’s SkyBridge Capital. Skybridge intends to use some of the proceeds to buy crypto, which will be added to its corporate balance sheet. Blockworks has more details

Links

Links That Don’t Suck:

🤚 Huobi wins license in the British Virgin Islands; no timeline for the UK yet

💸 Ethereum Futures Hit $1 Trillion; Overtakes Bitcoin For First Time Ever

😐 Terra 2.0 (LUNA) Pumps 260% as Terra Classic (LUNC) Falls

🚨 ‘We’re not giving crypto a pass,’ says SEC’s enforcement chief