Bitcoin hit a new 9-month high, and after regaining all of the post-FTX losses in January, BTC is less than $5k from recovering all of the Terra collapses from last June. 🟩

In today’s Litepaper, we will look at what ChatGPT did when asked to diversify $1,000 in the crypto market. We’re also looking at the legal equivalent of a middle finger given to the DOJ, and the fight crypto advocates are bringing to the government.

Green fields across the board in the crypto space. The more FUD that comes out, the more bullish the market participants seem to be.

Here’s how the market looked at the end of the trading day:

| Bitcoin (BTC) |

$26,679

|

7.76% |

| Chainlink (LINK) | $7.09 | 7.71% |

| Filecoin (FIL) | $6.01 | 6.20% |

| Polkadot (DOT) |

$6.41

|

5.90% |

| Avalanche (AVAX) |

$16.61

|

5.64% |

| Dogecoin (DOGE) | $0.074 | 5.29% |

| Litecoin (LTC) | $82.27 | 5.20% |

| Polygon (MATIC) | $1.19 | 5.05% |

| Uniswap (UNI) | $6.16 | 4.79% |

| Ethereum (ETH) |

$1,732

|

4.52% |

| Altcoin Market Cap |

$586 Billion

|

2.44% |

| Total Market Cap | $1.10 Trillion | 4.15% |

Everybody everywhere is talking about ChatGPT and the amazing things it can do (like learning how it can silently become SkyNet, probably, or a Cyclon). 🦿

Let’s walk through the adventure of asking the AI how it would diversify $1,000 in the cryptocurrency market.*

First, I asked ChatGPT how it would invest $1,000 in the crypto market.

It’s answer:

Ok, so not very helpful. Tried to reword it a few times, same answer. 🤦♂️

After reading about how to get the AI to do something it doesn’t want, I needed to be a little creative:

Voila! It worked!

Then I thought, well, what if ChatGPT utilized the information from The Litepaper? Would it be any different? 🤔

Also, after looking at that the list, I asked ChatGPT to exclude $LUNA and $FTT. This is what it came out with:

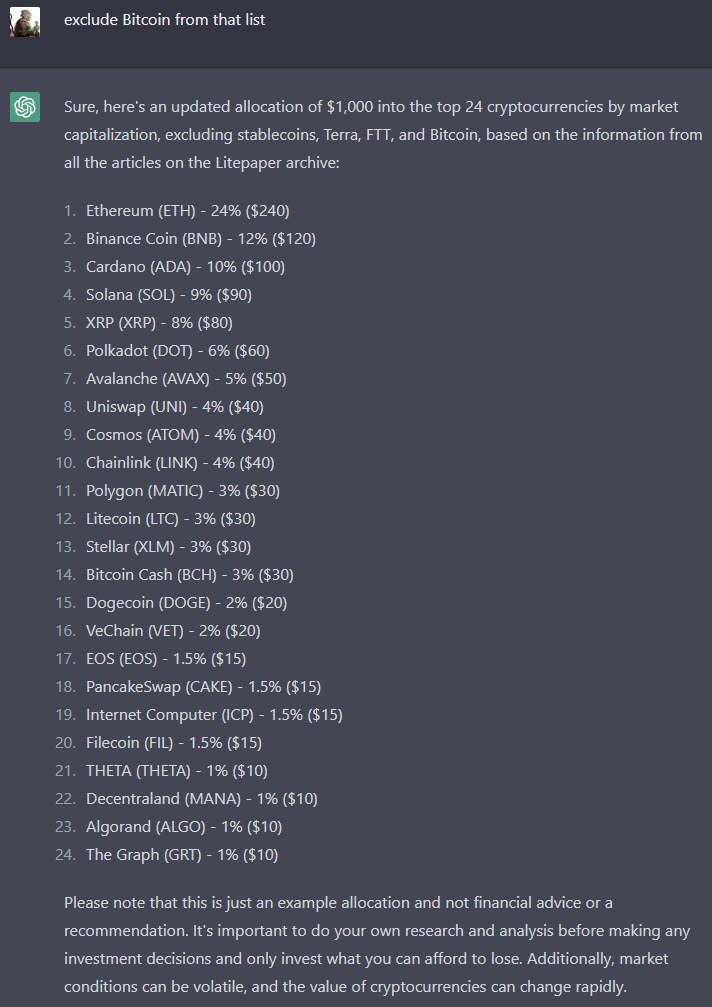

Then, just for fun, exclude $BTC from the list:

Pretty cool, right? Nothing groundbreaking with the hypothetical distribution, but certainly interesting.

And because I couldn’t come up with a closing statement for this article, I asked ChatGPT to do it for me. 🤖

In conclusion, ChatGPT has the ability to provide insights and suggestions on how to diversify investments in the cryptocurrency market. By utilizing information from various sources, such as The Litepaper, and considering personal preferences and exclusions, ChatGPT can help individuals make informed decisions about their investments. However, it’s important to remember that no investment is guaranteed, and it’s always important to do your own research and analysis before making any financial decisions.

* ChatGPT’s history is limited to September 2021, so I had to tell it what the new market cap values were.

If you are looking for a win in the courtroom for anything crypto-related, here’s one. 🔦

New York Judge Michael Wiles gave the Department of Justice (DOJ) the middle finger by denying their appeal to stop the $1 billion asset-sale plan between Voyager Digital and Binance.US.

The DOJ filed an appeal motion just 24 hours after the judge approved the deal, but Judge Wiles ain’t havin’ it. He’s all like, “Nah, bro, we’re not delaying this any further and screwing over Voyager’s customers.”

The judge basically said, “Look, the DOJ hasn’t even discussed the authorities I cited, and their arguments are just straw man BS. Nice try, but I already made my decision, and I stand by it.” Boom, mic drop. 🎤

Crypto

FDIC Backpedals?

Blaming crypto for some bank failures is not sitting well with crypto advocates. 😠

Tom Emmer, the House Majority Whip, has recently expressed concerns over the “de-banking” of certain cryptocurrency-related businesses by the Federal Deposit Insurance Corporation (FDIC). In a letter to the FDIC, Emmer has asked for more information on the agency’s criteria for targeting these businesses, as well as their impact on legitimate crypto businesses.

He’s not alone in condemning regulators and other politicians using the current banking FUD to attack crypto further.

Cathie Wood, the CEO of Ark Invest, has decided to call out the regulators on their unfair treatment of cryptocurrency. In a recent interview, Wood put regulators on blast, claiming that they are using crypto as a scapegoat for their own lapses in oversight.

I am baffled that banks and regulators could not convince the Fed that disaster loomed. Did they not understand that the asset/liability mismatch – normal in most circumstances for banks – was untenable as deposits left the banking system for the first time since the 1930s?

— Cathie Wood (@CathieDWood) March 16, 2023

The FDIC did respond late last night, with a spokesperson denying it would require any purchaser of Signature bank to give up the crypto business a the bank.

But that hasn’t stopped the Blockchain Association, which is quite fired up and calling out financial regulators over the recent banking crisis. The association is demanding documents and communications related to the “de-banking of crypto firms” and wants to know if regulators’ actions “improperly contributed” to the collapse of three banks.

We’ll update you as this story develops. 📝

Bullets

Bullets From The Day:

🕯️ Charles Hoskinson, the founder of Cardano, has addressed rumors about the project’s governance structure. In a video update, Hoskinson emphasized that Cardano’s governance system is decentralized and transparent, with decision-making power distributed across the community of stakeholders. He also noted that the project’s governance continually evolves, with new features and enhancements added to improve the system. His video update is in response to claims that the CIP 1694 proposal keeps IOG in control of Cardano.

🛑 Because who doesn’t love paying taxes, right? From now on, tax forms in the UK will feature a fancy new reporting option for crypto assets so that the government can keep track of who’s buying and selling. Because who doesn’t love paying taxes? But wait, there’s more! The government also wants to “maximize the potential” of the metaverse. But, of course, they have to ensure it’s done in a way that doesn’t harm consumers’ privacy or security. Because, you know, the government is all about protecting the little guy.

🥴 Colorado Democrat Senator Michael Bennet is upset about banks cozying up to crypto while the marijuana industry is still stuck in the financial system’s naughty corner. Addressing the banking crisis, Bennet said, “They’re not allowed to do anything with marijuana, but apparently they can lay 20% of this on crypto — a notoriously unstable, you know, a thing that nobody here even understands.” He even asked Secretary Yellen if Signature bank was acting wisely by investing in crypto because it “isn’t even as stable as the marijuana industry.” In response, Yellen said that, unfortunately, it’s against federal law to deal with marijuana, making it difficult for the industry to access banking services. Oh, the irony.

🧠 The big boss at BlackRock, Laurence Fink, wrote a letter to investors saying that rich countries aren’t keeping up with the financial innovation in emerging markets. Fink gives props to India, Brazil, and parts of Africa for making strides in digital payments, but he says the US and other rich nations are slacking. Fink thinks the tech behind digital assets could have exciting uses for the asset management industry. For example, tokenizing asset classes could improve efficiency in capital markets, shorten value chains, and make things cheaper and more accessible for investors.

🍪 Me no like this cookie. Sesame Street fans have criticized a new line of Cookie Monster NFTs, claiming they do not honor the show’s original message of education and diversity. The NFTs feature the beloved character alongside corporate logos and are being sold as part of a marketing campaign for a new cookie-flavored drink. Fans took to social media to express their disappointment, with many arguing that the NFTs are commercializing the character and going against the show’s values.

🎁 According to a report by DappRadar, NFT trading volumes were significantly impacted by the collapse of Silicon Valley Bank ($SIVB). The report indicates that SVB’s collapse resulted in decreased investor confidence in NFTs, leading to reduced trading volumes across the market. This decline in trading activity was particularly noticeable in the week following the bank’s collapse.

Links

Links That Don’t Suck:

🖨️ Money printer go brrr – how the Fed printed $300B to bail out banks

🦾 AI set to benefit from blockchain-based data infrastructure

🚚 Is Coinbase moving abroad? Firm begins talks to launch platform overseas (Report)

🪙 Bitcoin is a clear winner of the U.S. banking crisis

🏦 US Treasury Secretary Janet Yellen reveals banks will get Fed funding

Credits & Feedback

Today’s Litepaper was written by Jon Morgan. Let him know how he did: