It appeared as if crypto had made it through today’s Fed decision unscathed, but it began falling again after the stock market closed. 🙃

In today’s Litepaper, we’re starting off with today’s inflation data and Fed decision. We summarize what the Fed said, how the market reacted, and what remains unclear. 📝

We’ll also dive into a longer-term look at Ethereum’s trend using its monthly chart. And lastly, this week’s Crypto 101 series is on DEXs, specifically Automated Market Makers. 👀

Here’s how the market looked at the end of the trading day:

| Bitcoin (BTC) | $25,081 | 3.01% |

| Ethereum (ETH) | $1,652 | 5.03% |

| XRP (XRP) | $0.48 | 8.07% |

| Litecoin (LTC) |

$73.07

|

5.63% |

| Cardano (ADA) |

$0.262

|

4.64% |

| Solana (SOL) | $14.46 | 3.68% |

| Polkadot (DOT) | $4.60 | 0.45% |

| Dogecoin (DOGE) | $0.05979 | 3.08% |

| Uniswap (UNI) | $4.42 | 3.41% |

| Tron (TRX) |

$0.07101

|

1.10% |

| Shiba Inu (SHIB) |

$0.000006536

|

3.55% |

| BNB (BNB) | $237.09 | 1.94% |

Policy

A “Pause” That Refreshes

Today’s big story was the Federal Reserve’s interest rate decision and projections, so let’s jump right into it. 👇

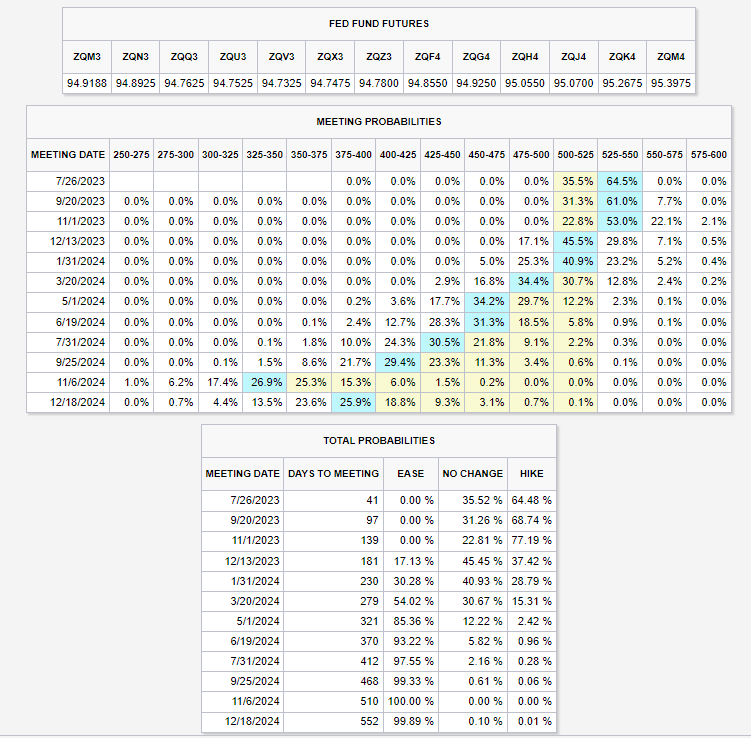

First, we’ll start with the market’s expectations. Coming into the decision, the bond market was pricing in a roughly 93% chance of a Fed “pause” today, with only 7% expecting another 25 bp hike. And…that’s exactly what we got. However, the devil is in the details. 🔍

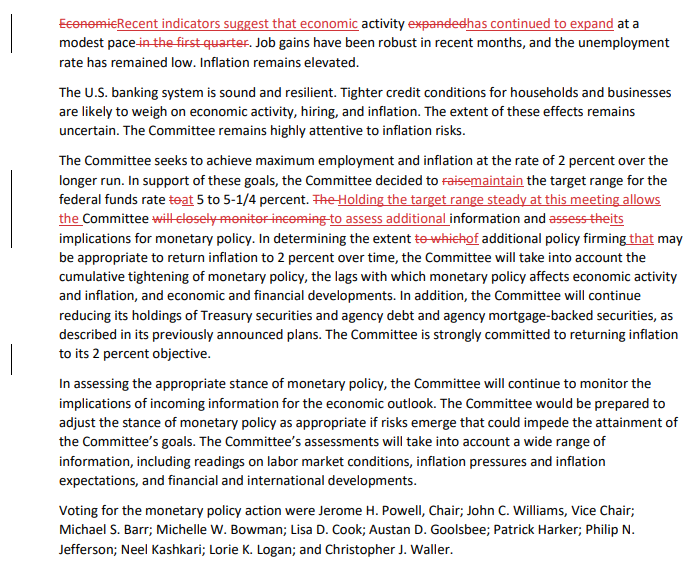

The Federal Reserve unanimously decided against an 11 consecutive interest rate hike, instead keeping rates unchanged. The redlined version of the FOMC Statement showed that this is more of a skip than a pause. Or at least that’s what the Fed would like the market to believe.

The language changed from “determining the extent to which additional firming may be appropriate” to determining the extent of additional policy firming that may be appropriate,” indicating that further hikes are expected; they’re just unsure how many or when. 🤔

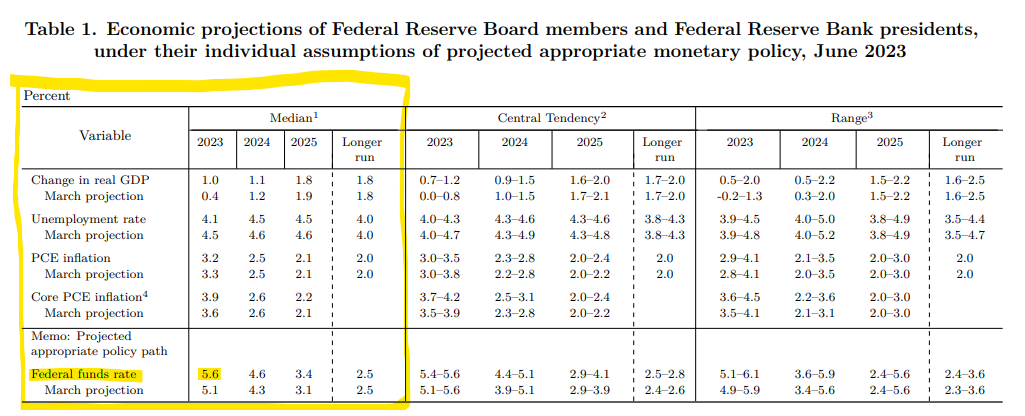

Meanwhile, the Federal Open Market Committee (FOMC) also released new economic projections that:

- Revised up growth expectations for ’23, ’24, and ’25

- Slightly revised down unemployment rate expectations for ’23, ’24, and ’25

- Kept PCE inflation expectations essentially flat while raising ’23 Core PCE inflation to 3.9%

- Raised federal funds rate expectations for ’23, ’24, and ’25

The key takeaway here is that the Fed sees more hikes ahead. The median federal funds rate projection is now 5.6%, implying two more 25 bp hikes before the end of the year. 🔺

As for why that’s the case? It expects core inflation to remain sticky through the end of the year, nearly double its 2% target. And it doesn’t anticipate that figure will reach its target until the end of 2025. 📆

During his press conference, Fed Chair Jerome Powell admitted that the committee’s inflation projections have been poor. However, its weak track record in anticipating inflation’s moves doesn’t change the fact that core inflation remains too high. Additionally, after a year of aggressive hiking, the federal funds rate is finally in line with rates set by market participants.

As such, the Fed is pausing and giving its policy decisions the time required to impact the economy. ⏯️

A slowdown in the labor market is the final piece of the puzzle for the Fed. Core inflation remains sticky because of services, which are driven by employment. After all, competition for labor means higher wages. And a lot of people with jobs and higher incomes ultimately means more money being spent in the economy. 🛒

So far this year, there have been some early signs that the labor market is softening and wage pressure is waning. Housing weakness, while dissipating recently, has helped bring down housing services inflation and should continue to do so at a moderate pace. But the economy continues to hum along, making the pace of disinflation too slow and the overall level of inflation too high.

As a result, the Fed’s messaging was left hawkish to keep a leash on markets and credit conditions. It believes that rates may be high enough to bring employment and inflation down but needs to wait and see like the rest of us. Unfortunately, it doesn’t have a crystal ball, or else this job would be much easier. 🦅

For the market, that means no rate cuts until at least 2024.

The CME FedWatch Tool shows expectations aren’t entirely aligned with the Fed just yet. It shows the market pricing in one more rate hike before the end of the year compared to the Fed’s two. The market has been ahead of the curve on inflation, so we’ll have to see who is right. 🤷

The stock market experienced volatility throughout the announcement, with the S&P 500 and Nasdaq 100 managing to close green on the back of big tech stocks. Interestingly enough, crypto markets held up well throughout the session but sold off after the 4:00 PM stock market close. 🔻

Initial moves following these announcements are always tricky to gauge, so we’ll have to see how the rest of the week pans out. 👀

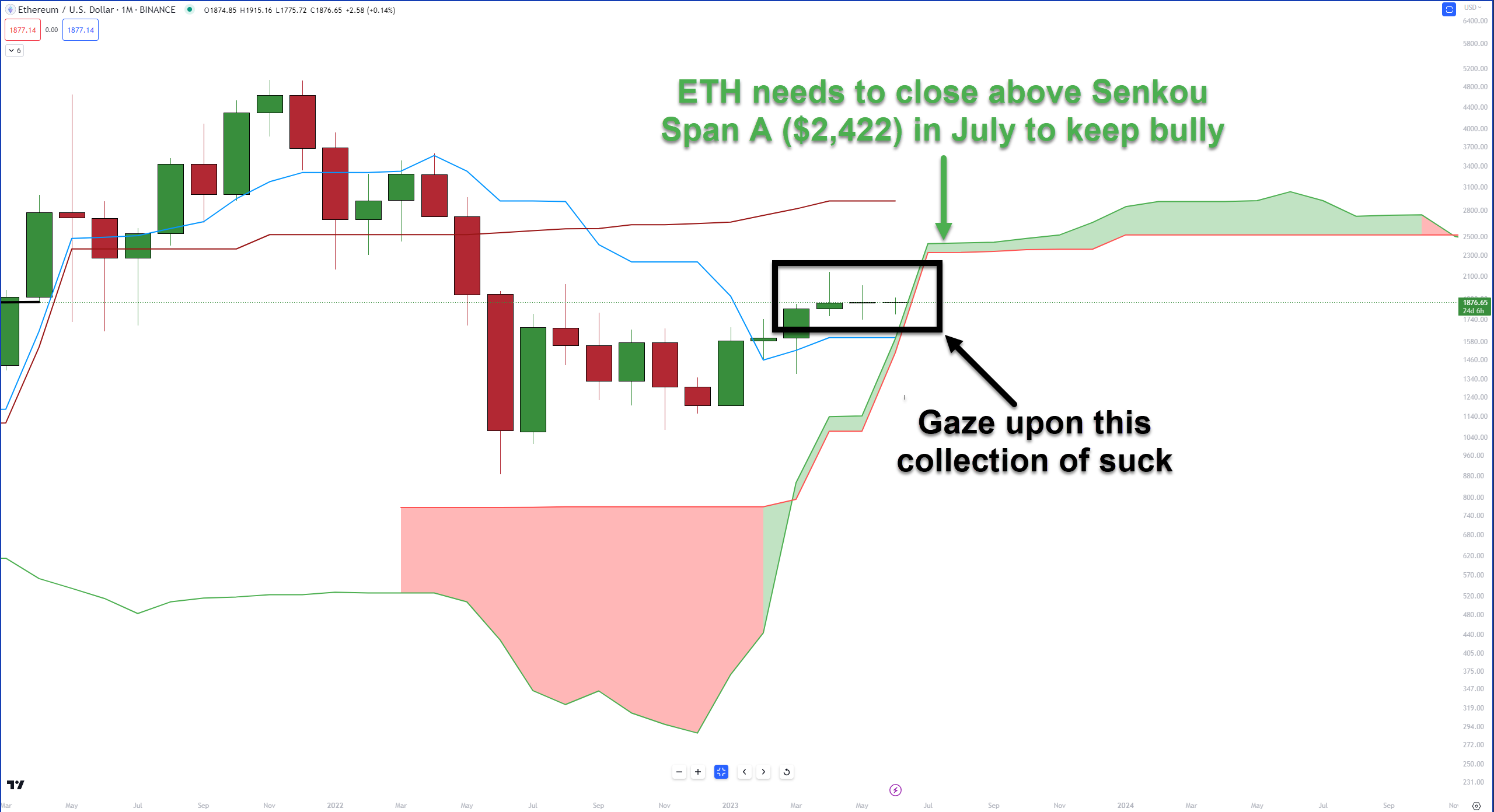

As we approach the middle of June, let’s examine the monthly chart for $ETH. 👁️🗨️

If you feel like Ethereum hasn’t made much progress, you’re not wrong. Look at the horribleness of the April, May, and June candlesticks. Blegh.

However, don’t let the lackluster price action discourage you, as there may be some, um, fireworks ahead in July. 🎆

From an Ichimoku perspective, ETH must close the monthly chart above the Cloud, currently at $1,597. So far, it seems to be on track.

But here’s the catch.

Suppose Ethereum closes around the $1,800 range for June. In that case, it will open the July candlestick below the Ichimoku Cloud, which presents a challenge for the bulls.

To maintain their advantage, bulls must close July above the Cloud, specifically at or above $2,422. No big deal, right? Just need a 30%-ish rally between now and July 31.

The positive aspect for bulls is that the Cloud is relatively thin. Thin Clouds indicate weakness and make it easier to move through them.

We’ll closely monitor the situation in the coming weeks to see how things unfold.

Automated Market Makers (AMMs) are the lifeblood of decentralized exchanges (DEXs). They use algorithms to provide liquidity for trades, ensuring a smoother, decentralized trading experience.

But not all AMMs are created equal. This guide will dive into different types of AMMs and their ideal use cases.

Constant Product Market Maker (CPMM)

Used by platforms like Uniswap ($UNI), the CPMM model abides by the formula x*y=k, keeping the product of two token quantities constant.

Great for general trading pairs, it does come with a downside called “impermanent loss,” which can impact liquidity providers’ profits. 🟣

Constant Mean Market Maker

This model, utilized by Balancer ($BAL), accommodates multiple tokens in a pool with different weights. It’s like an upgraded version of the CPMM, offering more flexibility but retaining some vulnerability to impermanent loss. 🟠

StableSwap Invariant Market Maker

Designed for stablecoins (cryptocurrencies pegged to stable assets), Curve Finance ($CRV) uses this model to minimize impermanent loss, keeping things steady and secure. 🔴

Hybrid Function Market Maker

Bancor’s ($BNT) model allows liquidity providers to stake just one token instead of two, mitigating the impermanent loss problem. It also keeps a separate stash of Bancor Network Tokens (BNT) for every listed token. 🟢

Concentrated Liquidity Market Maker

Uniswap V3’s innovative model lets liquidity providers choose their capital’s price ranges, making liquidity provision more efficient. You can decide where you want your money to work. ⚫

Dynamic Automated Market Maker (DAMM)

Kyber Network’s ($KNC) DAMM (also known as KyberDMM) auto-adjusts parameters in response to market conditions.

Ideal for stable pairs, it offers ‘amplified pools’ to boost capital efficiency. 🔵

Matching AMMs with Liquidity Pools or Trading: A Quick Guide

-

CPMM for General Pairs: If you’re dealing with trading pairs like $ETH/$DAI, go for CPMM like on Uniswap.

-

Constant Mean for Multi-Token Pools: Balancer’s model is perfect for a pool with multiple tokens (ETH, DAI, $MKR) with different weights.

-

StableSwap for Stablecoin Pools: If you’re focusing on stablecoin swaps ($USDC/DAI/$USDT), Curve Finance’s StableSwap is your best bet.

-

Hybrid Function for Single-Token Liquidity: Prefer to provide liquidity with a single token (like ETH)? Go with Bancor’s Hybrid Function model.

-

Concentrated Liquidity for Specific Ranges: Uniswap V3 allows you to target specific price ranges, which is perfect for setting liquidity provisions.

-

Dynamic AMM for Stable Pairs: KyberDMM is ideal for stable pairs (like USDT/USDC) and shines during high volatility periods.

Bullets

Bullets From The Day:

🕵️ Ripple legal chief calls for investigation into Former SEC director Hinman. He’s specifically looking to discover the reasons behind Bill Hinman’s 2018 speech on crypto transactions and the application of the Howey test. In that speech, he stated Ethereum shouldn’t be considered a security as it was “sufficiently decentralized,” something that created confusion when the SEC sued Ripple Labs. The documents related to that speech were formally unsealed to the public on Tuesday, adding fuel to the already fiery debate. Decrypt.co has more.

🏦 Brazil’s central bank unveils roadmap for CBDC rollout. The Banco Central do Brasil (BCB) release shows it’s beginning to assess the possibility of enabling the launch of tokenized assets. It’s unveiled a list of “monthly webinars” as part of its digital real platform development. These events will run until November as it partners with banks, fintech experts, and BCB partners to discuss CBDC rollouts and the results of the central bank’s own pilot. Ultimately the country is looking to further position itself as an attractive place for the crypto industry, with its own CBDC supporting businesses in the space. More from CryptoNews.

📆 It may be four months until the SEC responds to Coinbase’s petition. The U.S. Securities and Exchange Commission (SEC) told the courts that it needs an additional 120 days to reply to Coinbase’s request that it adopt new rules and provide further clarity on the laws governing crypto. This was in response to a court’s June 6 order to respond within seven days. Coinbase Chief Legal Officer Paul Grewal took to Twitter, saying that this is another attempt by the SEC to avoid committing to a firm deadline despite an explicit court order. CoinTelegraph has more.

Links

Links That Don’t Suck:

🤑 Someone flash loaned $200M from MakerDAO to make $3.24 profit

🚫 eToro follows Robinhood in delisting four cryptos for U.S. customers

🤖 Salesforce leads $6M round for AI-backed Web3 data platform Mnemonic

💬 A crypto lesson from George Soros amid Binance and Coinbase accusations

🧑⚖️ Binance.US, SEC ordered to start negotiations Wednesday amid asset freeze tussle

📊 Coinbase is the fourth most traded stock in the UK: overtaking even Meta and Apple

🌎 Binance applies to deregister its local entity in Cyprus as it refocuses on larger markets