Will the crypto market cap hit and stay above $1 trillion? Or won’t it? The back and forth during Friday’s trading has been frustrating for many crypto investors and traders.

Risk-on markets, in general, have seen plenty of pamp today – but Friday afternoon often translates into big and small players taking money off the table, so it will be interesting to see how crypto responds at the end of the day and into the weekend.

On deck for today’s Litepaper is the growing number of entities in Ripple’s case against the SEC, 10 people in crypto you should know, and major price levels analysts are looking at.

By a long shot, the best performer today is Polygon (MATIC.X) – screaming close to a +20% daily gain and back above a buck. Litecoin ($LTC.X) and Cosmos ($ATOM.X) are just behind with +10% gains.

And while it’s not listed here in the top performers, Dogecoin ($DOGE.X) is one of the only major market cap cryptos in the red (-1.01%). It’s currently down -23% to $0.122 from its November 1 high of $0.158. But that’s crypto for ya.

Before we dive into the Friday Litepaper, here’s how the market looked at the end of the trading day:

| Polygon (MATIC) |

$1.12

|

18.57% |

| Litecoin (LTC) | $68.05 | 10.01% |

| Cosmos (ATOM) | $14.86 | 10.00% |

| Uniswap (UNI) |

$7.59

|

9.67% |

| Algorand (ALGO) |

$0.399

|

7.79% |

| Chainlink (LINK) | $8.28 | 7.28% |

| Solana (SOL) |

$33.02

|

7.00% |

| Ethereum (ETH) |

$1,620

|

5.84% |

| Polkadot (DOT) |

$6.79

|

5.79% |

| Avalanche (AVAX) |

$19.04

|

5.54% |

| Altcoin Market Cap |

$601 Billion

|

4.89% |

| Total Market Cap | $1.008 Trillion | 4.00% |

Crypto

Nobody’s Cheering The SEC

Legal shtuff is boring. If you’ve read some of our stories about something called an ‘Amicus Brief,’ think of it like a sports game, and someone who files an amicus brief for one party in court is a ‘fan’.

Using that analogy, this is what Team Ripple’s ($XRP) fan base looks like:

And here’s what the SEC’s looks like:

How many entities have filed as ‘Friends of the Court’ for Ripple? Well, another just joined yesterday (VeriDAO). That brings the total to twelve.

https://twitter.com/dao_veri/status/1588295477052997633

Ripple CEO Brad Garlinghouse took to Twitter, sharing his/Ripple’s attorney, and commented that 12 amici briefs are “… unprecedented….”

For those of you keeping count, 12 (!) amici briefs submitted. It’s unprecedented (I’m told) to have this happen at this stage. They each explain – in their own unique way – the irreparable harm the SEC will do to every facet of the US crypto economy if it gets its way. https://t.co/Na9fWq3GvO

— Brad Garlinghouse (@bgarlinghouse) November 3, 2022

Things are looking better and better for Ripple and for the broader crypto community as a whole.

There’s a TL;DR (Too Long;Didn’t Read) at the end of this article if you want to skip to the summary.

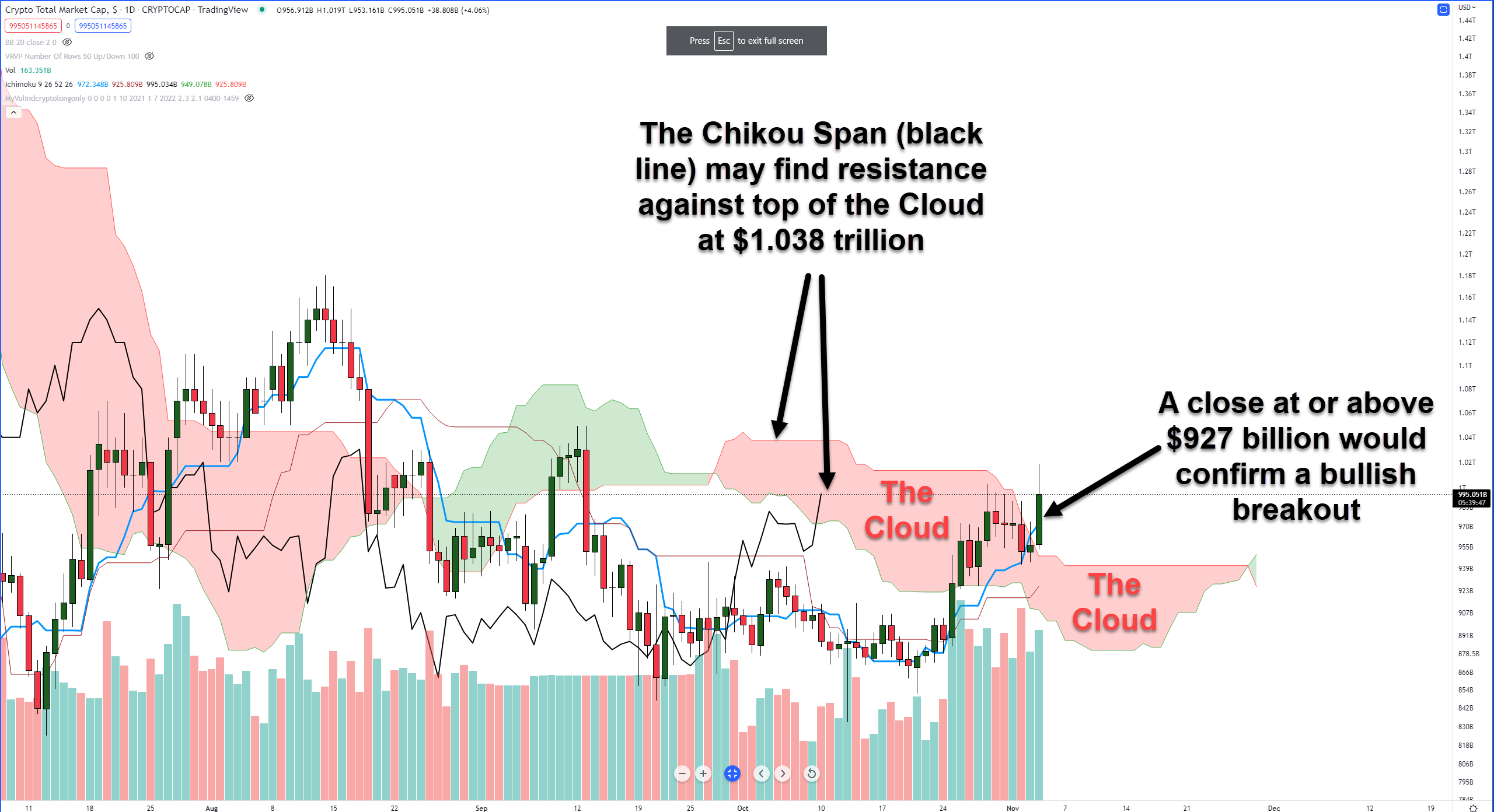

The daily chart for the Total Crypto Market cap below is a perfect example of how evil the Cloud is. The Cloud represents volatility, indecision, misery, and everything bad. It’s where trading accounts go to die.

If we look back at the past week, chop doesn’t really begin to define what a frustrating week it’s been for bulls and bears alike. But, hopefully, maybe some of that chop might end.

If the Total Market Cap closes above the Cloud and the Tenkan-Sen, then it will fulfill one of the most sought-after bullish conditions within the Ichimoku Kinko Hyo system, known as an Ideal Bullish Ichimoku Breakout. The Total Market Cap chart doesn’t even need to close at $1 trillion to accomplish that, it just needs to close at or above $927 billion.

If the Total Market Cap chart closes above the Cloud, it will be the first time since August 18, 2022. But does that mean moon time is coming? Don’t count your chickens. The weekend is coming up, and weekends are notorious for killing any gains made in the week – Sundays in particular; that’s why they’re called Sell-Off Sundays, Slaughter Sundays, or Bloody Sundays.

Bulls might have a tricky time moving higher over the weekend because of where the Chikou Span is (black line). The Chikou Span reacts to the same support and resistance levels as price, and the top of the Ichimoku Cloud (Senkou Span B) is just above it at $1.038 trillion.

So, the Total Market Cap could move lower, but the strongest level of support/resistance in the Ichimoku system, Senkou Span B, is just below. And when Senkou Span B is flat, it represents strength. And the longer Senkou Span B is flat, the stronger it’s perceived to be.

That means sellers may have some problems keeping the Total Market Cap below $942 billion.

TL;DR

Weekends are dangerous and often generate massive volatility. Primary resistance ahead for the Total Market Cap is near the $1.038 trillion value area. Support is at $942 billion.

Crypto

10 People To Know In Crypto

Here’s a list of 10 people you may or may not have heard of who have a lot of influence in the crypto space. In no particular order, here they are.

Hester Pierce

Current SEC Commissioner, also known as ‘Crypto Mom’ for her ardent support of the cryptocurrency space and vocal opposition to the SEC preventing a spot Bitcoin ETF.

Bullets From The Day:

🕶️ Are you an influencer who comments on crypto in the EU? You may need to input and/or make a disclosure about your crypto holdings if/when MiCA passes. The Markets in Crypto Assets (MiCA) bill, passed by the EU Parliament’s Committee on Economic and Monetary Affairs in October, contains language addressing people who shill talk about crypto. Especially those taking positions long or short without disclosing their ownership or non-ownership. What constitutes an ‘influencer’ or what the final penalty will be is still not known. We’ll keep you updated. Full story from Finbold

🚔It sounds like Do ‘Con’ Kwon is in more hot water. Not only was his passport recently made invalid, but South Korean officials now accuse Kwon of fraud. A South Korean prosecutor claims to have obtained a private conversation between Kwon and a Terra employee where Kwon gives the employee orders to manipulate LUNA’s ($LUNA.X) price. And he’s apparently in Europe now – but still won’t say where he is to avoid authorities’ arrest because it’s not safe. Read more from beincrypto

🇨🇦 Canada’s 2022 Fall Economic Statement outlined several crypto-centric issues. First, that money digitalization poses challenges to democratic institutions around the world – because it can be used to avoid sanctions and other illegal activity. Second, they want to create a Canadian CBDC. Unrelated but related, Canada is immediately ceasing the issuance of real-return bonds. CoinTelegraph has more

Links That Don’t Suck:

🪙 Coinbase Reports Mixed Q3 Financials as Block and PayPal Surge

🇮🇳 High Taxes Can Kill the Crypto Industry in India, CZ Cautions

📈 Bloomberg Strategist on $BTC and $ETH: ‘I Only See Increasing Adoption and Demand Increasing’

💸 Digital asset platform Bakkt set to acquire Apex Crypto for $200M

🏎️ XRP price surges over 8% in 24 hours boosted by events in Ripple’s SEC lawsuit

📐 MSCI introduces digital assets classification system in partnership with Goldman Sachs, CoinMetrics

❓ Q&A: Immutable’s Alex Connolly on Protecting NFT Creator Royalties